Tech 5: Aide Says Harris Supports Policies to Expand Crypto Sector, AMD to Buy ZT Systems

Catch up on the most exciting tech news stories of the week, as well as market and crypto performance updates.

Investors proceeded cautiously through the week's opening days, but the tone shifted on Friday (August 23) afternoon in response to an optimistic announcement from US Federal Reserve Chair Jerome Powell

In a Jackson Hole speech, he signaled that the Fed is ready to begin cutting interest rates.

Crypto markets also saw a surge, breaking free from a weeks-long pricing gridlock. In company news, Waymo introduced a new version of its self-driving technology, marking another milestone in a series of wins in recent months.

Stay informed on the latest developments in the tech world with the Investing News Network's round-up.

1. Markets celebrate with rate cuts in sight

The week started shaky for the stock markets, with the S&P 500 S&P 500 (INDEXSP:.INX) and Nasdaq Composite (INDEXNASDAQ:.IXIC) opening below last week’s close on Monday (August 19) before notching their eighth consecutive day of wins, along with the S&P/TSX Composite Index (INDEXTSI:OSPTX).

The Russell 2000 Index (INDEXRUSSELL:RUT) saw gains of 1.1 percent on the day.

Cautious trading left the major indexes little changed on Tuesday (August 20) morning as investors awaited a fresh round of inflation data. Wednesday (August 21) saw the release of US non-farm payroll benchmark revisions and minutes from July's Fed meeting. The data from the Bureau of Labor Statistics showed that, while the labor market is expanding, job growth between March 2023 and March 2024 was lower than previously estimated.

Meanwhile, the Fed meeting minutes revealed that policymakers considered a quarter percentage point rate cut in July due to reduced inflation and increased unemployment, increasing confidence in a rate cut in September. The news sent indexes higher, with the Russell 2000 taking the lead, gaining over 1 percentage point to close at 2,170.32.

The upward trend continued on Thursday (August 22) morning, with all but the S&P/TSX Composite index opening above the previous day’s close. Economic data showed that the US manufacturing PMI fell to 48 in August from 49.6 in July, coming in softer than expected. Conversely, initial jobless claims rose slightly in the week ended on August 17 compared to the prior week, up by 4,000 to 232,000.

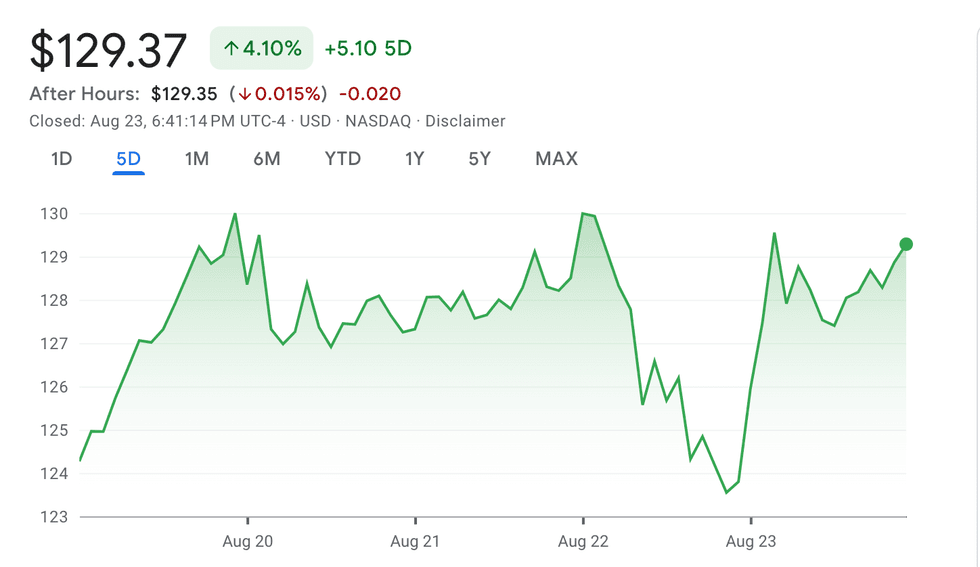

NVIDIA performance, August 19 to August 23, 2024.

Chart via Google Finance.

Stocks retreated midday Thursday, led by the tech sector. NVIDIA (NASDAQ:NVDA) saw its share price fall by 4.77 percent by the end of the day. Optimism returned on Friday morning as Powell addressed bankers and financial professionals at the Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming.

During the highly anticipated speech, Powell endorsed an imminent rate cut, but refrained from specifying the exact number of basis points by which the rates might be reduced.

"The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks," he said.

The news ignited a surge in all three major stock indexes as investors reacted positively. The Russell 2000 outperformed by far, climbing more than 3 percent midday. This continued a recent trend of increased investor interest in mid-cap stocks, which has been observed in response to optimistic Fed data over the past couple of months.

The week ended strong with all four major indexes up more than 1 percent on the week, including the Russell 2000, which was up by over 3 percent.

2. Bitcoin price breaks US$60,000

Bitcoin experienced a dip below US$58,000 in pre-market trading on Monday morning, spending most of the trading day at that level before recovering to move above US$61,000 in the hours between Monday and Tuesday.

Tuesday saw another sharp pullback, coinciding with a dip in US stock indexes. At the same time, K33 analysts reported that Tuesday’s seven day average annualized funding rate was the lowest one since March 2023, indicating increased short bets and potential for a squeeze. More price movement was observed on Wednesday, with Bitcoin trading in the US$59,000 range for most of the day before breaking above US$60,000 and then US$61,000 in the final hours of the trading day. The popular cryptocurrency held above US$60,000 for the remainder of the week.

Recent data shows a slight decrease in demand for Bitcoin, although long-term holders have continued accumulating tokens. Concurrently, the number of institutional investors holding Bitcoin ETFs witnessed a notable growth of 14 percent in Q2 compared to Q1, suggesting continued interest from larger market participants.

Analysts at Fairlead Strategies suggested on Wednesday that Bitcoin could be heading into a period of downturn in the near future based on a reading of the 14 month stochastic indicator, which compares a security’s closing price to its price range over a specific period. The indicator is used to assess the momentum and potential trend reversals in financial markets. While it was previously above the 80 level, indicating an overbought condition, it recently crossed below 80, indicating that Bitcoin may be entering an overbought downturn and could start falling in price.

However, the crypto market surged in response to positive economic developments on Friday. The likelihood of an impending September rate cut being further solidified following Powell’s address in Jackson Hole Wyoming on Friday morning sent the price of Bitcoin above US$64,000 by 5:20 p.m. EDT on Friday.

Ether, which had a volatile week, also saw a significant boost, trading above US$2,770 as of that time.

3. Democrats leave crypto off 2024 platform, but Harris could support the sector

Ahead of the Democratic National Convention, the party unveiled its 2024 Platform on Sunday (August 18). The 92 page document covers the party’s stance on various issues, including economic policy and social justice.

However, an important issue was noticeably absent: Vice President Kamala Harris's stance on cryptocurrency and web3 infrastructure. While voices in the crypto community have expressed optimism that Harris could be more open to supporting the industry compared to the current administration, Harris herself has been tight-lipped about where she stands on issues related to the regulation and taxation of decentralized finance.

However, the platform released on Sunday refers to “Biden’s second term." Given the tight deadline — the plan was finalized less than one week before President Joe Biden withdrew from the race — Harris may be more outspoken about her views on cryptocurrency and web3 infrastructure as the campaign progresses.

During a Bloomberg News roundtable at the Democratic National Convention, which kicked off in Chicago this past Monday, Brian Nelson, the campaign's senior adviser for policy, said that Harris would back measures that “ensure that emerging technologies and that sort of industry can continue to grow.”

Before Harris took over the Democratic campaign, Republican candidate Donald Trump’s embrace of Bitcoin and other digital assets seemed to give his party an advantage with crypto-focused voters.

The two candidates have been in competition on crypto-betting platform Polymarket, which enables users to use cryptocurrencies to place bets on real-world events. While the odds of a Democratic win surged by 12 percent on Polymarket just two weeks ago, propelling Harris into the lead, Trump overtook her this week.

Crypto media outlet Decrypt has suggested that the lack of a clear stance on cryptocurrency and Bitcoin in the Democratic Party's platform may have contributed to Trump overtaking Harris.

4. Waymo introduces 6th generation self-driving technology

Waymo, a subsidiary of Alphabet (NASDAQ:GOOGL), introduced the newest version of its self-driving technology, the 6th Generation Waymo Driver, on Monday. According to the company’s press release, the 6th generation system is more cost-effective than the current version while providing more capabilities and compute power.

The Waymo Driver will be able to see further, up to 500 meters away, and can better withstand harsh weather conditions. The new hardware also consists of an enhanced camera-radar surround view and advanced sensor technology that will reportedly improve its navigation capabilities.

Waymo CEO Tekedra Mawakana shared via LinkedIn this week that the company’s robotaxi service, Waymo One, surpassed 100,000 rides per week, double the 50,000 weekly rides the company reported in May. The company’s fleet is made up of Geely Zeekr electric vehicles (EVs) using the Waymo Driver technology.

Waymo began as a self-driving project in 2009. It has since expanded to offer commercial services in Texas, Arizona and California and partnered with Uber (NYSE:UBER) in May 2023. During Alphabet’s Q2 earnings call on July 23, Jim Friedland, director of investor relations, shared that Alphabet was committing to a US$5 billion investment in Waymo.

The new systems are currently still in testing with updates expected to be provided as development progresses.

5. AMD makes AI move with ZT Systems purchase

Semiconductor manufacturer Advanced Micro Devices (AMD) (NASDAQ:AMD) announced plans to acquire ZT Systems, a company that specializes in the development of servers and network equipment. The move, announced on Monday, is part of AMD’s efforts to expand its data center artificial intelligence (AI) capabilities.

“Our acquisition of ZT Systems is the next major step in our long-term AI strategy to deliver leadership training and inferencing solutions that can be rapidly deployed at scale across cloud and enterprise customers,” AMD Chair and CEO Dr. Lisa Su said in a press release. The deal is valued at US$4.9 billion, and consists of a blend of cash and stock, including up to US$400 million based on post-closing milestones.

AMD shares were up 4.66 percent on Monday, and reached US$161.57 during trading on Tuesday, the company's highest valuation this week. AMD's share price was sitting US$154.97 on Friday afternoon, up 4.46 percent for the week.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.