August 01, 2024

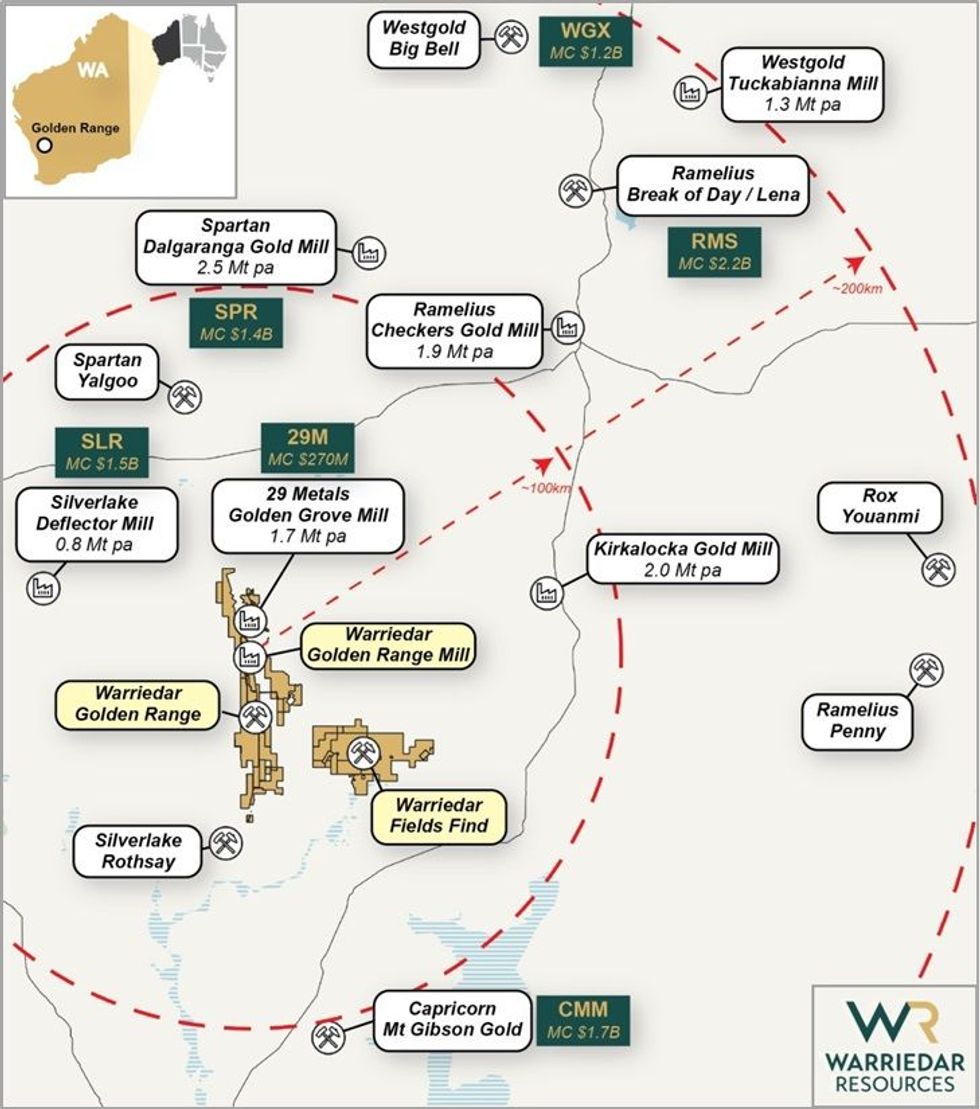

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to provide an update on drilling progress and assay results from its Golden Range Project, located in the Murchison region of Western Australia (Figure 1).

HIGHLIGHTS:

- Assay results for a further two (2) diamond tails at Ricciardo confirm a 77m wide (not true width) mineralisation zone 180m down-dip of the current Resource beneath the Ardmore pit, including a high-grade shoot.

- Significant gold intervals include:

- 7.2m @ 4.51 g/t Au from 232.8m, incl. 3m @ 9.03 g/t Au from 234m

- 10.5m @ 1.53 g/t Au from 218.8m

- 3.9m @ 3.35 g/t Au from 218.8m

- 23.2m @ 1.60 g/t Au from 270.8m

- Mineralisation in this area is structurally complex, extends to a vertical depth of ~ 460m and remains open.

- Ricciardo sits in the middle of the 25km-long ‘Golden Corridor’ at Golden Range, which hosts six (6) discrete deposits (18 historic pits) that are all open at depth and possess immediate growth potential.

- Current diamond drilling program (now extended to 3,000m) at Ricciardo and M1 set to be completed in mid-August, with all assays expected by late-September.

- Update of the Ricciardo MRE is targeted for Q4 2024.

- Further growth-focussed drilling of the ‘Golden Corridor’ scheduled for H2 2024.

The results reported in this release are for a further two (2) of the diamond holes drilled in the current program. Results for the first twelve (12) diamond holes of the current program were previously reported (refer WA8 ASX releases dated 3 July 2024 and 19 July 2024).

The results for these two (2) holes again demonstrate wide infill of the broader Ricciardo deposit at depth, further validating the outstanding Mineral Resource Estimate (MRE) growth potential that exists at Ricciardo and along the broader ‘Golden Corridor’ trend (refer Figure 2).

Warriedar Managing Director and CEO, Amanda Buckingham, commented:

“The outcomes of these two diamond tails are significant, given that they represented substantial depth step-outs under the shallow Ardmore pit. A 77m wide mineralised zone (downhole) with a central high-grade shoot (4.51 g/t), 180m below the MRE is a great result. We don’t fully understand the structural geometry here yet, but we are delighted that the deeper part of hole 49 validates the drill results from a previous explorer – confirming the deposit extends to about 460m vertical depth and retains some good grade (3.19 g/t). Excellent progress.

We continue to drill ahead at Ricciardo as part of the current diamond program, with follow-up growth drilling activities in planning for the remainder of H2 2024.”

Ricciardo deposit

The Ricciardo gold system spans a strike length of approximately 2.3km, with very limited drilling having been undertaken below 100m depth. Ricciardo possesses a current MRE of 8.7 Mt @ 1.7 g/t Au for 476 koz gold.1 The oxide material at Ricciardo has been mined by previous operators.

Click here for the full ASX Release

This article includes content from Warriedar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

6h

Filing of Initial Prospectus

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that it has filed a preliminary non-offering prospectus (the "Prospectus") with the Ontario Securities Commission (the "Commission") and has applied to the Canadian Securities... Keep Reading...

12 February

Keith Weiner: Silver Being Remonetized "With a Vengeance" as Gold Rises

Keith Weiner, founder and CEO of Monetary Metals, shares his outlook for gold and silver in 2026, saying that while he expects higher prices there will be volatility. He also outlines his thoughts on the role of precious metals in the monetary system. Don’t forget to follow us @INN_Resource for... Keep Reading...

12 February

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

12 February

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00