April 27, 2025

Eclipse Metals Ltd (ASX: EPM) is pleased to report highly encouraging analytical results from 23 selected core samples from six historic diamond drill holes that were completed at the Company’s flagship Ivigtût multi-commodity project in southwest Greenland.

The results confirm the presence of high-grade rare earth element (REE) mineralisation at the Grønnedal Prospect, which is located within the Ivigtût Project Area.

The analyses, conducted by SGS Laboratories in Canada, demonstrate the occurrence of significant Total Rare Earth Oxide (TREO) values. A sample from drillhole R between 25.5 and

25.8m returned 20,092ppm (2.01%) TREO thus reinforcing the project's potential as a strategically located and globally significant source of magnetic and critical REEs essential for decarbonisation and advanced technologies.

Significant Analytical Results include:

- Drillhole R (25.5–25.8m) returned 20,092ppm (2.01%)TREO with 4,677ppm Nd₂O₃, 1,143ppm Pr₂O₃, 246ppm Dy₂O₃, 855ppm Y₂O₃ and 58ppm Tb₂O₃;

- Drillhole S (14.7–15.2m) returned 17,595ppm TREO including 4,269ppm Nd₂O₃, 484ppm Y₂O₃ and 371ppm Gd₂O₃

Director of Eclipse Metals, Mr Carl Poppal, stated:

“These latest analytical results are outstanding. They exceed our expectations and confirm the scale and quality of REE mineralisation present at depth in the Grønnedal prospect. With TREO grades over 2%, including significant Nd, Pr, Dy and Tb concentrations, the magnetic rare earth potential is truly world-class. Importantly, these findings allow us to calibrate the HyperXRF system, enabling rapid assessment across the broader project area and helping fast-track our pathway to an expanded MRE and feasibility development.”

Introduction

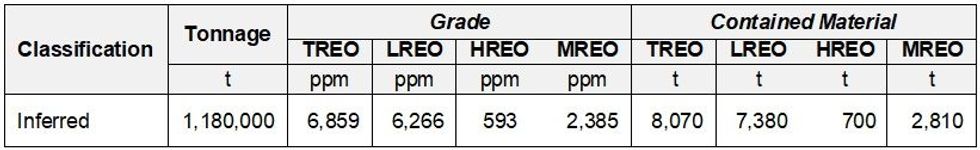

The Grønnedal carbonatite-hosted mineral resource is located within the Grønnedal Igneous Complex (Figure 1). The initial mineral resource estimate (MRE) (Table 1) is based on limited shallow drill testing of a small portion of the larger carbonatite complex.

The MRE is underpinned by analytical data derived from both exploration trenching and shallow drilling programs (refer to ASX announcement 25 July and 8th August 2023). Thus, the vertical extents of the MRE are limited to an average depth of only 12m.

In 1950, Kryolitselskabet Øresund A/S, Cryolite Company drilled six diamond holes in the vicinity of the Grønnedal resource to test for a potential iron ore deposit (Figure 1). This drilling extends to depths of up to 200m.

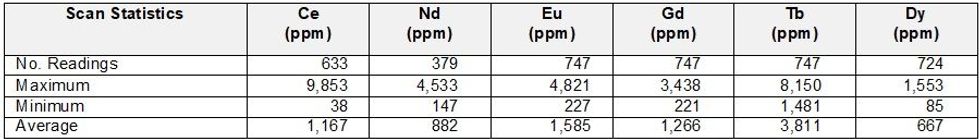

During 2024, the Greenland Government granted Eclipse permission to conduct non-destructive analyses of the government-archived core from these drillholes using the Minalyze XRF TruScan technology developed by Veracio in Gothenburg, Sweden. These data, which are summarised in Table 2, suggest that anomalous rare earth mineralisation, as defined by six key indicator elements, extends to depths of approximately 200m (refer to ASX announcement January 2025).

To verify the TruScan data, conventional laboratory analyses were required. In late 2024 Eclipse were allowed to extract small specimens from selected core intervals, using sampling protocols approved by the Greenland Government, from 23 intervals representing key lithologies for analytical test work. Sample treatment was carried out by SGS Lakefield, Canada using a sodium peroxide (Na₂O₂) digestion followed by ICP-MS (Inductively Coupled Plasma Mass Spectrometry).

Click here for the full ASX Release

This article includes content from Eclipse Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EPM:AU

The Conversation (0)

25 March 2024

Eclipse Metals

Pursuing Multi-commodity Assets to Support Decarbonization

Pursuing Multi-commodity Assets to Support Decarbonization Keep Reading...

20 February

Cellulose Breakthrough Could Simplify Rare Earths Separation

A team of researchers at Penn State have developed a plant-based nanomaterial capable of selectively extracting dysprosium from rare earth mixtures, according to a recent report.The findings published in the study detail how the team engineered a modified form of cellulose capable of isolating... Keep Reading...

12 February

Binding Option to Acquire 90% of Advanced Pomme REE Project in Quebec, Partnering with Metallium

New Frontier Minerals Ltd (LSE and ASX: NFM) is pleased to announce that it has entered into a binding option and earn-in agreement providing NFM with the right to acquire a majority (90%) interest in the Pomme REE Project from Australian-listed company Metallium (ASX: MTM), which is located... Keep Reading...

10 February

Geopolitics, Power and Resources Collide as Global Order Frays

Rising geopolitical tensions, intensifying competition for critical minerals and the accelerating breakdown of the postwar global order were some of the key themes at the Vancouver Resource Investment Conference (VRIC) in late January, as investors grappled with what a volatile world means for... Keep Reading...

10 February

Why Rare Earth Processing Remains China’s Strongest Leverage Point

As governments scramble to secure supplies of rare earth elements, a new engineering study from Malaysia has cast fresh light on why China continues to dominate one of the most critical parts of the supply chain—processing.The research zeroes in on what many industry insiders already regard as... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00