August 25, 2024

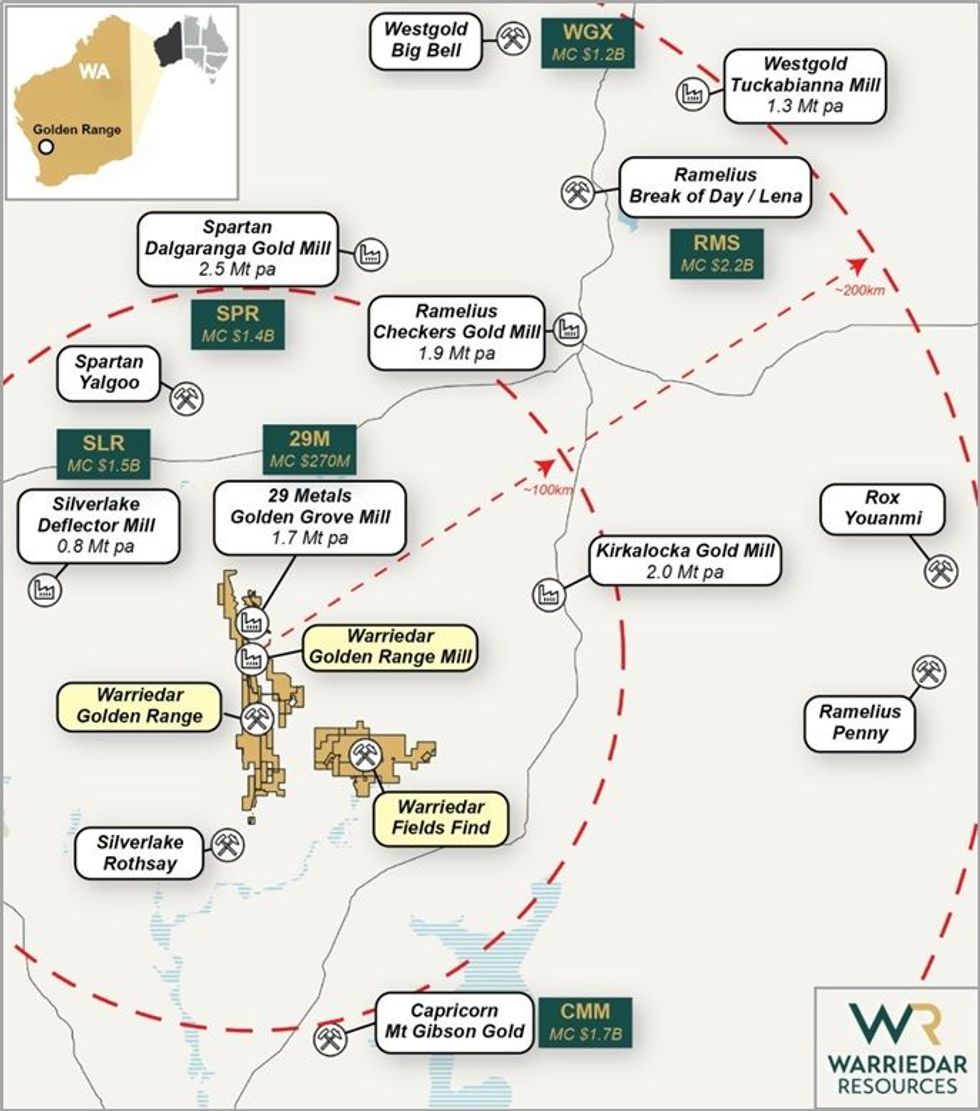

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at Ricciardo (6 holes for 1,102m), as well as 2 diamond tails drilled at M1 and Austin (2 holes for 259m). Results for the first 14 diamond holes of the current program were previously reported (refer WA8 ASX releases dated 3 July 2024, 19 July 2024 and 2 August 2024).

HIGHLIGHTS:

- Assay results received for a further 1,102m of diamond drilling at Ricciardo.

- Extremely high-grade antimony (Sb) intersected in multiple holes below the Ardmore pit, including in RDRC067 above the main zone of high-grade gold mineralisation:

- 12.7m @ 4.98% Sb and 0.36 g/t Au (10.92 g/t AuEq*) from 229.2m

incl. 1.85m @ 28.50% Sb and 0.45 g/t Au (60.94 g/t AuEq) from 238.25m

- 12.7m @ 4.98% Sb and 0.36 g/t Au (10.92 g/t AuEq*) from 229.2m

- A wide zone of antimony mineralisation was encountered in hole RDRC001:

- 34m @ 1.0% Sb and 0.59 g/t Au (2.72 g/t AuEq) from 158.80m

- This newly identified and exceptionally high-grade Sb zone, along with the broader antimony potential at Ricciardo, demands prompt follow-up and evaluation.

- Further high-grade gold extension delivered below the Ardmore pit:

- 18m @ 3.41 g/t Au and 0.27% Sb (3.97 g/t AuEq) from 276m (RDRC048B) incl. 4.5m @ 9.90 g/t Au and 0.01% Sb (9.93 g/t AuEq) from 286.5m

- 1m @ 28.31 g/t Au and 2.18% Sb (32.92 g/t AuEq) from 286m (NMRC005)

- 42.6m @ 1.08 g/t Au and 0.05% Sb (1.17 g/t AuEq) from 253.38m (RDRC067)

- ‘Golden Corridor’ diamond drilling now complete, with 31 holes drilled for 3,300m.

- All residual diamond assays expected to be received by late September, with update of the Ricciardo Mineral Resource targeted for Q4 2024.

- Further growth-focussed RC drilling of the ‘Golden Corridor’ scheduled for H2 2024, as well as planned aircore drilling along select parts of the regional shear.

Warriedar Managing Director and CEO, Amanda Buckingham, commented:

“The results for these holes successfully demonstrate further extensional high-grade gold, and for the first time very high-grade antimony zones below the Ardmore pit area.

Given the relative absence of assaying for antimony in historical drilling at Golden Range, we are cautiously optimistic on the potential that might exist here. Moreover, the apparent zonation in RDRC067 is also highly encouraging for any future antimony development potential.

I want to emphasise however that pursuit of this opportunity will be in parallel with our growth-focussed gold drilling at Golden Range, which remains our current core focus.”

* Refer to page 8 of this release for full gold equivalent (AuEq) calculation methodology.

Key Ricciardo context

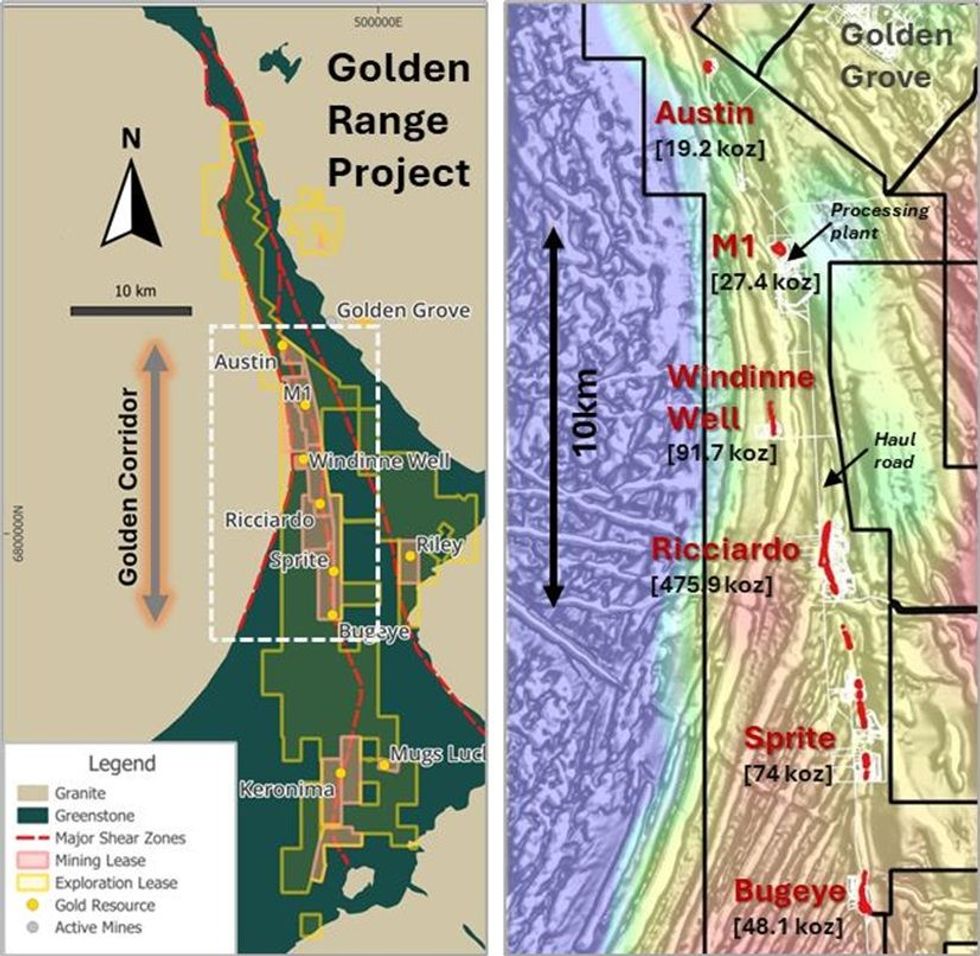

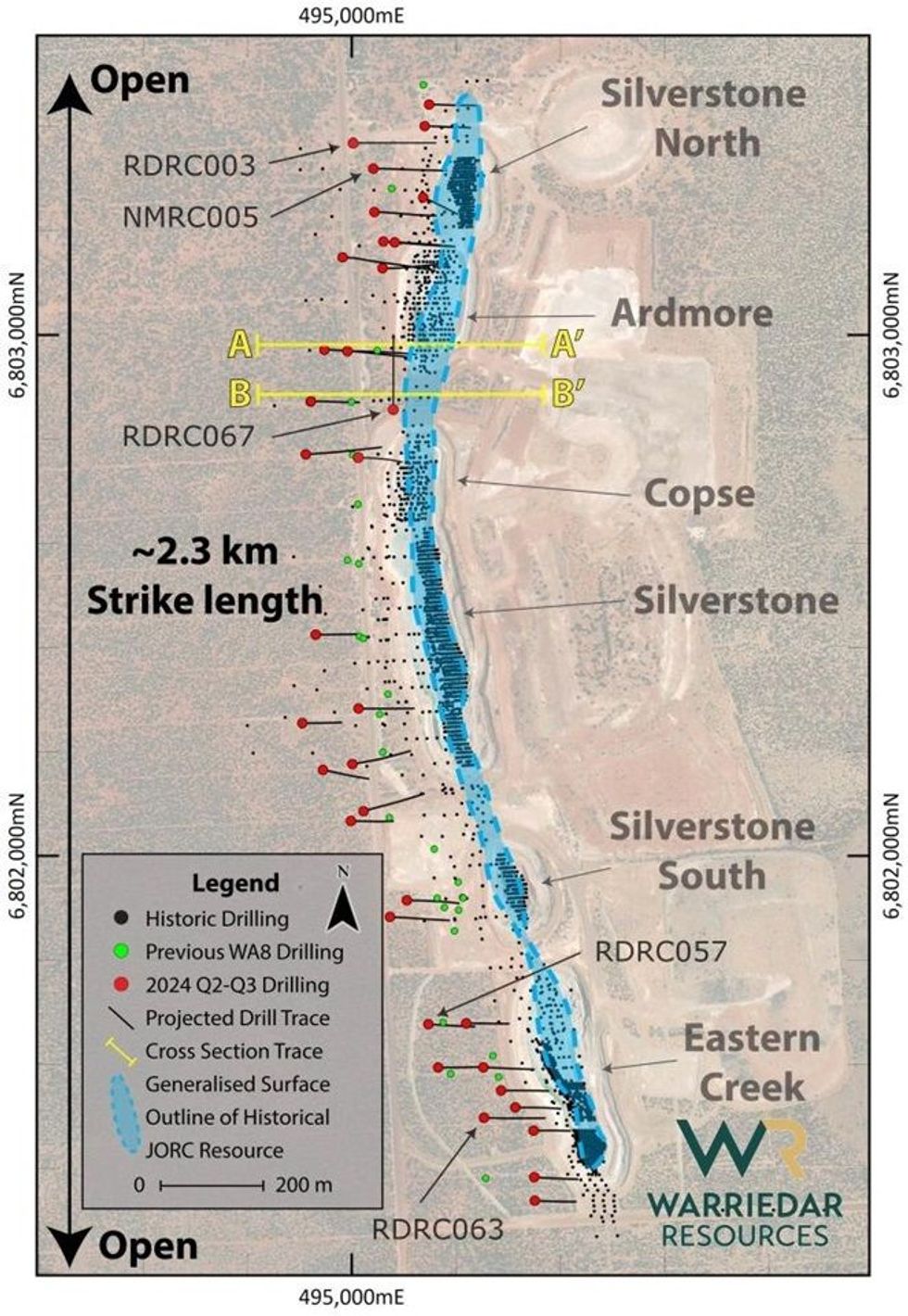

The Ricciardo gold system spans a strike length of approximately 2.3km, with very limited drilling having been undertaken below 100m depth. Ricciardo possesses a current MRE of 8.7 Mt @ 1.7 g/t Au for 476 koz gold.1 Historical mining operations at Ricciardo were primarily focused on oxide material, with the transition and primary sulphides mineralisation not systematically explored.

Due to the limited number of multi-element assays from historical drill holes at Ricciardo, other mineral potential (outside of gold) has also not been properly evaluated historically.

The gold mineralisation at Ricciardo is predominantly hosted with intensified altered and deformed ultramafic units. It is important to note that the newly identified antimony-dominant mineralisation identified in RDRC067 (discussed below) sits above high-grade gold mineralisation in the same area, and may overprint the earlier gold mineralisation in some areas.

High-grade antimony zone discovery below the Ardmore pit

RDRC067 was designed to drill south to north along strike to better understand the structural controls within the Ricciardo deposit and assess the continuity of the ultramafic unit (Figure 3). All previous drill holes (by Warriedar and previous explorers) have been drilled eastward perpendicular to the known mineralised structure. RDRC067 was considered an important hole by the Warriedar technical team in order to confirm there are no additional structural controls and to provide further confidence in the geological model.

Unexpectedly, RDRC067 intersected significant high-grade antimony mineralisation from 229.2m to 241.9m downhole, returning 12.7m @ 4.98% Sb and 0.36 g/t Au (10.92 g/t AuEq) (Figure 4). Above this high-grade antimony zone, another significant zone was also identified from 183m to 198.1m downhole, returning 15.1m @ 1.42% Sb and 0.42 g/t Au (3.42 g/t AuEq) (Figure 4).

The antimony zones intersected by RDRC067 are interpreted to correlate with a lower grade antimony zone intersected in RDRC038 and RDRC049 (Figure 4). Encouragingly, drillhole RDRC001 returned a wide zone of antimony mineralisation: 34m @ 1.0% Sb and 0.59 g/t Au (2.72 g/t AuEq). Further work is required to determine the geometry and extent of the antimony mineralisation.

RDRC067 concluded at 296.96m downhole depth, within the gold mineralisation domain, as the target depth of the hole had been reached. As RDRC067 is not drilled perpendicular to the Mougooderra Shear, which is the main control of the mineralisation, it is important to note that the intersected thickness does not reflect the true thickness of the mineralisation.

Click here for the full ASX Release

This article includes content from Warriedar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

01 August 2024

Infill Drilling of Ricciardo Deposit Delivers Significant Gold Mineralisation

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to provide an update on drilling progress and assay results from its Golden Range Project, located in the Murchison region of Western Australia (Figure 1). HIGHLIGHTS: Assay results for a further two (2) diamond tails... Keep Reading...

22h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00