December 11, 2023

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce further results from surface sampling at the Piedra Dura Prospect, within the Fortuna Project (the Project), Chile. Results confirm the extension of mineralisation for an additional 400m to the north and 150m east, with grades up to 9.78% Cu and 13.4g/t Au.

HIGHLIGHTS

- High grade copper and gold surface results returned from follow-up sampling at the Piedra Dura Prospect, within the Fortuna Project.

- Grades of up to 9.78% Cu and 13.4g/t Au from outcropping zones of mineralisation.

- Mineralisation extended 400m to the north and 150m to the east, strike now >1.5km and up to 250m wide.

- Mineralisation remains open to the north and south.

- Drilling is ongoing at the El Quillay North Prospect.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“The 2023 exploration program continues to impress with high-grade, out-cropping copper and gold mineralisation now extending an additional 400m to the north and 150m to the east at Piedra Dura. Assay results returned for Piedra Dura reveal new wide, high-grade copper and gold zones that have the potential to add significant volumes of near-surface mineralisation.

The latest results are an excellent outcome as we continue to demonstrate the potential for a district scale copper and gold deposit within the Fortuna Project. We look forward to reporting further news from Fortuna, including drill hole results in the coming weeks.”

PIEDRA DURA PROSPECT

The Piedra Dura Prospect is located 1.8km west of El Quillay within the Fortuna Project (Figure 2). The structurally controlled outcropping copper mineralisation has been delineated over 1.5km of strike and up to 250m width.

The Company previously reported the discovery of significant high-grade outcropping copper and gold mineralisation at Piedra Dura with several parallel structures identified1. Recent exploration activities focused on exploring additional prospective structures in the area.

The field program at Fortuna continued during November, with the collection of a further 27 rock chip samples, focussed on extending the Piedra Dura mineralisation to both the north and east.

Of the 27 samples collected, 11 returned high-grade copper results >2% Cu (Table 1) including a sample of 9.78% Cu and 7.52g/t Au (CPO0008661) from within a gossanous shallow dipping structure, strongly mineralised with secondary copper including malachite, azurite and covellite (Figure 1).

High-grade gold results accompanied the significant copper mineralisation with sample number CPO0008659 returning 13.4g/t Au and 6.04% Cu (Figure 3).

It is clear from the assay results that the western tenure of Culpeo’s Fortuna Project, which includes Piedra Dura, is highly prospective for economic copper and gold mineralisation. The recent rock chip sampling extends mineralisation 400m to the north and 150m to the east with the target structure remaining open to the north and south.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

09 July

Copper Soars to All-time High as Trump Unveils 50 Percent Tariff on Imports

US President Donald Trump said Tuesday (July 8) that he plans to impose a 50 percent tariff on all copper imports, a dramatic escalation of his administration’s use of targeted trade restrictions on national security grounds.

“I believe the tariff on copper, we're going to make 50 percent,” Trump said during a White House cabinet meeting.

Though he did not provide a timeline, Commerce Secretary Howard Lutnick said in a subsequent CNBC interview that the tariff could take effect by late July or as early as August 1, with details to be posted on Trump’s Truth Social account.

The announcement triggered immediate market reaction. According to Reuters, copper futures for September delivery surged 13 percent on the day, closing at US$5.6855 per pound—its biggest single-day jump since 1989.

Traders cited fears of a supply crunch and price volatility as buyers scrambled to secure US-bound shipments ahead of the tariff implementation.

The decision marks a culmination of a months-long process that began in February, when Trump signed an executive order instructing the Department of Commerce to investigate whether copper imports posed a national security threat under Section 232 of the Trade Expansion Act of 1962.

The rarely used statute gives the president broad authority to impose tariffs or quotas if imports are deemed harmful to national defense or essential industries.

The copper tariff follows a similar pattern established during Trump’s first term, when the White House used Section 232 to levy tariffs on steel and aluminum.

Since returning to office, Trump has expanded his use of the provision to include automobiles, pharmaceuticals and critical minerals like rare earths.

Countries in the crosshairs

The brunt of the copper tariff is expected to fall on key US trade partners — most notably Chile, Canada and Mexico, which collectively accounted for the majority of America’s US$17 billion in copper imports in 2024, according to US Census Bureau data.

Chile alone shipped US$6 billion worth of copper to the US last year.

Officials from Chile, Canada and Peru, have pushed back against the measure, arguing their exports pose no threat to US national security and citing long-standing free trade agreements.

However, none have been granted exemptions as of Wednesday (July 9), and negotiations remain in limbo.

The looming copper tariff comes on the heels of broader trade actions taken by the Trump administration. On Monday (July 7), the White House imposed stiff tariffs on imports from 14 countries, including Japan, South Korea, Malaysia, South Africa and Kazakhstan.

These levies, effective August 1, targeted a wide range of sectors, from steel and aluminum to automotive parts and textiles.

Despite its relatively small trade deficit in copper — the US exported US$11.3 billion and imported US$9.6 billion worth of the metal in 2024 — the White House argues that the country remains dangerously reliant on foreign refining and processing capacity.

National security as justification

The legal foundation for the copper tariff lies in Section 232, which allows the president to act unilaterally on trade when national security is at stake. Experts say the provision gives Trump more durable legal ground than his recent attempts to use emergency powers to implement broad, country-specific tariffs — some of which are being challenged in federal court.

“Section 232 tariffs are central to President Trump’s tariff strategy,” said Mike Lowell, a trade attorney with ReedSmith, in an interview with CNBC. “They aren’t the target of the pending litigation, and they’re more likely to survive a legal challenge and continue into the next presidential administration.”

The administration’s increasing reliance on Section 232 tariffs reflects a shift toward industrial policy motivated by supply chain security, particularly for materials with dual-use applications in civilian and defense sectors.

Copper is a case in point. Used extensively in electrical wiring, motors, semiconductors and military-grade communications equipment, the red metal has been classified as critical to US infrastructure and defense capabilities.

Analysts point out that demand for the red metal is set to surge in the coming years due to the ongoing energy transition and growing adoption of electric vehicles.

In April, Trump issued a separate executive order launching a Section 232 investigation into US reliance on imported critical minerals and processed rare earths, calling them “essential for national security and economic resilience.” The order cited specific applications in jet engines, missile guidance, radar systems and advanced electronics.

As of Wednesday, no formal timeline had been posted on Trump’s Truth Social account, and details around carve-outs or exemptions remained unclear.

For now, however, Trump appears undeterred. The head of state has already threatened that pharmaceuticals may be next in line for potential action.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

08 July

Nobel Resources Announces Additional Results at the Cuprita Project, Atacama Region, Chile

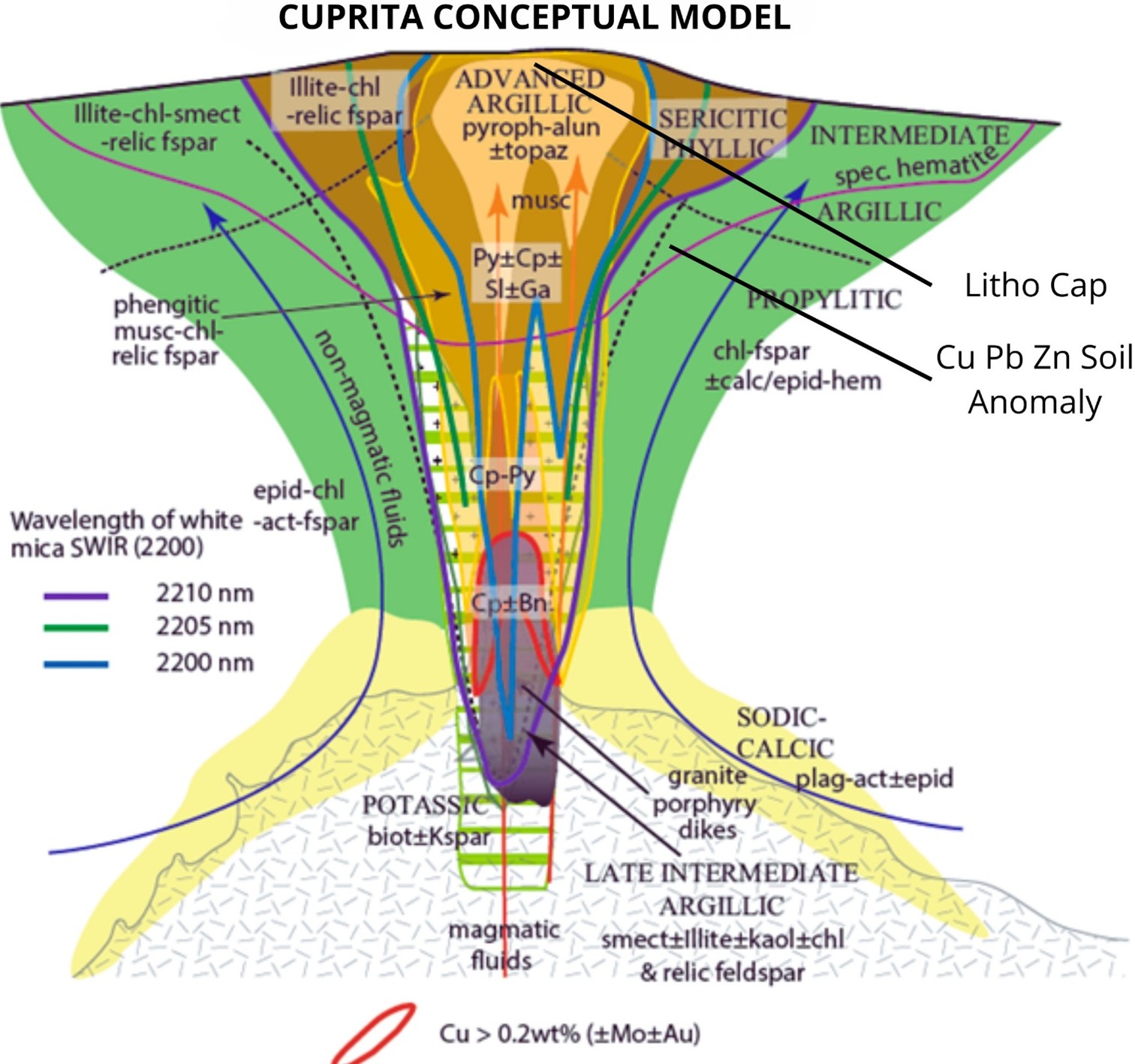

Nobel Resources Corp. (TSX – V: NBLC) (the “Company” or “Nobel”) is pleased to provide an update on its ongoing exploration at the Cuprita Project (the “Project” or “Cuprita”) in Atacama Region, Chile. Following the recent identification by Nobel geologists of a leach cap with characteristics strongly associated with porphyry copper-(gold) deposits in the region at Cuprita, including associated highly anomalous copper in soils and bedrock, the Company has additionally confirmed:

- the existence of an IP chargeability and resistivity anomaly typical of porphyry copper deposits in the region; and

- the presence of highly anomalous copper chip samples from outcrops associated with the leach cap.

The geological features being identified by Nobel field work at Cuprita demonstrates the Project is highly prospective.

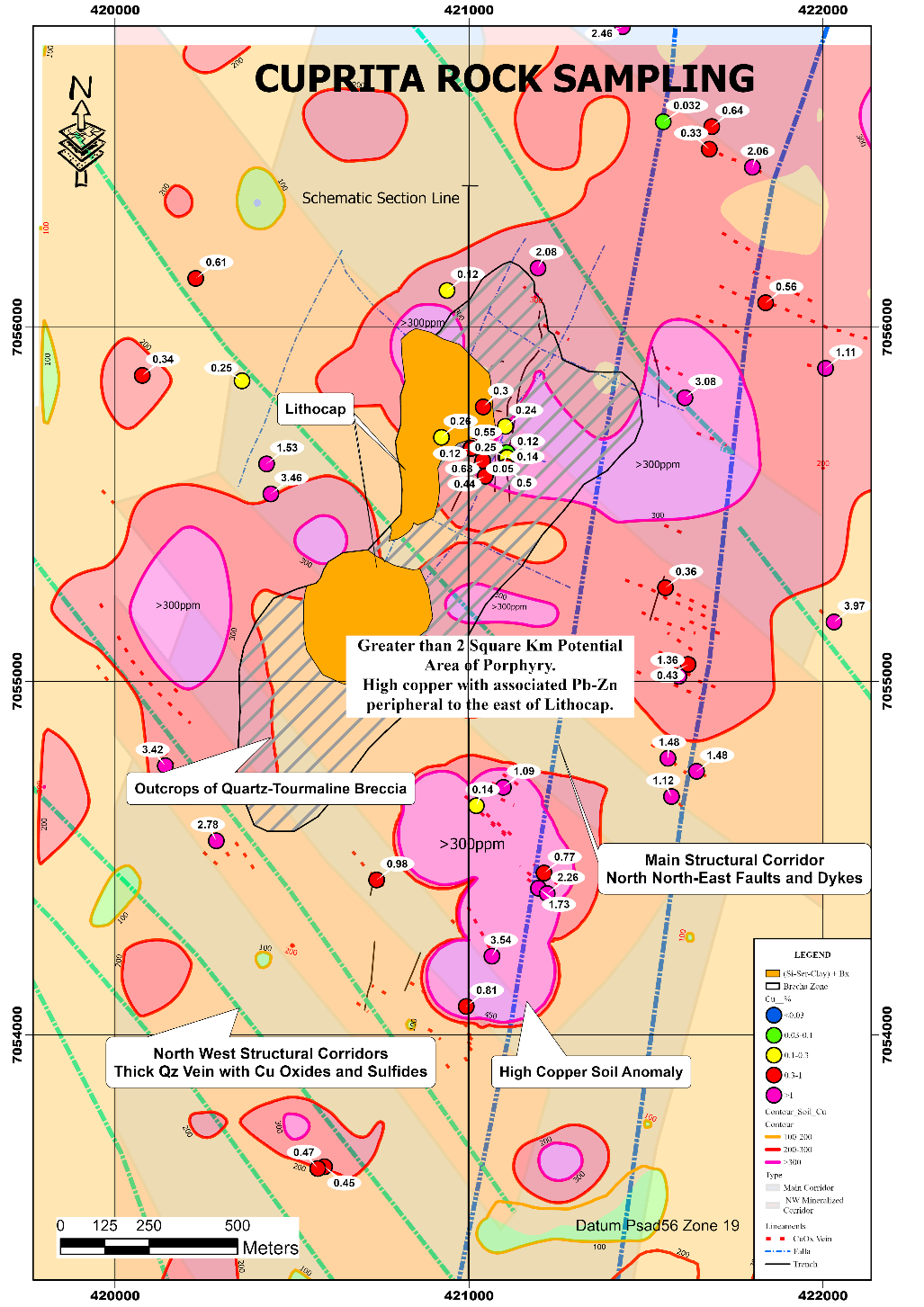

According to Vern Arseneau, COO of Nobel, “After only a few short weeks in the field, Nobel Geologists have identified key characteristics of a shallow mineralized porphyry system at Cuprita. The leach cap, IP anomaly, significant copper bearing rock chips and the copper in soil anomaly are all located adjacent to a ground magnetic low. These traits are situated near the intersection of a major north-northeast striking fault structure with numerous northwest striking quartz veins with copper oxides. Intersecting major faults is a common, if not essential, structural control for the emplacement of copper-gold porphyries in the region (Figure 3). This is essentially the complete suite of important indicators used when identifying productive porphyry copper systems, combined with a leach cap in one of the most important porphyry copper belts globally indicate excellent potential for a mineralized porphyry deposit at the Cuprita project.”

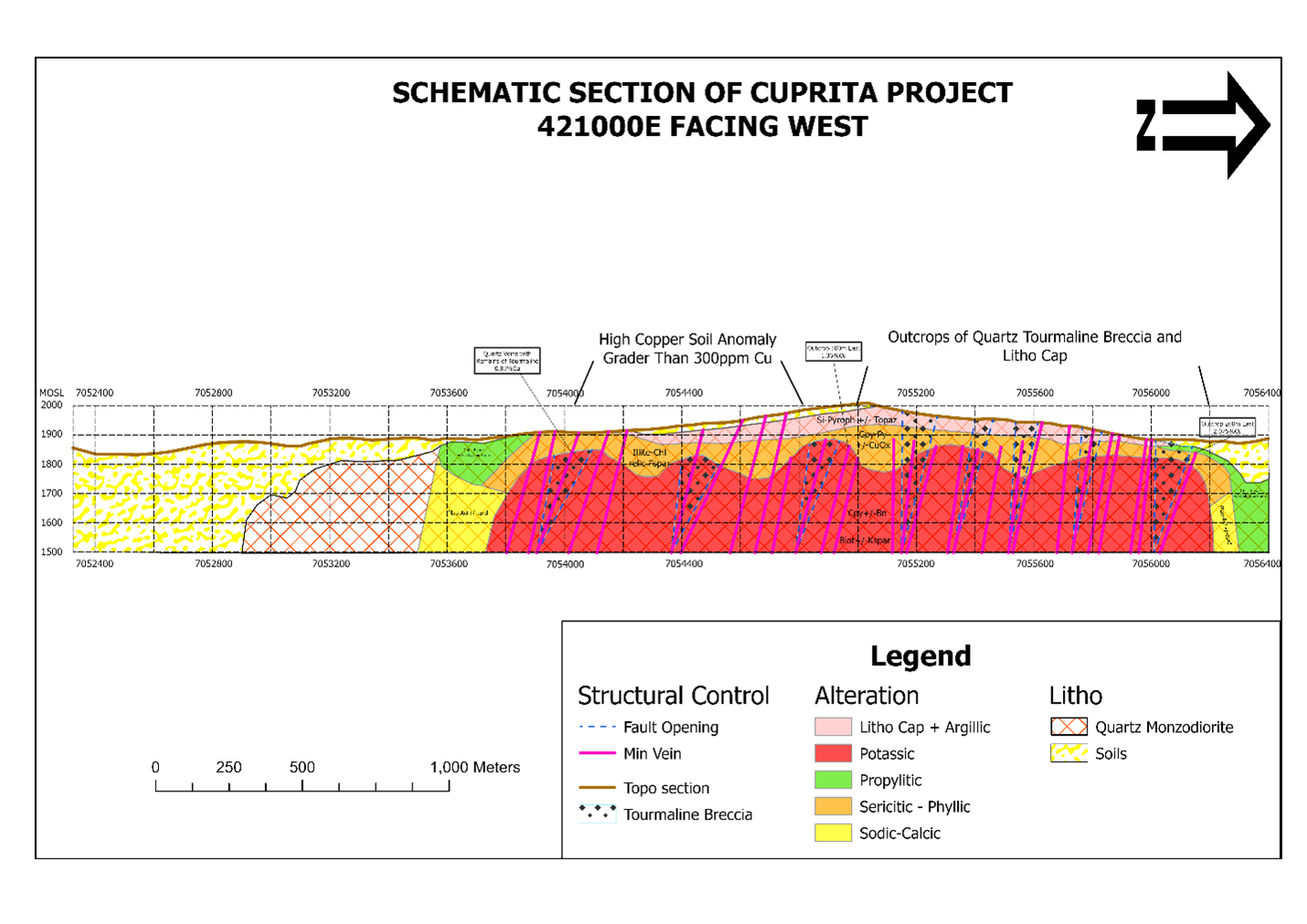

The IP survey was carried out by Argali Geophysical SA during November 2018 and consisted of three E-W lines across the area of the recently identified leach cap. Survey parameters were 100m spaced dipoles with an estimated depth penetration of 700m at N=27. The top of the IP anomaly, based on this data, is estimated to be approximately 200meters below surface. (Figure 3; line 7055700N). All three lines exhibit a similar chargeability/resistivity response and the anomaly remains open to the North and South.

The chargeability anomalies from 7 to 9 mV/V are in line with many of the porphyry copper deposits near Inca de Oro which are notoriously low in pyrite and therefore in chargeability. Chargeability of less than 10 mV/V has been observed at many deposits local to Cuprita. Similarly, field observations by Nobel geologists have also confirmed the general lack of pyrite in altered rocks at Cuprita.

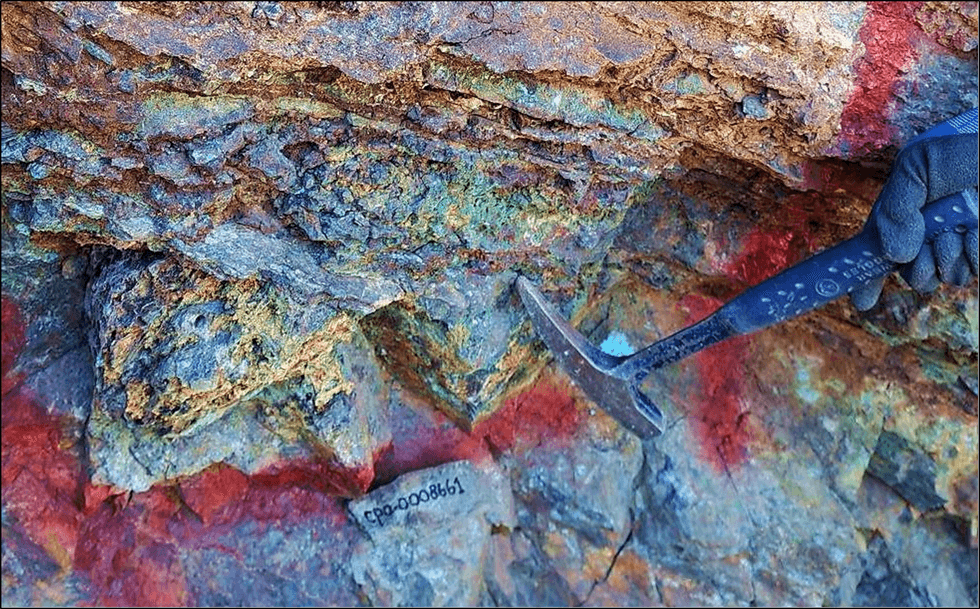

Rock chip sampling of mineralized structures associated with the leach cap, anomalous soil samples and the ground magnetic anomalies returned highly anomalous copper values ranging from 0.25 to 3.46% Cu. Many of the rock samples contain remnant copper sulfides, such as Chalcocite, Chalcopyrite and locally Bornite (Figure 1). Additionally, a sample taken 500m to the northeast, where QZ vein stockwork with disseminated chrysocolla outcrops with a grade of 2.06% Cu (Figure 2) signifying the potential for a large extensive system.

Figure 1: Rock sample with Chalcopyrite and Bornite grading 1.36% copper associated with the leach cap.

Figure 2: Sample of copper-rich stockwork of quartz and chrysocolla grading 2.06% copper from 500 meters northeast of previous sample.

According to Larry Guy, CEO, “Nobel geologists believe that this newly identified geological / geochemical evidence along with the geophysical compilation points to potential for a large mineralized porphyry at shallow depth covering the area between the anomalous soil results to the South and extending more than 2 kilometers North to the previously reported ground magnetic lows. (Figures 3 and 4; map and cross section and Figure 5 conceptual geological model).

Geologically, Cuprita is part of the Metallogenic Paleocene Porphyry Copper Belt that hosts several major porphyry copper deposits, such as El Salvador, Cerro Colorado, Spence, Sierra Gorda, Fortuna, as well as several gold deposits. Recent field work at Cuprita has focused the targeting for forthcoming drill programs.

Figure 3: Compilation map showing the location of the extensive leached cap (lithocap) and associated structures, outcrop samples, quartz-copper veins, soil geochemical anomalies, tourmaline breccias associated with a magnetic low, that comprise the key criteria for a mineralized porphyry target.

Figure 4. Schematic Section showing the Conceptual Model of the Porphyry in Cuprita.

Figure 5. Conceptual model for the Cuprita porphyry target (modified after Halley et al., 2015) The key geological components for the classic mineralized Andean porphyry model have been identified at the Cuprita target.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. David Gower, P.Geo., as defined by National Instrument 43-101 of the Canadian Securities Administrators. Mr. Gower is a consultant of Nobel and is not considered independent of the Company.

About Nobel

Nobel Resources is a Canadian resource company focused on identifying and developing prospective mineral projects. The Company has a team with a strong background of exploration success.

For further information, please contact:

Lawrence Guy

Chairman and Chief Executive Officer

+1 647-276-0533

Vincent Chen

Investor Relations

vchen@nobel-resources.com

www.nobel-resources.com

Cautionary Note Regarding Forward-looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, the mineralization and prospectivity of the Project, the Company’s ability to explore and develop the Project, the Company’s ability to obtain adequate financing and the Company’s future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward- looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nobel, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operation in foreign jurisdictions; ability to successfully integrate the purchased properties; foreign operations risks; and other risks inherent in the mining industry. Although Nobel has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Nobel does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/62309a33-4664-4149-92df-4891438fdf87

https://www.globenewswire.com/NewsRoom/AttachmentNg/63eb007a-2863-4dc7-99d8-f47d66583ae8

https://www.globenewswire.com/NewsRoom/AttachmentNg/3f84beb6-2d48-41e4-b0b0-6dca5442321a

https://www.globenewswire.com/NewsRoom/AttachmentNg/b512640a-ae96-4730-9d81-c3ea1ee96e90

https://www.globenewswire.com/NewsRoom/AttachmentNg/066dd95f-6cec-4cdb-ba39-f44238b70ac1

Keep reading...Show less

07 July

Empire Metals Limited Announces Completion of MRE Drilling Campaign

Completion of Major Drilling Campaign Targeting Maiden Mineral Resource Estimate

Empire Metals Limited, the AIM-quoted and OTCQB-traded exploration and development company, is pleased to announce the successful completion of its largest drilling campaign to date at the Pitfield Project in Western Australia ('Pitfield' or the 'Project'). This programme focussed on high-grade titanium mineralisation within the in-situ weathered cap at the Thomas Prospect and is designed to underpin the Company's maiden JORC compliant Mineral Resource Estimate ('MRE').Highlights

- 180 drill holes completed at the Thomas prospect, comprising:

- 140 Air Core ('AC') drill holes for a total of 6,360 metres;

- 40 Reverse Circulation ('RC') drill holes for a total of 3,776 metres;

- Total metres drilled: 10,136

- Drilling was conducted on a systematic 400m by 200m grid covering over 1,352 hectares and was designed to support the initial MRE as well as providing key data for economic evaluation studies.

- The Thomas Prospect was selected as the basis for the maiden MRE due to the extensive, thick and high-grade titanium mineralisation hosted within the broad, in-situ weathered zone.

- This campaign marks a major milestone in the development of Pitfield, laying the foundation for a globally significant MRE and enabling the identification of near-surface, high grade zones to support the development of mine planning and ore scheduling as part of upcoming economic evaluation studies.

Shaun Bunn, Managing Director, said: "We are very pleased to have completed this important drilling campaign on time, on budget and without safety incident. With drilling now complete, our focus turns to resource modelling and progressing Pitfield towards its maiden Mineral Resource Estimate, which is a key milestone as we look to bring this globally significant titanium project to commercialisation, maintaining the ambitious development schedule we have delivered over the past two years."

MRE Drilling Programme

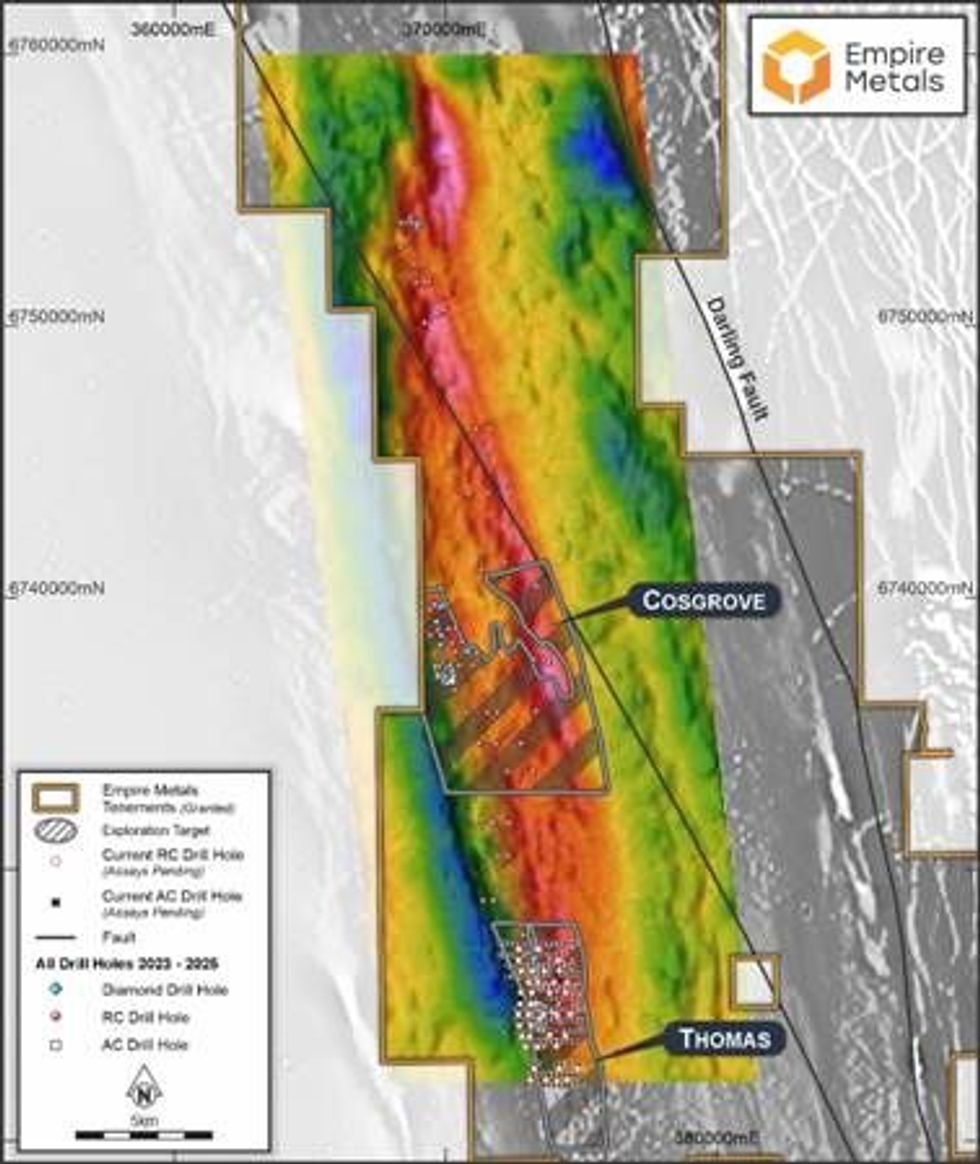

With the completion of the current drill campaign, the largest undertaken by the Company to date, total drilling at Pitfield has now surpassed 32,000m across 382 holes, providing a robust foundation for geological modelling, resource definition (refer Figure 1) and initial economic evaluation work.

Since commencing the maiden drilling campaign at Pitfield on 27 March 2023 Empire has completed 382 drill holes for a total 32,265 metres comprising:

- 17 Diamond drill holes for 2,704 m

- 140 RC drill holes for 18,764 m

- 225 AC drill holes for 10,797 m.

May-June 2025 Campaign

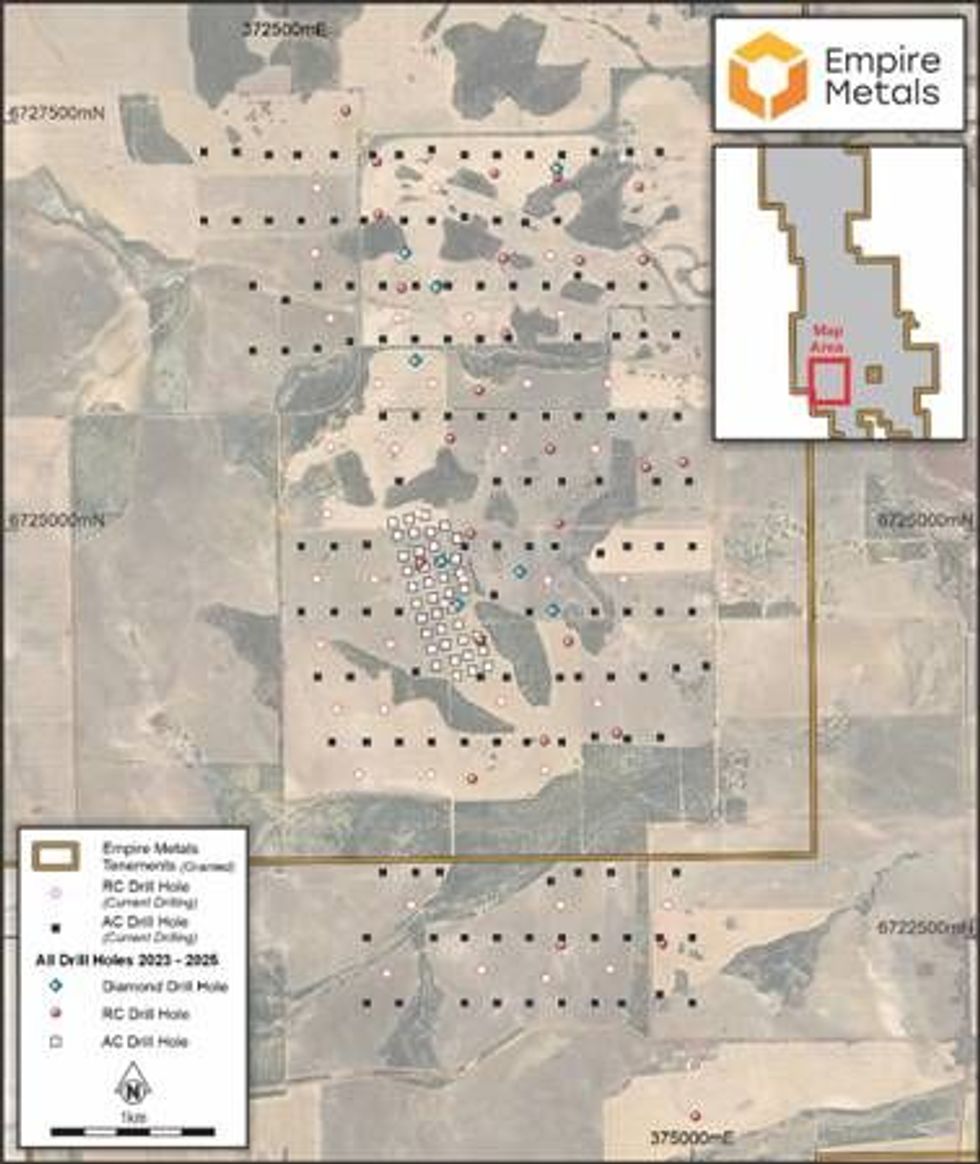

The location and spacing of the current RC and AC drillholes were designed, with the input of mineral resource consultants Snowden-Optiro, to provide the necessary drill assay data density to allow the preparation of an MRE at the Thomas Prospect.

The completed drill campaign consisted of 140 AC drillholes, on a 400 x 200m drillhole-spaced grid with an average forecast depth of 45.4m, for a total of 6,360 metres, and 40 RC drillholes within the AC drilling grid, to an average depth of 94.4m, for a total of 3,776 metres. The overall drillhole grid extends 5.2km by 2.6km and totals an area of 1,352 hectares (refer Figure 2).

During the campaign all drill holes were subsampled on a 2m interval, resulting in over 5,000 drill samples being collected, logged by our on-site team of geologists and then prepared for shipment to Intertek's Perth based analytical laboratory. As of the end of June all drill hole and QA/QC samples have been delivered to Intertek for geochemical analysis and assaying.

The Pitfield Titanium Project

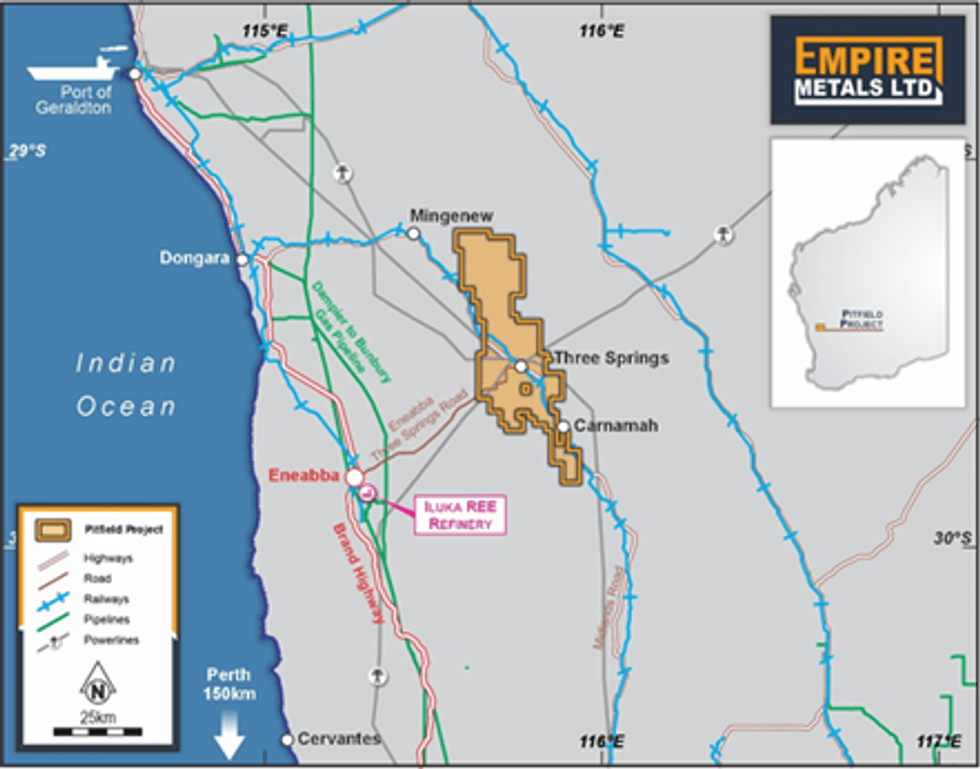

Located within the Mid-West region of Western Australia, near the northern wheatbelt town of Three Springs, the Pitfield titanium project lies 313km north of Perth and 156km southeast of Geraldton, the Mid West region's capital and major port. Western Australia is ranked as one of the top mining jurisdictions in the world according to the Fraser Institute's Investment Attractiveness Index published in 2023, and has mining-friendly policies, stable government, transparency, and advanced technology expertise. Pitfield has existing connections to port (both road & rail), HV power substations, and is nearby to natural gas pipelines as well as a green energy hydrogen fuel hub, which is under planning and development (refer Figure 2).

Competent Person Statement

The technical information in this report that relates to the Pitfield Project has been compiled by Mr Andrew Faragher, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Mr Faragher is a Member of the Australian Institute of Mining and Metallurgy. Mr Faragher has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Faragher consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON:EEE) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com

Click here to connect with Empire Metals (OTCQB:EPMLF, AIM:EEE) to receive an Investor Presentation

Keep reading...Show less

02 July

Loyal to Acquire the High-Grade Highway Reward Copper Gold Mine

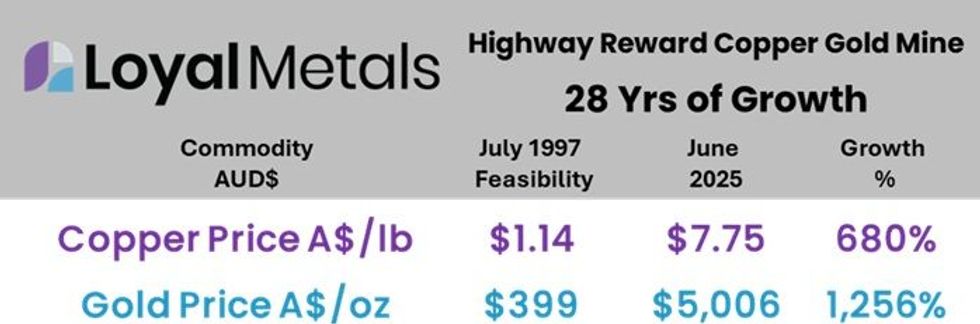

Loyal Metals Limited (ASX:LLM) (Loyal, LLM, or the Company) is pleased to announce that it has acquired a binding option to purchase the Highway Reward Copper Gold Mine in Queensland, Australia, one of the highest-grade copper mines worldwide, with past production totalling 3.65 million tonnes at 5.7% Cu and 260,000 tonnes at 4.5 g/t Au 1-9. This acquisition is the first step in Loyal’s 2025 Strategic Plan to broaden its critical minerals portfolio into copper. No exploration has been conducted on the mining leases since mining ceased in July 2005, despite a ~680% increase in copper prices and a ~1,256% increase in gold prices since the 1997 feasibility study 3,4. With over $4.4 million in funding, Loyal is well-positioned to revisit the high-grade Highway Reward Copper Gold Mine by deploying modern exploration techniques11.

Key Highlights

- Loyal secures binding option to acquire the Highway Reward Copper Gold Mine in Queensland, Australia - one of the world’s highest-grade copper mines, with past production totalling 3.65Mt at 5.7% Cu and 260kt at 4.5 g/t Au.

- The acquisition is the first step in Loyal’s 2025 Strategic Plan to broaden its critical minerals portfolio into copper.

- No exploration has been conducted on the granted mining leases since operations ceased in July 2005 despite a ~680% increase in copper prices and a ~1,256% increase in gold prices since the 1997 feasibility study.

- Significant increase in copper and gold prices, combined with the previous exclusion of gold in sulphides from the mine plan, highlights the enhanced remnant copper-gold potential.

- Exploration potential for new discoveries both along strike and at depth, as previous mining only reached depths of 220 metres for open pit and 390 metres for underground operations, with limited exploration beyond mined zones.

- With $4.4 million in funding, Loyal is well-positioned to revisit the high-grade Highway Reward Copper Gold Mine by deploying modern exploration techniques. With global initiatives to enhance energy grids and no USA tariffs on Australian copper, the outlook for copper is strong and unencumbered.

Loyal‘s Managing Director, Mr. Adam Ritchie, commented:

"We are thrilled to secure this incredibly rare opportunity for our current and future Loyal investors. The Highway Reward Copper Gold Mine, considered one of the highest-grade copper mines in the world, is now primed for a revisit after 20 years of dormancy.

The granted mining leases of the Highway Reward mine provide an amazing speed to market opportunity - especially when both copper and gold are near all-time highs. The short-term and long-term opportunities at Highway Reward are exciting, considering the significant growth in commodity prices since the 1997 feasibility study. Copper is driving our electric future and gold continues to play an important role in our global economy.

Whilst a lot has changed in the past 28 years, the unwavering demand for copper and gold has only intensified. This is truly an amazing opportunity to unlock and showcase the immense potential of this forgotten mine. With modern technology and innovative mining techniques, we believe the Highway Reward Copper Gold Mine will provide exceptional value and returns to our Loyal shareholders."

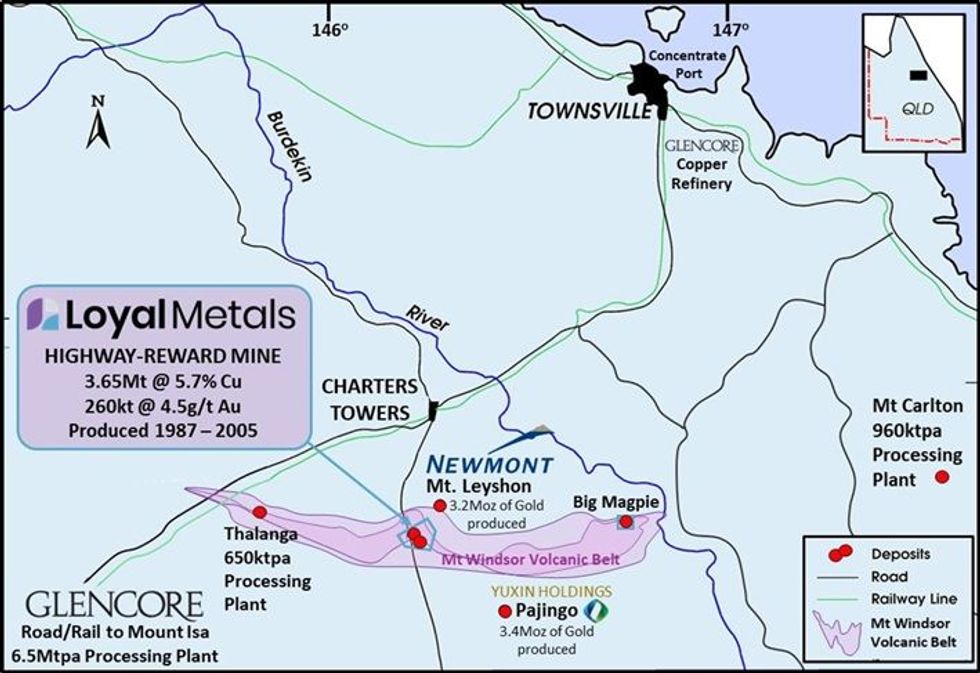

The Highway Reward Copper Gold Mine is located only 37 km from the active mining town of Charters Towers in Queensland, Australia, within the Mount Windsor Volcanic Belt. This area is renowned for its rich history in copper and gold mining, with strong social license support for mining activities. It features large-scale mining operations such as, Newmont’s 3.2 Moz Mt Leyshon gold mine and Yuxin Holding’s 3.4 Moz Pajingo gold mine. The region is close to the polymetallic, Thalanga Processing Plant and the Mount Carlton Processing Plant, with road and rail to Glencore’s Mount Isa copper hub, Townsville copper refinery and the Port of Townsville.

With the growth in commodity prices and advancements in exploration and mining technologies, the potential for remnant copper-gold mining has significantly improved. Previous mining operations targeted copper within chalcopyrite, while gold associated with both chalcopyrite and pyrite was excluded from the mine plan. With lower copper equivalent cut-off grades (copper & gold), higher continuity of copper-gold can be drill tested to demonstrate the reasonable prospects for eventual economic extraction and mineral resource potential.

Significant potential will be assessed and areas tested for copper-gold extensions to subvertical trends, that may exist below current mining levels at the Highway Reward Copper-Gold Mine. The previously mined, copper-gold rich pipes will also be assessed for drill testing along strike (Figure 2). Previous mining and surface mapping geological observations illustrate that high- grade copper-gold pipes have been identified in dacite, rhyolite, and volcaniclastic host rocks, therefore strong prospectivity exists for discovering additional pipes beyond the historically mined zones in all rock types on the property, except recent overlying sediments that conceal the basement host rocks (Figure 2). No modern advanced geophysical techniques or data processing methods have yet been applied to assess this potential.

Click here for the full ASX Release

This article includes content from Loyal Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Keep reading...Show less

25 June

Copper Market Hit by Major Supply Squeeze as LME Inventories Drop

One of the sharpest copper supply crunches in recent memory is rattling global commodities markets, as inventories at the London Metal Exchange (LME) plummet and the spot price soars.

Bloomberg reported that as of Monday (June 23), copper for immediate delivery was trading at a premium of US$345 per metric ton over three month futures, the widest spread since a record squeeze in 2021.

That dramatic price divergence reflects the market’s acute concerns over access to physical copper, with readily available inventories on the LME falling by around 80 percent this year alone.

Available stockpiles now cover less than a single day of global demand, amplifying anxiety across the supply chain.

Historic backwardation signals market distress

Backwardation in metals markets typically suggests that buyers are scrambling to obtain physical supply. In copper’s case, a combination of logistical, geopolitical and structural forces is driving the surge.

LME stockpiles have been rapidly drawn down as traders and manufacturers shift metal to the US in anticipation of potential trade barriers, spurred by US President Donald Trump's tariff moves.

That migration has created acute shortages in Europe and Asia. Chinese smelters, responding to the price premium and slackening domestic demand, have begun exporting surplus copper to global markets. Yet those flows have not kept pace with the drawdowns, and China's own inventories have also dwindled.

The LME had hoped recent regulatory interventions would prevent another disorderly squeeze like the one that disrupted the nickel market in 2022. Last week, the exchange enacted new rules mandating that traders with large front-month positions offer to lend those holdings if they exceed available inventories.

The so-called “front-month lending rule” is meant to discourage hoarding and promote liquidity.

However, recent copper trading data suggest that no single trader is behind the current squeeze. On Monday, the Tom/next spread — a one day lending rate — spiked to US$69 per metric ton.

This would only occur if no one entity held enough copper to trigger lending obligations under the new rules, indicating the tightness is likely the result of broad-based market dynamics rather than manipulation.

LME tightens oversight

As mentioned, the LME has begun cracking down on oversized positions across its metals complex.

In a June 20 statement, the exchange introduced a temporary, market-wide rule to manage large front-month exposures. Under the updated rules, traders holding positions in the front-month contract for a metal that exceed the total available exchange inventories — excluding any stock they already own — must offer to lend those positions at “level,” meaning they are required to roll them over to the next month at the same price.

The rule aims to rein in aggressive moves by commodities trading houses that have made deep inroads into metals markets over the past year. The LME emphasized in its release that recent market interventions are targeted, adding that the newly introduced rule offers a standardized approach.

Still, the unprecedented depth of copper’s backwardation — now extending years into the future — suggests that broader supply/demand dynamics are at play, beyond what position limits alone can control.

For manufacturers and industrial users, the squeeze presents a serious cost and planning risk. Many rely on the LME as a pricing and hedging mechanism. But when exchange inventories drop this low, even large players can face trouble sourcing metal to meet contract obligations. With exchange-based supply nearly exhausted, companies may increasingly turn to off-market deals or bilateral supply agreements — often at higher prices.

This shift weakens the LME’s role as a central clearinghouse for global copper, and raises questions about its ability to handle future shocks, especially as energy transition policies boost long-term demand for the metal.

Market watchers will also be looking to the next moves from Chinese exporters, US trade policy under Trump and the LME’s enforcement of its new regulations.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

24 June

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten.

In May 2024, the copper price hit a new all-time high of US$10,954 per metric ton (MT) on the London Metal Exchange and US$5.20 per pound on the COMEX on the back of increasing demand and growing supply concerns.

Copper is one of the most important resources for the energy transition. However, in recent years, demand for the red metal has outpaced mining supply. While construction and electrical grids have long been major markets for copper, today the rise in demand for electric vehicles, EV charging infrastructure and energy storage applications are emerging drivers of copper consumption.

Another trend driving future copper demand is the rapid urbanization in the Global South, as rural populations migrate to cities, putting pressure on electricity grids.

Due to the challenges associated with finding, developing, permitting and mining copper deposits, the higher demand is being met by slow growth of new supply. Mines that are in operation tend to be quite large and operate for decades as copper producers concentrate on mine expansions and brownfield projects aimed at extending mine lifetimes.

Given those factors, investors should keep an eye on the world’s top copper miners and their operations.

This list of the 10 largest copper-mining companies in the world is ranked by attributable copper production for 2024.

As companies' reporting methods for copper production differ, the Investing News Network has calculated attributable copper production for the companies below using figures from company reports and data from Mining Data Online in order to provide investors with the most accurate ranking of global copper production by company.

1. BHP (ASX:BHP,NYSE:BHP,LSE:BHP)

Copper production: 1.46 million metric tons

BHP is one of the world’s largest mining companies, and its global portfolio of assets includes significant copper mining operations in Chile, Australia and Peru.

According to the company’s quarterly operational review data, the mining giant reported consolidated copper production of 1.46 million metric tons across the calendar year 2024.

Its most significant copper asset is the Escondida mine, the world’s largest copper mine. BHP holds a 58 percent stake in the Chilean operation, which, according to MDO data, produced 2.04 billion pounds of copper in 2024. The company wholly owns the Pampa Norte operations in Chile, which produced 586 million pounds of copper in 2024.

BHP also owns the Olympic Dam polymetallic mine, the largest mine in Australia. The South Australian mine hosts one of the world’s largest copper deposits as well as the largest uranium deposit. In 2023, BHP expanded its portfolio in the state with its acquisition of OZ Minerals and its Prominent Hill and Carrapateena copper operations.

2. Codelco

Copper production: 1.44 million metric tons

The Chilean state-owned Codelco is the world’s third-largest producer with copper production of 1.44 million metric tons in 2024. According to its 2024 annual report, its copper output increased 1.2 percent from 1.42 million metric tons in 2023.

Its largest asset is the Chuquicamata mine located in Northern Chile, between 2017 and 2021 annual production was in the 700 million to 850 million pound range. However, lower grades in recent years have led to production falling below 600 million pounds. In 2024, Chuquicamata increased slightly to 637 million pounds.

The mine transitioned from an open pit to an underground mine beginning in 2019. In its report, the company stated that phase one of its continuity infrastructure project had reached 73 percent completion and that plans for the second phase were undergoing feasibility studies.

The company’s other significant Chilean mines include El Teniente, Quebrada Blanca and Andina.

3. Freeport-McMoRan (NYSE:FCX)

Copper production: 1.26 million metric tons

Freeport-McMoRan is consistently ranked among the world’s top copper producers, and its share of copper production from its mines totaled 1.26 million metric tons of copper in 2024. The company reported producing 4.21 billion pounds, or 1.9 million metric tons, of the red metal, calculated on a 100 percent basis for all operations except its Morenci joint venture.

The largest contributor to its output is the Grasberg copper-gold mine in Indonesia. The mine itself is a joint venture between Freeport and state-owned Indonesia Asahan Aluminum, with the entities holding interests of 48.76 percent and 51.24 percent respectively. According to MDO, copper output for the mine in 2024 totaled 1.8 billion pounds.

Grasberg has undergone a transition from an open pit to an underground block cave, and expansion work continues at the site. As of the close of 2024, the mine had 469 open drawbells.

Additionally, Freeport holds a 55 percent stake in the Cerro Verde copper-molybdenum complex in Peru. The mine routinely produces between 800 million and 1 billion pounds of copper and is expected to be in operation until 2052.

Its largest US based operation is its 72 percent owned Morenci mine in Arizona, which produced 700 million pounds in 2024. It also owns the Safford and Sierrita mines in the same state.

4. Glencore (LSE:GLEN,OTC Pink:GLCNF)

Copper production: 951,600 metric tons

Mining major Glencore's copper production dipped by 6 percent in 2024 to 951,600 metric tons from the 1.01 million metric tons produced in 2023. The company’s 2024 annual report attributed the decline to lower planned production at its Antapaccay and Collahuasi mines due to factors including lower grades, water constraints and geotechnical challenges.

Located along Chile’s coast, Collahuasi is the company's largest operation, a 44/44/12 joint operation between Glencore, Anglo American (LSE:AAL,OTCQX:NGLOD) and Japan’s Mitsui & Co. (OTC Pink:MITSF,TSE:8031). The mine produced 558,600 metric tons of copper in 2024.

The partners are working to build a large-scale desalination plant designed to help overcome water shortage issues. The plant reached 86 percent completion in 2024 and is expected to begin operating in 2026. Once open, it will provide 1,050 litres of desalinated water per second to the mine via a 194 kilometer pipeline.

Other significant copper-producing assets in the company’s portfolio include Antamina in Peru, Mount Isa in Australia and the Katanga Complex in the Democratic Republic of the Congo.

5. Southern Copper (NYSE:SCCO)

Copper production: 883,462 metric tons

A majority-owned, indirect subsidiary of Grupo Mexico (OTC Pink:GMBXF), Southern Copper recorded 883,462 metric tons of total copper production for 2024, a 6.9 percent increase over 2023. In the company’s 2024 results, the company attributed the increase to higher production across all operations, with a 10.7 percent increase from its Peruvian assets and a 4.3 percent increase from Mexican production.

The company operates major copper mines in Peru and Mexico and has exploration projects in Argentina, Chile, Ecuador, Mexico and Peru.

Its largest copper-producing asset is the Buenavista mine in Northern Mexico, which sits atop one of the world’s largest porphyry copper deposits. According to MDO, the site produces approximately 700 billion to 750 billion pounds of copper per year.

Its other copper operations include the Cuajone and Toquepala mines in Peru and the La Caridad mine in Mexico.

6. Anglo American (LSE:AAL,OTCQX:NGLOD)

Copper production: 772,700 metric tons

British miner Anglo American reported a 6.5 percent decrease in copper production to 772,700 metric tons from 826,200 metric tons in 2023.

The company attributed the decline to lower recovery and grades at the Collahuasi and Los Bronces operations in Chile, noting that the planned closure of the Los Bronces processing plant also impacted production. The company holds a 44 percent stake in Collahuasi and 50 percent in Los Bronces.

In addition to Collahuasi, the company also owns a 60 percent stake in the Quellaveco mine in Peru, with Mitsubishi owning the remaining 40 percent. The open pit mine started operating in 2022 and, according to MDO, produced 675 million pounds of copper in 2024.

It also owns a 50 percent stake in the El Soldado mine in Chile, which it operates in partnership with Mitsui, which holds a 30 percent stake, and Mitsubishi Materials (OTC Pink:MIMTF), which holds the remaining 20 percent. Data from MDO shows that the mine produced 48,200 metric tons of copper in 2024.

7. KGHM Polska Miedz (FWB:KGHA.F)

Copper production: 729,700 metric tons

Poland’s KGHM Polska Miedz Group has operations in Europe, North America and South America, and says that it controls over 40 million metric tons of copper ore resources worldwide. In 2024, KGHM produced 729,700 metric tons of copper, a slight increase from the 710,900 metric tons of copper produced in 2023.

According to MDO, KGHM’s largest operation is the Polkowice-Sieroszowice mine in Western Poland. The mine has been in operation since 1968 and produces approximately 430 million to 440 million pounds of copper annually.

The company’s Polish operations also include the Rudna mine, which produced 338 million pounds of copper last year, and the Lubin mine, which produced 156 million pounds.

Other options under the KGHM banner include the Robinson mine in Nevada, United States, and the 55 percent owned Sierra Gorda mine in Chile.

8. CMOC Group (OTC Pink:CMCLF,HKEX:3993)

Copper production: ~502,600 metric tons

CMOC Group is a new addition to the top 10 after its copper production jumped significantly in 2024, with its share of production from its joint venture copper-cobalt mines in the Democratic Republic of the Congo totaling approximately 502,600 metric tons. On a 100 percent basis, the company reported annual copper production of 650,161 metric tons.

The majority of CMOC's copper production came from its Tenke Fungurume copper-cobalt mine, an 80/20 joint venture with the state-owned mining firm Gecamines. According to MDO data, the mine has experienced significant growth over the past few years, ramping up from 400 million pounds of copper in 2020 to 618 million pounds in 2023. In 2024, Tenke Fungurume's copper production soared to 992 million pounds, or 450,138 metric tons.

Its other DRC mine is Kisanfu, a 71/24/5 joint venture with Chinese battery manufacturer Contemporary Amperex Technology (SZSE:300750) and the DRC government. The mine produced 200,013 metric tons of copper cathode in 2024, up substantially from 114,000 in 2023.

9. Antofagasta (LSE:ANTO)

Copper production: 448,800 metric tons

Antofagasta’s share of copper production from its four joint venture operations in Chile totaled 448,800 metric tons in 2024.

The company's largest operation is its 60 percent owned Los Pelambres mine, a joint venture with Mitsubishi. According to MDO, Los Pelambres’ copper production totaled 320,000 metric tons in 2024, up from 300,000 the previous year.

Its Centinela mine is another significant producer, with 224,000 metric tons of copper mined in 2024. The company is constructing a second concentrator at Centinela that, once it comes online in 2027, should add 144,000 metric tons of copper production annually and extend Centinela’s mine life by 15 years to 2051.

The company's other Chilean joint ventures are the Antucoya and Zaldivar mines.

10. Teck (TSX:TECK.A,TECK.B,NYSE:TECK)

Copper production: 358,910 metric tons

Rounding out the top 10 is Canada’s Teck, which increased consolidated copper production by 50 percent in 2024, reaching 446,000 metric tons. On an attributable basis, the copper company's production totaled 358,910 metric tons in 2024.

Much of the gain came from the ramp-up of the Quebrada Blanca mine in Chile. The mine started production in 2023 and produced just 122 million pounds of copper that year. 2024 saw a significant advancement, with the mine producing 458 million pounds of the red metal.

Teck holds a 60 percent ownership stake in the mine, while Japan’s Sumitomo (OTC Pink:SSUMF,TSE:8053) controls a 30 percent stake and Chile’s state-run Codelco owns the final 10 percent.

Teck also owns the Highland Valley mine in British Columbia, Canada. The mine is one of the largest open pit mines in Canada and produced 226 million pounds of copper in 2024.

Other copper operations in the Teck portfolio include Antamina in Peru and Carmen de Andacollo in Chile.

This is an updated version of an article originally published by the Investing News Network in 2016.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00