July 28, 2022

Arcadia Minerals Limited (ASX:AM7, FRA:8OH) (Arcadia, AM7 or the Company), the diversified exploration company targeting a suite of battery metal projects aimed at Lithium, Tantalum, Nickel, Copper and Gold in Namibia, is pleased to provide its quarterly activities report for the period ending June 2022.

HIGHLIGHTS

- Bitterwasser Lithium Project: Final assay results for remaining 32 of the 64 holes drilled over the Eden Pan on a 500m grid received

- Bitterwasser Lithium Project: Regional investigation into Bitterwasser Lithium-in-clay and Lithium-in-brines minerals system defined extensive tectonic rift-related fault structures in a closed basin (the Kalkrand half-graben), similar to Clayton Valley in Nevada1

- Kum-Kum Nickel Project: Historical core samples obtained during investigation were sampled and returned the first known record of PGE and Au mineralisation in the ultramafic units of the Tantalite Valley Complex. The best results indicated mineralisation of2:

- 0.71% Ni, 0.28% Cu, 0.84 g/t Pd and 0.4 g/t Pt in orthopyroxenite

- 0.58% Ni, 0.30% Cu, 0.69 g/t Pd, 0.31 g/t Pt and 0.26% Au in orthopyroxenite

- Swanson Tantalum Project: Mineral Resource update delivers an estimate for a total indicated and inferred resource of 2.59Mt (an increase of 115%) at an average grade of 486 ppm Ta2O5 (an increase of 17.9%), 73 ppm Nb2O5 and 0.15 % Li2O.3 An Environmental Clearance Certificate and Mining Licence was also issued for the project.

1 Refer to ASX Announcement dated 09 May 2022 titled “Regional study advances work program for district scale Lithium in brines”

2 Refer to ASX Announcement dated 09 May 2022 titled “Kum-kum nickel project mineral systems approach results”

3 Refer to ASX Announcement dated 06 May 2022 titled “JORC Mineral Resource at Swanson Tantalum project doubles in size

SUMMARY OF MINING EXPLORATION FOR THE QUARTER

Bitterwasser Lithium Project

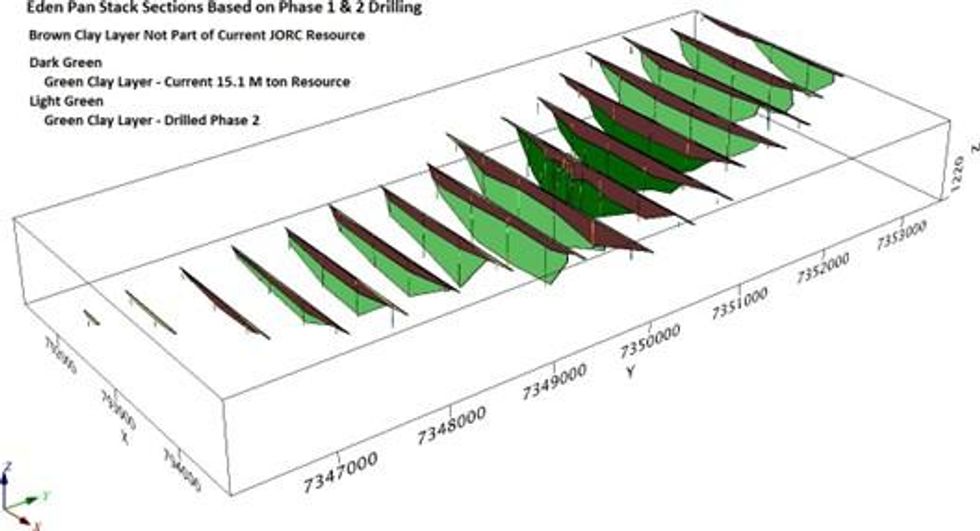

Assay results for the outstanding 32 drill holes from the 64-hole follow-up auger drilling campaign completed on 9 February 20224 over the Eden Pan was received during the quarter. All the drill holes commenced in the mineralised Upper Brown Clay Unit and every hole, except two drill holes where thin clay units were intercepted at the edges of the Eden Pan, were sampled from top to bottom up to a depth of 9.60m. Notably, the entire sequence of the drill holes sampled (i.e. Upper Brown Clay Unit and Middle Green Glay Unit) returned lithium mineralisation5.

The Middle Green Clay Unit, lithologically named the Middle-Unit (MU), comprises the dominant lithological unit from which the maiden Mineral Resource6 was derived. This green clay unit was intersected in 18 of the 32 drill holes from which assay results were received and extended from a depth of 1.4 m below surface to the maximum End-of-Hole (EOH) depth of 9.60m. A total of 43 holes from the 64-hole follow-up auger drilling campaign intersected the Middle Green Clay Unit at similar depths.

Figure1: Stacked cross section of the Eden Pan depicting drill-hole interpretation with reference to the existing Mineral Resource (green layers) and clay units intercepted in the follow-up auger drilling program.

4 Refer to ASX Announcement dated 10 March 2022 titled “Encouraging lithium drilling assay results at Bitterwasser”.

5 Refer to ASX Announcement dated 2 May 2022 titled “Final Lithium Drilling assay results at Bitterwasser”.

6 Refer to ASX Announcement dated 3 November 2021 titled “Arcadia acquires lithium project with JORC Mineral Resources”.

Click here for the full ASX Release

This article includes content from Arcadia Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AM7:AU

The Conversation (0)

11 September 2021

Arcadia Minerals

A Battery Metal Explorer Operating Within Resource-Rich Namibia

A Battery Metal Explorer Operating Within Resource-Rich Namibia Keep Reading...

23 September 2022

Drilling Completed At Karibib Copper-Gold Project

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that its drilling contractor Hammerstein Mining and Drilling completed a 551m... Keep Reading...

29 August 2022

Drilling Commenced At Karibib Copper-Gold Project

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that it instructed Hammerstein Mining and Drilling to execute a 526m RC... Keep Reading...

09 May 2022

Kum-Kum Nickel Project Mineral Systems Approach Results

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that the Department of Earth Sciences at the University of Stellenbosch... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00