May 05, 2024

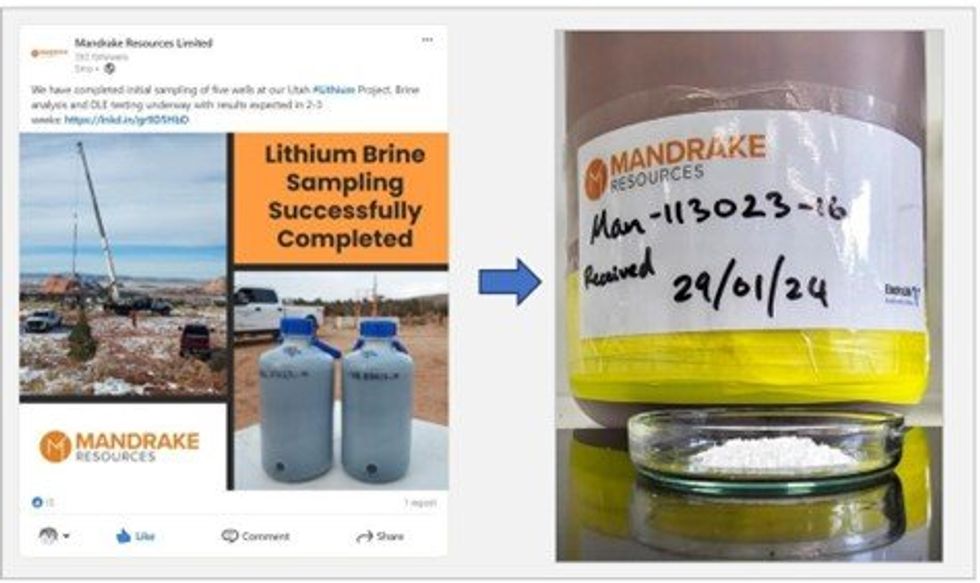

Mandrake Resources Limited (ASX: MAN) (Mandrake or the Company) advises that next- generation Direct Lithium Extraction (DLE) and Refining provider ElectraLith Pty Ltd (ElectraLith) has produced 99.9% pure battery grade Lithium Hydroxide directly from Mandrake’s 100%-owned flagship 93,755 acre (~379km2) Utah Lithium Project brines.

Highlights

- Rio Tinto-backed Direct Lithium Extraction (DLE) and Refining company ElectraLith has successfully produced 99.9% pure battery-grade Lithium Hydroxide from Mandrake’s 100%-owned Utah Lithium Project using it’s cutting-edge DLE-R process

- Requiring no water or chemicals, ElectraLith’s Direct Lithium Extraction and Refining (DLE-R) process has greatly enhanced the potential of the Utah Lithium Project

- The production of battery-grade Lithium Hydroxide direct from brine revolutionises DLE by skipping the conventional interim step of producing lithium carbonate using costly, carbon intensive converters

- Mandrake and ElectraLith progressing a Strategic Partnership Agreement to facilitate the construction of a DLE-R pilot facility at the Utah Lithium Project

ElectraLith's DLE and Refining (DLE-R) technology processed brines in parallel from both Mandrake’s Utah Lithium Project and Rio Tinto’s globally significant Rincon lithium brine project in Argentina.

Spun out of Monash University and backed by Rio Tinto and IP Group Australia, ElectraLith’s DLE-R is emerging as one of the cleanest, fastest, most versatile and cost-efficient methods of extracting and refining lithium. It’s proprietary electro-membrane technology requires no water or chemicals and can run entirely on renewable power, making it ideal for the water and resource constrained Paradox Basin.

Mandrake sent ElectraLith brines from the Lisbon B-912 well - one of the lower lithium concentration bulk samples from sampling activities undertaken in December 2023. The Lisbon B-912 brines contained 65.6mg/L lithium whilst the Big Indian #1 well (bulk sample sent to DLE provider Electroflow – results expected shortly) brines contained lithium concentrations of 147mg/L. Please see Mandrake’s ASX release of 22 January 2024 and Table 1 attached for further details.

ElectraLith’s work represents the groundbreaking production of Lithium Hydroxide direct from Mandrake’s Utah Lithium Project brines. It also confirms DLE-R’s ability to do so without consuming water or chemicals, greatly enhancing the potential of the Utah Lithium Project.

The ability of ElectraLith’s DLE-R technology to produce battery grade Lithium Hydroxide directly from brine revolutionises DLE by completely circumventing the conventional interim steps of lithium processing, being the production of lithium chloride and lithium carbonate, which often involves the use of costly, carbon intensive converters.

The relationship between ElectraLith and Mandrake is non-exclusive, enabling Mandrake to continue exploring and assessing other competing DLE technologies. To that end, Mandrake is currently awaiting test results from bulk brine samples sent to the Bill Gates-backed US- based DLE company Electroflow (see ASX release dated 22 December 2023).

Managing Director James Allchurch commented:

‘DLE technology is absolutely critical to the future of lithium and the broader global energy transition. Our research into this innovative technology has been comprehensive, quickly identifying ElectraLith as one of the leaders in the field. The ability for ElectraLith’s DLE-R to produce Lithium Hydroxide directly from brine using limited power, no water and no chemicals is revolutionary in the DLE space, putting Mandrake’s US-based brine asset in a commanding position.

I look forward to concluding a partnership agreement with ElectraLith which will facilitate the construction of a DLE-R facility at Mandrake’s Utah Lithium Project.

Furthermore, the maiden Mineral Resource Estimate for the Utalh Lithium Project is well advanced, and I look forward to updating the market when complete.’

Click here for the full ASX Release

This article includes content from Mandrake Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00