- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

February 15, 2023

2023 drilling campaign gathering momentum with seven diamond drilling rigs currently on‐site drilling

Latin Resources Limited (ASX: LRS) (“Latin” or “the Company”) is pleased to provide the latest assay results and an update on the progress of the 2023 drilling campaign at the Company’s 100% owned Colina Lithium Deposit (“Colina”) located in the state of Minas Gerais, Brazil (Appendix 1).

HIGHLIGHTS

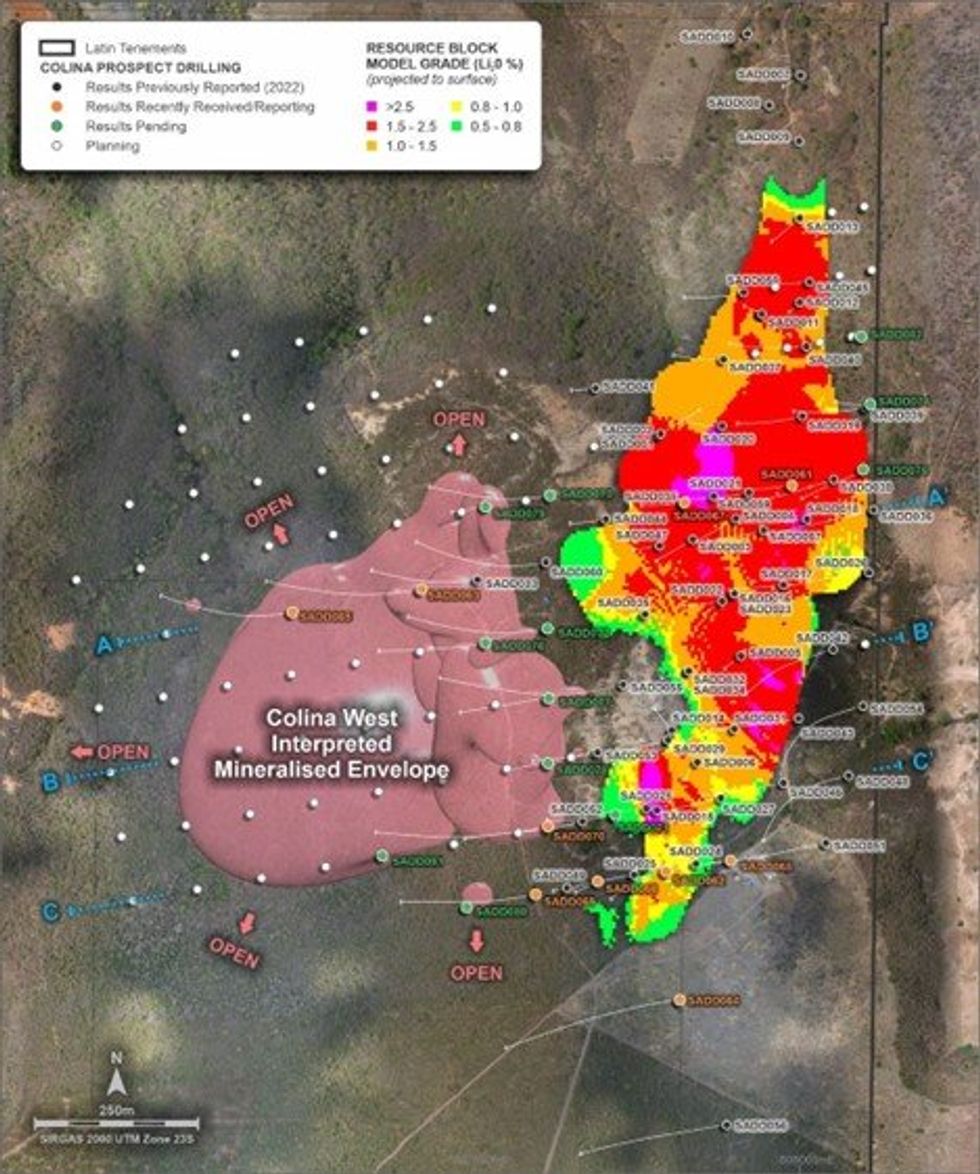

- Recent drilling is showing very positive signs that Colina West will become a major contributor to the Salinas lithium JORC Resource upgrade.

- Thick spodumene rich pegmatites intersected at Colina West (assay results pending), defining emerging priority growth zone extending for over 500m along strike and 300m up dip which remains open in all directions.

- High‐grade mineralisation envelope confirmed at Colina West from latest drilling results within this zone.

- Latest results include:

- SADD061: 20.70m @ 1.51% Li2O from 159.00m

- SADD062: 10.00m @ 1.13% Li2O from 149.51m

- SADD063: 4.03m @ 1.60% Li2O from 125.12m

and: 6.79m @ 1.52% Li2O from 267.37m - SADD070: 5.03m @ 1.64% Li2O from 192.97m

and: 5.52m @ 1.50% Li2O from 292.03m

and: 16.43m @ 1.69% Li2O from 323.57m

and: 18.89m @ 1.56% Li2O from 356.91m

- Seven diamond drilling rigs currently on site and one additional diamond drilling rig due in late February ‐ early March with 2023 drilling campaign well on track.

- Latin aims to add Reverse Circulation capability to grow the drilling fleet on site to ten, enabling the rapid ‘step‐out’ testing of the prospective lithium corridor.

Latin Resources’ Geology Manager, Tony Greenaway, commented:

“These results continue to confirm the exceptional prospectivity of the Latin landholding, and the potential to expand our mineral resource inventory. We are continuing to see outstanding pegmatite intersections in our new drill core from the 2023 campaign. These intersections support our current interpretation of mineralisation, with the emergence of a clear, thick, plunging high‐grade envelope at Colina West which remains open in all directions.

“We are seeing a significant increase in the abundance and thickness of spodumene pegmatites developed at Colina West, with this emerging priority area now extending over 500m along strike and 300m up‐dip. We will continue to target this area with more drilling to ascertain its limits and to provide sufficient drill coverage to include this area in our planned Mineral Resource update scheduled for the second quarter of this year.”

2022 Drilling Assay Results

Results from drilling completed in late 2022 have been returned from the laboratory and continue to show good correlation with the JORC 2012 Indicated and Inferred Mineral Resource Estimate (“MRE”). Results include holes from both within the existing Colina Deposit MRE model, and the Colina West area which is currently outside of the MRE block model (Figure 1 – Figure 4).

Recent intersections include:

- SADD061: 20.70m @ 1.51% Li2O from 159.00m

- SADD062: 10.00m @ 1.13% Li2O from 149.51m

- SADD063: 4.03m @ 1.60% Li2O from 125.12m

and: 6.79m @ 1.52% Li2O from 267.37m - SADD070: 5.03m @ 1.64% Li2O from 192.97m

and: 5.52m @ 1.50% Li2O from 292.03m

and: 16.43m @ 1.69% Li2O from 323.57m

and: 18.89m @ 1.56% Li2O from 356.91m

Click here for the full ASX Release

This article includes content from Latin Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRS:AU

The Conversation (0)

02 February 2022

Latin Resources

Developing mineral projects to support the global decarbonization

Developing mineral projects to support the global decarbonization Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00