August 11, 2024

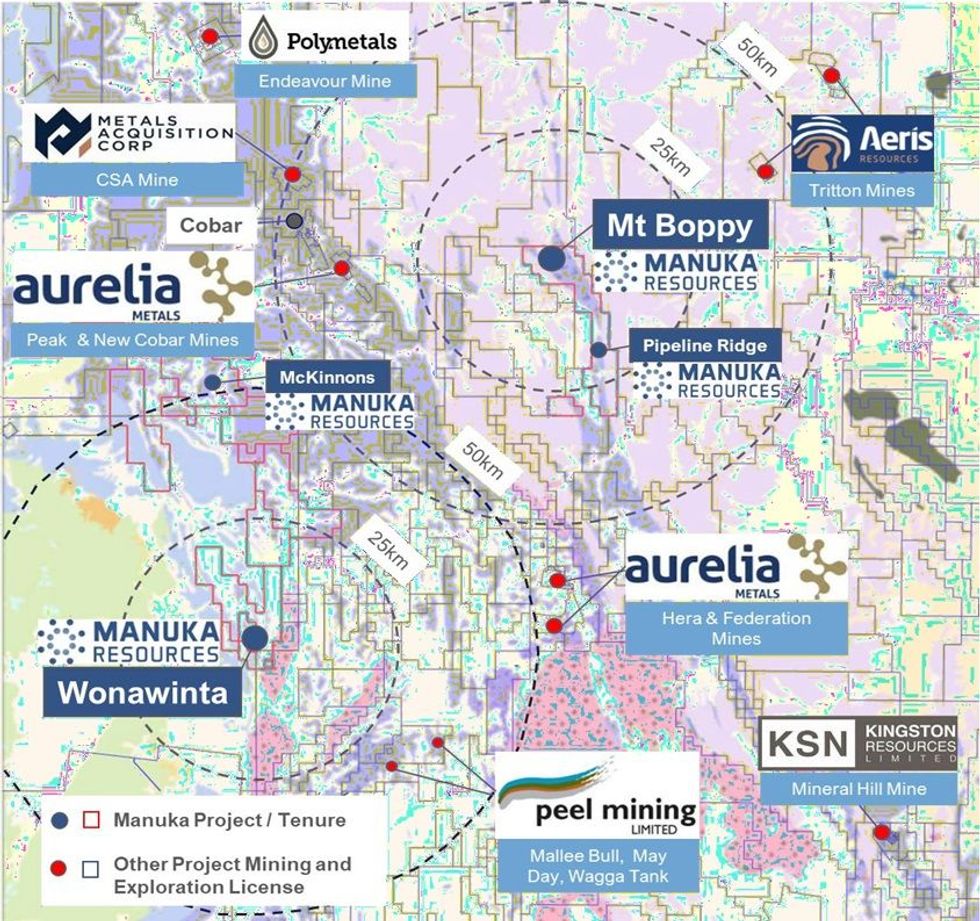

Manuka Resources Limited (“Manuka” or the “Company”) is pleased to provide a progress update on the restart of gold doré production from its 100% owned Mt Boppy gold mine (“Mt Boppy”) located in the Cobar Basin, NSW (Figure 1).

Highlights

- Manuka is executing a strategy to construct a fit-for-purpose processing and gold doré production facility at its 100% owned Mt Boppy gold mine.

- Previously, ore from Mt Boppy had been hauled to and processed at the Company’s CIL plant located at the Wonawinta Silver Mine (“Wonawinta”) 150km south of Mt Boppy.

- Mt Boppy is forecast to be a low capex (A$11.6M), high margin (~A$19M EBITDA per annum) operation1.

- Relocation of the existing 400kW ball mill located at Wonawinta to Mt Boppy has commenced. The ball mill is surplus to requirements at Wonawinta where a 1800kW ball mill has been previously installed.

- Acquisition of a second-hand Inline Pressure Jig (IPJ) and Intensive Leach Reactor (ILR) has resulted in approximately A$850k savings versus that originally budgeted. The purchased equipment is currently undergoing refurbishment at Gekko Systems, the original equipment manufacturer.

- The Company is currently investigating opportunities to increase milling capacity and accelerate gold production at Mt Boppy.

- The Company is targeting first gold production from Mt Boppy in Q4 2024.

Dennis Karp, Manuka’s Executive Chairman, commented:

“The execution of our plan to restart gold operations at Mt Boppy is well underway.

The opportunistic purchasing of selected second-hand processing equipment is consistent with our low capex strategy that includes the leveraging and repurposing of existing assets including the Wonawinta 400kW ball mill, diesel generators, 48-man accommodation camp and mobile screening plant.

We look forward to providing regular updates to the markets as we progress towards first gold production at Mt Boppy.

Background

The Mt Boppy gold mine is an existing gold operation comprising a brownfields open pit and associated historic ROM stockpiles, rock dumps and tailings.

In April 2024, Manuka announced a strategy whereby a fit-for-purpose processing and gold production facility would be established at Mt Boppy for a capital cost A$11.6M to generate an average EBITDA of ~A$19M per annum over an initial 5-year period2.

A sonic drilling program over the Main Rock Dump and Tailings Storage Facility 3 (“TSF3”) was completed in late 2023 which improved confidence in Resource3 grade and ore type distribution and underpins the updated production strategy.

Previously, ore mined by Manuka at Mt Boppy had been hauled 150km to the CIL process plant located at Wonawinta at a cost of ~A$27/t. The updated strategy of on- site processing is expected to save in the order of A$7M per annum.

Click here for the full ASX Release

This article includes content from Manuka Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKR:AU

The Conversation (0)

26 March 2025

Manuka Resources

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales Keep Reading...

05 August 2025

Results of Fully Underwritten Entitlement Offer

Manuka Resources (MKR:AU) has announced Results of Fully Underwritten Entitlement OfferDownload the PDF here. Keep Reading...

31 July 2025

June 2025 Quarter Activities and Cashflow Reports

Manuka Resources (MKR:AU) has announced June 2025 Quarter Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

29 July 2025

Maiden Mt Boppy Open Pit Ore Reserve

Manuka Resources (MKR:AU) has announced Maiden Mt Boppy Open Pit Ore ReserveDownload the PDF here. Keep Reading...

10 July 2025

Further Information to 26 June Announcement

Manuka Resources (MKR:AU) has announced Further Information to 26 June AnnouncementDownload the PDF here. Keep Reading...

08 July 2025

$8 Million Fully Underwritten Entitlement Offer

Manuka Resources (MKR:AU) has announced $8 Million Fully Underwritten Entitlement OfferDownload the PDF here. Keep Reading...

14h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

14h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

15h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00