October 24, 2024

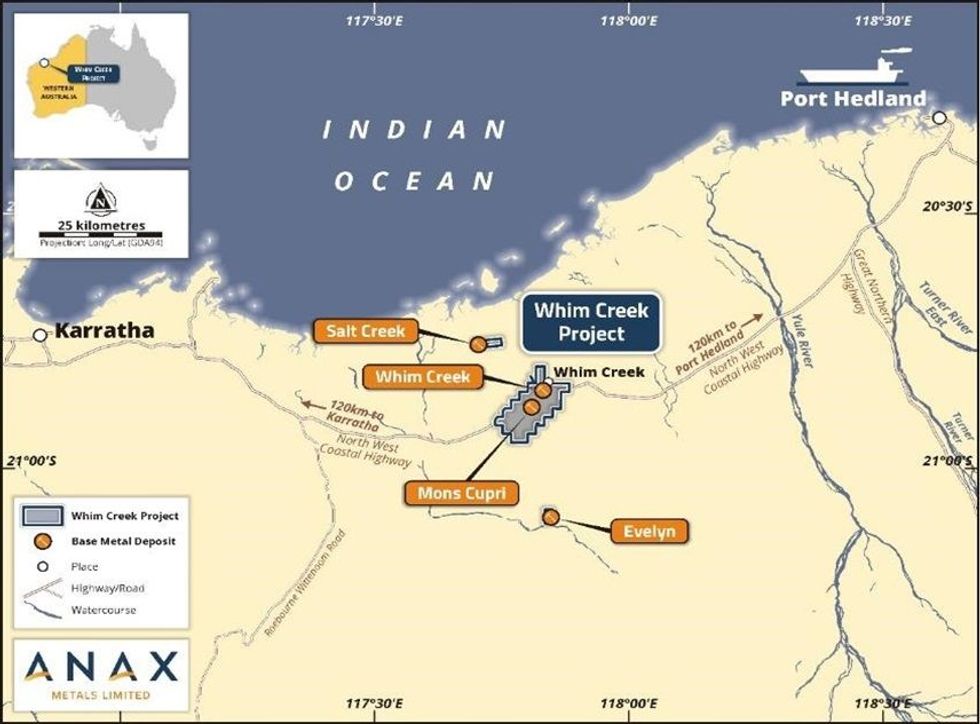

Anax Metals Limited – “consolidating base metals production in the Pilbara”

Anax Metals Limited (ASX: ANX, Anax, the Company) is pleased to provide its Activities Report and Appendix 5B for the quarter ended 30 September 2024 (Quarter).

Highlights:

- Massive sulphide mineralisation intersected in drilling at Evelyn

- Multiple exciting high-potential VMS targets identified

- Memorandum of Understanding (MOU) executed with Artemis Resources Ltd

- Commercial-scale trial of aggregate production from previously mined waste rock paves the way for possible near-term revenue through the production of road base and aggregates

- Advancement of the project growth processing hub studies

- Strategic capital raise of $2.54 million completed post Quarter-end

Project Growth (Exploration)

Diamond Drilling

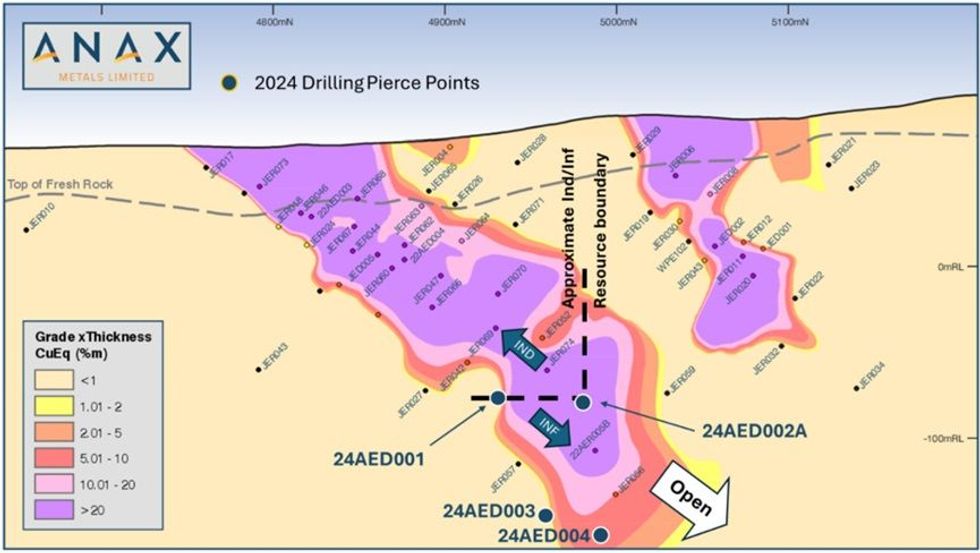

In July 2024, Anax announced commencement of a diamond drilling programme at the Evelyn deposit (Figure 1).12 The programme was designed to increase drill density and test for down- plunge extensions below a 2022 RC hole, 22AER005B, which intersected 13m @ 4.46% Cu, 3.10% Zn, 45 g/t Ag and 1.61 g/t Au from 204 m (Figure 2).2

The drilling programme was successfully completed in late August 2024 with all holes intersecting visual sulphide mineralisation.13

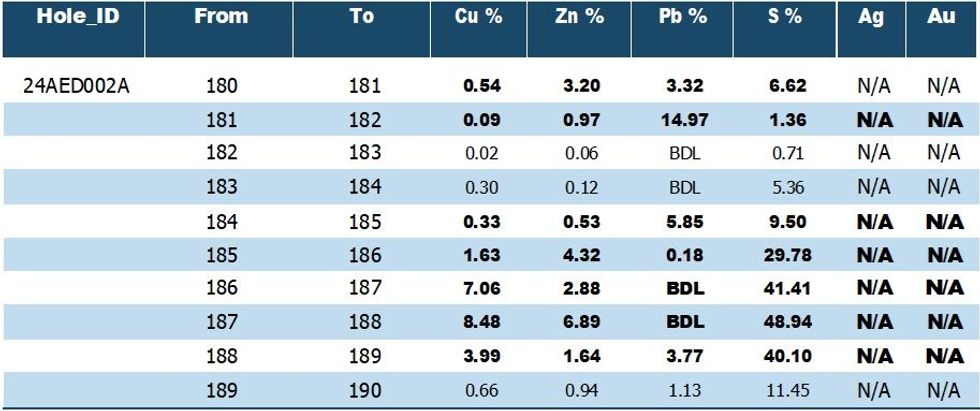

The best observed intersection from the drilling programme was from 24AED002A, which encountered a strongly mineralised zone between 176.45m and 189.9m. Preliminary results from Minalyzer continuous XRF-scanning have confirmed the high-grade nature of the intersection (Table 1 and Figure 3).13

CAUTIONARY STATEMENT ON CONTINUOUS XRF SCANNING RESULTS:

Core was processed through the Minalyzer CS (Minalyzer) continuous XRF scanning unit in Perth. Six trays of calibration core samples were submitted with the new drilling, but no high-grade mineralisation was available. The results presented in this announcement are therefore considered partially calibrated as the upper limit of likely assays are not represented in the calibration core. The XRF results that are subject of this report will be submitted for laboratory assay and some variation from the results presented herein should be expected. For further information about the XRF scanning results and Minalyzer refer to the ASX Announcement dated 27 August 2024.

Click here for the full ASX Release

This article includes content from Anax Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ANX:AU

The Conversation (0)

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

02 July 2025

Anax withdraws from arbitration

Anax Metals Limited (ANX:AU) has announced Anax withdraws from arbitrationDownload the PDF here. Keep Reading...

05 May 2025

ANX secures commitment for funding from cornerstone investor

Anax Metals Limited (ANX:AU) has announced ANX secures commitment for funding from cornerstone investorDownload the PDF here. Keep Reading...

01 May 2025

Trading Halt

Anax Metals Limited (ANX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12h

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00