July 28, 2022

Latest drilling results to further enhance Jaguar Resource model, with next Resource update on-track for September Quarter; Definitive Feasibility Study progressing well

Centaurus Metals Limited (ASX:CTM) is pleased to present the company's June 2022 quarterly activities report.

JAGUAR NICKEL SULPHIDE PROJECT

- Significant shallow results received from ongoing in-fill drilling at the Jaguar Central (JC), Jaguar South (JS) and Jaguar Northeast (JNE) deposits, demonstrating the continuity of the mineralisation within the current Mineral Resource model and demonstrating the continuity of the mineralisation both down-dip and along strike. New assay results include:

- 46.0m at 2.17% Ni from 128.0m incl. 23.2m at 2.82% Ni (JC)

- 49.3m at 1.20% Ni from 31.9m incl. 13.2m at 2.37% Ni (JC)

- 38.3m at 1.16% Ni from 87.7m (JS)

- 15.2m at 2.12% Ni from 187.8m incl. 2.6m at 9.14% Ni (JS)

- 33.3m at 0.89% Ni from 136.3m (JC)

- 26.9m at 0.93% Ni from 91.6m (JC)

- 22.5m at 1.01% Ni from 116.5m incl. 6.0m at 2.29% Ni (JC)

- 15.0m at 1.42% Ni from 122.0m incl. 5.5m at 2.82% Ni (JS)

- Extensive infill and step out drilling completed during the quarter. Over 120 drill holes currently in laboratory awaiting assay.

- 15 rigs currently on site (13 diamond and 2 RC) drilling double shift, with the drilling focused on upgrading the maximum amount of the Mineral Resource Estimate (MRE) into the Measured and Indicated categories.

- Next MRE update to be delivered at the end of September will underpin the Definitive Feasibility Study (DFS) and the Project’s maiden Ore Reserve estimate.

- Definitive Feasibility Study (DFS) progressing well, though completion now Q1 2023 due, in part, to the expansion in the overall Project design flowing from a significantly larger Jaguar Resource base and project footprint and in part due to delays in being able to start the pilot program as originally scheduled.

- A Final Investment Decision (FID) remains on track for the end of Q3 2023, after relevant environmental approvals have been secured.

CORPORATE

- Cash at 30 June 2022 of $60.1 million.

JAGUAR NICKEL PROJECT

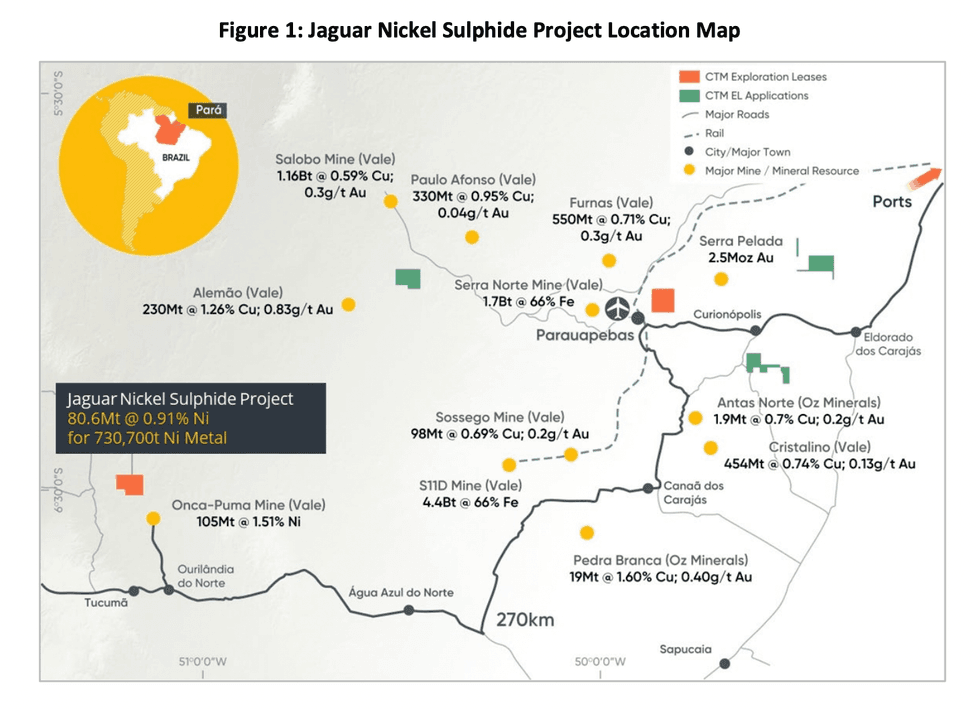

The Jaguar Nickel Sulphide Project, located in the world-class Carajás Mineral Province of northern Brazil (Figure 1), was acquired from global mining giant, Vale S.A. (“Vale”) in April 2020.

DRILLING & EXPLORATION PROGRAMS

Resource in-fill, extensional and step-out drilling continued at the Jaguar Project throughout the reporting period, with the drilling results to feed into the next MRE update scheduled for the end of Q3 2022.

Resource Development In-fill Drilling

The December 2021 MRE comprised 80.6Mt @ 0.91% Ni for 730,700t of contained nickel, with an Indicated component of the Resource being 43.4Mt @ 0.92% Ni for 397,000t of contained nickel, representing 54% of the Global MRE.

The focus of drilling during the first half of 2022 was resource development in-fill drilling at all the Jaguar Deposits. In-fill drilling is designed to upgrade all resources within a constrained US$22,000/t nickel price pit shell limit into the Measured and Indicated categories. The Company is targeting more than 500,000t of contained nickel in the Measured and Indicated categories of the next MRE based on the extensive in-fill drill currently being undertaken and the MRE already in place.

The MRE planned for the end of Q3 2022 will underpin the Jaguar DFS and maiden Ore Reserve estimate. The current resource definition in-fill drilling is important as it will ensure that as much of the in-pit Resource as possible will be upgraded to the higher-confidence Indicated category, which in turn increases the potential production target and anticipated conversion of Resource to Ore Reserves.

Click here for the full ASX Release

This article includes content from Centurus Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CTM:AU

The Conversation (0)

16 December 2021

Centaurus Metals

The World’s Next Green Nickel Project

The World’s Next Green Nickel Project Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00