Highlights

- Acquisition of 13 additional target properties consolidates district scale potential.

- Combined target surface footprint of 37.7 square km – 40 times larger than current Crawford Main Zone resource of 0.85 square km.

- Ten target properties have larger footprint than Crawford and nine confirmed to contain the same host mineralization as Crawford.

- Sothman target property has historical higher grade, shallow resource of approximately 190,000 tons of 1.24% nickel (with 300 metres strike length) 1 ; remaining 2.2 km of strike length is largely untested.

- Four target areas have yielded drill intersections of > 0.3% nickel including:

- Sothman: 2.31% nickel and 0.19% copper over true width of 3.2 metres within 1.58% nickel and 0.12% copper over true width of 8.6 metres from 41 metres;

- Deloro : 0.38% nickel and 0.22 g/t PGM over core length of 15.5 metres within 0.28% nickel and 0.09 g/t PGM over core length of 299 metres from 241 metres;

- Midlothian: 0.24% nickel over core length of 345 metres, including 0.30% nickel over 42 metres;

- Mann Southeast: multiple 3 metre intervals grading 0.31-0.33% nickel within 111 metres of dunite across entire core length

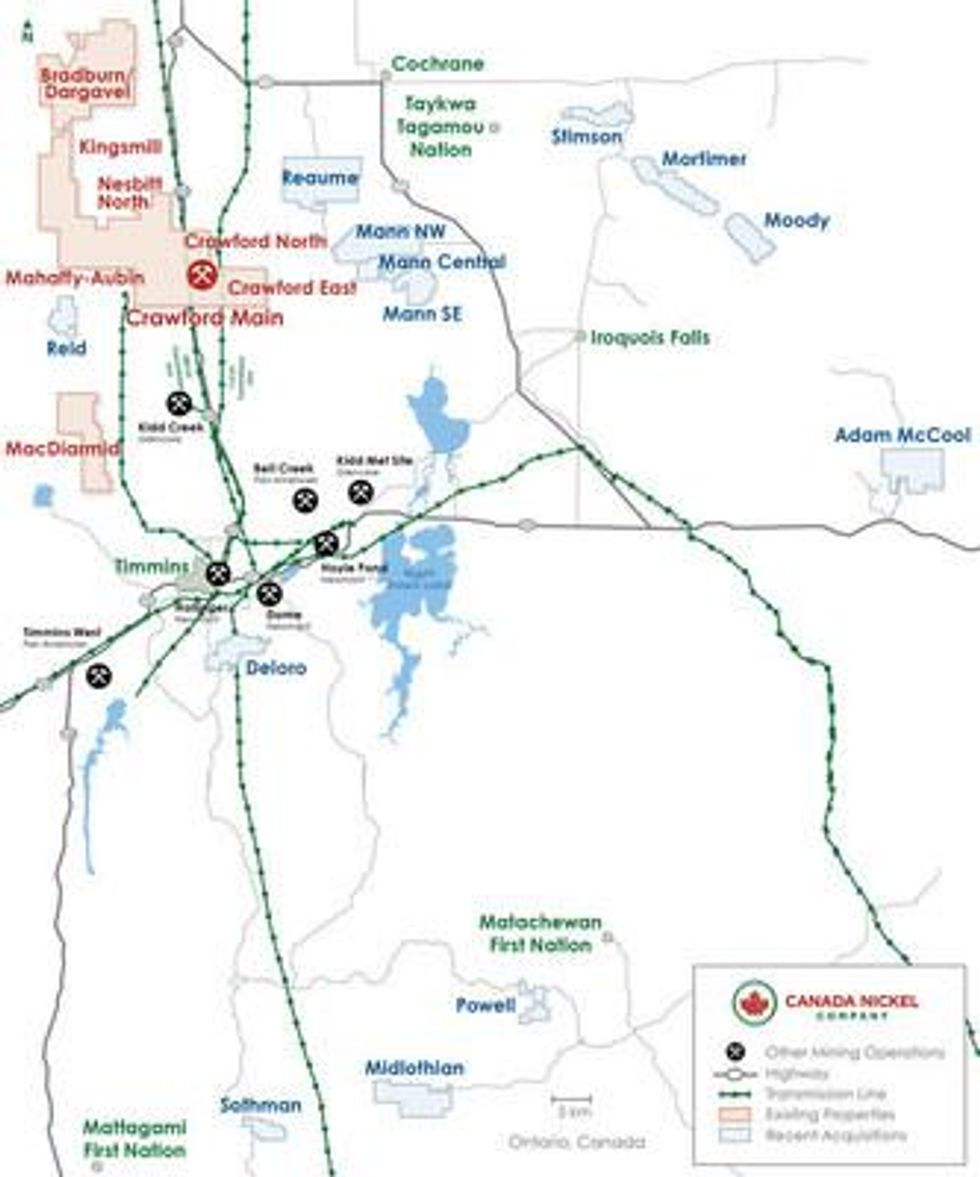

Canada Nickel Company Inc. (" Canada Nickel " or the " Company ") (TSXV: CNC) (OTCQX: CNIKF) today announced that the Company has concluded 18 separate transactions resulting in the outright acquisition or earn-in to 13 additional target properties within a radius of 95 km of the Company's flagship Crawford Nickel-Sulfide Project, consolidating Canada Nickel's position in the Timmins area. Each of the additional properties contains one or more ultramafic targets based on combinations of historical geophysical work and drilling over the past 65 years. See transaction summary at the end of the release for a summary of the acquisition terms.

"The acquisition of these highly prospective target properties represents a transformational milestone for Canada Nickel, on par with the initial discovery of our flagship property, Crawford. The consolidation of these properties underscores our strong belief in the district-scale potential of the Timmins region and in our journey to become a leader of the Next Generation of Nickel Supply – large, scalable, low carbon nickel supply," said Mark Selby , Chair & CEO of Canada Nickel. "These properties have combined target structures 40 times the scale of the structure which hosts our current Crawford Main Zone resource (contained nickel of 1.56 million tonnes M&I + 0.76 million tonnes inferred 2 ), and like Crawford, all these target structures are near excellent infrastructure. Each target has had some amount of historical work, and in some cases, much more than Crawford did initially, confirming these targets contain the same serpentinized dunite and/or peridotite that hosts Crawford mineralization and, as our last release reported, has the potential to permanently sequester CO2."

| ______________________ |

| 1 See Statement Regarding Historical Resource Estimates on page 27 of this press release. |

| 2 See Preliminary Economic Assessment, titled "Crawford Nickel-Sulphide Project National Instrument 43-101 Technical Report and Preliminary Economic Assessment", with an effective date of May 21, 2021 |

Figure A – The Timmins Nickel District

The Company will host a conference call and webcast today, Monday, November 22, 2021 , at 10:00 a.m. EDT , to discuss the property acquisitions and answer questions related to the advancement of the Timmins Nickel District (see details at the end of this announcement).

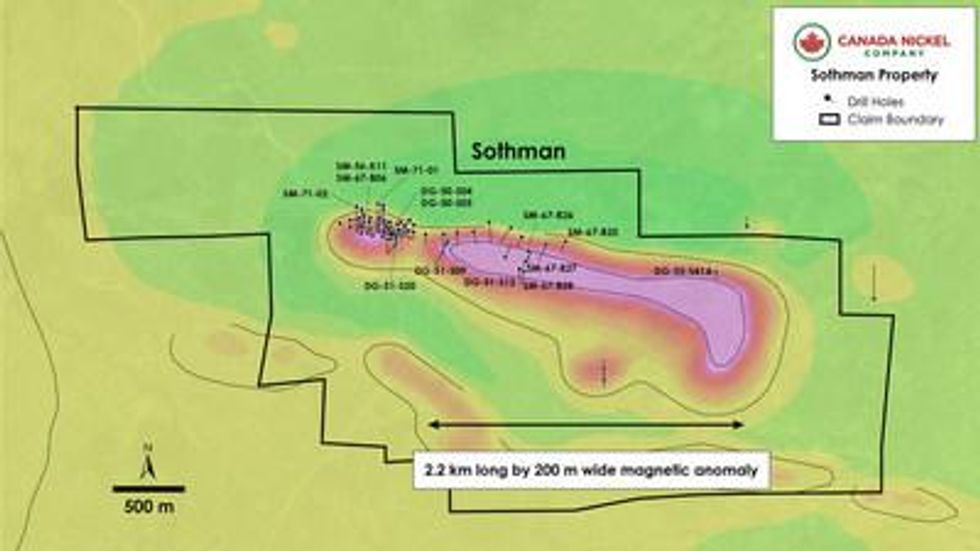

Sothman

Sothman is a property of approximately 1,000 ha located 70 km south of Timmins. The project was acquired from Glencore.

The Sothman Property contains an ultramafic sill comprised mainly of dunite (see Figure 2) that is estimated to be up to 200-300 metres thick, 2.2 km long and open at depth. An unclassified historical resource estimate reported as 189,753 tons grading 1.24% nickel (the Sothman West Zone) 3 is centred 500 metres west of the sill (the 2.2 km dunite sill is largely untested).

The Sothman West Zone occurs at the north ultramafic contact within a footwall embayment approximately 300 metres wide and open at depth. The best historical intersection was hole DG50-S04 with 1.58% nickel over 12.2 metres (8.6 metres estimated true width) from 41.2 metres downhole including 4.6 metres (3.2 metres estimated true width) of 2.31% nickel and 0.19% copper. A sample of historical drill results is shown in Table 1a and 1b . Two drillholes intersected a deeper pod of similar sulphide mineralization (3.4 metres of 1.32% nickel from 398 metres in SM71-1 and 5.5 metres of 0.49% nickel from 353.2 metres in SM71-2) outside of the resource during the last drill program in 1971.

The Sothman Main Zone has seen very limited exploration but is known to contain dunite and peridotite and is similar in size to the East Zone at Crawford. For example, drillhole SM67-B25, SM67-B26 and SM67-B27 all intersected peridotite below overburden intersecting 54.56 metres of peridotite from 36.6 metres, 112.47 metres of peridotite from 7.6 metres, and 109.43 metres of peridotite from 12.19 metres respectively. All three holes ended in peridotite. Drillhole SM67-B28 was collared in peridotite (intersecting 46.02 metres of ultramafics from 15.24 metres) and crossed the south contact into volcanics at 61.26 metres, completing the only geologic section across the Sothman Main Zone.

Drillhole DG53-S41A is the only hole drilled in the eastern area of the Sothman Main Zone and intersected 60.1 metres of peridotite from 23.8 metres downhole, ending in peridotite. The south contact of the Sothman Main Zone has been intersected in three drillholes (DG51-S09, DG51-S12 and SM67-B28) with all holes starting in peridotite and ending in volcanics.

Table 1a – Historical Drilling – Sothman West Zone – Significant Intersections

| Hole ID | From (m) | To (m) | Length (m) | Estimated True | Ni % | Cu % |

| SM56-K11 | 93.2 | 102.4 | 9.2 | 4.6 | 1.58 | 0.17 |

| including | 93.2 | 97.5 | 4.3 | 2.2 | 2.58 | 0.34 |

| SM67-B06 | 28.7 | 40.5 | 11.8 | 8.4 | 1.57 | 0.11 |

| including | 28.7 | 33.8 | 5.1 | 3.6 | 2.28 | 0.16 |

| DG50-S04 | 41.2 | 53.3 | 12.2 | 8.6 | 1.58 | 0.12 |

| including | 41.2 | 45.7 | 4.6 | 3.2 | 2.31 | 0.19 |

| DG51-S20 | 89.9 | 95.8 | 5.9 | 4.0 | 1.56 | 0.13 |

| DG50-S05 | 19.8 | 21.0 | 1.2 | 0.9 | 7.51 | 0.62 |

| SM71-1 | 398.1 | 409.0 | 11.0 | 4.1 | 0.66 | 0.04 |

| ___________________________ |

| 3 See Statement Regarding Historical Resource Estimates on page 27 of this press release. |

Table 1a – Historical Drilling – Sothman West Zone – Significant Intersections (continued)

| Hole ID | From (m) | To (m) | Length (m) | Estimated True | Ni % | Cu % |

| including | 398.1 | 401.4 | 3.4 | 1.2 | 1.32 | 0.05 |

| SM71-2 | 353.3 | 358.8 | 5.5 | 2.5 | 0.49 | 0.03 |

Table 1b – Historical Drilling – Sothman Property – Selected Lithologies

| Hole ID | From (m) | To (m)* | Rock Type |

| DG-50-S04 | 32.4 | 107.9 | Ultramafics - Peridotite |

| DG-50-S05 | 22.9 | 82.0 | Ultramafics - Peridotite |

| DG-51-S09 | 7.3 | 217.0 | Ultramafics - Peridotite |

| DG-51-S12 | 7.0 | 111.4 | Ultramafics - Peridotite |

| DG-51-S12 | 111.4 | 114.1 | Ultramafics - Gabbro |

| DG-51-S12 | 114.1 | 118.3 | Ultramafics - Peridotite |

| DG-51-S12 | 118.3 | 142.8 | Ultramafics - Gabbro |

| DG-51-S20 | 19.8 | 96.9 | Ultramafics - Peridotite |

| DG-53-S41A | 23.8 | 83.8 | Ultramafics - Peridotite |

| SM-56-K11 | 85.7 | 148.4 | Ultramafics - Peridotite |

| SM-67-B06 | 25.5 | 101.8 | Ultramafics - Peridotite |

| SM-67-B25 | 36.6 | 91.1 | Ultramafics - Peridotite |

| SM-67-B26 | 7.6 | 120.1 | Ultramafics - Peridotite |

| SM-67-B27 | 12.2 | 121.6 | Ultramafics - Peridotite |

| SM-67-B28 | 15.2 | 47.7 | Ultramafics - Peridotite |

| SM-71-01 | 394.0 | 426.7 | Ultramafics - Peridotite |

| SM-71-02 | 351.1 | 366.7 | Ultramafics - Peridotite |

| * Denotes ended in mineralization | |||

Figure 1 – Sothman Property – Historical Drillholes Over Total Magnetic Intensity ("TMI").

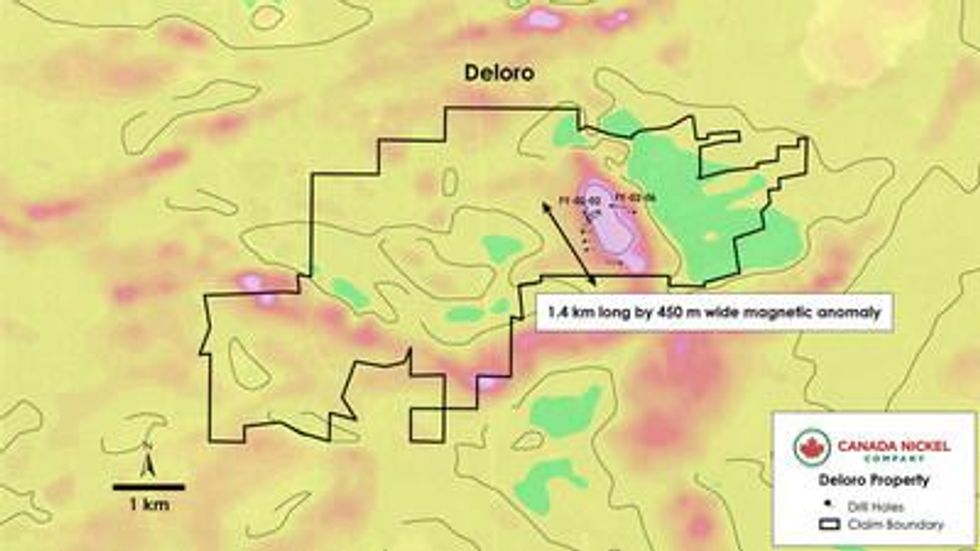

Deloro

Deloro is a property of approximately 1,800 ha located 10 km southeast of Timmins . It contains an ultramafic unit 1.4 km in length and up to 450 metres wide, striking south-southeast identified by the high magnetic intensity anomaly and historical drilling (see Figure 2). Six holes (FY-02-02, FY-02-06, FY-02-10, FY-02-11, FY-02-12, FY-02-13) were drilled inside and on the edge of the anomaly. Five of six holes intersected serpentinized dunite/peridotite with a core length of 24.2 metres in hole FY-02-10 up to 138.4 metres in hole FY-02-13, with four of five holes ending in serpentinized dunite/peridotite.

All five holes noted presence of magnetite (up to 20-25% magnetite in interval 39.4-89.5 metres from hole FY-02-02) and disseminated sulphides. Only specific non-consecutive intervals were assayed. Two of the four holes had nickel mineralization exceeding 0.40% nickel: FY02-02 with 0.42% nickel over a core length of 4.2 metres, with up to 0.73 g/t Pd and 0.23 g/t Pt over 1.2 metres, and FY-02-10 with 0.48% nickel, 0.28 g/t Pd, and 0.14 g/t Pt over 2.8 metres. See Table 2a and 2b below.

Figure 2 – Deloro Property – Historical Drillholes Over TMI

Table 2a – Historical Drilling – Deloro Property – Significant Intersections*

| Hole ID | From (m) | To (m) | Length (m) | Ni % | Cu % | Pd g/t | Pt g/t |

| FY-02-02 | 241.0 | 314.5 | 73.5 | 0.28 | 0.03 | 0.06 | 0.03 |

| Including | 299.0 | 314.5 | 15.5 | 0.38 | 0.06 | 0.15 | 0.07 |

| FY-02-02 | 324.2 | 345.0 | 20.8 | 0.24 | 0.03 | 0.03 | 0.01 |

| including | 342.8 | 343.1 | 0.4 | 0.74 | 0.23 | 0.16 | 0.17 |

| FY-02-10 | 54.7 | 59.7 | 5.0 | 0.27 | 0.03 | 0.01 | 0.00 |

| FY-02-10 | 95.8 | 98.6 | 2.8 | 0.48 | 0.03 | 0.28 | 0.14 |

| FY-02-13 | 122.8 | 152.9 | 30.1 | 0.25 | 0.01 | 0.02 | 0.01 |

| FY-02-13 | 177.5 | 200.5 | 23.0 | 0.24 |

| 0.00 | 0.00 |

| FY-02-13 | 298.0 | 318.0 | 20.0 | 0.26 |

| 0.00 | 0.00 |

| * Insufficient drilling completed to determine dip and true width of orebody | |||||||

Table 2b – Historical Drilling – Deloro Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| FY-02-01 | 4.0 | 11.0 | 7.0 | Peridotite |

| FY-02-01 | 11.0 | 14.1 | 3.1 | Serpentinite |

| FY-02-01 | 14.8 | 18.2 | 3.4 | Serpentinite |

| FY-02-01 | 18.2 | 29.9 | 11.7 | Peridotite |

| FY-02-01 | 29.9 | 31.3 | 1.4 | Peridotite |

| FY-02-01 | 31.3 | 34.8 | 3.5 | Peridotite |

| FY-02-01 | 36.5 | 98.5 | 62.0 | Peridotite |

| FY-02-01 | 98.5 | 102.0 | 3.5 | Serpentinite |

| FY-02-02 | 5.8 | 21.3 | 15.5 | Peridotite/Dunite |

| FY-02-02 | 23.1 | 33.7 | 10.6 | Peridotite/Dunite |

| FY-02-02 | 33.7 | 34.7 | 1.0 | Serpentinite |

| FY-02-02 | 39.4 | 89.5 | 50.1 | Peridotite/Dunite |

| FY-02-02 | 89.5 | 90.4 | 0.8 | Pyroxenite |

| FY-02-02 | 92.1 | 117.1 | 25.0 | Peridotite/Dunite |

| FY-02-02 | 117.1 | 120.7 | 3.6 | Serpentinite |

| FY-02-02 | 132.5 | 134.4 | 1.9 | Peridotite |

| FY-02-02 | 135.4 | 136.8 | 1.4 | Pyroxenite |

| FY-02-02 | 137.1 | 138.6 | 1.5 | Serpentinite |

| FY-02-02 | 138.6 | 149.8 | 11.2 | Peridotite/Dunite |

| FY-02-02 | 151.7 | 206.1 | 54.4 | Peridotite/Dunite |

| FY-02-02 | 210.6 | 217.9 | 7.2 | Serpentinite |

| FY-02-02 | 219.3 | 314.7 | 95.4 | Peridotite |

| FY-02-02 | 316.7 | 319.0 | 2.3 | Pyroxenite |

| FY-02-02 | 319.0 | 319.7 | 0.7 | Peridotite |

| FY-02-02 | 319.7 | 321.2 | 1.5 | Peridotite/Dunite |

| FY-02-02 | 321.2 | 324.2 | 3.0 | Peridotite |

| FY-02-02 | 324.2 | 324.8 | 0.6 | Peridotite |

| FY-02-02 | 324.8 | 325.8 | 1.0 | Peridotite |

| FY-02-02 | 325.8 | 332.2 | 6.4 | Peridotite |

| FY-02-02 | 332.2 | 333.5 | 1.3 | Serpentinite |

| FY-02-02 | 333.5 | 339.7 | 6.2 | Peridotite |

| FY-02-02 | 339.7 | 365.7 | 26.0 | Serpentinite |

| FY-02-02 | 373.5 | 381.1 | 7.7 | Serpentinite |

| FY-02-06 | 25.0 | 110.3 | 85.3 | Serpentinite |

| FY-02-06 | 110.9 | 208.9 | 98.0 | Serpentinite |

Table 2b – Historical Drilling – Deloro Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| FY-02-06 | 211.2 | 301.0 | 89.8 | Serpentinite |

| FY-02-10 | 31.7 | 50.0 | 18.3 | Pyroxenite |

| FY-02-10 | 54.7 | 59.7 | 5.0 | Pyroxenite |

| FY-02-10 | 69.9 | 73.8 | 3.8 | Peridotite |

| FY-02-10 | 75.5 | 97.6 | 22.1 | Pyroxenite/Peridotite |

| FY-02-10 | 97.6 | 113.5 | 15.9 | Peridotite/Dunite |

| FY-02-10 | 113.5 | 121.9 | 8.4 | Peridotite |

| FY-02-10 | 121.9 | 123.5 | 1.7 | Serpentinite |

| FY-02-10 | 123.9 | 124.6 | 0.7 | Serpentinite |

| FY-02-10 | 124.8 | 130.7 | 5.9 | Peridotite |

| FY-02-10 | 130.7 | 135.0 | 4.3 | Peridotite |

| FY-02-12 | 52.4 | 58.6 | 6.2 | Pyroxenite |

| FY-02-12 | 58.6 | 64.7 | 6.1 | Serpentinite |

| FY-02-12 | 75.3 | 79.1 | 3.8 | Serpentinite |

| FY-02-12 | 80.0 | 80.3 | 0.3 | Serpentinite |

| FY-02-12 | 80.3 | 82.3 | 2.0 | Serpentinite |

| FY-02-12 | 85.6 | 86.2 | 0.6 | Serpentinite |

| FY-02-12 | 86.2 | 97.3 | 11.1 | Peridotite |

| FY-02-12 | 97.3 | 113.5 | 16.2 | Pyroxenite |

| FY-02-12 | 113.5 | 118.2 | 4.7 | Peridotite |

| FY-02-12 | 119.4 | 122.0 | 2.5 | Peridotite |

| FY-02-12 | 122.0 | 133.3 | 11.3 | Peridotite/Dunite |

| FY-02-12 | 133.3 | 146.4 | 13.2 | Dunite |

| FY-02-12 | 146.6 | 272.0 | 125.4 | Dunite |

| FY-02-13 | 114.3 | 156.0 | 41.6 | Peridotite |

| FY-02-13 | 166.1 | 168.1 | 2.0 | Peridotite |

| FY-02-13 | 168.1 | 171.9 | 3.8 | Peridotite |

| FY-02-13 | 171.9 | 177.5 | 5.6 | Dunite |

| FY-02-13 | 177.5 | 179.6 | 2.1 | Peridotite |

| FY-02-13 | 179.6 | 318.0 | 138.4 | Dunite |

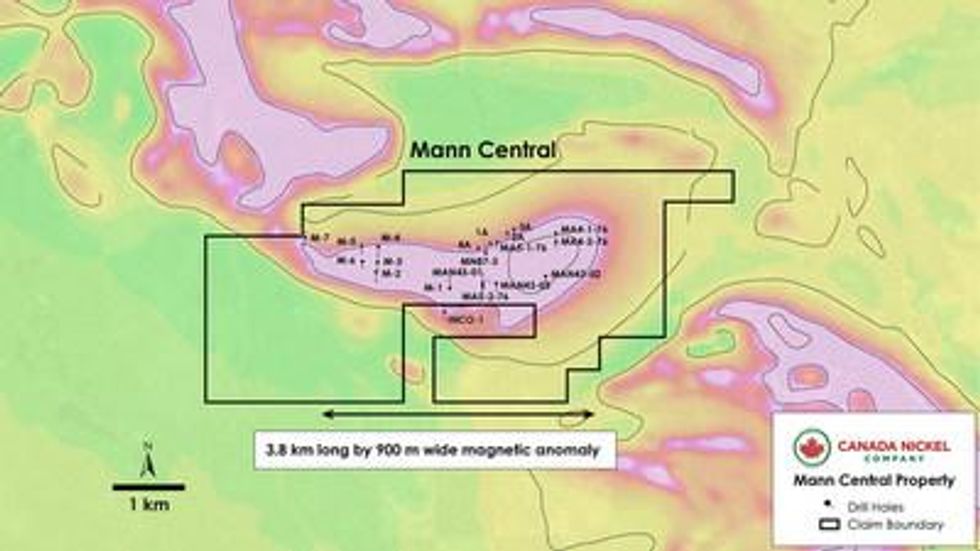

Mann

Mann is located 25 km east of Crawford and totals 7,800 ha. The ultramafic is estimated to be a combined 21 km in length with variable thickness and having at least three main dunitic cores like that at Crawford (Mann Central, Mann Northwest, and Mann Southeast). The Company has acquired the right to earn an 80% interest in the Mann Property from Noble by an initial payment of $100,000 in cash and 150,000 shares and paying a further $100,000 per year over the four-year Option Period (for a total cash payment of $400,000 ) and issuing a further 250,000 common shares, and incurring total exploration expenditures of $1.7 million , over the Option Period. Noble will retain a 2.00% Net Smelter Return ("NSR") with a 1.00% buy-back to Canada Nickel for $1.0 million plus 50% of the buy-back provisions that total $4.5 million ( $2.25 million to CNC).

Mann Central

The Mann Central Property area covers a single 4 km long by up to 1 km wide ultramafic intrusion (see Figure 3) that is evident in TMI geophysical surveys. Historical drilling has already delineated ultramafic mineralization over a strike length of 2,700 metres and 690 metres wide. Only one historical hole had assays – Falconbridge Ltd. intersected 79 metres (MAN43-03) of ultramafic which was intermittently sampled - with the highest reported assay of 0.29% nickel over ~1 metre (See Table 3a below). Historical drilling began in 1951 with seven of eight holes intersecting serpentinized peridotite containing magnetite. The longest intersection occurred in hole M-1, with 212 metres of well serpentinized peridotite along its entire core length. A 1976 drilling campaign reported wide intercepts of serpentinized ultramafic intrusive with visible sulphides and pervasive magnetite. Hole MA5-2-76 was the longest at 114 metres of serpentinized ultramafics along its entire core length (see Table 3a below).

Table 3a – Historical Drilling – Mann Central Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| INCO-1 | 5.2 | 162.5 | 157.3 | Peridotite |

| M-1 | 1.5 | 213.7 | 212.1 | Peridotite |

| M-2 | 7.3 | 214.9 | 207.6 | Peridotite |

| M-3 | 7.6 | 14.9 | 7.3 | Peridotite |

| M-3 | 18.0 | 96.3 | 78.3 | Peridotite |

| M-3 | 96.3 | 141.7 | 45.4 | Pyroxenite |

| M-3 | 141.7 | 155.1 | 13.4 | Peridotite |

| M-3 | 165.8 | 172.8 | 7.0 | Pyroxenite |

| M-4 | 11.3 | 50.0 | 38.7 | Dunite |

| M-4 | 50.0 | 54.6 | 4.6 | Pyroxenite |

| M-4 | 54.6 | 88.4 | 33.8 | Dunite |

| M-4 | 88.4 | 191.4 | 103.0 | Peridotite |

| M-4 | 191.4 | 196.0 | 4.6 | Pyroxenite |

| M-5 | 10.1 | 41.1 | 31.1 | Pyroxenite |

| M-5 | 41.1 | 153.3 | 112.2 | Peridotite |

| M-5 | 161.5 | 172.5 | 11.0 | Pyroxenite |

| M-6 | 7.9 | 114.9 | 107.0 | Peridotite |

| M-6 | 123.1 | 128.0 | 4.9 | Pyroxenite |

| M-7 | 11.3 | 107.3 | 96.0 | Peridotite |

| M-7 | 113.4 | 127.1 | 13.7 | Peridotite |

| M-7 | 129.2 | 172.8 | 43.6 | Peridotite |

| 1A | 0.9 | 7.0 | 6.1 | Peridotite |

| 1A | 51.5 | 54.6 | 3.1 | Peridotite |

| 2A | 2.4 | 8.7 | 6.3 | Peridotite |

| 2A | 22.0 | 52.1 | 30.2 | Peridotite |

| 2A | 83.8 | 111.3 | 27.4 | Peridotite |

| 3A | 1.2 | 57.3 | 56.1 | Peridotite |

Table 3a – Historical Drilling – Mann Central Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| 3A | 61.3 | 80.5 | 19.2 | Peridotite |

| 4A | 0.6 | 10.4 | 9.8 | Peridotite |

| 4A | 11.0 | 37.5 | 26.5 | Peridotite |

| MA4-2-76 | 84.4 | 90.8 | 6.5 | Gabbro |

| MA4-2-76 | 90.8 | 121.9 | 31.1 | Pyroxenite |

| MA4-2-76 | 121.9 | 123.1 | 1.2 | Peridotite |

| MA5-1-76 | 102.4 | 108.8 | 6.4 | Gabbro |

| MA5-1-76 | 108.8 | 138.1 | 29.3 | Peridotite |

| MA5-2-76 | 8.7 | 123.1 | 114.4 | Ultramafic |

| MN87-3 | 32.3 | 200.0 | 167.7 | Ultramafic |

| MAN43-01 | 9.0 | 188.0 | 179.0 | Ultramafic |

| MAN43-03 | 78.6 | 158.0 | 79.4 | Ultramafic |

Table 3b – Historical Drilling – Mann Central Property – Significant Intersections

| Hole ID | From (m) | To (m) | Length (m) | Ni % |

| MAN43-03 | 89.1 | 90.3 | 1.2 | 0.29 |

| MAN43-03 | 95.1 | 95.5 | 0.4 | 0.15 |

| MAN43-03 | 107.2 | 107.6 | 0.4 | 0.16 |

| MAN43-03 | 116.0 | 116.5 | 0.5 | 0.19 |

| MAN43-03 | 122.0 | 122.4 | 0.4 | 0.21 |

| MAN43-03 | 131.0 | 131.6 | 0.6 | 0.23 |

| MAN43-03 | 142.7 | 143.0 | 0.3 | 0.21 |

| MAN43-03 | 149.0 | 149.5 | 0.5 | 0.22 |

Figure 3 – Mann Central Property – Historical Drillholes Over TMI.

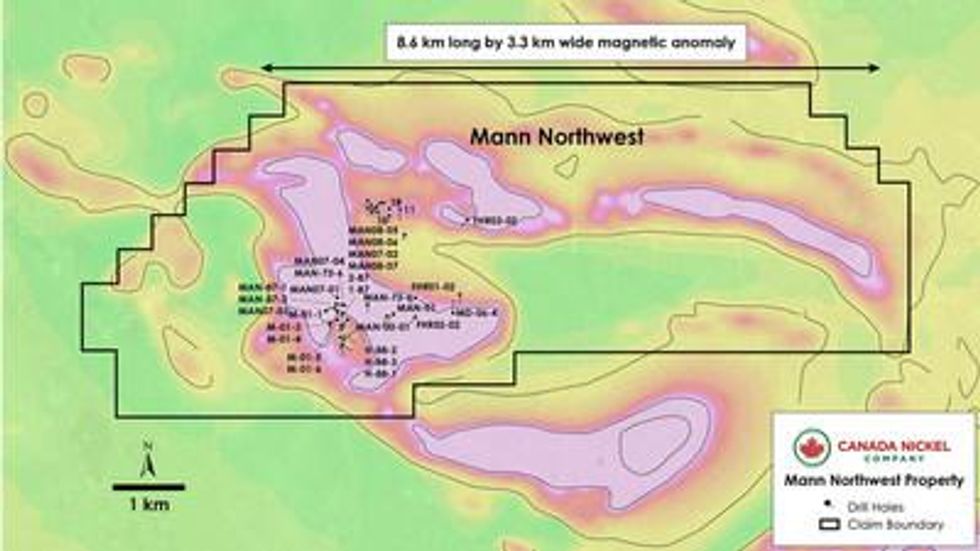

Mann Northwest

The Mann Northwest Property covers an ultramafic intrusion having dimensions of 3.5 km long by 600-800 metres wide (see Figure 4). The intrusion is described as mostly peridotite, commonly serpentinized, with overlying leuco-gabbro and pyroxenite.

First Point Minerals Corp. conducted a three-hole drill program (468 metres) in 2002 targeting PGMs in pyroxenites that overlie the ultramafic units. While the first hole (FHR-01-01) targeted the contact between the volcanics and the ultramafic rocks, the second hole (FHR02-02) intersected serpentinized peridotite containing magnetite and some sulphide stringers in fractures. Nickel assays were taken at selected intervals and ranged from a low of 0.10% nickel to a high of 0.31% nickel with average values >0.20% nickel (see table 4a).

Drilling conducted by Tres-Or Resources Ltd., did not report nickel assays but did intersect wide sections of serpentinized peridotite with magnetite and/or sulphide minerals (e.g., MAN-87-1) as observed in 22 drill holes (see Table 4b ), as well as elevated PGM values (e.g., 0.57-0.59 g/t PGM) from several channel samples. Geological descriptions and geochemistry from these programs resemble what is observed at Canada Nickel's Crawford property.

Table 4a – Historical Drilling – Mann Northwest Property – Significant Intersections

| Hole ID | From (m) | To (m) | Length (m) | Ni % | S % | Cr % | Co % | Pd (g/t) | Pt (g/t) |

| FHR01-02 | 25.3 | 29.0 | 3.7 | 0.22 | 0.06 | 0.20 | 0.01 | 0.001 | - |

| FHR01-02 | 73.0 | 76.0 | 3.0 | 0.21 | 0.07 | 0.11 | 0.01 | - | - |

| FHR01-02 | 86.0 | 89.0 | 3.0 | 0.23 | 0.06 | 0.08 | 0.01 | 0.002 | - |

| FHR01-02 | 89.0 | 92.3 | 3.3 | 0.24 | 0.05 | 0.07 | 0.01 | 0.002 | - |

| FHR01-02 | 92.6 | 95.0 | 2.4 | 0.23 | 0.05 | 0.06 | 0.01 | 0.003 | - |

| FHR01-02 | 98.0 | 101.0 | 3.0 | 0.24 | 0.05 | 0.06 | 0.01 | 0.002 | 0.007 |

| FHR01-02 | 101.0 | 104.0 | 3.0 | 0.23 | 0.05 | 0.08 | 0.01 | 0.001 | - |

| FHR01-02 | 131.0 | 134.0 | 3.0 | 0.25 | 0.04 | 0.08 | 0.01 | 0.002 | 0.007 |

| FHR02-02 | 33.5 | 35.0 | 1.5 | 0.22 | 0.07 | 0.23 | 0.01 | 0.063 | 0.048 |

| FHR02-02 | 75.4 | 76.4 | 1.0 | 0.21 | 0.10 | 0.14 | 0.01 | 0.003 | - |

| FHR02-02 | 113.0 | 114.3 | 1.3 | 0.31 | 0.17 | 0.10 | 0.02 | 0.021 | 0.013 |

| FHR02-02 | 117.0 | 118.6 | 1.6 | 0.21 | 0.09 | 0.08 | 0.01 | 0.002 | - |

| FHR02-02 | 121.7 | 122.3 | 0.6 | 0.29 | 0.12 | 0.15 | 0.01 | 0.038 | 0.017 |

| FHR02-02 | 134.7 | 135.4 | 0.7 | 0.28 | 0.19 | 0.19 | 0.01 | 0.044 | 0.021 |

| FHR02-02 | 158.0 | 161.0 | 3.0 | 0.27 | 0.14 | 0.07 | 0.01 | 0.031 | 0.009 |

| FHR03-02 | 27.5 | 32.0 | 4.5 | 0.17 | 0.10 | 0.08 | 0.01 | 0.004 | 0.014 |

| FHR03-02 | 133.0 | 137.0 | 4.0 | 0.15 | 0.18 | 0.18 | 0.01 | 0.005 | - |

Table 4b – Historical Drilling – Mann Northwest Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| FHR01-02 | 25.3 | 63.5 | 38.2 | Peridotite |

| FHR01-02 | 63.5 | 87.5 | 24.0 | Peridotite |

| FHR01-02 | 87.5 | 92.3 | 4.8 | Peridotite |

| FHR01-02 | 92.6 | 111.8 | 19.2 | Peridotite |

Table 4b – Historical Drilling – Mann Northwest Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| FHR01-02 | 116.9 | 119.1 | 2.2 | Peridotite |

| FHR01-02 | 119.1 | 137.0 | 17.9 | Peridotite |

| FHR02-02 | 7.0 | 33.5 | 26.5 | Peridotite |

| FHR02-02 | 33.7 | 43.5 | 9.8 | Peridotite |

| FHR02-02 | 43.5 | 150.0 | 106.5 | Peridotite |

| FHR02-02 | 150.8 | 161.0 | 10.2 | Peridotite |

| FHR03-02 | 15.0 | 123.8 | 108.8 | Peridotite |

| MAN-73-6 | 12.2 | 112.3 | 100.1 | Peridotite |

| MAN-73-6 | 115.5 | 119.9 | 4.4 | Peridotite |

| MAN-73-6 | 119.9 | 128.0 | 8.1 | Pyroxenite |

| MAN-73-6 | 152.1 | 167.6 | 15.5 | Peridotite |

| MAN-00-01 | 5.2 | 100.3 | 95.1 | Peridotite |

| MAN-00-01 | 100.3 | 104.0 | 3.8 | Gabbro |

| MAN-00-01 | 104.0 | 106.5 | 2.4 | Peridotite |

| MAN-00-01 | 106.5 | 128.8 | 22.3 | Gabbro |

| MAN-00-01 | 128.8 | 200.3 | 71.5 | Peridotite |

| MAN-01 | 5.2 | 100.3 | 95.1 | Peridotite |

| MAN-01 | 100.3 | 104.0 | 3.8 | Gabbro |

| MAN-01 | 104.0 | 106.5 | 2.4 | Peridotite |

| MAN-01 | 106.5 | 128.8 | 22.3 | Gabbro |

| MAN-01 | 128.8 | 200.3 | 71.5 | Peridotite |

| M-01-1 | - | 192.0 | 192.0 | Peridotite |

| M-01-2 | - | 212.3 | 212.3 | Gabbro |

| M-01-2 | 212.3 | 237.1 | 24.8 | Carbonatized Zone |

| M-01-2 | 237.1 | 251.0 | 13.9 | Peridotite |

| M-01-3 | - | 150.0 | 150.0 | Peridotite |

| M-01-4 | - | 102.0 | 102.0 | Peridotite |

| M-01-5 | - | 40.2 | 40.2 | Peridotite |

| M-01-5 | 40.2 | 59.8 | 19.6 | Gabbro |

| M-01-5 | 59.8 | 73.6 | 13.8 | Pyroxenite |

| M-01-5 | 73.6 | 116.9 | 43.3 | Gabbro |

| M-01-5 | 116.9 | 150.0 | 33.1 | Peridotite |

| M-01-6 | - | 51.6 | 51.6 | Peridotite |

| M-01-6 | 51.6 | 70.2 | 18.6 | Gabbro |

| M-01-6 | 70.2 | 81.5 | 11.3 | Pyroxenite |

| M-01-6 | 81.5 | 107.9 | 26.4 | Gabbro |

| M-01-6 | 107.9 | 147.5 | 39.6 | Peridotite |

Table 4b – Historical Drilling – Mann Northwest Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| M-01-6 | 147.5 | 156.0 | 8.5 | Gabbro |

| MAN-87-1 | - | 9.7 | 9.7 | Gabbro |

| MAN-87-1 | 9.7 | 41.2 | 31.4 | Peridotite |

| MAN-87-2 | - | 11.6 | 11.6 | Gabbro |

| MAN-87-2 | 11.6 | 35.4 | 23.8 | Peridotite |

| MAN-88-1 | - | 61.6 | 61.7 | Peridotite |

| MAN-88-1 | 61.6 | 64.0 | 2.4 | Gabbro |

| MAN-88-2 | - | 61.0 | 61.0 | Peridotite |

| MAN-88-3 | - | 60.7 | 60.7 | Peridotite |

| MAN-91-1 | 1.8 | 79.6 | 77.7 | Gabbro |

| MAN-91-1 | 79.6 | 138.9 | 59.4 | Peridotite |

| MAN-91-1 | 138.9 | 155.5 | 16.6 | Gabbro |

| MAN-91-1 | 155.5 | 166.2 | 10.7 | Gabbro |

| MAN-91-1 | 166.2 | 181.9 | 15.7 | Pyroxenite |

| MAN-91-1 | 181.9 | 246.0 | 64.1 | Peridotite |

| MAN-96-1 | 1.5 | 42.1 | 40.5 | Gabbro |

| MAN-96-1 | 42.1 | 107.3 | 65.2 | Peridotite |

| MAN-96-1 | 107.3 | 115.2 | 7.9 | Pyroxenite |

| MAN-96-1 | 115.2 | 227.1 | 111.9 | Peridotite |

| MAN-96-1 | 227.1 | 248.7 | 21.6 | Pyroxenite |

| MAN-96-1 | 248.7 | 279.8 | 31.2 | Peridotite |

| MAN52-02 | 96.6 | 179.0 | 82.4 | Ultramafic |

| MAN07-01 | 6.4 | 37.8 | 31.4 | Peridotite |

| MAN07-01 | 37.8 | 47.7 | 9.9 | Gabbro |

| MAN07-01 | 47.7 | 53.5 | 5.8 | Pyroxenite |

| MAN07-01 | 53.5 | 76.7 | 23.2 | Gabbro |

| MAN07-01 | 76.7 | 102.0 | 25.3 | Peridotite |

| MAN07-02 | 14.2 | 30.0 | 15.8 | Pyroxenite |

| MAN07-02 | 30.0 | 110.0 | 80.1 | Gabbro |

| MAN07-02 | 110.0 | 129.0 | 19.0 | Peridotite |

| MAN07-03 | 40.5 | 41.9 | 1.4 | Gabbro |

| MAN07-03 | 41.9 | 61.7 | 19.8 | Peridotite |

| MAN07-03 | 61.7 | 82.0 | 20.3 | Pyroxenite |

| MAN07-03 | 82.0 | 107.3 | 25.3 | Peridotite |

| MAN07-04 | 9.0 | 21.5 | 12.5 | Peridotite |

| MAN07-04 | 21.5 | 22.3 | 0.8 | Pyroxenite |

| MAN07-04 | 22.3 | 76.8 | 54.5 | Gabbro |

Table 4b – Historical Drilling – Mann Northwest Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| MAN07-04 | 76.8 | 141.0 | 64.2 | Peridotite |

| MAN08-05 | 14.5 | 26.9 | 12.4 | Pyroxenite |

| MAN08-05 | 26.9 | 60.0 | 33.1 | Gabbro |

| MAN08-06 | 13.0 | 25.8 | 12.8 | Peridotite |

| MAN08-06 | 25.8 | 38.3 | 12.5 | Pyroxenite |

| MAN08-06 | 38.3 | 60.0 | 21.7 | Gabbro |

| MAN08-07 | 16.0 | 33.9 | 17.9 | Peridotite |

| MAN08-07 | 33.9 | 46.3 | 12.4 | Pyroxenite |

| MAN08-07 | 46.3 | 54.0 | 7.7 | Gabbro |

| MAN08-07 | 54.0 | 57.5 | 3.5 | Pyroxenite |

| MAN08-07 | 57.5 | 75.0 | 17.5 | Gabbro |

Figure 4 – Mann Northwest Property – Historical Drillholes Over TMI.

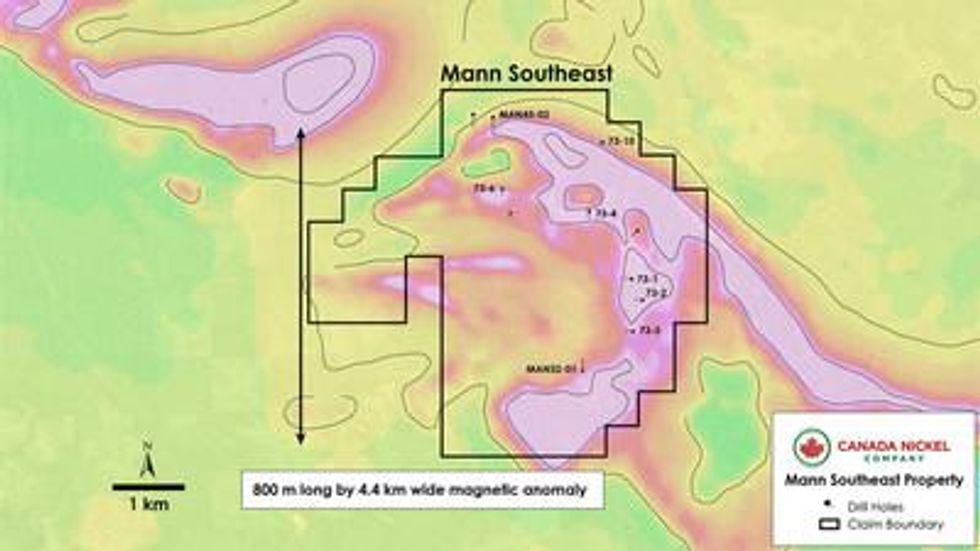

Mann Southeast

Mann Southeast is characterized by an arcuate-shaped ultramafic intrusion located in southeast Mann township with approximate dimensions of 6.2 km long and up to 800 metres wide (see Figure 5). Eight widely spaced holes drilled into the anomaly outlined 5 km of serpentinized dunite / peridotite across the anomaly (see Table 5c below).

In 1996, Falconbridge Ltd. drilled 111 metres of strongly serpentinized peridotite (MAN-35-01) with select assays grading: 0.31-0.33% nickel over 3 metre sampled intervals. See Table 5a.

A drill program conducted in 1973 around the southeast Mann ultramafic intersected wide intervals of serpentinized peridotite in five holes, with assays ranging up to 0.29% nickel (see Table 5b below). The southernmost and largest section of ultramafic – 1.2 km by 800 metres – remains untested with no historical drilling reported.

Table 5a – Historical Drilling – Mann Southeast Property – Significant Intersections

| Hole ID | From (m) | To (m) | Ni % |

| MAN-35-01 | 47.0 | 50.0 | 0.33 |

| MAN-35-01 | 71.0 | 74.0 | 0.32 |

| MAN-35-01 | 101.0 | 104.0 | 0.31 |

Table 5b – Historical Drilling – Mann Southeast Property – Significant Intersections

| Hole ID | From (m) | To (m) | Ni % |

| 73-1 | 41.1 | 42.7 | 0.25 |

| 73-1 | 73.2 | 74.8 | 0.23 |

| 73-1 | 86.7 | 88.4 | 0.22 |

| 73-1 | 103.6 | 105.2 | 0.24 |

| 73-1 | 120.4 | 121.9 | 0.23 |

| 73-1 | 137.2 | 138.7 | 0.22 |

| 73-1 | 153.9 | 155.4 | 0.25 |

| 73-3 | 41.1 | 42.7 | 0.25 |

| 73-3 | 56.4 | 57.9 | 0.28 |

| 73-3 | 73.2 | 74.7 | 0.18 |

| 73-3 | 88.4 | 89.9 | 0.16 |

| 73-3 | 103.6 | 105.2 | 0.20 |

| 73-3 | 120.4 | 121.9 | 0.25 |

| 73-3 | 136.2 | 137.8 | 0.29 |

| 73-3 | 150.9 | 152.1 | 0.29 |

| 73-4 | 69.2 | 70.7 | 0.28 |

| 73-4 | 86.0 | 87.5 | 0.23 |

| 73-4 | 103.6 | 105.2 | 0.23 |

| 73-4 | 120.4 | 121.9 | 0.23 |

| 73-4 | 137.5 | 139.0 | 0.29 |

| 73-6 | 61.6 | 63.1 | 0.27 |

| 73-6 | 76.2 | 77.7 | 0.23 |

| 73-6 | 94.5 | 96.0 | 0.23 |

| 73-6 | 99.1 | 100.6 | 0.22 |

| *Hole 73-2 had assays all below 0.15% | |||

Table 5c – Historical Drilling – Mann Southeast – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| 73-1 | 38.4 | 159.7 | 121.3 | Peridotite |

| 73-2 | 39.9 | 166.7 | 126.8 | Peridotite |

| 73-3 | 36.6 | 152.1 | 115.5 | Peridotite |

| 73-4 | 55.2 | 64.9 | 9.8 | Peridotite |

| 73-4 | 64.9 | 144.5 | 79.6 | Peridotite |

| 73-6 | 12.8 | 48.5 | 35.7 | Peridotite |

| 73-6 | 48.5 | 112.5 | 64.0 | Peridotite |

| MAN-35-01 | 38.0 | 149.0 | 111.0 | Dunite |

| MAN-45-01 | 99.0 | 155.0 | 56.0 | Peridotite |

| MAN-45-01 | 195.0 | 245.0 | 50.0 | Peridotite |

| MAN-45-02 | 95.0 | 211.0 | 116.0 | Peridotite |

Figure 5 – Mann Southeast Property – Historical Drillholes Over TMI.

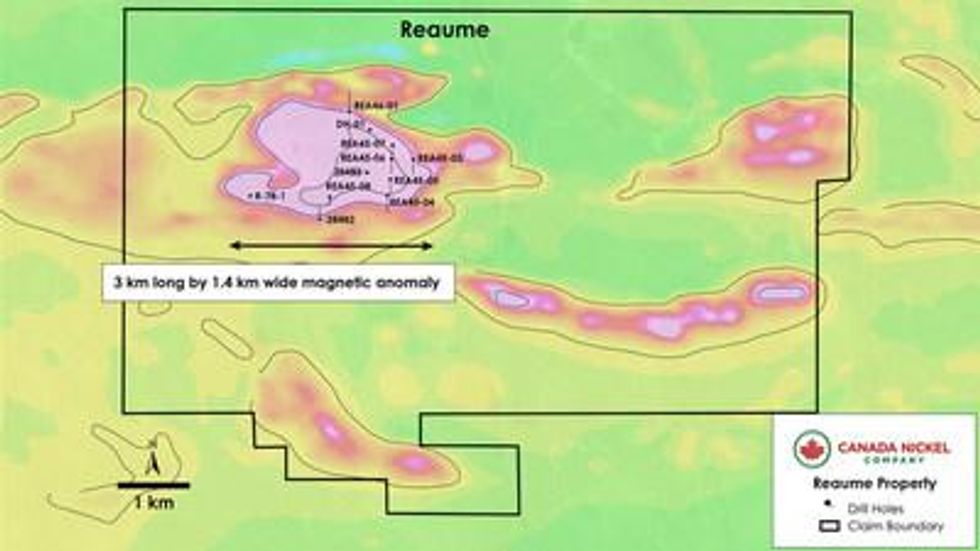

Reaume

Reaume is a property approximately 5,800 ha located 54 km north-northeast of Timmins and contains a large ultramafic intrusion having an approximate outline of 3 km (east-west) by 1.8 km (north-south) as defined by its magnetic footprint and historical drilling (see Figure 6). Inco holes 28482 and 28483 returned peridotite/dunite mineralization across the entire core length. Hole 28483 intersected from surface approximately 264 metres of serpentinized peridotite/dunite containing magnetite with some disseminated sulphides. Hole 28482 intersected 108 metres of serpentinized peridotite/dunite with up to 20% magnetite and disseminated sulphides. Both drillholes ended in peridotite/dunite.

Seven drillholes by Falconbridge (1995) intersected thick sections of peridotite and dunite (up to 168 metres of dunite in Hole REA-45-07). These historic holes delineated a peridotite/dunite unit with an east-west extent of approximately 1,200 metres and a north-south extent of 900 metres.

Four of the Falconbridge holes ended in peridotite/dunite. Six of seven holes reported the widespread presence of magnetite as well as disseminated sulphides. No assays were reported; however, the TMI exceeds the peak levels at Crawford Main Zone near the centre of the intrusion and is strongly anomalous across the ultramafic.

Figure 6 – Reaume Property – Historical Drillholes Over TMI.

Table 6 – Historical Drilling – Reaume Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| 28483 | 37.0 | 89.0 | 52.0 | Peridotite |

| 28483 | 89.0 | 147.0 | 58.0 | Peridotite |

| 28483 | 147.0 | 301.0 | 154.0 | Peridotite/Dunite |

| 28482 | 140.0 | 158.0 | 18.0 | Peridotite/Dunite |

| 28482 | 158.0 | 248.0 | 90.0 | Peridotite |

| REA-45-03 | 21.0 | 89.0 | 68.0 | Peridotite |

| REA-45-03 | 89.0 | 117.0 | 28.0 | Pyroxenite |

| REA-45-03 | 117.0 | 164.0 | 47.0 | Peridotite |

| REA-45-03 | 164.0 | 198.0 | 34.0 | Pyroxenite |

| REA-45-03 | 198.0 | 278.0 | 80.0 | Peridotite |

| REA-45-03 | 294.0 | 335.0 | 41.0 | Pyroxenite |

| REA-45-04 | 29.0 | 99.0 | 70.0 | Dunite |

Table 6 – Historical Drilling – Reaume Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| REA-45-04 | 101.1 | 156.5 | 55.4 | Dunite |

| REA-45-04 | 160.3 | 198.5 | 38.3 | Peridotite |

| REA-45-04 | 198.5 | 344.9 | 146.4 | Dunite |

| REA-45-05 | 30.0 | 123.8 | 93.8 | Dunite |

| REA-45-05 | 123.8 | 223.1 | 99.3 | Peridotite |

| REA-45-05 | 238.6 | 244.4 | 5.8 | Pyroxenite |

| REA-45-05 | 244.4 | 293.0 | 48.6 | Peridotite |

| REA-45-05 | 293.0 | 300.6 | 7.6 | Dunite |

| REA-45-05 | 300.6 | 308.0 | 7.4 | Peridotite |

| REA-45-06 | 21.7 | 320.0 | 298.3 | Peridotite |

| REA-45-07 | 45.2 | 131.1 | 85.9 | Peridotite |

| REA-45-07 | 131.1 | 299.0 | 167.9 | Dunite |

| REA-45-08 | 33.0 | 54.5 | 21.5 | Dunite |

| REA-45-08 | 54.5 | 64.4 | 9.9 | Pyroxenite |

| REA-46-01 | 15.0 | 28.4 | 13.4 | Dunite |

| REA-46-01 | 28.4 | 136.8 | 108.4 | Dunite |

| REA-46-01 | 136.8 | 259.5 | 122.7 | Peridotite |

| REA-46-01 | 259.5 | 310.0 | 50.5 | Pyroxenite |

| REA-46-01 | 310.0 | 337.9 | 27.9 | Peridotite |

| REA-46-01 | 350.3 | 388.5 | 38.2 | Pyroxenite |

| REA-46-01 | 388.5 | 419.4 | 30.9 | Peridotite |

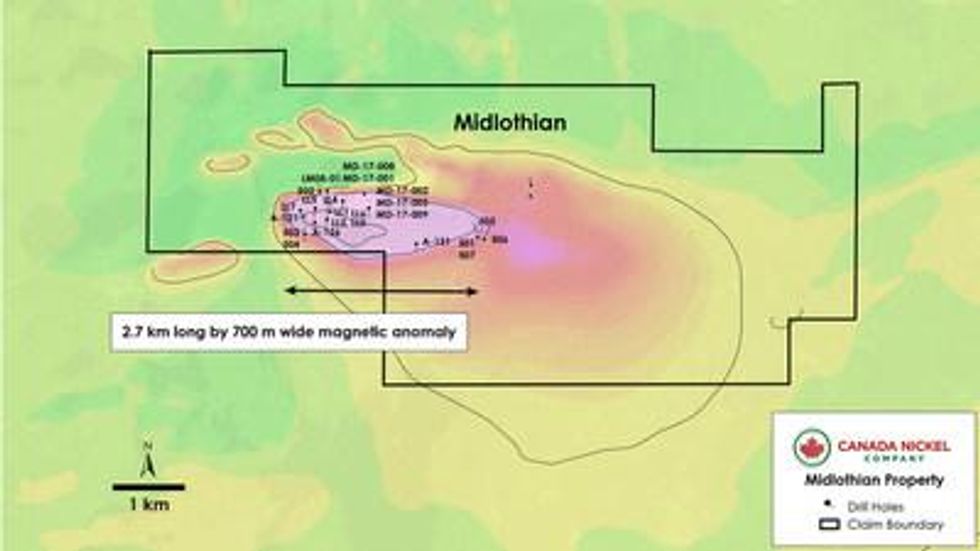

Midlothian

Midlothian covers an area of 3,257 ha and is located 70 km south-southeast of Timmins . The ultramafic body is defined by a magnetic anomaly 2.7 km long and up to 700 metres wide (see Figure 7 below).

A total of 30 holes were drilled over the last 50 years by various operators with 23 holes intersecting serpentinized peridotite/dunite and 17 ending while still in the ultramafics. Six drillholes, each intersected over 100 metres of continuous, uninterrupted dunite/ultramafic, with LM08-01 intersecting 263.8 metres to the end of hole. (See Table 7a).

Seven holes had nickel assays, with the best interval in hole LM08-01 which yielded 0.24% nickel across core length of 345 metres with the final 42 metres grading 0.30% nickel (See Table 7b ). Nickel sampling was not continuous down most drillholes.

The above drillholes outline serpentinized dunite/peridotite over a strike distance of 3.1 km long by 670 metres wide.

Figure 7 – Midlothian Property – Historical drillholes over TMI.

Table 7a – Historical Drilling – Midlothian Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| LM08-01 | 51.6 | 60.2 | 8.6 | Peridotite/dunite |

| LM08-01 | 60.2 | 135.8 | 75.7 | Serpentinite |

| LM08-01 | 136.4 | 400.2 | 263.8 | Peridotite/dunite |

| LL1 | 7.0 | 165.8 | 158.8 | Dunite |

| LL2 | 8.8 | 163.1 | 154.3 | Dunite |

| LL3 | 9.8 | 160.0 | 150.3 | Dunite |

| A-121 | 2.7 | 48.8 | 46.0 | Dunite |

| A-126 | 7.6 | 37.2 | 29.6 | Dunite |

| A-126 | 41.8 | 92.0 | 50.3 | Dunite |

| A-126 | 92.7 | 152.7 | 60.1 | Dunite |

| 501 | 133.2 | 196.3 | 63.1 | Dunite |

| 506 | 206.0 | 301.8 | 95.7 | Dunite |

| 507 | 106.1 | 280.7 | 174.7 | Dunite |

| A-131 | 0.9 | 13.1 | 12.2 | Dunite |

| A-131 | 36.6 | 39.9 | 3.4 | Dunite |

| A-131 | 102.7 | 106.7 | 4.0 | Dunite |

| A-131 | 110.9 | 113.1 | 2.1 | Dunite |

| 503 | 3.7 | 20.4 | 16.8 | Dunite |

| 504 | 6.7 | 114.0 | 107.3 | Dunite |

Table 7a – Historical Drilling – Midlothian Property – Selected Lithologies (continued)

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| MD-17-001 | 20.5 | 20.5 | 0.0 | Serpentinite |

| MD-17-001 | 20.5 | 26.1 | 5.6 | Serpentinite |

| MD-17-001 | 26.1 | 29.0 | 2.9 | Dunite |

| MD-17-002 | 20.0 | 29.0 | 9.0 | Serpentinite |

| MD-17-003 | 0.0 | 31.1 | 31.1 | Serpentinite |

| MD-17-003 | 0.0 | 35.0 | 35.0 | Dunite |

| MD-17-004 | 18.4 | 19.9 | 1.5 | Dunite |

| MD-17-005 | 41.0 | 53.0 | 12.0 | Dunite |

| MD-17-006 | 32.0 | 38.0 | 6.0 | Dunite |

| MD-17-007 | 28.8 | 35.0 | 6.2 | Serpentinite |

| MD-17-007 | 35.0 | 67.0 | 32.0 | Dunite |

| MD-17-008 | 29.3 | 38.0 | 8.8 | Serpentinite |

| 514 | 45.9 | 52.1 | 6.2 | Dunite |

| 514 | 52.1 | 70.7 | 18.6 | Dunite |

| 514 | 70.7 | 92.7 | 21.9 | Dunite |

| 514 | 92.7 | 107.3 | 14.6 | Dunite |

| 514 | 117.7 | 149.4 | 31.7 | Dunite |

| 515 | 32.6 | 33.8 | 1.2 | Dunite |

| 515 | 33.8 | 78.3 | 44.5 | Peridotite/dunite |

| 515 | 78.3 | 86.3 | 7.9 | Dunite |

| 515 | 86.3 | 125.6 | 39.3 | Peridotite/dunite |

| 515 | 125.6 | 143.3 | 17.7 | Dunite |

| 516 | 48.5 | 84.7 | 36.3 | Peridotite/dunite |

| 516 | 92.0 | 105.2 | 13.1 | Dunite |

| 516 | 107.9 | 119.8 | 11.9 | Peridotite/dunite |

| 516 | 119.8 | 137.2 | 17.4 | Dunite |

Table 7b – Historical Drilling – Midlothian Property – Significant Intersections

| Hole ID | From (m) | To (m) | Length (m) | Ni % |

| LM08-01 | 52.0 | 397.0 | 345.0 | 0.24 |

| including | 352.0 | 397.0 | 45.0 | 0.30 |

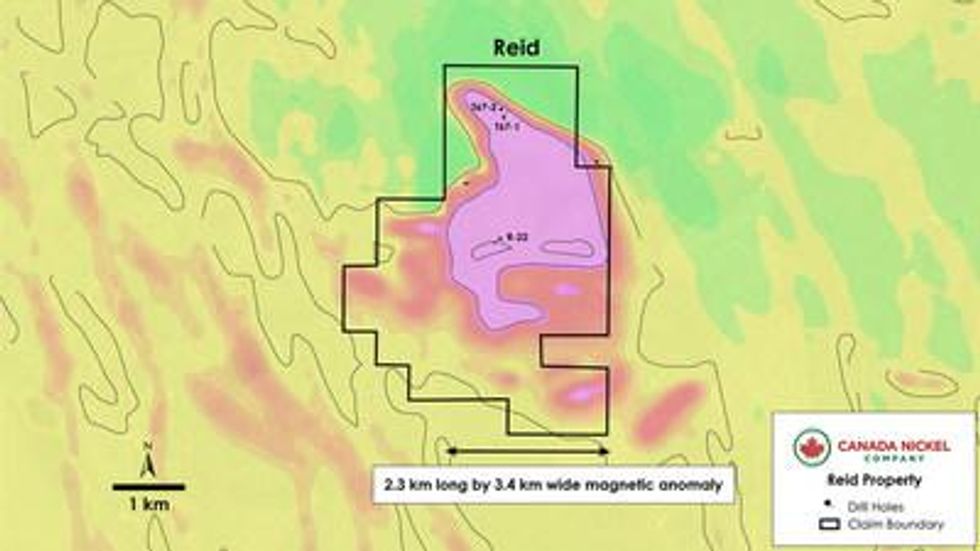

Reid

The Reid Property is located 16 km southwest of Crawford and covers an area of 3,800 ha. The property contains a series of folded ultramafic bodies that measure 3.3 km north-south by 2.1 km east-west based on the TMI. See Figure 8.

Only four holes were ever drilled inside or near the edge of the ultramafic (from 1966 to 1972) by three different companies. All four holes collared and ended in ultramafic rocks with the holes ending at depths of 59.7-171.0 metres with intervals of ultramafics ranging from 44.5-123.7 metres. While none of the holes were assayed, all four holes intersected peridotite with up to 5-10% disseminated magnetite noted in each hole (see Table 8 below).

Table 8 – Historical Drilling – Reid Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Rock Type |

| R-22 | 29.0 | 106.7 | Serpentinized gabbro to peridotite |

| R-22 | 125.0 | 171.0 | Serpentinized peridotite |

| R-18 | 54.6 | 96.9 | Peridotite |

| T67-1 | 20.7 | 128.3 | Serpentinized peridotite |

| T67-2 | 15.2 | 59.7 | Serpentinized peridotite |

Figure 8 – Reid Property – Historical Drillholes Over TMI.

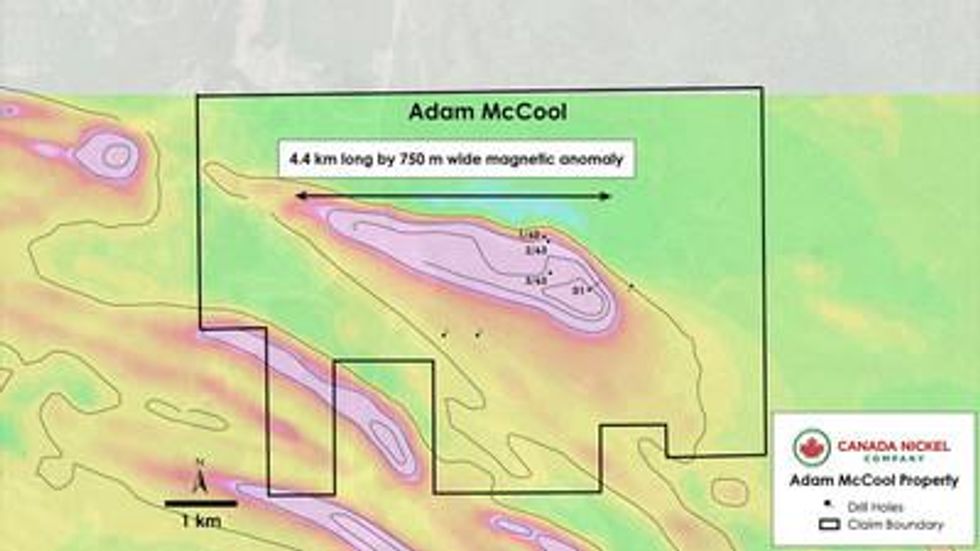

Adam McCool

Adam McCool was staked directly by Canada Nickel and covers 2,832 ha. The property is located 92 km east of Timmins . The main intrusion was identified by its anomalous TMI and is estimated to have dimensions 4.6 km long by up to 800 metres wide (see Figure 9).

Mid-North Engineering Ltd. drilled three holes in McCool Township in 1963, intersecting serpentinized dunite in all three holes at shallow depths (to 495 ft or 151 m ). See Table 9. No assays were provided.

Table 9 – Historical Drilling – Adam McCool Property – Selected Lithologies

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| 1-63 | 33.5 | 121.9 | 88.1 | Serpentinized Dunite |

| 1-62 | 38.1 | 150.9 | 112.8 | Serpentinized Dunite |

| 1-63 | 3.0 | 33.8 | 30.8 | Serpentinized Dunite |

| 1586-1 | 48.6 | 139.7 | 91.1 | Peridotite |

| 1586-1 | 139.7 | 153.3 | 13.6 | Gabbro |

| D-1 | 29.3 | 279.5 | 250.2 | Serpentinite |

Figure 9 – Adam McCool Property – Historical Drillholes Over TMI.

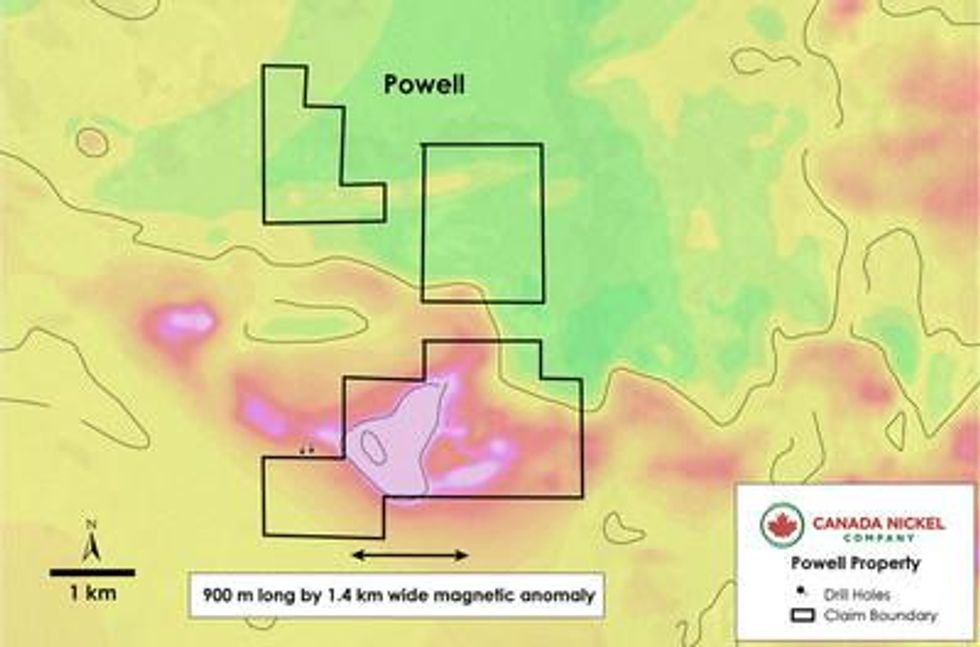

Powell

The Powell Property is located 74 km southeast of Timmins and consists of several single cell mining claims totaling approximately 1,000 ha. The mining claims cover an ultramafic intrusion having dimensions of 1.4 km by 1.0 km showing a highly anomalous TMI. Two shallow holes drilled off the southeast edge of the anomaly were described as containing a pervasive mafic metavolcanic unit with high concentrations of magnetite and intervals of fracture-filling sulphide, which is more typical of serpentinized ultramafics. See Figure 10.

Figure 10 – Powell Property – Historical Drillholes Over TMI.

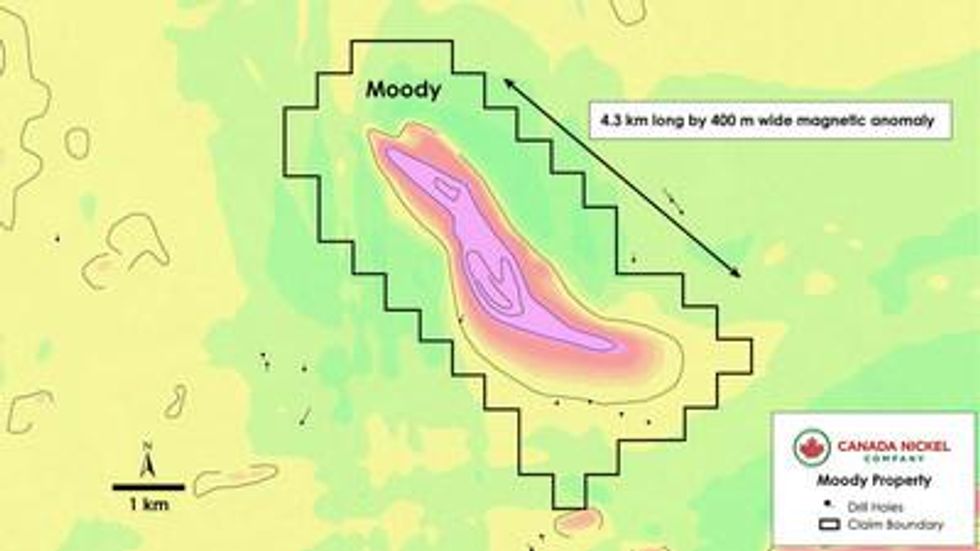

Moody

The Moody Property covers an area of 1,940 ha and was staked by Canada Nickel. The claims are located 72 km east of the Crawford Project and within 3 km from an all-weather mining road. Mistango River Mines Limited drilled a total of 34 diamond drillholes in the search for ultramafics. While the drilling results were reported by Utah Mines Ltd. in 1964, the location of the drillholes and drill results have not been provided on the Mining Lands Administration System ("MLAS"). The ultramafic is interpreted to have dimensions of 4.2 km long by up to 700 metres wide.

The Utah Mines Ltd. program consisted of reverse circulation drilling of several holes in 1984 (only seven were reported to MLAS) and core was not recovered. At the overburden-bedrock interface the rock was often described as being dark green and mafic.

Figure 11 – Moody Property – Historical Drillholes Over TMI.

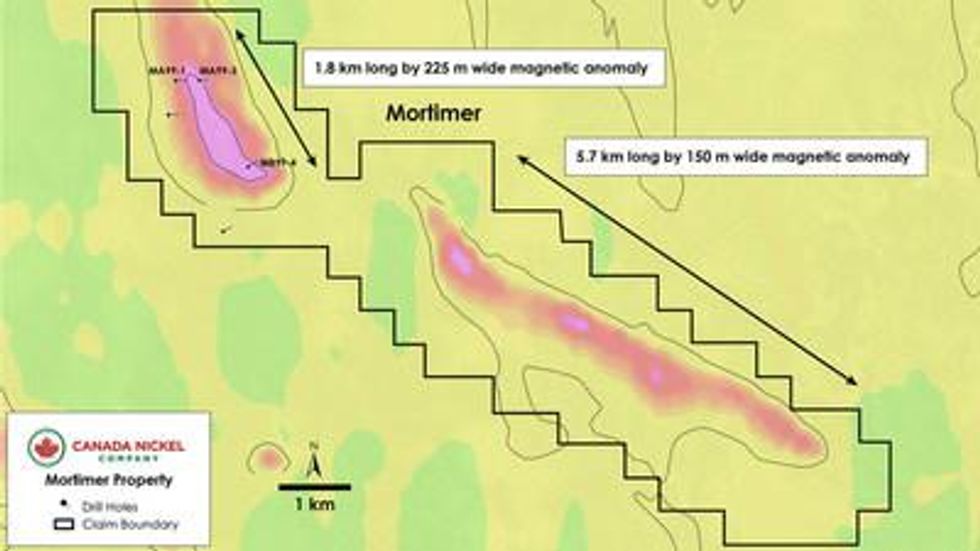

Mortimer

The Mortimer Property includes two ultramafic intrusions that cover a total distance of 10 km, in an area staked by Canada Nickel totaling 2,732 ha. The main intrusion has dimensions of 1.8 km long, up to 400 metres wide and has never been intersected by drilling. The secondary intrusion, although longer in strike extent, does not show the same high intensity in the TMI but does have three locally high responses within the intrusion, none of which appears to have been drilled. The property is easily accessed by an all-weather logging road. See Figure 12.

Figure 12 – Mortimer Property – Historical Drillholes Over TMI.

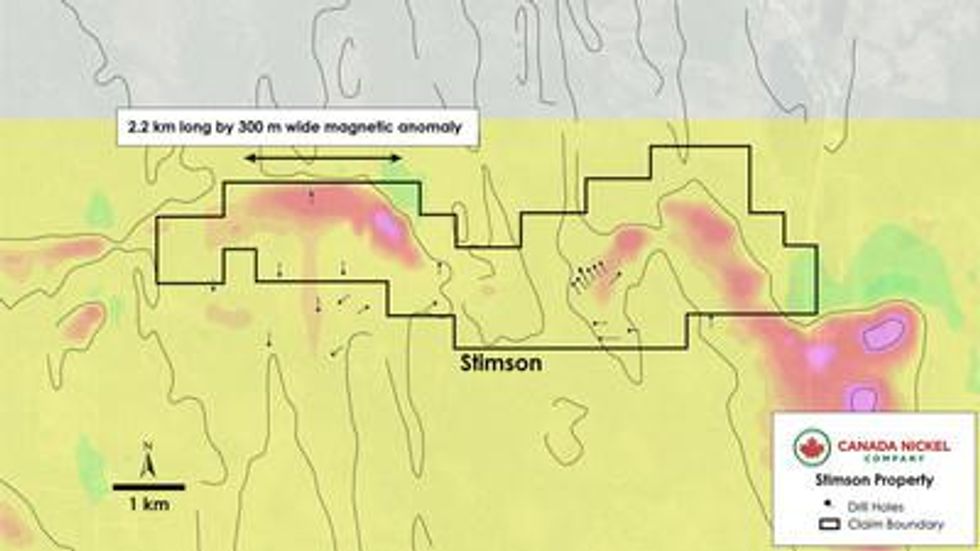

Stimson

The Stimson Property covers 1,491 ha and encompasses a weakly magnetic ultramafic having a strike length of at least 2 km and with a higher amplitude TMI of 400 metres long. The ultramafic is interpreted to be a more distal extension of more strongly magnetic ultramafics found in Mortimer and Moody Townships, staked by Canada Nickel at the same time. See Figure 13.

Figure 13 – Stimson Property – Historical Drillholes Over TMI.

Purchase and Option Agreements

The Company has negotiated 18 agreements to acquire the properties described in the release. On signing, the Company will pay a combined $371,500 in cash and 2,044,000 shares. $25,000 of this cash has already been paid and 125,000 shares have already been issued.

Table 10 – Consolidated Summary of Cash & Share Consideration: 18 transactions

| | Cash | Shares |

| On Signing | $371,500 | 2,044,000 |

| Year 1 | $350,000 | 926,000 |

| Year 2 | $200,000 | 35,000 |

| Year 3 | $600,000 | 425,000 |

| Year 4 | $500,000 | 140,000 |

| Total | $2,021,500 | 3,570,000 |

Sothman

Canada Nickel has entered into an agreement with Glencore Canada Corporation (Glencore) to acquire 50 mining leases that are in Sothman, Kemp and Mond Townships, 45 of which have associated Mining and Surface rights and five of which have Mining Rights only. Glencore will also hold a contingent right to receive a bonus payment in the amount of $10,000,000 (paid in cash or shares, at the Company's election) in the event the Company discloses a mineral resource pursuant to National Instrument 43-101 of 10,000 tonnes or more of nickel or nickel equivalent. Glencore will also retain offtake rights to purchase the ore, concentrate or other mineral products produced from the property at market pricing. Canada Nickel staked an additional nine mining claims adjacent to the mining leases.

Deloro

The Deloro Project consists of mining claims and patents acquired from two vendors in separate Purchase Agreements. In the first Purchase Agreement a 100% ownership was acquired to 35 mining claims and 30 mining patents. The mining claims are subject to a 2.00% NSR while the patents are subject to various NSRs, ranging from 2.00-5.50%. In the second Purchase Agreement, Canada Nickel acquired a 100% ownership in four contiguous mining patents. The vendor will retain a 3.00% NSR on any gold resource outlined.

Mann

The Mann Property was acquired from Noble Mineral Exploration ("Noble") in an Option Agreement with work commitments, cash payments, share issuances, NSRs, and buy-back provisions. The Company has acquired the right to earn an 80% interest in the Mann Property from Noble. Work commitments are $1.7 million over the Option Term with an initial $500,000 required in the first year. Noble will retain a 2.00% NSR (due to various vendors) with a 1.00% buy-back provision to Canada Nickel for $1.0 million plus 50% of the buy-back provisions that total $4.5 million ( $2.25 million to CNC). Once Canada Nickel earns its 80% interest it will form a joint-venture with Noble to continue exploring the Property on an 80%-20% basis. An acceleration provision exists to allow the Company to reach its 80% interest earlier than the Option Period.

Reaume

The Reaume Property was acquired through a combination of Purchase and Option Agreements. In one Purchase Agreement Canada Nickel acquired a 100% right to 65 contiguous mining claims with a 2.00% NSR to the vendor and a 1.00% buy-back provision. In a second Option Agreement Canada Nickel has the option to earn a 100% interest in 48 mining claims through work expenditures (2,100 metres of diamond drilling) over a 12-month period. In a third Purchase Agreement Canada Nickel acquired a 100% interest in a group of 201 in-fill claims (surrounding the ultramafic units) with the vendor retaining a 2.00% NSR with a buy-back of 1.00%. In a fourth Purchase Agreement Canada Nickel acquired a small group of claims which have a 2.00% NSR with a 1.00% buy-back.

Midlothian

The Midlothian Property was acquired under an Option Agreement with Canadian Gold Miner Corp. (70% interest) and Laurion Mineral Exploration Inc. (30% interest), collectively the vendors. Under the terms of the agreement, Canada Nickel can earn a 100% interest in the property through cash and share payments and a commitment to $500,000 of exploration expenditures within the first twelve months of the agreement. On or before the fourth anniversary, Canada Nickel will complete an exploration program having a cumulative value of $2.5 million (including the first-year expenditures of $0.5 million ). Cash and share payments in the first year are $50,000 and 100,000 respectively. In subsequent years payments are $100,000 and 35,000 (18 months), $200,000 and 70,000 (27 months), $300,000 and 105,000 (year 3) and $400,000 and 140,000 (year 4) for total cash payments of $1,050,000 and share issuances of 450,000. The vendors will retain an NSR of 4.00% for gold and 2.00% for nickel with a commercial production payment of $4.0 million . Canada Nickel will retain a 1.00% NSR buy-back right for aggregate payments of $2.5 million . The Option Agreement includes clauses for acceleration of the exploration program and payment in lieu of exploration expenditures.

Reid

The Reid Property was acquired through Purchase Agreements with several different vendors. The Company has committed to conduct a 2,500 m drill program and fly an airborne survey over the Property. The vendor retains a 2.00% NSR on the claims with certain buy-down provisions. In a second Purchase Agreement 14 single cell mining claims were acquired with a 2.00% NSR to the vendor and a 1.00% buy-back. In a third agreement Canada Nickel acquired a 100% interest in 18 mining claims with a 2.00% NSR to the vendor and a 1.00% NSR buy-back.

Adam McCool

The Adam McCool Property was staked directly by Canada Nickel as 72 contiguous mining claims (1,152 ha) with additional claims purchased from local prospectors for a total land package of 2,832 ha consisting entirely of mining claims owned 100% by Canada Nickel. Mining claims purchased by Canada Nickel are subject to a 2.00% NSR, 1.00% of which can be bought-back for $1 million . The claims with an NSR represent about 60% of the property.

Powell

The Powell Property was acquired through a Purchase Agreement with a single vendor. The vendor retains a 2.00% NSR with a 1.00% buy-back for $1 million .

Stimson-Mortimer-Moody

The Stimson, Mortimer and Moody Properties were staked directly by Canada Nickel as single cell mining claims and are not subject to an NSR. The total cost for staking was $10,750 . There are 215 mining claims totaling 3,440 ha. Each mining claim is 16 ha. Claims are valid for two years and require an exploration expenditure of $400 /claim thereafter to be renewed annually.

Additional Land Acquisition - Kingsmill and Mabee Townships

The Company has agreed to acquire the remaining patents in Kingsmill and Mabee township covering approximately 15,000 hectares from Noble Mineral Exploration in exchange for 500,000 shares of the Company.

Statement Regarding TSX Venture

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The completion of any transactions mentioned in this release is subject to customary closing conditions, including final TSX Venture Exchange approval. The common shares issued pursuant to the above noted acquisitions will be subject to a four month hold period under applicable Canadian securities laws. Some transactions may have been approved prior to this release.

Statement Regarding Historical Resource Estimates

The Sothman historical resource estimate is unclassified and does not comply with CIM Definition Standards on Mineral Resources and Mineral Reserves as required by NI 43-101. The historical resource was reported by D. R. Bell for Sothman Mines Limited on Oct. 1, 1969 , as 189,753 tons of 1.24% nickel and 0.15% Cu over an average width of 17.8 ft (undiluted) using a 1.00% nickel cut-off. The reliability of the historical resource is considered reasonable, but a qualified person has not done sufficient work to classify the historical resource estimate as a current mineral resource and the Company is not treating the historical resource estimate as a current resource. The Company plans on conducting an exploration program, including twinning of historical drill holes, to redefine the historical resource as a current mineral resource category.

Qualified Person and Data Verification

Stephen J. Balch P.Geo . (ON), VP Exploration of Canada Nickel and a "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

Conference Call Details

Date: Monday, November 22, 2021

Time: 10:00 a.m. ET

Participants may join the call as follows:

Dialing local Toronto : +1-416-764-8688

Dialing North American Toll Free: +1-888-390-0546

Dialing International Toll Free: available upon request

Webcast URL:

https://produceredition.webcasts.com/starthere.jsp?ei=1514838&tp_key=41b4857d60

Confirmation #: 94728691

For those unable to participate, a web-based archive of the conference call will be available for playback at the same Audience URL used to access the live webcast. Also, an audio replay will be available from 12:30 p.m. Eastern Time on Monday , November 22, 2021, through Monday, December 13, 2021 . To access the replay, please call 1-888-390-0541 (North American toll free) or 1-416-764-8677 (local or international) and enter confirmation code 728691#.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero Nickel TM , NetZero Cobalt TM , NetZero Iron TM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins - Cochrane mining camp. For more information, please visit www.canadanickel.com.

For further information, please contact:

Mark Selby

Chair and CEO

Phone: 647-256-1954

Email: info@canadanickel.com

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, drill and exploration results relating to the target properties described herein (the "Properties"), the potential of the Crawford Nickel Sulphide Project and the Properties, timing of economic studies and mineral resource estimates, the ability to sell marketable materials, strategic plans, including future exploration and development results, and corporate and technical objectives. Forward-looking information is necessarily based upon several assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Factors that could affect the outcome include, among others: future prices and the supply of metals, the future demand for metals, the results of drilling, inability to raise the money necessary to incur the expenditures required to retain and advance the property, environmental liabilities (known and unknown), general business, economic, competitive, political and social uncertainties, results of exploration programs, risks of the mining industry, delays in obtaining governmental approvals, failure to obtain regulatory or shareholder approvals, and the impact of COVID-19 related disruptions in relation to the Company's business operations including upon its employees, suppliers, facilities and other stakeholders. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Canada Nickel disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, except as required by law.

Appendix

Table A – Collars

| Hole ID | Property | Northing | Easting | Azimuth | Dip | Length |

| | | (mN-NAD27) | (mE-NAD27) | (o) | (o) | (m) |

| SM56-K11 | Sothman West | 5,299,305.0 | 481,535.0 | 180 | -60 | 148.4 |

| SM67-B06 | Sothman West | 5,299,281.8 | 481,575.8 | 180 | -45 | 101.8 |

| DG50-S04 | Sothman West | 5,299,235.0 | 481,714.0 | 131 | -45 | 107.9 |

| DG51-S20 | Sothman West | 5,299,112.9 | 481,750.5 | 0 | -48 | 111.0 |

| DG50-S05 | Sothman West | 5,299,224.0 | 481,767.0 | 180 | -45 | 82.0 |

| SM71-01 | Sothman West | 5,299,404.0 | 481,638.0 | 180 | -68 | 426.7 |

| SM71-02 | Sothman West | 5,299,385.0 | 481,487.0 | 180 | -63 | 366.7 |

| SM67-B25 | Sothman | 5,299,144.5 | 482,936.8 | 207 | -45 | 91.2 |

| SM67-B26 | Sothman | 5,299,069.3 | 482,692.9 | 207 | -45 | 120.1 |

| SM67-B27 | Sothman | 5,299,007.8 | 482,659.2 | 200 | -45 | 121.6 |

| SM67-B28 | Sothman | 5,298,937.8 | 482,650.8 | 191 | -45 | 107.9 |

| DG51-S12 | Sothman | 5,298,954.6 | 482,617.8 | 180 | -45 | 148.4 |

| DG51-S09 | Sothman | 5,299,124.3 | 482,107.5 | 206 | -44 | 229.8 |

| DG53-S41A | Sothman | 5,298,932.2 | 483,982.2 | 175 | -55 | 83.8 |

| FY-02-01 | Deloro | 5,361,223.0 | 480,883.0 | 270 | -45 | 102.0 |

| FY-02-02 | Deloro | 5,361,232.0 | 480,387.0 | 223 | -40 | 472.0 |

| FY-02-03 | Deloro | 5,360,750.0 | 481,376.0 | 180 | -45 | 100.0 |

| FY-02-04 | Deloro | 5,360,987.0 | 481,945.0 | 345 | -45 | 147.0 |

| FY-02-05 | Deloro | 5,361,019.0 | 482,117.0 | 343 | -50 | 172.0 |

| FY-02-06 | Deloro | 5,361,309.0 | 480,561.0 | 100 | -45 | 301.0 |

| FY-02-07 | Deloro | 5,361,678.0 | 481,022.0 | 70 | -45 | 77.0 |

| FY-02-08 | Deloro | 5,361,629.0 | 481,012.0 | 75 | -45 | 77.0 |

| FY-02-09 | Deloro | 5,361,564.0 | 480,990.0 | 82 | -45 | 125.0 |

| FY-02-10 | Deloro | 5,361,124.0 | 480,240.0 | 37 | -45 | 135.0 |

| FY-02-11 | Deloro | 5,361,216.0 | 480,192.0 | 22 | -45 | 115.0 |

| FY-02-12 | Deloro | 5,361,085.0 | 480,267.0 | 55 | -45 | 272.0 |

| FY-02-13 | Deloro | 5,361,161.0 | 480,224.0 | 60 | -60 | 318.0 |

| 1A | Mann Central | 5,410,706.6 | 498,457.0 | 180 | -60 | 57.9 |

| 2A | Mann Central | 5,410,850.6 | 498,694.2 | 180 | -50 | 128.7 |

| 3A | Mann Central | 5,410,906.2 | 498,782.2 | 180 | -45 | 80.6 |

| 4A | Mann Central | 5,410,641.2 | 498,291.4 | 180 | -70 | 37.5 |

| INCO-1 | Mann Central | 5,409,763.7 | 497,819.1 | 180 | -45 | 162.5 |

| M-1 | Mann Central | 5,410,084.4 | 497,893.6 | 360 | -45 | 213.7 |

| M-2 | Mann Central | 5,410,312.5 | 496,873.2 | 180 | -45 | 214.9 |

| M-3 | Mann Central | 5,410,447.3 | 496,891.5 | 180 | -45 | 172.9 |

| M-4 | Mann Central | 5,410,662.2 | 496,900.1 | 180 | -45 | 213.1 |

Table A – Collars (continued)

| Hole ID | Property | Northing | Easting | Azimuth | Dip | Length |

| M-5 | Mann Central | 5,410,675.8 | 496,672.5 | 180 | -45 | 172.6 |

| M-6 | Mann Central | 5,410,454.5 | 496,683.0 | 180 | -45 | 128.1 |

| M-7 | Mann Central | 5,410,788.5 | 495,884.3 | 180 | -45 | 172.9 |

| M-8 | Mann Central | 5,410,852.2 | 495,864.3 | 360 | -45 | 172.0 |

| MA4-1-76 | Mann Central | 5,410,846.5 | 499,368.3 | 180 | -50 | 134.2 |

| MA4-2-76 | Mann Central | 5,410,725.8 | 499,366.5 | 180 | -50 | 123.2 |

| MA5-1-76 | Mann Central | 5,410,722.7 | 498,551.2 | 180 | -50 | 138.1 |

| MA5-2-76 | Mann Central | 5,410,108.0 | 498,351.5 | 180 | -50 | 123.2 |

| MAN43-01 | Mann Central | 5,410,157.8 | 498,349.5 | 360 | -45 | 188.0 |

| MAN43-02 | Mann Central | 5,410,255.4 | 499,225.2 | 180 | -45 | 113.0 |

| MAN43-03 | Mann Central | 5,410,152.9 | 498,539.9 | 180 | -45 | 158.0 |

| MN87-3 | Mann Central | 5,410,577.1 | 498,394.2 | 360 | -50 | 151.2 |

| 87-01 | Mann NW | 5,412,224.9 | 494,853.7 | 270 | -65 | 41.2 |

| 87-02 | Mann NW | 5,412,225.6 | 494,853.7 | 270 | -80 | 35.4 |

| 79-01 | Mann NW | 5,413,332.9 | 495,724.4 | 190 | -55 | 133.5 |

| 91-01 | Mann NW | 5,411,924.9 | 494,887.1 | 120 | -48 | 246.0 |

| FHR01-02 | Mann NW | 5,412,461.5 | 495,870.1 | 215 | -45 | 137.0 |

| FHR02-02 | Mann NW | 5,412,192.5 | 495,873.8 | 215 | -45 | 161.0 |

| FHR03-02 | Mann NW | 5,413,542.5 | 496,596.6 | 215 | -45 | 170.0 |

| H-88-1 | Mann NW | 5,412,164.8 | 494,936.1 | 225 | -50 | 64.0 |

| H-88-2 | Mann NW | 5,412,162.3 | 494,936.1 | 225 | -65 | 61.0 |

| H-88-3 | Mann NW | 5,412,162.6 | 494,937.2 | 225 | -40 | 60.7 |

| M-01-1 | Mann NW | 5,412,280.0 | 494,630.5 | 70 | -45 | 192.0 |

| M-01-2 | Mann NW | 5,411,887.5 | 494,880.9 | 55 | -45 | 251.0 |

| M-01-3 | Mann NW | 5,412,117.0 | 494,683.2 | 280 | -45 | 150.0 |

| M-01-4 | Mann NW | 5,412,080.0 | 494,686.2 | 45 | -45 | 102.0 |

| M-01-5 | Mann NW | 5,412,164.0 | 494,771.6 | 240 | -45 | 150.0 |

| M-01-6 | Mann NW | 5,412,156.9 | 494,787.6 | 240 | -70 | 150.0 |

| M96-1 | Mann NW | 5,411,921.3 | 494,847.2 | 172 | -65 | 245.0 |

| MAN-01 | Mann NW | 5,412,235.0 | 495,567.8 | 215 | -45 | 200.3 |

| MAN07-01 | Mann NW | 5,412,468.0 | 494,789.0 | 280 | -50 | 102.0 |

| MAN07-02 | Mann NW | 5,412,251.0 | 494,872.0 | 240 | -48 | 126.0 |

| MAN07-03 | Mann NW | 5,412,319.1 | 494,754.0 | 270 | -48 | 108.0 |

| MAN07-04 | Mann NW | 5,412,369.0 | 494,848.0 | 240 | -46 | 141.0 |

| MAN08-05 | Mann NW | 5,412,251.0 | 494,872.0 | 240 | -48 | 60.0 |

| MAN08-06 | Mann NW | 5,412,251.0 | 494,872.0 | 0 | -90 | 60.0 |

| MAN08-07 | Mann NW | 5,412,251.0 | 494,872.0 | 300 | -48 | 75.0 |

| MAN52-02 | Mann NW | 5,412,507.4 | 496,491.1 | 180 | -45 | 179.0 |

| MAN-73-6 | Mann NW | 5,412,367.0 | 495,208.9 | 180 | -50 | 167.6 |

Table A – Collars (continued)

| Hole ID | Property | Northing | Easting | Azimuth | Dip | Length |

| MAN-73-6 | Mann NW | 5,412,358.5 | 494,887.8 | 180 | -50 | 167.6 |

| MAN-87-1 | Mann NW | 5,412,274.6 | 494,791.6 | 270 | -65 | 41.2 |

| MAN-87-1 | Mann NW | 5,412,375.5 | 494,775.7 | 270 | -65 | 41.2 |

| MAN-87-2 | Mann NW | 5,412,251.0 | 494,793.5 | 270 | -80 | 35.4 |

| MAN-87-2 | Mann NW | 5,412,356.1 | 494,776.2 | 270 | -80 | 35.4 |

| MAN-88-1 | Mann NW | 5,412,098.9 | 494,880.2 | 235 | -50 | 64.0 |

| MAN-88-1 | Mann NW | 5,412,077.5 | 494,846.5 | 235 | -50 | 64.0 |

| MAN-88-2 | Mann NW | 5,412,070.5 | 494,878.4 | 235 | -65 | 61.0 |

| MAN-88-2 | Mann NW | 5,412,044.5 | 494,842.1 | 235 | -65 | 61.0 |

| MAN-88-3 | Mann NW | 5,412,046.0 | 494,872.6 | 235 | -40 | 60.7 |

| MAN-88-3 | Mann NW | 5,412,015.5 | 494,843.9 | 235 | -40 | 60.7 |

| MAN-91-1 | Mann NW | 5,411,812.0 | 494,843.2 | 120 | -48 | 246.0 |

| MAN-91-1 | Mann NW | 5,411,815.5 | 494,866.9 | 120 | -48 | 246.0 |

| MAN-96-1 | Mann NW | 5,411,779.5 | 494,862.6 | 172 | -65 | 279.8 |

| MD-06-4 | Mann NW | 5,412,250.1 | 496,400.0 | 360 | -50 | 260.0 |

| 73-01 | Mann SE | 5,407,714.3 | 503,532.3 | 273 | -56 | 159.8 |

| 73-10 | Mann SE | 5,409,611.1 | 503,128.9 | 230 | -54 | 125.0 |

| 73-02 | Mann SE | 5,407,421.6 | 503,682.0 | 273 | -55 | 166.8 |

| 73-03 | Mann SE | 5,406,989.3 | 503,547.8 | 273 | -50 | 152.1 |

| 73-04 | Mann SE | 5,408,652.6 | 502,940.7 | 183 | -51 | 144.5 |

| 73-05 | Mann SE | 5,408,627.3 | 501,849.5 | 183 | -50 | 109.5 |

| 73-06 | Mann SE | 5,408,961.4 | 501,738.5 | 183 | -50 | 112.5 |

| MAN35-01 | Mann SE | 5,408,387.8 | 503,614.6 | 220 | -45 | 149.0 |

| MAN45-01 | Mann SE | 5,409,991.9 | 501,335.1 | 180 | -45 | 245.0 |

| MAN45-02 | Mann SE | 5,409,950.4 | 501,605.7 | 180 | -45 | 211.3 |

| MAN52-01 | Mann SE | 5,406,451.4 | 502,850.9 | 360 | -45 | 219.0 |

| 28482 | Reaume | 5,421,363.0 | 487,600.0 | 0 | -50 | 248.0 |

| 28483 | Reaume | 5,422,007.0 | 488,260.0 | 270 | -50 | 301.0 |

| REA-45-04 | Reaume | 5,421,707.0 | 488,542.0 | 180 | -50 | 368.0 |

| REA-45-05 | Reaume | 5,421,932.0 | 488,576.0 | 180 | -50 | 308.0 |

| REA-45-06 | Reaume | 5,422,212.0 | 488,604.0 | 180 | -50 | 320.0 |

| REA-45-07 | Reaume | 5,422,398.0 | 488,610.0 | 180 | -50 | 299.0 |

| REA-45-08 | Reaume | 5,421,684.0 | 487,735.0 | 180 | -50 | 199.4 |

| DH-01 | Reaume | 5,422,601.0 | 488,298.0 | 0 | -90 | 95.0 |

| DH-02 | Reaume | 5,422,601.0 | 489,004.0 | 0 | -90 | 103.6 |

| REA-45-03 | Reaume | 5,422,190.0 | 488,903.0 | 180 | -50 | 335.0 |

| REA-46-01 | Reaume | 5,422,850.0 | 488,016.0 | 180 | -50 | 419.4 |

| R-78-1 | Reaume | 5,421,678.0 | 486,639.0 | 210 | -45 | 49.7 |

| LM08-01 | Midlothian | 5,303,260.0 | 499,195.0 | 180 | -50 | 400.2 |

Table A – Collars (continued)

| Hole ID | Property | Northing | Easting | Azimuth | Dip | Length |

| LL1 | Midlothian | 5,302,980.0 | 499,242.0 | 6 | -45 | 165.8 |

| LL2 | Midlothian | 5,302,870.0 | 499,192.0 | 6 | -45 | 163.1 |

| LL3 | Midlothian | 5,302,870.0 | 499,194.0 | 186 | -45 | 160.0 |

| A-121 | Midlothian | 5,302,910.0 | 498,866.0 | 187 | -45 | 91.4 |

| A-126 | Midlothian | 5,302,820.0 | 499,021.0 | 188 | -45 | 152.7 |

| 501 | Midlothian | 5,302,620.0 | 501,288.0 | 25 | -45 | 196.3 |

| 505 | Midlothian | 5,302,630.0 | 501,288.0 | 205 | -45 | 82.0 |

| 506 | Midlothian | 5,302,590.0 | 501,369.0 | 25 | -45 | 301.8 |

| 507 | Midlothian | 5,302,620.0 | 501,289.0 | 340 | -45 | 280.7 |

| A-131 | Midlothian | 5,302,520.0 | 500,429.0 | 183 | -45 | 115.8 |

| 503 | Midlothian | 5,302,650.0 | 498,883.0 | 181 | -45 | 121.9 |

| 504 | Midlothian | 5,302,660.0 | 498,883.0 | 1 | -45 | 121.9 |

| 502 | Midlothian | 5,303,250.0 | 499,094.0 | 352 | -45 | 146.6 |

| MD-17-008 | Midlothian | 5,303,230.0 | 499,727.0 | 280 | -50 | 38.0 |

| MD-17-009 | Midlothian | 5,303,230.0 | 499,727.0 | 300 | -50 | 38.0 |

| MD-17-007 | Midlothian | 5,303,230.0 | 499,727.0 | 220 | -50 | 67.0 |

| MD-17-006 | Midlothian | 5,303,230.0 | 499,727.0 | 260 | -55 | 38.0 |

| MD-17-005 | Midlothian | 5,303,230.0 | 499,727.0 | 260 | -89 | 53.0 |

| MD-17-004 | Midlothian | 5,303,220.0 | 499,709.0 | 256 | -49 | 19.9 |

| MD-17-003 | Midlothian | 5,303,220.0 | 499,709.0 | 220 | -84 | 35.0 |

| MD-17-002 | Midlothian | 5,303,220.0 | 499,709.0 | 220 | -45 | 29.0 |

| MD-17-001 | Midlothian | 5,303,220.0 | 499,709.0 | 220 | -60 | 29.0 |

| LL6 | Midlothian | 5,303,020.0 | 499,770.0 | 185 | -45 | 166.4 |

| 516 | Midlothian | 5,303,350.0 | 502,009.0 | 360 | -45 | 137.2 |

| 515 | Midlothian | 5,303,350.0 | 502,014.0 | 0 | -90 | 150.3 |

| 514 | Midlothian | 5,303,180.0 | 502,010.0 | 0 | -90 | 154.5 |

| LL7 | Midlothian | 5,302,990.0 | 498,825.0 | 187 | -50 | 160.7 |

| LL4 | Midlothian | 5,303,120.0 | 499,410.0 | 185 | -45 | 164.6 |

| LL5 | Midlothian | 5,303,020.0 | 499,030.0 | 187 | -45 | 165.9 |

| R-22 | Reid | 5,403,720.0 | 456,699.0 | Grid W | -50 | 171.0 |

| R-18 | Reid | 5,404,480.0 | 456,224.0 | Grid E | -50 | 96.9 |

| T67-1 | Reid | 5,405,400.0 | 456,745.0 | 35 | -50 | 128.3 |

| T67-2 | Reid | 5,405,510.0 | 456,709.0 | 210 | -49 | 59.7 |

| 1-63 | McCool | 5,384,613.0 | 566,975.6 | 360 | -85 | 122.0 |

| 2-63 | McCool | 5,383,250.0 | 566,050.3 | 35 | -60 | 188.0 |

| 3-63 | McCool | 5,384,550.8 | 567,035.3 | 0 | -90 | 150.9 |

| 1586-1 | McCool | 5,384,110.0 | 567,059.1 | 0 | -90 | 33.8 |

| D-1 | McCool | 5,383,880.8 | 567,597.7 | 54 | -45 | 279.6 |

SOURCE Canada Nickel Company Inc.