July 19, 2023

Outcrop rock chip results include 13.4% Ni, 5.4g/t Au

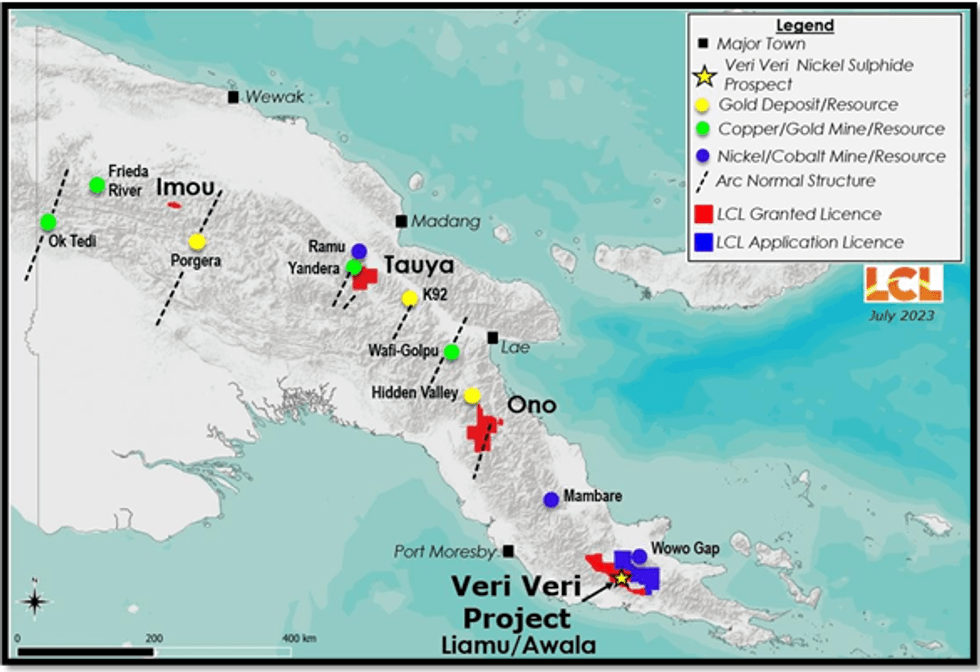

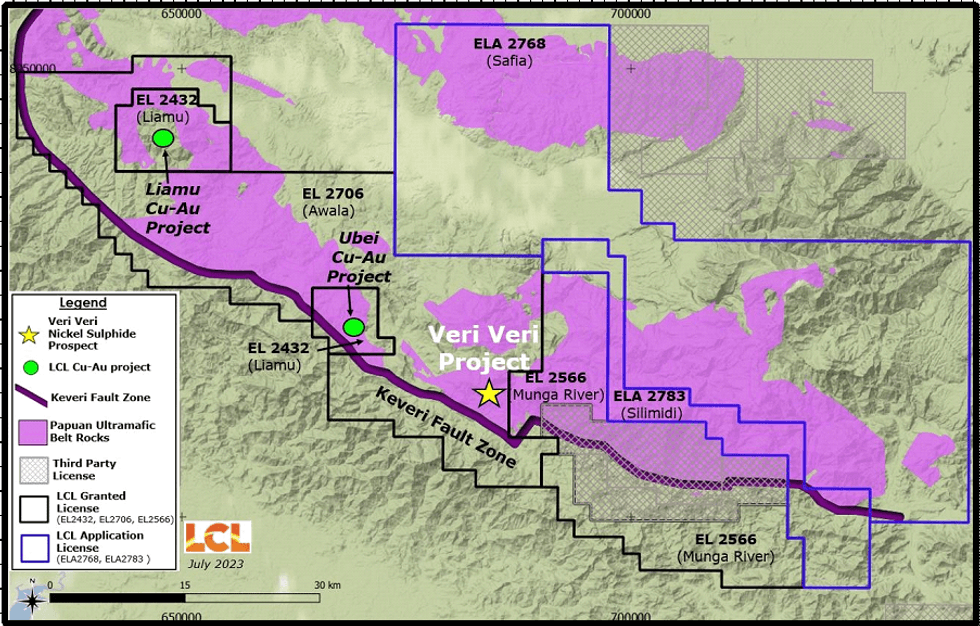

LCL Resources Limited (ASX: LCL) (LCL or the Company), is pleased to provide an update on significant developments at its Veri Veri nickel prospect in southern PNG (Figure 1), part of the Company’s 100% owned Awala licence area which surrounds the Liamu and Ubei gold-copper projects.

- Scout program to confirm the source of high grade nickel sulphide float in Veri Veri creek identifies a 200m wide mineralised corridor in ultramafic rocks as a likely source.

- Multiple surface samples return > 10% Ni from nickel sulphides including a trench of 3m @ 2.11%Ni and 0.23g/t Au.

- LCL mapping/sampling confirms high grade nickel (with gold) mineralisation extends beyond the historical trench assays (including 7.8m @ 3.17% Ni, 1.32g/t Au, 7m @ 4.21% Ni, 1.45g/t Au and 10m @ 2.61% Ni, 0.77g/t Au).

- Veri Veri identified as a distinctive hydrothermal nickel sulphide-gold system with significant scale potential.

- LCL is currently considering its next steps at Veri Veri to ultimately identify first drilling targets.

A reconnaissance field program was conducted with the objective of finding the source of high grade nickel float, including boulders up to 1m in diameter, and to confirm assays and locations of trench sampling reported by previous explorer Goldminex Resources Ltd (ASX:GMX), (Figures 2, 3 & 4). The field work identified a 200m wide corridor which contains numerous serpentinised shear zones containing lenses (boudins) of nickel rich sulphides which are considered to be the likely source of the high grade nickel mineralisation.

The Company is encouraged by the very high grade and frequency of nickel sulphide boudins noted along and across the strike of the corridor, and its potential to yield bulk nickel grades of economic significance. LCL geologists were impressed with “boulder fields” of nickel sulphides and, when random pits/trenches were excavated within the corridor, nickel sulphide bearing outcrops up to 13.38% Ni and 5.35g/t Au were found (Plates 3 & 4) that confirmed surface boulders (boudins) to be in situ (Plate 1), and not transported float. LCL outcrop rock chip sampling also confirmed historical GMX rock grab samples of up to 19.8% Ni, 8.7g/t Au.

LCL’s limited scout trenching program returned an intersection of 3m @ 2.11% Ni, 0.23g/t Au, confirming historical GMX trenching results1 of:

- Trench V14 7.8m @ 3.17% Ni, 1.32g/t Au

- Trench V13 3m @ 4.9% Ni, 2.72g/t Au

- Trench V10 7m @ 4.21%Ni, 1.45g/t Au

- Trench V9 10m @ 2.61% Ni, 0.77g/t Au

The area of interest hosts ultramafic rocks (peridotites, pyroxenites and dunites) of the Papuan Ultramafic Belt of southern PNG proximal to the Keveri Fault. High grade nickel sulphide mineralisation is typically in the form of heazlewoodite, millerite and pentlandite and locally associated with the nickel silicate mineral garnierite plus gold.

A video discussing Veri Veri mineralisation can be accessed from the Digital Media page at LCL’s website – www.lclresources.au.

The Company’s Awala exploration licence covers 70km of the Papuan Ultramafic Belt bordered by the Keveri Fault. The proposed acquisition of the Munga River licence EL2566 to the east of Veri Veri2 and recently applied for exploration licences ELA2768 and ELA2783, will add approximately 30km of additional strike of the Keveri Fault and Papuan Ultramafic Belt lithologies (Figure 2).

LCL Managing Director Jason Stirbinskis commented: “We currently don’t know the extent and number of nickel-bearing shear zones within the identified structural corridor nor the presence of nickel sulphides separate from the boudin structures, however the scale of the shear zones in the small area we have mapped suggests they are part of a large nickel mineralised system which has yet to be tested either across its entire 200m width or along the majority of the Keveri Fault strike length.

The frequency of boudins and the very high nickel grades at Veri Veri bode well for the potential for what appears to be a distinctive hydrothermal nickel-gold mineralised system to ‘bulk up’ to something with economic potential.

The Company is currently planning its next steps for exploration programs appropriate for the steep topography and poor exposure, including new generation airborne electromagnetic (EM) geophysical surveys.”

About LCL

LCL Resources (previously Los Cerros Limited) is an active explorer across multiple targets prospective for Au, Cu and Ni in Papua New Guinea. The Company is currently drilling the priority gold/copper Kusi target that has already delivered exciting results.

The Company’s portfolio is underpinned by a 2.6Moz gold Resource4 in Colombia with early- stage engineering and metallurgy studies completed, including a 0.5Moz Reserve in final mining development approvals review. Given the prospectivity and size of its portfolio, the Company also aims to attract JV partners to advance targets in PNG and Colombia.

Click here for the full ASX Release

This article includes content from LCL Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00