October 02, 2024

GTI Energy Limited (ASX: GTR) (GTI or Company) is pleased to advise that the final phase of its 2024 drilling campaign will commence in late October to drill and construct 3 hydrogeologic and water monitoring wells. Following completion of this work, GTI will be in a position to update the Mineral Resource Estimate and Exploration Target for Lo Herma by year end as planned. A decision will then be made on commencing a Scoping Study to demonstrate the economic potential of the project.

HIGHLIGHTS

- Lo Herma drilling for construction of groundwater monitoring wells to commence by late October

- Lo Herma Mineral Resource Estimate and Exploration Target updates on track for late Q4 2024

- Green Mountain drilling permit conditions satisfied

- UEC pays US$175m for Rio Tinto’s Great Divide Basin & Green Mountain assets

GREEN MOUNTAIN PROJECT: DRILLING PERMIT

As previously disclosed on 21 February 2024, the GTI technical team finalised the maiden drill plan at Green Mountain, selecting 16 drill holes for permitting. The drill program is designed to test the validity of the historical Kerr McGee drill hole maps, as well as the interpreted 12 Miles (~19kms) of mineralised regions as determined from the airborne geophysical survey completed during late 2023. All surveys and drilling permit approval conditions have been met and a reclamation bond amount has now been determined by Wyoming’s DEQ & the United States Bureau of Land Management (BLM). The Company will make a final decision regarding timing of drilling at Green Mountain in due course.

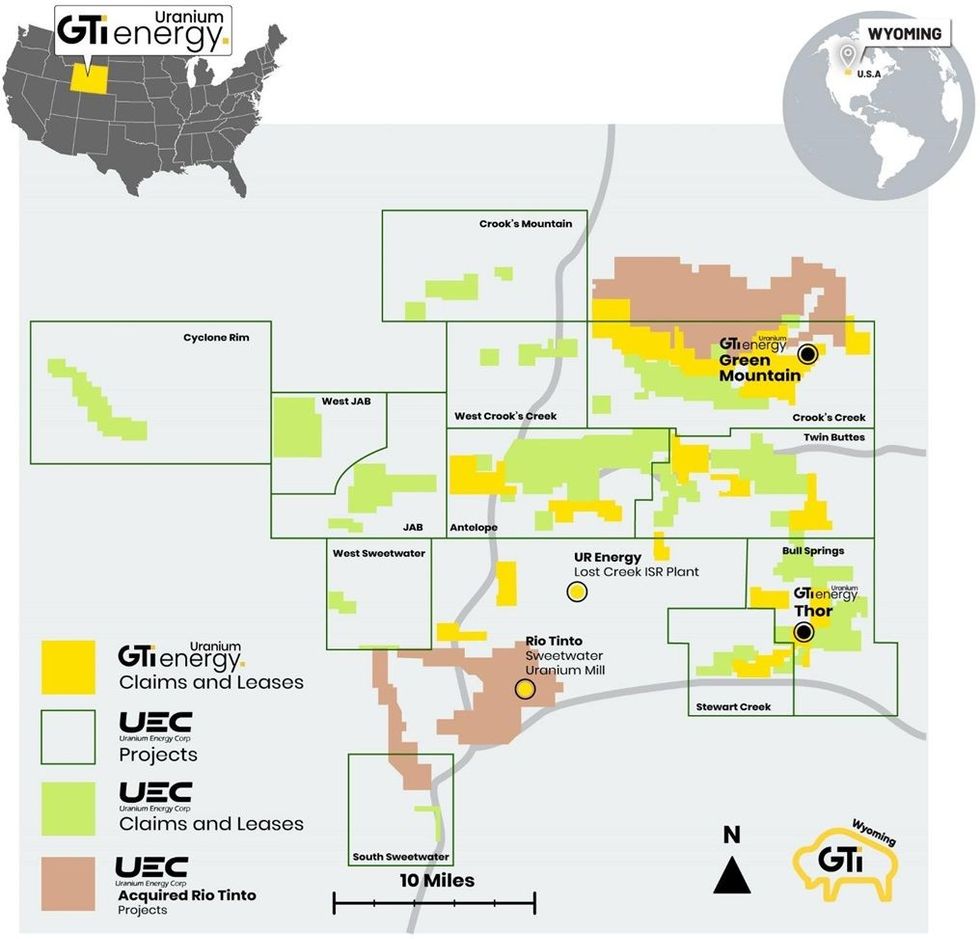

UEC ACQUIRES RIO TINTO’S GREEN MOUNTAIN AND GREAT DIVIDE BASIN ASSETS1

NYSE American-listed Uranium Energy Corp (UEC), the largest uranium company in the US, announced on September 23rd that it will acquire all of Rio Tinto's Wyoming assets. The assets include the Sweetwater uranium plant and a portfolio of mining projects, in the Great Divide Basin and at Green Mountain, for US$175 million.

UEC President and CEO Amir Adnani said that, with the acquisition, UEC was building on its transformative purchase of Uranium One Americas in 2021, which expanded its holdings in Wyoming’s Great Divide basin. “We recognised early on that there are meaningful development synergies with the Rio Tinto assets, particularly the Sweetwater plant,” said Mr Adnani. UEC stated that the Rio acquisition will establish UEC’s third hub-and-spoke production platform [in addition to its Texas and Wyoming, Powder River Basin operations] and bolster UEC’s resources by circa 175 million pounds, about half of which UEC considers to be amenable to in-situ recovery (ISR) mining.

UEC said it plans to prioritise ISR-amenable resources for development and near-term production, while conventional resources will provide flexibility for future production growth. UEC stated that the 3,000 t/d Sweetwater plant, which has a licensed capacity of 4.1 million pounds a year, can be adapted for recovery of uranium from loaded resins produced by ISR operations. This would potentially provide UEC with production flexibility for both ISR and conventional mining.

GTI Director & CEO Bruce Lane commented, “we are excited that UEC has acquired these assets from Rio with a plan to build their third ‘hub-and-spoke’ ISR production centre at the Sweetwater mill site. We remain convinced that uranium resources in the Great Divide Basin and Green Mountain district have real potential to be developed in a similar fashion to those in Texas and the nearby Powder River Basin production district. UR Energy’s producing Lost Creek ISR plant and Shirley Basin ISR satellite mine development demonstrate the viability of ‘hub-and-spoke’ production strategies within the district”

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman Jon Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00