Ur-Energy Inc. (NYSE American:URG)(TSX:URE) (the "Company" or "Ur-Energy") wishes to congratulate Constellation on their recently announced power purchase agreement with Microsoft. The deal for 835 megawatts of electricity is the largest ever power purchase agreement for Constellation and will result in the restart of the Three Mile Island Unit 1 nuclear reactor in Pennsylvania. This historic project will contribute 835 megawatts of carbon-free electricity to the grid while creating 3,400 jobs and offsetting approximately 61 million metric tons of CO2 emissions over 20 years. Constellation has named the project the Crane Clean Energy Center in honor of Chris Crane, a well-respected leader in the nuclear industry and a past CEO of Constellation's former parent company

John Cash, Ur-Energy's CEO stated, "We wish to congratulate Constellation on their continued growth and leadership in the U.S. nuclear power industry. We are excited to continue in our role as an established, long-term supplier of domestic uranium to Constellation. As the demand for nuclear power grows, our objective is to continue being a reliable supplier to U.S. and global utilities from our Wyoming mines."

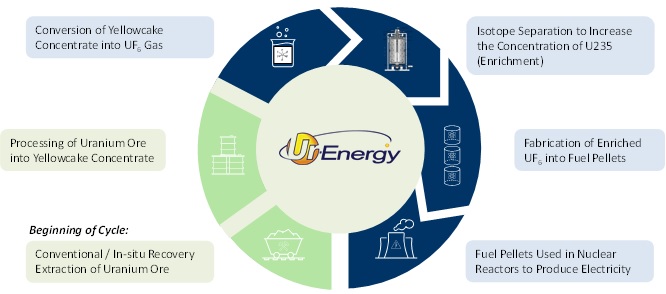

Ur-Energy plays an important role in the nuclear energy sector within the United States. Ur-Energy was the largest domestic uranium producer in the U.S. in 2024 H1 and is a trusted long-term supplier to leading U.S. utilities such as Constellation. As the U.S. advances the clean energy transition and continues efforts to decarbonize its grid, nuclear energy will play an increasingly critical role as a carbon-free source of baseload power. The U.S. has the largest nuclear power generation capabilities globally (by reactor count and electricity produced from nuclear) and has also recently taken important steps to rebuild a strong domestic nuclear fuel cycle. Ur-Energy is uniquely positioned to play an integral role in the first steps of the U.S. nuclear fuel cycle (see diagram below) both today, as the largest domestic uranium producer from its Lost Creek ISR mine in Sweetwater County, Wyoming in 2024 H1, and tomorrow as it continues construction of its Shirley Basin ISR mine in Carbon County, Wyoming, which is expected to be completed in late 2025 and will increase Ur-Energy's licensed production capacity by over 83%.

The demand for carbon free, baseload electricity from big data centers is growing at a nearly unimaginable rate. According to the Electric Power Research Institute's May 28, 2024, White Paper titled Powering Intelligence, data centers are expected to consume as much as 9.1% of U.S. electricity generation by 2030 versus an estimated 4% today. The International Energy Agency stated in its Electricity 2024, Analysis and Forecast to 2026 report

Data centres are significant drivers of growth in electricity demand in many regions. After globally consuming an estimated 460 terawatt-hours (TWh) in 2022, data centres' total electricity consumption could reach more than 1 000 TWh in 2026. This demand is roughly equivalent to the electricity consumption of Japan.

As electricity demand from big data and other industries continues to grow, Ur-Energy expects to see increasing interest in sourcing power from existing and new conventional nuclear power plants and, within a few years, from Small Modular Reactors (SMRs). The carbon-free energy provided by nuclear power, combined with around-the-clock production for as long as two years between refueling outages, makes it a perfect fit for data centers that must operate without interruption while meeting carbon emission objectives. Currently, 60 conventional reactors are under construction globally with many utilities seeking power rate increases and life extensions. The International Energy Agency expects nuclear power output to increase by 2.5 times its current rate by 2050.

As a recognized leader in U.S. uranium production with significant mineral resources, Ur-Energy expects to play a critical role in fueling the global nuclear industry for many years to come.

About Ur-Energy

Ur-Energy is a uranium mining company operating the Lost Creek in situ recovery uranium facility in south-central Wyoming. We have produced and packaged approximately 2.7 million pounds U3O8 from Lost Creek since the commencement of operations. Ur-Energy has all major permits and authorizations to begin construction at Shirley Basin, the Company's second in situ recovery uranium facility in Wyoming and is advancing Shirley Basin construction and development following the March 2024 ‘go' decision for the mine. We await the remaining regulatory authorization for the expansion of Lost Creek. Ur‑Energy is engaged in uranium mining, recovery and processing activities, including the acquisition, exploration, development, and operation of uranium mineral properties in the United States. The primary trading market for Ur‑Energy's common shares is on the NYSE American under the symbol "URG." Ur‑Energy's common shares also trade on the Toronto Stock Exchange under the symbol "URE." Ur-Energy's corporate office is in Littleton, Colorado and its registered office is in Ottawa, Ontario.

FOR FURTHER INFORMATION, PLEASE CONTACT

John W. Cash, Chairman, CEO & President

720-981-4588, ext. 303

John.Cash@Ur-Energy.com

Cautionary Note Regarding Forward-Looking Information

This release may contain "forward-looking statements" within the meaning of applicable securities laws regarding events or conditions that may occur in the future (e.g., whether global demand for nuclear energy continues to grow at currently projected rates, including whether electricity demands by big data continue to increase; whether our mine sites will continue to reliably supply global utility customers for years to come and what role they will play in fueling nuclear power; whether increased use of nuclear energy will successfully reduce emissions as projected) and are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans," "expects," "does not expect," "is expected," "is likely," "estimates," "intends," "anticipates," "does not anticipate," or "believes," or variations of the foregoing, or statements that certain actions, events or results "may," "could," "might" or "will be taken," "occur," "be achieved" or "have the potential to." All statements, other than statements of historical fact, are considered to be forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements express or implied by the forward-looking statements. Factors that could cause actual results to differ materially from any forward-looking statements include, but are not limited to, capital and other costs varying significantly from estimates; failure to establish estimated resources and reserves; the grade and recovery of ore which is mined varying from estimates; production rates, methods and amounts varying from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; inflation; changes in exchange rates; fluctuations in commodity prices; delays in development and other factors described in the public filings made by the Company at www.sedarplus.ca and www.sec.gov. Readers should not place undue reliance on forward-looking statements. The forward-looking statements contained herein are based on the beliefs, expectations and opinions of management as of the date hereof and Ur-Energy disclaims any intent or obligation to update them or revise them to reflect any change in circumstances or in management's beliefs, expectations or opinions that occur in the future.

SOURCE: Ur-Energy Inc.

View the original press release on accesswire.com