FPX Nickel Corp. (TSXV: FPX) (OTCQB: FPOCF) (" FPX " or the " Company ") is pleased to announce results from an Awaruite Refinery Scoping Study (the " Study ") which demonstrates a compelling business case for the development of a standalone refinery (the " Refinery ") to refine awaruite concentrate into battery-grade nickel sulphate for the electric vehicle (" EV ") industry, along with producing valuable cobalt, copper, and ammonium sulphate by-products.

The Study has been prepared by Wood Canada Limited and all amounts are in US Dollars unless otherwise indicated. The Study relates to a standalone industrial project and anticipates the production of awaruite ore from projects that are not limited to mineral projects of the Company; without limiting the foregoing, the Study is separate and standalone from the Baptiste Nickel Project, which demonstrated the technical and commercial advantage of mining and concentrating awaruite ore to a high-grade awaruite concentrate.

Highlights

- Strong Economics: After-tax NPV 8% of $445 million and IRR of 20% at $8.50 /lb Ni

- Large-Scale, Long Life : 40-year operating life producing 32,000 tpa of nickel contained in battery-grade nickel sulphate

- Valuable Products: Production of battery-grade nickel sulphate for the EV industry, and by-products including cobalt, copper, and ammonium sulphate, a valuable fertilizer product for the agricultural sector

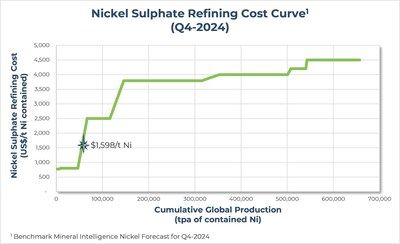

- Low Cost: Total estimated operating costs of $1,598 /t Ni, or $133 /t Ni ( $0.06 /lb Ni) on a by-product basis for refining awaruite concentrate to battery-grade nickel sulphate, resulting in total all-in production costs of $8,290 /t Ni ( $3.76 /lb Ni) for nickel sulphate generated from awaruite mineralization (inclusive of mining, processing, refining, on a by-product basis), with both figures ranking in the lowest decile of the respective global nickel sulphate cost curves

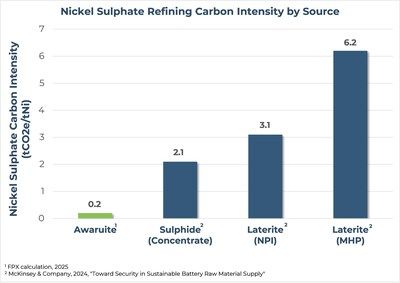

- Low Carbon : A carbon intensity of 0.2 tCO2/t Ni for refining operations, resulting in a total all-in carbon intensity of 1.4 t CO2/t Ni for nickel sulphate generated from awaruite mineralization, which is magnitudes lower than current nickel sulphate production routes

"This Study confirms the disruptive potential of awaruite concentrate as an ideal feedstock for the production of battery-grade nickel sulphate for the automotive sector," commented Martin Turenne , FPX Nickel's Chief Executive Officer and President. "The Study reinforces the opportunity for the development of an integrated, made-in- Canada solution from mine-to-battery, utilizing awaruite concentrate as a lynchpin source of nickel, with conventional refining steps underpinning low-cost, low-carbon nickel production for use in domestic and allied country EV battery supply chains."

Background

FPX commenced development of the Study in October 2024 to further demonstrate the economic and strategic opportunity to refine awaruite concentrates to battery-grade nickel sulphate and other valuable by-products. This Study incorporates the flowsheet advancements outlined in the Company's previously reported pilot-scale hydrometallurgical testwork results (see FPX news release dated October 15, 2024 ).

Scoping Study Overview

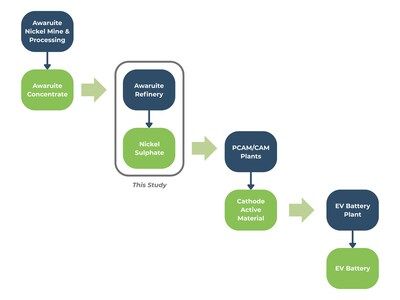

The mine-to-battery pathway for awaruite mineralization is presented in Figure 3. At a mine site, awaruite mineralization could be subjected to a simple mineral processing flowsheet to produce a high-grade awaruite concentrate, which could then be marketed either to the stainless steel or EV battery supply chains. This Study envisions purchasing of such awaruite concentrate and refining to battery-grade nickel sulphate, which would then be marketed to precursor cathode active material (" PCAM ") and cathode active material (" CAM ") producers to further process the nickel sulphate into CAM, a direct input in EV battery cell fabrication.

This Study outlines a mid-stream Refinery located in an industrial location in central British Columbia which will be fed with awaruite concentrate and produce battery-grade nickel sulphate. The Study considers a Refinery capable of producing 32,000 tonnes per year of contained nickel in battery-grade nickel sulphate.

In addition to nickel sulphate, the Refinery will produce three by-products, approximately as follows:

- 570 tonnes per year of contained cobalt in cobalt carbonate;

- 240 tonnes per year of contained copper in copper cement; and

- 87,400 tonnes per year of ammonium sulphate, a valuable fertilizer product.

The Refinery would process commercially available awaruite concentrate. Published metallurgical testwork on awaruite (Ni 3 Fe) nickel ores has shown that a relatively simple mineral processing flowsheet utilizing magnetic separation followed by conventional froth flotation can produce a highly desirable awaruite concentrate that presents flexibility for downstream consumption. Considering other awaruite nickel projects in development by FPX and others, a refinery operation lifespan of 40 years is considered.

Study economics are presented in Table 1, demonstrating the Refinery has robust economics while producing meaningful quantities of battery-grade nickel sulphate for the EV supply chain.

Table 1 – Awaruite Refinery Scoping Study Economics

| Criteria | Units | Value | |

| Initial Capital Cost | $, millions | $424 | |

| Operating Cost | $/t Ni produced | $1,598 | |

| Operating Cost, net of by-products | $/t Ni produced | $133 | |

| After- Tax | NPV 8% | $, millions | $445 |

| IRR | % | 20 | |

| Payback Period | Years | 4.0 | |

The Refinery's operating costs excluding byproduct credits ( $1,598 /t nickel contained) would fall within the lowest decile of global production as per Benchmark Mineral Intelligence's (" Benchmark ") nickel sulphate cost model, as presented in Figure 1. When byproduct credits are included, the Refinery would have a lower production cost that any current global producer.

The Refinery will be supplied with low-carbon power from the BC Hydro grid, resulting in a carbon intensity of 0.2 t CO 2 /tNi. As presented in Figure 2, this is magnitudes lower than current nickel sulphate production routes.

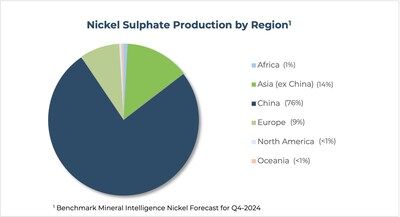

According to Benchmark's database, the 2024 annualized nickel sulphate production market size was approximately 657,000 tonnes per year of contained nickel as of the fourth quarter of 2024, with production heavily dominated by China at 76%, as presented in Figure 4. Additionally, less than 1% of current nickel sulphate production is North American (3,300 tonnes per year of contained nickel). As such, the 32,000 tonnes per year of high-quality nickel sulphate produced by the Refinery in Canada would represent an approximate tenfold increase in current North American nickel sulphate production.

Metallurgy & Process Design

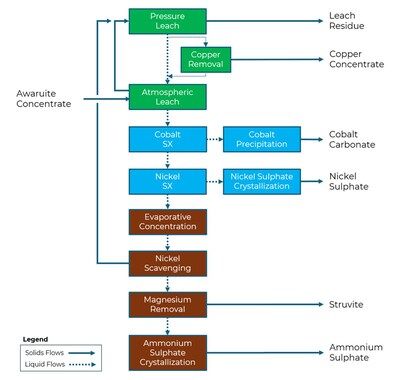

The metallurgical testwork program involved multiple bench- and a pilot-scale campaigns (see FPX news release dated October 15, 2024 ). The latest testwork campaign involved continuous pilot-scale testing of leaching unit operations and confirmed the leaching flowsheet. Nickel leach extractions greater than 99% and production of low-impurity leach solution, suitable for downstream purification and crystallization, were simultaneously achieved during piloting. In addition, bench-scale testing of solution purification and crystallization unit operations demonstrated the ability to produce battery-grade nickel sulphate crystals using the new ammonia-based flowsheet. Incorporating testwork results, the refining strategy takes advantage of awaruite's characteristics in a simple flowsheet utilizing well proven unit operations, as presented in Figure 5.

Refinery Process Description

In the leaching area, awaruite concentrate is first subjected to an atmospheric leach, which serves the dual purpose of 1) commencing awaruite dissolution, and 2) using awaruite as a reagent to neutralize free acid and precipitate remaining iron, aluminum, and chromium from the pressure leach solution. Any unleached awaruite is then further leached in a mild pressure oxidation circuit, where full awaruite dissolution is achieved in tandem with initial iron precipitation. Pressure leach solution then reports to the atmospheric leach circuit and pressure leach residue is dewatered for disposal. A slipstream of pressure leach solution is processed in a copper removal circuit, where a copper cement grading approximately 70 to 80% copper is produced.

The final leach solution, grading 100 g/l nickel, is first processed in a solvent extraction (" SX ") circuit to extract cobalt. Extracted cobalt is then precipitated from the cobalt-rich solution as a carbonate product grading approximately 50% cobalt. While a cobalt carbonate product was selected for the Study, FPX testwork has also demonstrated the ability to produce cobalt-rich mixed hydroxide precipitate (" MHP ").

Nickel is then extracted away from the cobalt depleted leach solution to produce a purified and concentrated stream of nickel sulphate which is then crystallized into battery-grade nickel sulphate crystals suitable for use in the EV supply chain.

The nickel depleted leach solution is then treated to sequentially removal trace levels of nickel and magnesium. This purified stream is then crystallized into ammonium sulphate crystals, a widely used industrial fertilizer. Miscellaneous minor process streams are also processed in the ammonium sulphate crystallizer which enables the refinery to operate as a zero liquid discharge facility.

Capital Cost Estimate

Initial capital costs have been estimated in alignment with AACE (Association for the Advancement of Cost Engineering) Class 5 standards, while sustaining and closure capital costs have been estimated on an order-of-magnitude (" OOM ") basis. The total initial capital cost for the Project is estimated to be $424 million , with no expansion considered. Total sustaining capital cost is estimated to be $40 million and total closure capital cost is estimated to be $42 million . No salvage value is considered due to the 40-year operation life.

Table 2 – Total Estimated Capital Costs

| Capital Cost Type | Category | Total ($, millions) | Notes |

| Initial Capital Costs | Refinery Process | $152 | |

| Reagents | $45 | | |

| Utilities, Services, & Infrastructure | $40 | | |

| Total Direct Costs | $237 | | |

| Indirect Costs | $81 | 34% of Direct Costs | |

| Contingency | $89 | 28% of Direct and Indirect Costs | |

| Owners Costs | $18 | | |

| Total Initial Capital | $424 | | |

| Total Sustaining Capital Costs | $40 | Expended years 1-40 | |

| Total Closure Capital Costs | $42 | Expended years 41-42 | |

| Total Capital Costs | $506 | | |

Operating Cost Estimate

Total operating costs are estimated to average $1,598 per tonne of nickel produced before by-product credits, with a breakdown of these costs by cost centre presented in Table 3. The net operating cost inclusive of by-product credits for cobalt, copper, and ammonium sulphate is $133 /t Ni ( $0.06 /lb Ni).

Table 3 –Estimated Operating Costs (excludes by-product credits)

| Category | Units | Value |

| Reagents | $/t Ni produced | $757 |

| Consumables | $/t Ni produced | $264 |

| Labour | $/t Ni produced | $258 |

| Maintenance | $/t Ni produced | $136 |

| Power | $/t Ni produced | $69 |

| General & Administrative | $/t Ni produced | $114 |

| Total | $/t Ni produced | $1,598 |

Economic Analysis

At an assumed nickel price of $8.50 /lb ( $18,738 /t) and a USD:CAD exchange rate of 0.74, the Refinery generates an after-tax NPV 8% of $445 million , an after-tax IRR of 20%, and an after-tax payback of 4.0 years. Table 4 provides further details on study economics.

Benchmark maintains a comprehensive database of nickel production statistics and forecasts long-term pricing premiums relative to the LME nickel price for battery-grade nickel sulphate. While the nickel sulphate market is currently small with inherent pricing volatility, even the most conservative of EV adoption rates will see a significant increase in nickel sulphate requirements. As the nickel sulphate market grows in coming years and preferred feedstocks are established, it is expected that a more consistent premium basis will be established based on typical upgrading costs. Benchmark's forecast nickel sulphate premium basis for the year 2030 is $1,575 /t nickel ( $0.71 /lb nickel), which has been applied in the economic analysis. This premium is based on Benchmark's "base case" forecast of EV adoption and battery chemistry trends.

The Study models taxes in accordance with provincial and federal legislation. The Study reflects the impact of the federal government's refundable critical minerals investment tax credit, announced in the 2023 Federal Budget, which is proposed to be equal to 30% of the capital cost of eligible property for the extraction and processing of certain critical minerals, including nickel. The Study estimates total LOM taxes paid of C$1,000 million including C$520 million to the Province of British Columbia and C$480 million to the Government of Canada .

Table 4 – Study Economics

| Economic Basis/Result | Units | Value | |

| Payability, Awaruite Concentrate | % of LME Ni | 92 | |

| Price | Nickel | $/lb | 8.50 |

| Cobalt | $/lb | 15.00 | |

| Copper | $/lb | 4.00 | |

| Ammonium Sulphate | $/t | 330 | |

| Payability | Cobalt | % | 85 |

| Copper | % | 95 | |

| After-Tax | NPV 8% | $, millions | $445 |

| IRR | % | 20 | |

| Payback | years | 4.0 | |

Environmental Assessment and Permitting

The Refinery has been assumed in the Study to be located in central B.C., with the selected location ultimately subject to community consultation, environmental characterization and baseline studies. The BC Environmental Assessment Act Reviewable Projects Regulation specifies that a new non-ferrous metal refinery would require assessment under the established provincial EA process.

Study Report

FPX intends to file the Study Report on the FPX website before the end of the first quarter of 2025. As this Study presents a separate midstream industrial project which does not impact in any way the Baptiste Nickel Project, or any of FPX's other projects, there is no mineral resource attributed to the Study. For readers to fully understand the information in this news release, they should read the Study Report in its entirety, including all qualifications, assumptions, exclusions, and risks that relate to the Study. The Study Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Study Lead

The Study has been prepared by Wood Canada Limited, who has reviewed and approved the technical and cost estimating content of this news release.

Qualified Person

Andrew Osterloh , P.Eng., FPX's Senior Vice President, Projects and Operations, has reviewed and approved the content of this news release.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Baptiste Nickel Project, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron mineralization known as awaruite. For more information, please view the Company's website at https://fpxnickel.com/

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws, including those which relate to the proposed development of the Refinery, the intended processing of commercially available awaruite concentrate at the Refinery and the ability to obtain same; the projected economics of the Refinery, including capital cost; operating costs; NPV; IRR; carbon intensity; processing life; growth of the EV market; marketability of the concentrate; growth of demand for nickel sulphate and pricing therefor; and all other statements, other than statements of historical facts. These statements address future events and conditions and actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects', "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved". Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements are set forth in the public reports and filings for FPX, filed on SEDAR+ at www.sedarplus.com . Although FPX believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, FPX disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2025/24/c4996.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2025/24/c4996.html