February 01, 2024

Chariot Corporation Limited (“Chariot”, “CC9” or the “Company”) is pleased to advise that it has intersected significant zones of strong lithium-tantalum mineralisation in the first three (3) holes (“First Three Holes”) of the maiden drill program at the Black Mountain Project (“Black Mountain”), in Wyoming, U.S.A.

HIGHLIGHTS:

- Black Mountain maiden drill program delivers strong initial hard rock lithium results with multiple mineralised lithium intersections from first three (3) holes

- First three (3) holes all intersected high-grade spodumene mineralisation confirming the potential of the Black Mountain LCT pegmatite swarms

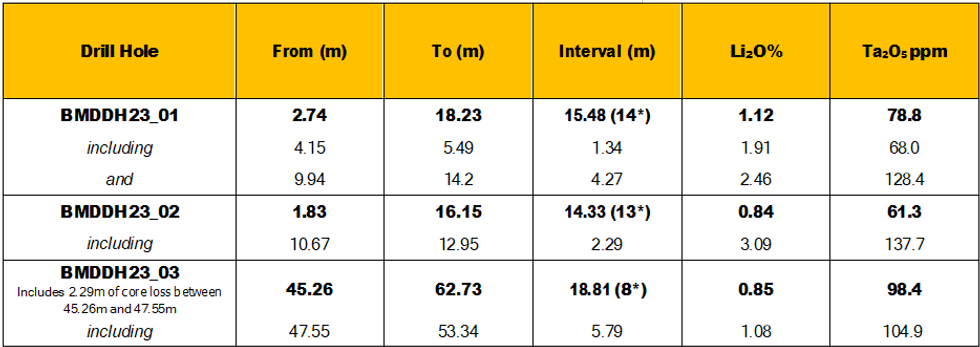

- Notable results from first three (3) holes include:

- BMDDH23_01 15.48m @ 1.12% Li2O and 79ppm Ta2O5 from 2.74m, including 4.27m @ 2.46% Li2O and 128 ppm Ta2O5 from 9.94m

- BMDDH23_02 14.33m @ 0.84% Li2O and 61ppm Ta2O5 from 1.83m, including 2.29m @ 3.09% Li2O and 138ppm Ta2O5 from 10.67m

- BMDDH23_03 18.81m @ 0.85% Li2O and 98ppm Ta2O5 from 45.26m, including 5.79m @ 1.08% Li2O and 105ppm Ta2O5 from 47.55m

- High-grade potential with individual grades downhole of up to 3.79% Li2O and 230ppm Ta2O5

- Drilling continues with eight (8) holes having been completed to date, assay results for the subsequent five (5) holes are pending and expected to be announced by April 2024

- BDDDH23_01 intersected a zone of stockwork vein and disseminated pyrite-pyrrhotite mineralisation over an interval of approximately 100m within the biotite schist

- The Company is optimistic it may have intersected the peripheral portion of a potentially larger base metal mineral system, with selected intervals grading up to 0.6% (6,012ppm) Cu, 1.0% (9,931ppm) Zn and 15.4% (154,412ppm) Pb

- The Company plans to extend the soil sampling program and run preliminary IP lines over the base metals anomaly in Q3 2024

These drill results confirm the potential of the Black Mountain lithium caesium tantalum (“LCT”) pegmatite swarms with the assays returning individual lithium and tantalum values of up to 3.79% Li2O (BMDDH23_01-0021) and 230ppm Ta2O5 (BMDDH23_01-0033).

This is the first hard rock lithium discovery, through drilling, in Wyoming, U.S.A. Wyoming Lithium Pty Ltd (“WLPL”) and Panther Lithium Corporation (“PLC”) co-founder1, Dr Edward Max Baker2 commented:

“We’ve got stunning initial results in the midst of the North American winter. The targeted hard rock lithium system has been intersected in multiple holes, but we need to come back in the North American summer for a 5,000 – 10,000m drill program to get a better handle of the resource potential. The base-metals sulfide mineralisation is also very promising and indicates the potential for base metals and/or gold mineralisation, separate from the lithium mineralisation.”

First Three Holes: Drill Results

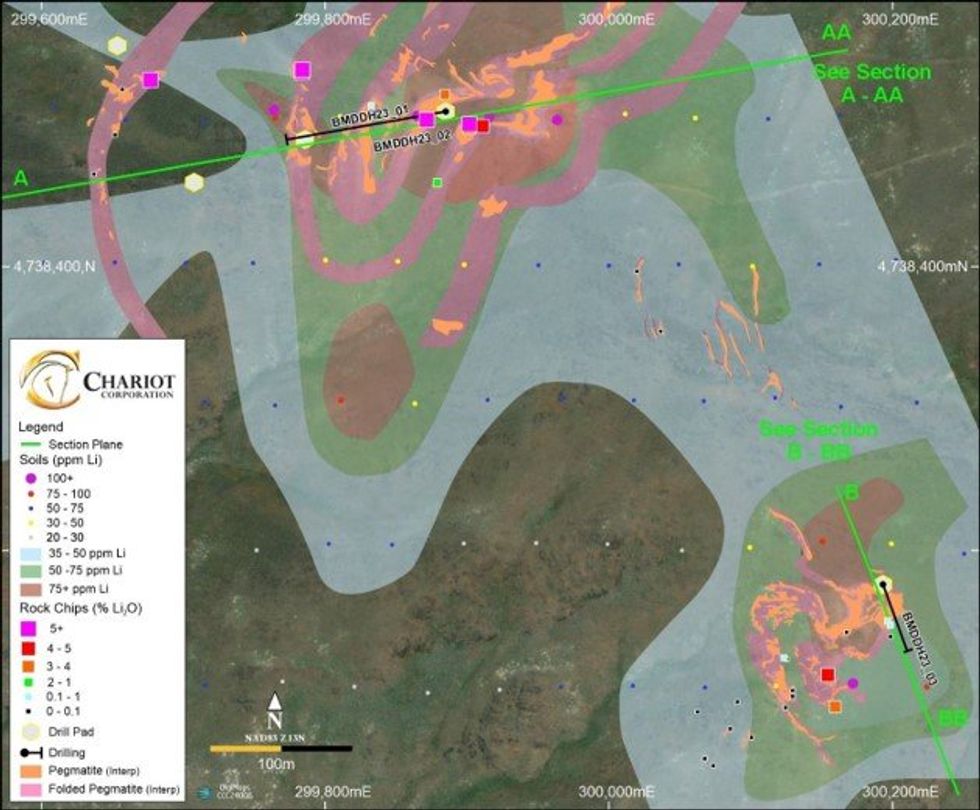

The First Three Holes (being drill holes BMDDH23_01 to BMDDH23_03) have been completed and assayed with the results summarised in Table 1 (see also Figure 1). A total of eight (8) holes have been drilled to date. The assay results for the subsequent five (5) drill holes are pending and expected to be announced by the end of April 2024.

The drill intercepts reported from the First Three Holes confirm the lithium potential of the Black Mountain LCT pegmatites (see Table 1), as indicated by the surface rock chip sampling results which were disclosed in the Company’s initial public offering prospectus and the Company’s announcement dated 9 November 2023.

The visual inspection of the drill cores indicates that the high-grade lithium values are from intervals containing spodumene mineralisation, with no other lithium bearing mineral phases being visually identified to date.

BMDDH23_01 and BMDDH23_02 were drilled from Pad 1 in the central Northwest swarm area (“Northwest Area”). BMDDH-23-01 hole was drilled to a depth of 177m at an azimuth of 260 degrees and a dip of -50 degrees (see Figure 2, Figure 3 and Figure 4 for selected photos of Drill Core). BMDDH23_02 hole was drilled to a total depth of 42m with the same azimuth BMDDH-23-01, but with a dip of -65 degrees (see Figure 1).

Click here for the full ASX Release

This article includes content from Chariot Corporation, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00