March 05, 2023

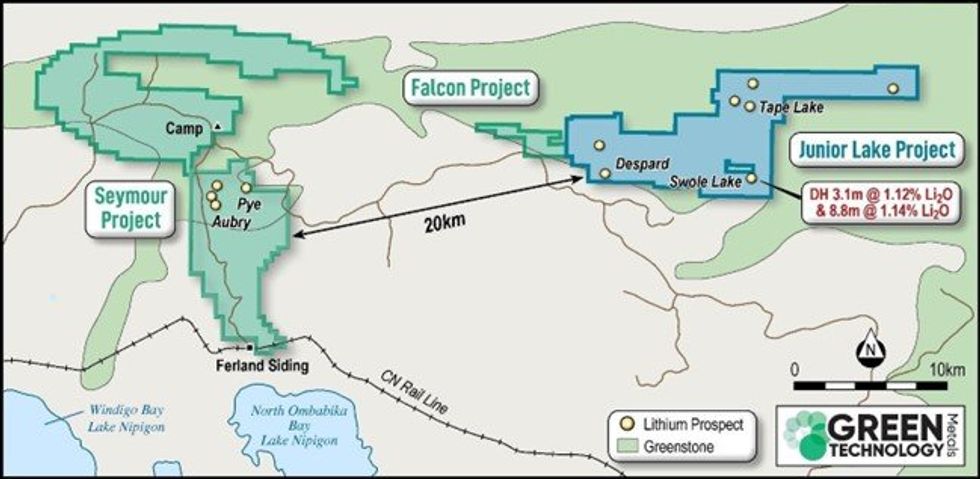

Green Technology Metals Limited (ASX: GT1) (GT1 or the Company), a Canadian-focused multi-asset lithium business, is pleased to announce that it has signed a binding option agreement (Option Agreement) for an option (Option) to purchase an 80% interest (80% Option Interest) in the Junior Lake Project (Junior Lake or the Project) from Landore Resources Canada Inc. (Landore) which comprise 591 staked mineral claims on 10,856 Hectares (109km2) of tenure located adjacent to the Flagship Seymour Project (Seymour) in Ontario, Canada.

HIGHLIGHTS

- Binding option agreement executed with Landore to secure the Junior Lake Project hosting identified Lithium-bearing pegmatites

- Located 22km east of GT1’s Flagship Seymour Project, covering ~109km2 of tenure

- Junior Lake hosts multiple LCT pegmatites at surface, confirmed by historical exploration activities on the property, with drill ready targets presenting similar geology to Seymour

- Junior Lake offers outstanding potential to make new proximal lithium discoveries and strategically grow the resource base for Seymour

- Preparation for summer mapping and initial 1,200m drilling program to commence in Q3 23 subject to approvals

The tenements are located immediately adjacent (approximately 22km) from the Company’s Flagship Seymour project in Ontario, The Junior Lake Project is host to three drill-ready LCT pegmatite prospects, identified from previous exploration, indicating the Project’s lithium potential.

“We are excited to secure the agreement with Landore, adding a sizeable tenement package to our portfolio and look forward to commencing exploration on the Junior Lake Project which offers the company a unique combination of a close proximity location, identified targets through previous regional exploration and early indications of similar geology to our flagship Seymour Project.

We plan to commence exploration activities imminently at Junior Lake as we look to grow our resource base for greater Seymour and move swiftly into development ”

GT1 Chief Executive Officer, Luke Cox

Project Background

The Junior Lake Project, currently 100% owned by Landore, consists of 33,029 hectares, including 10,856 hectares relating to Lithium tenure (refer to figure 1) in the province of Ontario, Canada. The project is located approximately 235 kilometres north-northeast of Thunder Bay and 75km east-northeast from the town of Armstrong and easily accessible via Jackfish Highway which connects the Seymour, Falcon and Junior Lake project areas.

Junior Lake is located within the Caribou Lake – O’Sullivan greenstone belt of the East Wabigoon Sub province of the Superior Province, a highly prospective Archean greenstone belt known host to multiple known gold and other precious and base metal occurrences. The greentone belt traverses the Junior Lake Property from east to west for approximately 31 kilometres and ranges from 0.5 to 1.5 kilometres wide containing all of Landore’s stated mineral resources and prospects including the BAM Gold Deposit, Lamaune Gold Prospect, the B4-7 Nickel-copper-cobalt- Platinum-Palladium-gold Deposit and the VW Nickel-Copper-cobalt Deposit. Previous exploration has been largely focused on the gold potential of the area and a greater portion of the greenstone belt and Junior Lake project remains underexplored.

Junior Lake is host to several LCT pegmatites with three previously identified target areas; Despard, Swole Lake and Tape Lake, all presenting similar geology to Seymour based on the lithium exploration undertaken to date:

The Despard Lithium target

Located approximately 1km north of the east end of North Lamaune Lake, holding exposed outcrop and boulders intermittently over an east-west length of ~914 metres and across widths up to 27 metres, containing up to 30% spodumene. Historic exploration at Despard is limited with a 10 hole diamond drilling program undertaken in 1959 intersecting 1.68% Li2O over 6.1 metres, 1.70% Li2O over 2.01 metres and 1.53% Li2O over 2.74 metres.

Click here for the full ASX Release

This article includes content from Green Technology Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GT1:AU

Sign up to get your FREE

Green Technology Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 September 2025

Green Technology Metals

Delivering the next lithium hub in North America

Delivering the next lithium hub in North America Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Green Technology Metals (GT1:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

07 January

EDC Extends LOI for Seymour Lithium Project of up to C$100m

Green Technology Metals(GT1:AU) has announced EDC Extends LOI for Seymour Lithium Project of up to C$100mDownload the PDF here. Keep Reading...

30 November 2025

Altris Engineering Appointed to Optimise & Lead Seymour DFS

Green Technology Metals (GT1:AU) has announced Altris Engineering Appointed to Optimise & Lead Seymour DFSDownload the PDF here. Keep Reading...

17 November 2025

Ontario Lithium Project Development Update

Green Technology Metals(GT1:AU) has announced Ontario Lithium Project Development UpdateDownload the PDF here. Keep Reading...

31 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Green Technology Metals(GT1:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Sign up to get your FREE

Green Technology Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00