March 27, 2023

CleanTech Lithium (AIM:CTL,FWB:T2N,OTC:CTLHF)) envisions being the greenest lithium supplier to the electric vehicle (EV) market by using direct lithium extraction (DLE) - a low-impact, low-carbon and low-water method of extracting lithium from brine – powered by renewable energy sources. The company has three large lithium assets with an estimated two million tonnes of lithium carbonate equivalent (LCE) in Chile’s Lithium Triangle, a world-renowned mining-friendly jurisdiction.

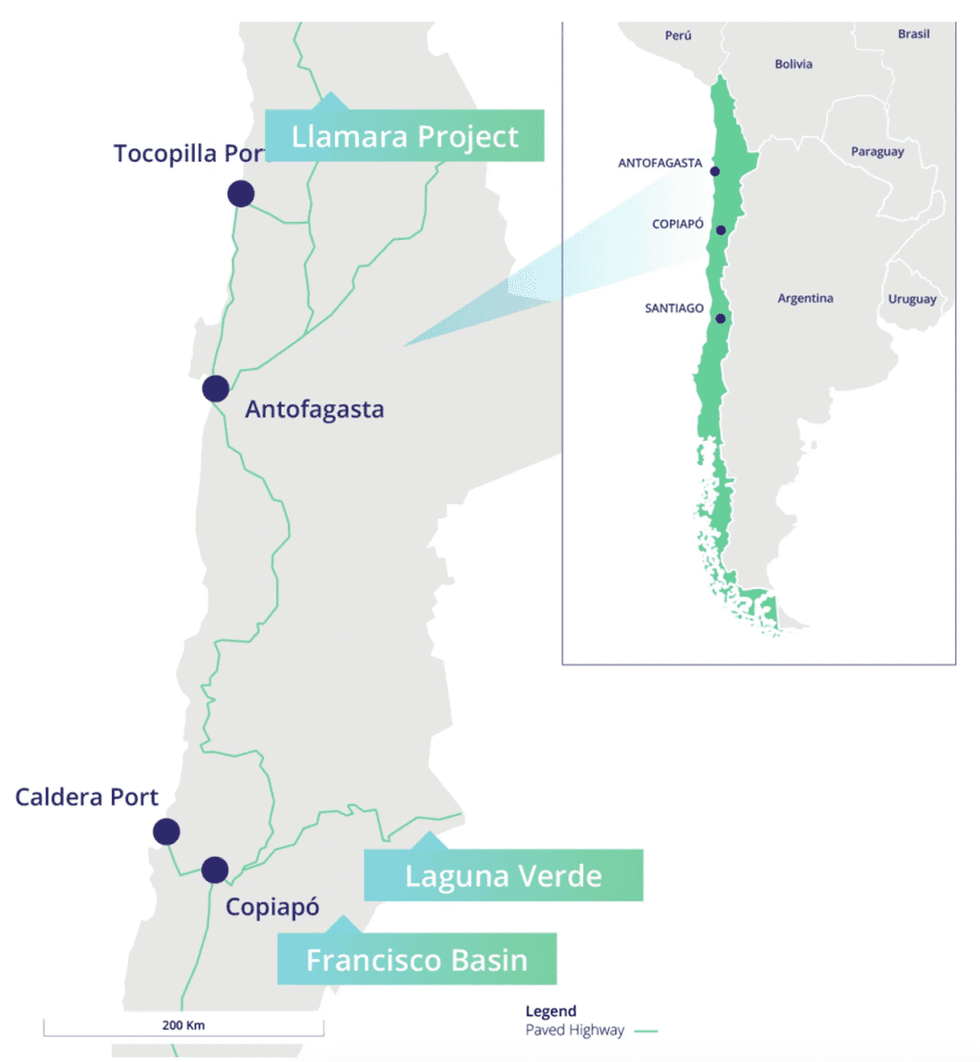

The company’s assets are all located in Chile and amenable to eco-friendly development. Laguna Verde, CleanTech’s flagship asset, is poised for near-term green lithium production by the end of 2025 with a resource estimate of 1.5 million tonnes of LCE. The company’s second flagship asset is Francisco Basin, approximately 100 km south of Laguna Verde. JORC-compliant inferred resource estimated 0.5 million tonnes of LCE. Both projects are 4,200+ meters above sea level, meaning there is minimal risk to biodiversity and impact on local communities. The company's third asset is the Llamara Project, a green-fields project located in the Antofagasta region and is around 600 km north of Laguna Verde and Francisco Basin. The area totalling 344 square kilometers located in the Pampa del Tamarugal basin, which is one of the largest basins in the lithium triangle.

CleanTech Lithium is committed to an ESG-led approach and supporting its downstream partners by producing the greenest lithium to the market. As a result, the company will use renewable energy and the eco-friendly direct lithium extraction (DLE) process throughout its projects. DLE is widely considered the best option for lithium brine extraction that makes the least environmental impact. No evaporation ponds, no carbon intensive processes and reduced levels of water consumption. In recognition, Chile’s government plans to prioritize DLE for all new lithium projects.

Company Highlights

- CleanTech Lithium is an exploration and development company with three notable lithium projects in Chile, totaling >500km2 licensed areas and lithium resources exceeding 2 million tonnes LCE

- The company aims to become the greenest lithium supplier to the EV market by adopting environmental and social sound practices throughout its assets and culture.

- Chile is quickly becoming a global leader in clean energy, which enables the company to take advantage of the existing renewable power throughout its operations

- The company will use DLE, a proven* method for extracting lithium brine that minimizes environmental impact and reduces production time, resulting in high quality battery grade lithium

- CleanTech Lithium’s flagship projects Laguna Verde and Francisco Basin are located nearby reliable renewable power sources and transport infrastructure that can support the scalability of each project.

- The company’s third highly prospective asset, Llamara, is undergoing exploration and represents blue-sky opportunities for additional lithium discoveries.

- This is being led by an experienced management team with the right blend of expertise leads the company towards its goals of supplying the growing EV market with eco-friendly lithium,

- Underpinned by an established ESG-led approach - a critical priority for governments introducing regulations that require a cleaner supply chain to reach net-zero targets.

- DLE plants operating successfully in Argentina and China

This CleanTech Lithium profile is part of a paid investor education campaign.*

CTL:HF

Sign up to get your FREE

CleanTech Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

10 November 2025

CleanTech Lithium

Premium lithium projects located in established mining districts to meet battery and EV demand

Premium lithium projects located in established mining districts to meet battery and EV demand Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

CleanTech Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00