September 03, 2024

Chariot Corp Limited (ASX:CC9) (“Chariot”) refers to the announcement dated 30 August 2024 entitled “Chariot and Mustang Lithium LLC repossess Horizon and Halo lithium projects” (the “Original Announcement”) pursuant to which the Company announced that Mustang Lithium LLC (“Mustang”), in which Chariot holds a 24.1% interest, was in the process of terminating property option agreements entered into by two of its wholly-owned subsidiaries, Horizon Lithium LLC and Halo Lithium LLC, with Canadian Securities Exchange (CSE) listed Pan American Energy Corp. (CSE:PNRG) (“Pan American Energy”) and POWR Lithium Corp. (CSE:POWR) (“POWR”), respectively. This action by Mustang will result in Horizon Lithium LLC’s and Halo Lithium LLC’s repossession of full and unencumbered ownership of the Horizon Lithium Project and Halo Lithium Project, respectively.

As disclosed in the Original Announcement:

- Each of Pan American Energy and POWR decided not to make the required payment of claims maintenance fees to the U.S. Bureau of Land Management (“BLM”) and to surrender their respective interests in the mineral claims constituting the Horizon Lithium Project and the Halo Lithium Project (together, the “Projects”). Both have cited current lithium market conditions as the principal reason for terminating their respective property option agreement.

- Mustang completed a capital raising of US$250,000 through the issue of convertible notes and has used the funds raised to pay the maintenance fees to the BLM to maintain its interest in the Projects.

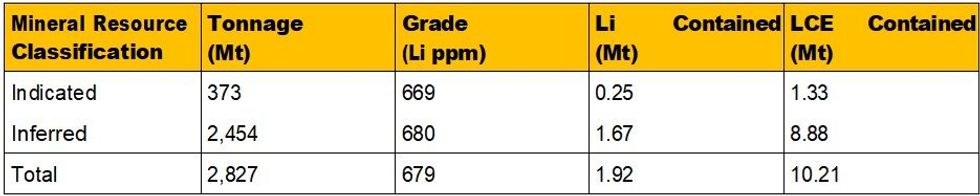

Chariot disclosed the mineral resource estimate stated in Figure 1 (the “Horizon NI 43-101 Mineral Resource Estimate”) in relation to the Horizon Lithium Project in the Original Announcement which was prepared by Pan American Energy in accordance with Canadian National Instrument 43-101 (“NI 43-101”) standards. This mineral resource estimate is considered a “foreign estimate” for the purposes of the ASX Listing Rules (“Listing Rules”) as it relates to a “material mining project” that the Company is reacquiring an interest in and therefore is required to be reported in compliance with Chapter 5 of the Listing Rules (particularly Listing Rule 5.12). The purpose of this announcement is to include the requisite disclosures required by Listing Rule 5.12 in respect to the Original Announcement.

Pan American Energy reported the Horizon NI 43-101 Mineral Resource Estimate to the Canadian Securities Exchange on 20 November 2023 and subsequently released an NI 43-101 compliant technical report on 4 January 20241.

Effective Date 15 November 2023, reported by Pan American Energy Corp. Resources are reported above a cut-off grade of 300 ppm Li.

Cautionary Statement

A “mineral resource” is as defined in the JORC Code (“Mineral Resource”) and the “competent person” is as defined in the JORC Code (the “Competent Person”).

The Horizon NI 43-101 Mineral Resource Estimate contained in this announcement and the Original Announcement has been prepared in accordance with NI 43-101 standards and has not been reported in accordance with the JORC Code.

Investors and other users of the Horizon NI 43-101 Mineral Resource Estimate are cautioned that, as is the case with any Mineral Resource, reported tonnages and grades obtained from sparse points of observation, are subject to change as further data that adds to knowledge of the Mineral Resource are received and interpreted. The reported Mineral Resource may also be subject to variation when compiled by a different Competent Person, reflecting differences in interpretation of available data and previous experience with the commodity and style of mineralisation being reported.

The reported tonnes and grades have been reported and classified in compliance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014). The CIM Definition Standards are closely comparable with the JORC Code.

The Competent Person for this announcement has yet to complete sufficient work to classify the foreign estimate in accordance with the JORC Code.

However, the Competent Person confirms that the information contained in this announcement and the Original Announcement is an accurate representation of the available data and studies for the Horizon Lithium Project.

Click here for the full ASX Release

This article includes content from Chariot Corporation, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00