April 03, 2023

As part of a German trade delegation trip to Australia, QPM has entered into a Collaboration Agreement with the German Suppliers. As part of its past feasibility and current engineering work for the TECH Project, QPM has worked closely with each of the German Suppliers to ensure their equipment will meet the requirements of the TECH Project.

Highlights

- Collaboration Agreement executed with German companies Plinke GmbH, Andritz Separation GmbH and Siemens Ltd (together the “German Suppliers”) regarding supply of capital equipment for the TECH Project.

- The German Suppliers will supply a significant proportion of equipment required for the TECH Project.

- Receipt of financing support has been received from two German financial institutions:

- Germany’s Export Credit Agency (“ECA”) Euler Hermes has provided a Letter of Interest to provide a tied loan guarantee that would be for an amount of approximately A$500m, linked to the value of equipment to be provided by the German Suppliers.

- KfW IPEX-Bank confirmed its in principle interest to provide up to US$250m (A$357m) in debt financing split between the Euler Hermes guaranteed debt and non ECA guaranteed debt.

- Total indicative and conditional debt funding expressed by interested financiers as part of QPM’s debt process exceeds A$1.4 Billion.

German Supplier Collaboration

As part of the Collaboration Agreement, QPM and the German Suppliers will:

- collaborate to advance the TECH Project for the mutual benefit of all parties;

- collaborate to ensure that proposed equipment to be supplied will be designed and constructed to meet the requirements of the TECH Project;

- work towards providing performance guarantees for their equipment; and

- identify the quickest pathway through to construction and commercial production.

Furthermore, subject to completion of current optimisation testwork, engineering and commercial negotiation:

- the German Suppliers will provide construction and commissioning assistance;

- the German Suppliers will organise visits to plants in which their equipment is in operation; and

- QPM will not undertake a competitive tender on this equipment.QPM and the German Suppliers are in the process ofcompleting design work and negotiating commercial terms, an important milestone which will be required as part of RPM Global’s due diligence as Independent Technical Expert for potentialfinanciers.

Indicative Funding Support from German Financial Institutions

As part of the debt financing process, QPM and its debt advisor (KPMG Corporate Finance) have been in ongoing discussions with key German Financial Institutions regarding debt financing for the TECH Project.

Euler Hermes, the Federal Republic of Germany’s (“FRG”) ECA.

- QPM, through its German Suppliers, has previously received Letters of Interest from Euler Hermes given the TECH Project would, in principle, qualify under the export credit guarantee scheme of the FRG. As discussions and workstreams have advanced with the German Suppliers, the value of equipment supply from Germany is now better understood. Based on the indicative value of this equipment, Euler Hermes has provided QPM with an updated Letter of Interest expressing conditional tied loan guarantee to finance up to A$500m of these contracts. QPM expects the final commitment from Euler Hermes could therefore be approximately $500m.

- The provision of the guarantee by Euler Hermes’ is non binding and subject to conditions standard for a debt facility of this nature including security, debt serviceability and equity financing, successful completion of the due diligence process and will be structured in accordance with the conditions of the OECD Arrangement on Officially Supported Export Credits.

KfW IPEX-Bank GmbH the German government owned specialist project and export finance bank

- KfW IPEX has issued a refreshed letter of support given the German exporter involvement. KfW IPEX confirmed its in principle interest to provide up to US$ 250M in debt financing

- Financing commitment would be split between the Euler Hermes guaranteed debt and non ECA guaranteed debt (in a typical sweet/sour ratio).

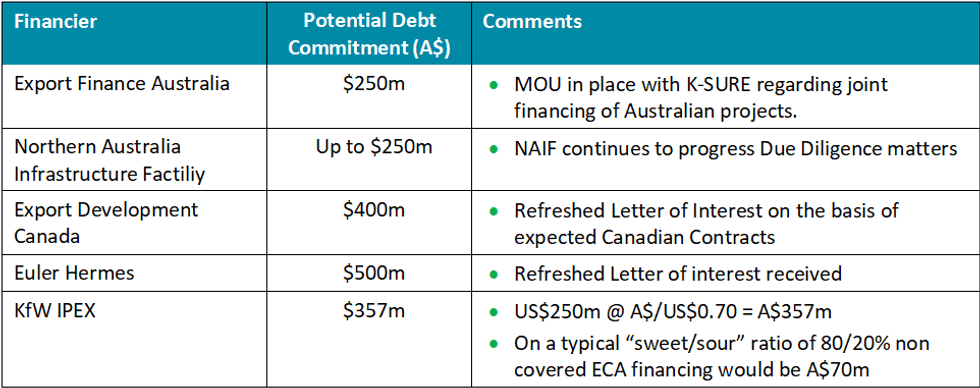

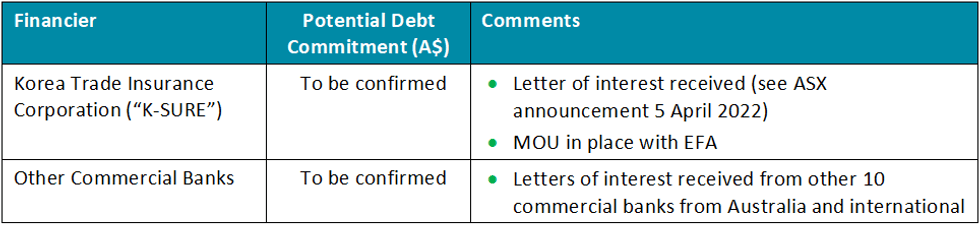

The table below summarises QPM’s debt financing progress, which now exceeds A$1.4 Billion of conditional funding support.

Comments

QPM’s Managing Director and Chief Executive Officer, Dr Stephen Grocott, commented,

“We have long identified that our German partners would be well positioned to supply commercially proven equipment required for the TECH Project. We have been actively engaged with Plinke, Andritz and Siemens throughout our feasibility work. Formalisation of these relationships through the Collaboration Agreement is a clear demonstration of each companies’ intentions and support for the TECH Project. This validates QPM’s strategy of sole-source partnering with leading equipment and technology suppliers. Furthermore, the conditional support received from Euler Hermes and KfW IPEX represents another milestone to our debt financing process. We are delighted they have the potential to provide loans and loan guarantees to support the financing of the German supply contracts.”

KBR’s Vice President, Gary Godwin, commented,

“We are honored to be supporting QPM in the development of their TECH project. Our technology specialists in Bad Homburg, along with KBR’s global delivery teams are utilising our laboratories, pilot plants, process design expertise and equipment knowledge to innovate and contribute to the overall success of this project.”

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00