August 06, 2024

Neptune GBX, a trusted partner for wealth management solutions, is a full-service precious metals dealer, and exchange operator in Wilmington, Delaware. Founded in 2002, the company has been building its reputation in the precious metals industry consistently expanding its services and expertise to meet the evolving needs of its diverse clientele. Neptune GBX focuses on first-class cost-efficient solutions, establishing itself as a knowledgeable and reliable partner in this specialized market.

Neptune GBX's combination of expertise, innovative products, and client-centric approach positions it as a distinctive and valuable partner in the precious metals investment sector.

$100,000 investment with 10% ROI compounded

$100,000 investment with 10% ROI compoundedNeptune GBX's value proposition centers on empowering clients through education and insightful market analysis. The company places a strong emphasis on client education. By providing clients with essential knowledge and tools, Neptune GBX enables them to navigate the precious metals investment landscape with confidence.

Company Highlights

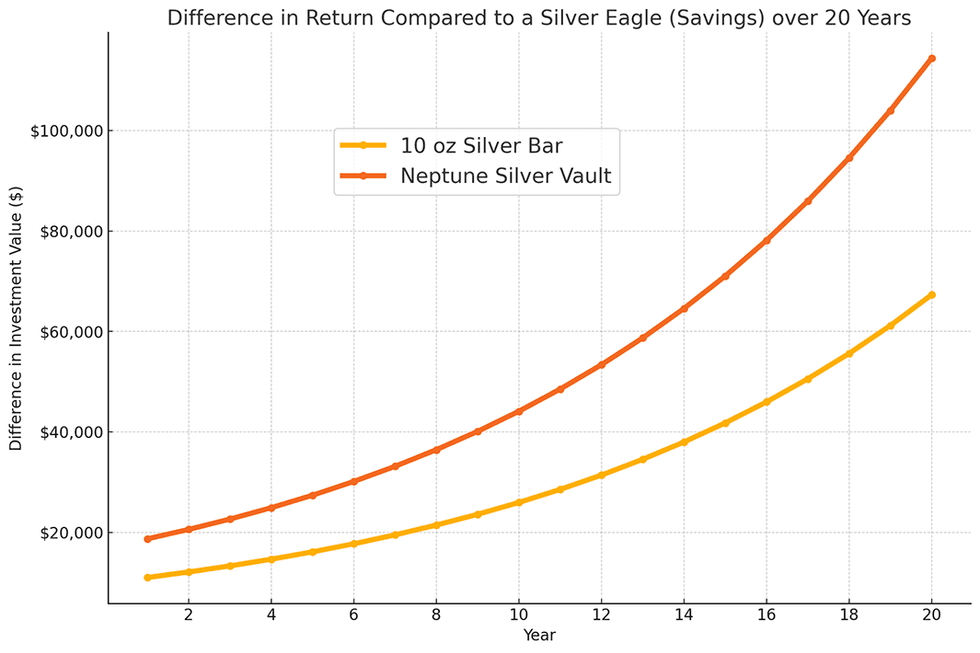

- Neptune Vault offers significantly lower premiums—up to 25 percent less than competitors. This reduction in premium costs translates to potential gains of more than twice over the long run. Minimizing spreads is crucial, and Neptune Vault excels in providing cost-effective options for investors.

- Neptune-GBX has teamed up with Franklin Templeton’s Fiduciary Trust International to provide precious metals investors with institutional-quality custodian, cash management and reporting services. This means products and services are tailored for various client types, from individual investors to wealth management professionals.

- Neptune Vault accounts offer storage fees as low as 0.30 percent per annum, ensuring substantial savings over time. For comparison, the PSLV Silver Fund has a management expense ratio of 0.60 percent. With Neptune Vault at 0.40 percent, investors gain an extra 1 percent every 5 years, totaling a 5 percent gain over 25 years.

- Neptune Vault accounts provide instant liquidity with better spreads than coins and small bars. With live pricing available five days a week, there is no need for shipping or assaying. A simple phone call or email can liquidate your investment promptly, ensuring access to funds in times of urgent need.

- Every ounce in a Neptune Vault account is directly allocated to the client's name, ensuring no over-allocation. The vault provides an asset custody letter to affirm true ownership, giving you peace of mind that you own the metal outright.

- Neptune Vault makes redemptions straightforward and quick. With just a phone call or email, your bullion can be transferred, shipped, or converted within days. The segregated and allocated nature of the product ensures that it is always ready for you, providing essential quick access to your physical investment.

- The PMC Ounce® offers diversified exposure to multiple precious metals.

This Neptune GBX profile is part of a paid investor education campaign.*

Click here to connect with Neptune GBX to receive an Investor Presentation

The Conversation (0)

09 March

Dynamic Active Multi-Crypto ETF

A single ticket solution offering access to leading crypto assets and companies deploying blockchain technology in real world applications.

A single ticket solution offering access to leading crypto assets and companies deploying blockchain technology in real world applications. Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

09 March

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

09 March

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00