August 06, 2024

Neptune GBX, a trusted partner for wealth management solutions, is a full-service precious metals dealer, and exchange operator in Wilmington, Delaware. Founded in 2002, the company has been building its reputation in the precious metals industry consistently expanding its services and expertise to meet the evolving needs of its diverse clientele. Neptune GBX focuses on first-class cost-efficient solutions, establishing itself as a knowledgeable and reliable partner in this specialized market.

Neptune GBX's combination of expertise, innovative products, and client-centric approach positions it as a distinctive and valuable partner in the precious metals investment sector.

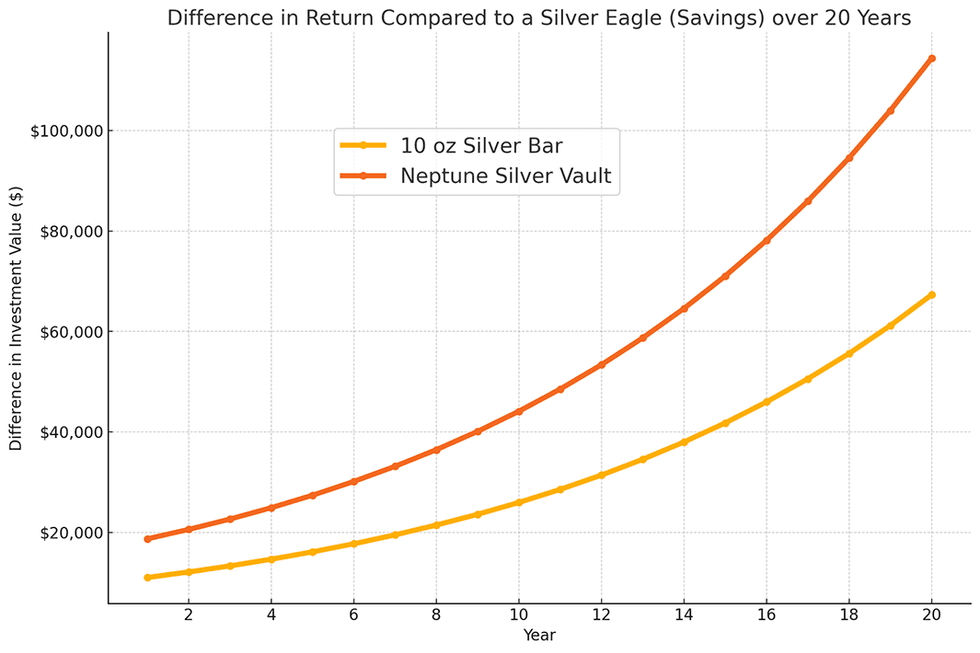

$100,000 investment with 10% ROI compounded

$100,000 investment with 10% ROI compoundedNeptune GBX's value proposition centers on empowering clients through education and insightful market analysis. The company places a strong emphasis on client education. By providing clients with essential knowledge and tools, Neptune GBX enables them to navigate the precious metals investment landscape with confidence.

Company Highlights

- Neptune Vault offers significantly lower premiums—up to 25 percent less than competitors. This reduction in premium costs translates to potential gains of more than twice over the long run. Minimizing spreads is crucial, and Neptune Vault excels in providing cost-effective options for investors.

- Neptune-GBX has teamed up with Franklin Templeton’s Fiduciary Trust International to provide precious metals investors with institutional-quality custodian, cash management and reporting services. This means products and services are tailored for various client types, from individual investors to wealth management professionals.

- Neptune Vault accounts offer storage fees as low as 0.30 percent per annum, ensuring substantial savings over time. For comparison, the PSLV Silver Fund has a management expense ratio of 0.60 percent. With Neptune Vault at 0.40 percent, investors gain an extra 1 percent every 5 years, totaling a 5 percent gain over 25 years.

- Neptune Vault accounts provide instant liquidity with better spreads than coins and small bars. With live pricing available five days a week, there is no need for shipping or assaying. A simple phone call or email can liquidate your investment promptly, ensuring access to funds in times of urgent need.

- Every ounce in a Neptune Vault account is directly allocated to the client's name, ensuring no over-allocation. The vault provides an asset custody letter to affirm true ownership, giving you peace of mind that you own the metal outright.

- Neptune Vault makes redemptions straightforward and quick. With just a phone call or email, your bullion can be transferred, shipped, or converted within days. The segregated and allocated nature of the product ensures that it is always ready for you, providing essential quick access to your physical investment.

- The PMC Ounce® offers diversified exposure to multiple precious metals.

This Neptune GBX profile is part of a paid investor education campaign.*

Click here to connect with Neptune GBX to receive an Investor Presentation

Sign up to get your FREE

Oreterra Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

05 March

Oreterra Metals

Close on the trail of a potentially major new BC copper-gold discovery

Close on the trail of a potentially major new BC copper-gold discovery Keep Reading...

1h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

22h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

22h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

23h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

23h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Oreterra Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00