January 17, 2024

In mid-November 2023, Jindalee Lithium Limited (Jindalee, the Company) announced results from beneficiation of composite samples from the Company’s 100% owned McDermitt Lithium Project located in Oregon, USA, and noted that acid leaching of beneficiated samples was underway1.

- Excellent lithium (Li) extraction rates from acid leaching of beneficiated McDermitt ore

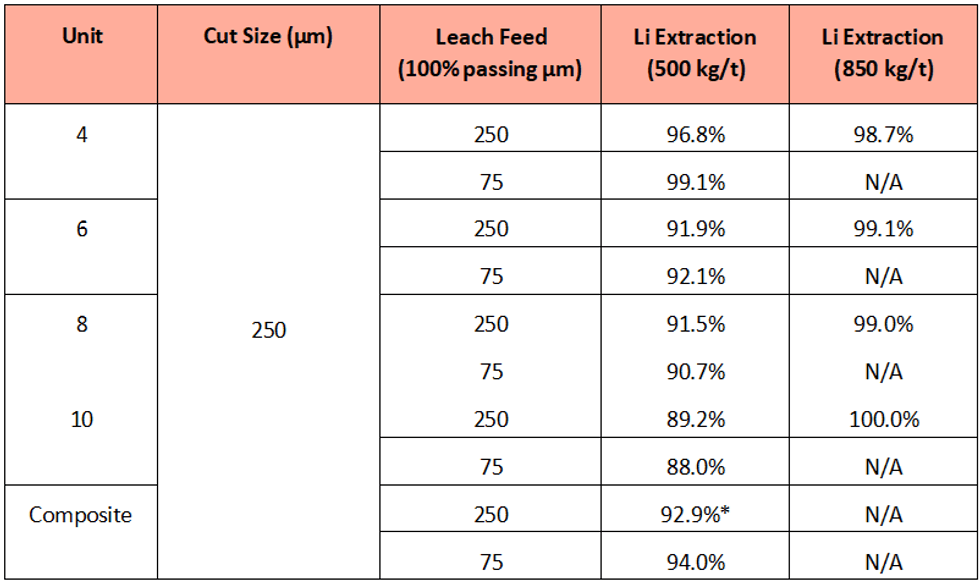

- Li extraction from composite samples averaged 93% (250µm) and 94% (75µm)

- Li extraction from all units exceeds 98% with higher acid additions

- Leaching of a bulk sample is underway to enable downstream testwork

- Samples have been shipped to POSCO for parallel leach testwork

Samples of ore were beneficiated with a cut-size of 250-micron (µm). Material passing was either leached directly (“250µm leach feed”) or ground further so that all passed 75µm (“75µm feed”).

Jindalee is pleased to advise that initial results from acid leaching of the beneficiated samples have been received, with extremely high lithium extraction rates recorded from both the 250µm and 75µm leach feeds using 500kg sulphuric acid per tonne of leach feed. The 250µm leach feed was also leached with a higher strength acid (850 kg/t leach feed) and returned exceptional extraction rates (>98.5%) for all units (Table 1).

The leach testwork extended for up to four hours with most of the Li extraction occurring in the first hour. Optimised lithium extraction and acid addition rates will be incorporated into the Pre-Feasibility Study (PFS).

Leaching of a bulk composite has commenced to provide lithium in solution for downstream testwork. Beneficiated samples (250µm) have also recently been shipped to POSCO Holdings (NYSE: PKX) (POSCO) for testwork, pursuant to the Memorandum of Understanding signed with POSCO in February 20234.

Discussion

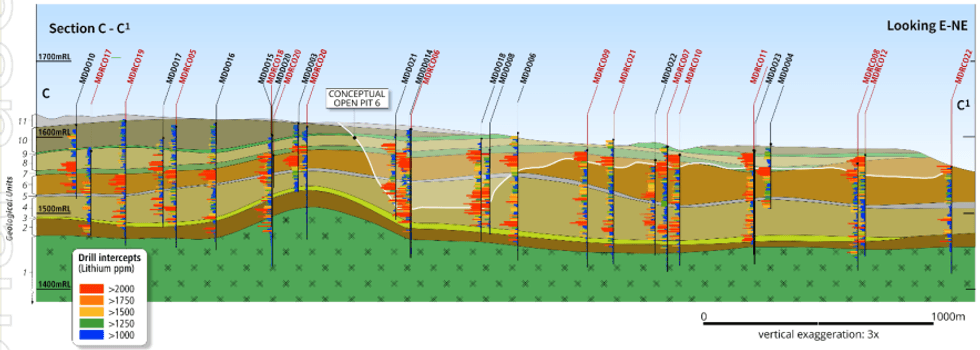

In July 2023 Jindalee shipped approximately 700kg of drill core to Hazen (Colorado, USA) for metallurgical testing, with this testwork being managed by global engineering, procurement, construction and maintenance (EPCM) company Fluor Corporation (Fluor). The core samples were selected from Units 4, 6, 8 and 10 within the Indicated portion of conceptual Pit Shell 6 (nominal 43 years); these units carry elevated lithium grades and selective mining of these units has the potential to deliver significantly higher-grade material (when compared to the Mineral Resource Estimate average grade) for processing (Figure 1) (Table 2)2.

Head assays for these samples were announced in October 20233 with Units 4, 6, 8 and 10 averaging 1,790 ppm Li, 34% higher than the average McDermitt Mineral Resource grade (1,340 ppm Li)2. Results from attrition scrubbing (beneficiation) of a composite sample of McDermitt ore (250µm cut-size) were announced mid- November 2023, recording 92.0% Li recovery with 25.3% mass rejection and the lithium grade to leach increasing to 2,107 ppm Li1.

The acid leaching testwork now being reported was conducted on both 250µm and 75µm leach feed sizes using 500 kg/t (and 850 kg/t for 250µm leach feed). A composite sample (representing a nominal life-of-mine average feed) was also tested using the two leach feed sizes, recording very high lithium extraction rates using 500 kg/t. Lithium extraction from the coarser (250µm) leach feed was 92.9% and compares favourably with the extraction rate (94.0%) achieved from the finer (75µm) leach feed (Table 1).

Next Steps

Acid leaching of a bulk composite sample is currently underway to provide lithium in solution for downstream work. Results from this testwork will feed into the PFS which is expected to be completed mid-2024.

Samples from Units 4, 6, 8 and 10 have been beneficiated (250µm) and shipped to POSCO for parallel leach testwork, pursuant to the Memorandum of Understanding signed with POSCO.

Click here for the full ASX Release

This article includes content from Jindalee Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

JLL:AU

Sign up to get your FREE

Jindalee Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

16 April 2025

Jindalee Lithium

Game-changing, economically significant lithium resource for North American battery supply chain

Game-changing, economically significant lithium resource for North American battery supply chain Keep Reading...

23 January

Quarterly Cashflow Report - December 2025

Jindalee Lithium (JLL:AU) has announced Quarterly Cashflow Report - December 2025Download the PDF here. Keep Reading...

23 January

Quarterly Activities Report - December 2025

Jindalee Lithium (JLL:AU) has announced Quarterly Activities Report - December 2025Download the PDF here. Keep Reading...

11 December 2025

US Government Approves Major Drilling Program at McDermitt

Jindalee Lithium (JLL:AU) has announced US Government Approves Major Drilling Program at McDermittDownload the PDF here. Keep Reading...

08 December 2025

Trading Halt

Jindalee Lithium (JLL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 November 2025

Drilling Underway at McDermitt Lithium Project

Jindalee Lithium (JLL:AU) has announced Drilling Underway at McDermitt Lithium ProjectDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Sign up to get your FREE

Jindalee Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00