June 18, 2024

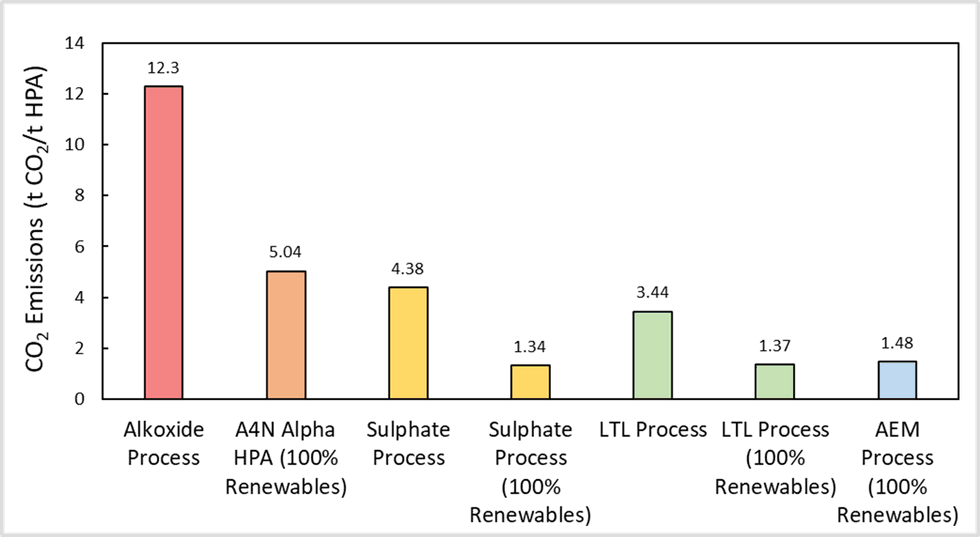

A preliminary study into the potential carbon dioxide (CO2) emissions from Impact Minerals Limited’s (ASX:IPT) Lake Hope High Purity Alumina (HPA) project in Western Australia has shown that Scope 1 and Scope 2 CO2 emissions will likely be significantly lower than incumbent processes that produce HPA, and on par or even much lower than emerging processes, in particular under a 100% renewable electrical energy development scenario (Figure 1).

- Scope 1 and Scope 2 CO2 emissions per tonne of HPA produced from the Lake Hope project to be on par with or lower than competing processes globally.

- The low emissions are similar for both metallurgical process routes (the Sulphate and LTL Processes) being considered for Lake Hope as part of the on-going Pre-Feasibility Study.

- A strategy to achieve zero carbon HPA has been defined including a 100% renewable energy development scenario.

- The Pre-Feasibility Study continues on schedule to be completed in Q4 this year.

The low emissions apply to both the Sulphate and Low-Temperature-Leach (LTL) processes that are being considered by Impact to produce HPA as part of the Pre-Feasibility Study for the development of the Lake Hope project (Figure 1 and ASX Releases February 19th, 2024, and February 27th, 2024).

The emissions study has shown that using the current Western Australian electricity supply, likely emissions are 4.38 tonnes of CO2 per tonne of HPA produced via the Sulphate process and 3.44 tonnes of CO2 per tonne of HPA for the LTL process. This is competitive with traditional and emerging HPA production methods (Figure 1). For example, most of the world’s HPA production comes from the refinement of aluminium metal (alkoxide process) or precursors (modified Bayer process) via energy-intensive processes that are also responsible for significant amounts of toxic waste.

Scope 1 emissions generally relate to CO2 produced directly from operations and include the proposed mine, haulage of ore and the processing plant.

Scope 2 emissions relate mostly to CO2 produced from the energy used to power the company’s operations.

Scope 3 emissions related to CO2 produced indirectly from the company’s downstream activities and include the emissions associated with purchased goods and services such as reagents, plant and equipment and Business-As-Usual emissions such as travel and commuting to work.

Only Scope 1 and Scope 2 emissions have been considered at this stage as these are within the direct control of Impact Minerals and this is an appropriate level of detail for the Pre-Feasibility Study. As per standard CO2 accounting practices, Scope 3 emissions will be passed through to the fertilizer by-products. Initial indications are that these emissions will also be on par or lower than incumbent fertilizer production processes.

100% Renewable Energy

The largest contributor to the overall CO2 emissions from the Project come from Scope 2 emissions from the electricity required to power the processing plant and which has been modelled to come from the South West Interconnected System (SWIS), Western Australia’s main power source. The SWIS is currently coal-powered and the emissions from this have been used in the main model.

However, the WA Government is committed to making the SWIS entirely powered by renewables by 2030 (https://www.brighterenergyfuture.wa.gov.au). In addition, advances in renewables technology also offer the potential to power the process plant entirely by renewable energy. Accordingly, Impact’s study has also modelled the CO2 emissions under a 100% renewable energy scenario. This results in a significant further reduction in emissions for both of Impact’s process routes to about 1.35 tonnes of CO2 per tonne of HPA.

Within the accuracy of this study, which is plus or minus 30%, this would be on par with or better than the lowest known CO2 emissions for HPA production which is powered by hydroelectric power (Figure 1).

Impact’s strategy to move towards 100% renewable power is to build-out or contract-to-purchase a renewable energy supply for the processing plant. This will be studied as part of engineering and financial modelling under the PFS.

Net-Zero Carbon Strategy

Impact will strive to reach full decarbonisation of the project over time. This will require elimination or off-setting of the emissions from the SWIS as well as from mining, transport and calcining. Calcining, heating in a furnace, represents the final stage of the HPA process.

As noted above, the majority of the CO2 emissions can be eliminated by substituting 100% renewable energy for SWIS energy by either build-out or contract-to-purchase a renewable energy supply.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

22h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00