July 11, 2022

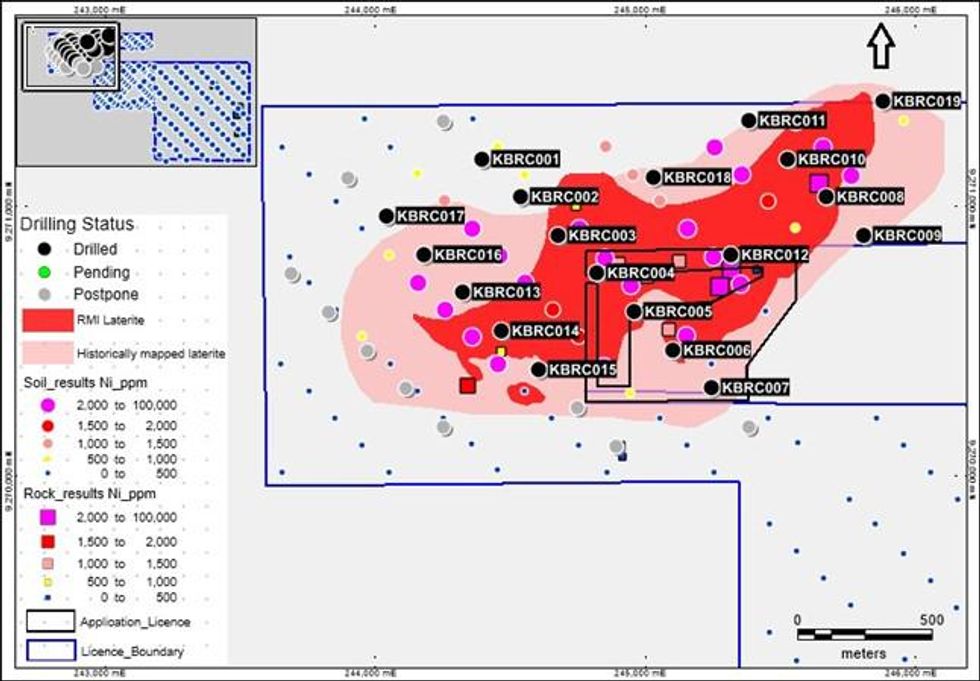

Nickel exploration company Resource Mining Corporation Limited (ASX:RMI) (“RMC” or the “Company”) is pleased to announce that it has completed its maiden RC drilling program at its Kabulwanyele Project. The completed program comprised 19 holes for a total of 799m drilled.

Highlights

- Resource Mining Corporation (RMC) has completed its maiden drilling program at its Kabulwanyele Nickel Project in Tanzania.

- The completed program comprised of 19 holes for a total of 799metres, testing the depth extents of the Nickel laterite.

- Geological logging of the RC chips has indicated a saprolite profile present consistently throughout the project area.

- Collected samples will be prepared at a laboratory in Mwanza and shipped to ALS Chemex South Africa for analysis.

- The Company will undertake a gravity survey followed potentially by electromagnetic surveys. This work defines the size and extent of the mafic– ultramafic inlier at Kabulwanyele, and aids in the definition of other forms of Nickel mineralization.

Geological logging of the RC chips has identified a lateritic profile comprising intercepts of ferruginous layers, saprolite (highly weathered rocks), saprolitic rocks (moderately weathered rocks) and fresh rock. The thickness of the ferruginous layer combined with saprolite / saprolitic rock layers ranges between 5m to 50m. Most of the holes ended in fresh rock. The drill holes to the north have generally not ended in fresh rock due to groundwater inundation that the RC rig is unable to clear through increased air pressure – so those holes have ended predominantly in saprolitic rock.

The samples collected from the drilling program have been dispatched to Nesch Mintek Mwanza for preparation before being shipped to the ALS Chemex South Africa for analysis. The assay results are expected in the next two months.

Resource Mining Corporation’s Chairman, Asimwe Kabunga, said: “We are very pleased to have completed the drill program testing the Kabulwanyele mineralisation. Our Tanzanian in-country team completed the program on time and on budget. We look forward to releasing the assay results as soon as they become available.”

Upcoming exploration program

A gravity survey program has been proposed to determine the size and characteristics of the deeply buried mafic-ulframafic inlier that has been weathered to form the identified nickel laterite anomalies. The program will commence in the next two weeks. The Gravity survey has the potential to define further targets associated with primary magmatic sulphide mineralization, these can be followed up by a ground Electromagnetic (EM) survey that would aid in the identification of any conducting sulphide layers that may exist at depth. Any combination of targets identified by the Gravity and EM surveys would then be drill tested using deeper diamond drilling.

Kabulwanyele is a lateritic occurrence overlying a mafic-ultramafic layered intrusion. The nature of the exploration to date confirms the potential for both lateritic nickel zones as well as an underlying nickel-enriched source within the mafic-ultramafic inlier.

Figure 1: Map showing the completed drilling program over previous mapping and sampling.

Image 1: RC Chips from KBRC012

Background

The Project is located in the Mpanda District of Tanzania, approximately 35km from the eastern shore of Lake Tanganyika, with the area forming part of the western limb of the East African Rift systems.

As background, in 2021 the Company conducted a sampling program that included a systematic collection of 254 soil samples and 19 rock chip samples from all tenements at the Project.

This program delivered highly encouraging nickel and cobalt results and delineated a Nickel-Cobalt anomaly with a strike length of 2km as illustrated in Figure 2, which is broadly coincident with a historically mapped nickel laterite. All samples collected from this anomaly returned grades equal to, or exceeding, 500ppm Ni and 200ppm Co, with grades of up to 1.27% Ni tested in a rock sample, and up to 0.85% Ni in soils1.

Click here for the full ASX Release

This article includes content from Resource Mining Corporation Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00