August 08, 2024

True North Copper Limited (ASX: TNC) (TNC or the Company) is pleased to announce an update to the copper- silver Mineral Resource at Vero, part of its Mt Oxide Project in Queensland.

HIGHLIGHTS

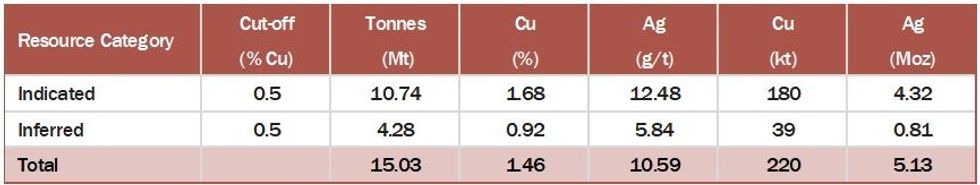

- True North’s updated Copper-Silver Mineral Resource Estimate (MRE) for its 100%-owned Vero deposit, reported in accordance with the JORC 2012, contains 15.03Mt at 1.46% Cu & 10.59g/t Ag for a contained 220kt Cu & 5.13Moz Ag (Indicated and Inferred, refer to Table 1).

- Vero’s updated Resource delivers a 20% increase in silver ounces, demonstrating the potential for Vero to deliver a significant sliver co-product in addition to copper.

- Reassessing underground mine voids and introduction of improved geological deposit model has resulted in a minimal 3% decrease in copper metal tonnes, delivering further confidence in the resource integrity following 2023 confirmatory drilling.

- TNC used revised geotechnical and metallurgical studies in the updated geological analysis for the MRE and will also inform possible mining options for the Vero deposit.

- MIMDAS IP program at Mt Oxide is progressing well with the line at Camp Gossans complete. MIMDAS is now being acquired over the Vero deposit aiming to identify drill target for resource expansion at depth.

COMMENT

True North Copper’s CEO and MD Bevan Jones, said:

“We are pleased to deliver an update to Vero’s contained resources, particularly an increase in silver, a metal which is currently seeing a supply-demand imbalance though demand in solar and other technology applications. This updated Resource also provides greater confidence in the deposit, following TNC’s first program of confirmatory drilling and a substantially updated geological model, which incorporates historic resource depletion by previous mining.

“We see exploration upside within reach of shallow drilling at Ivena, north of the Resource, and along a 10km section of the Dorman fault where we are actively exploring for satellite zones of mineralisation with the MIMDAS crew onsite completing the line at Camp Gossans. The survey team are now moving to the north to acquire the line over the Vero Deposits with the aim to identify drill targets at depth below the current resource.

We look forward to providing an update on our progress on these Mt Oxide exploration activities over the coming months.”

True North Copper is pleased to announce an updated JORC 2012 MRE for the Vero high-grade copper-silver deposit, prepared by Encompass Mining Pty Ltd (Encompass). This is the first MRE for Vero completed by TNC and follows the completion of 12 infill and extensional diamond drill holes completed by TNC in October 2023 and a geological model update1,2.

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

16h

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00