October 29, 2024

Impact Minerals Limited (ASX:IPT) is pleased to present its Quarterly Report.

HIGHLIGHTS

1. Lake Hope High Purity Alumina (HPA) Project, WA (IPT earning 80%)

- The Mine at Lake Hope:

- A negotiation protocol for Land Access and Cultural Heritage agreements with the Ngadju peoples reviewed and signed.

- Applications for a Mining Lease and associated Miscellaneous licence lodged.

- Infill drilling to define a maiden Measured Resource and Proven Reserve completed with resource calculations and economic studies in progress.

- Mining studies underway to provide mining schedules, proposed equipment, site logistics and costs of mining and transport of ore to Kwinana.

- Further flora fauna and heritage surveys are being planned for the mine haul road.

- The Process Plant:

- Kwinana selected as the location for process plant to produce a benchmark 10,000 tonnes per annum of HPA due to access to providers of the required input chemical reagents, buyers of the fertiliser and acid by-products and access to suitable land. Combined, these provide substantial strategic advantages for the project with savings on capex and opex.

- The Low-Temperature Leach process selected as the most straightforward processing method to produce HPA at scale.

- CPC Engineering selected to provide a design and engineering study for the full-scale plant that is underway.

- Product development, offtake and marketing

- Further test work on HPA and fertiliser by-products continues.

- Experimental work has produced a hydrated alumina product that may have major applications in the catalyst and flame retardant industries.

- Early-stage discussions are underway for potential synergies with existing alumina businesses in Europe and the USA.

- A marketing and product development team is being assembled.

2. Arkun-Beau, WA (IPT 100%)

- No major no activity occurred this quarter, though efforts remain on track to resume exploration after the cropping season ends in the wheatbelt in December.

- 413 soil samples were re-assayed to refine drill targets at Beau and Caligula prospects

- Land access agreements and statutory approvals are being finalised ahead of planned drill programme in Q1 2025

- Previous geochemical and MME survey data at Caligula support the project potential, with $180,000

- co funding awarded under the WA Government’ EIS scheme for drilling.

3. Corporate/Finance

- A FY23 Research and Development Rebate of $395,000 was received during the Quarter.

PROJECT REPORTS

1. LAKE HOPE HIGH PURITY ALUMINA PROJECT, WA (IPT earning 80%)

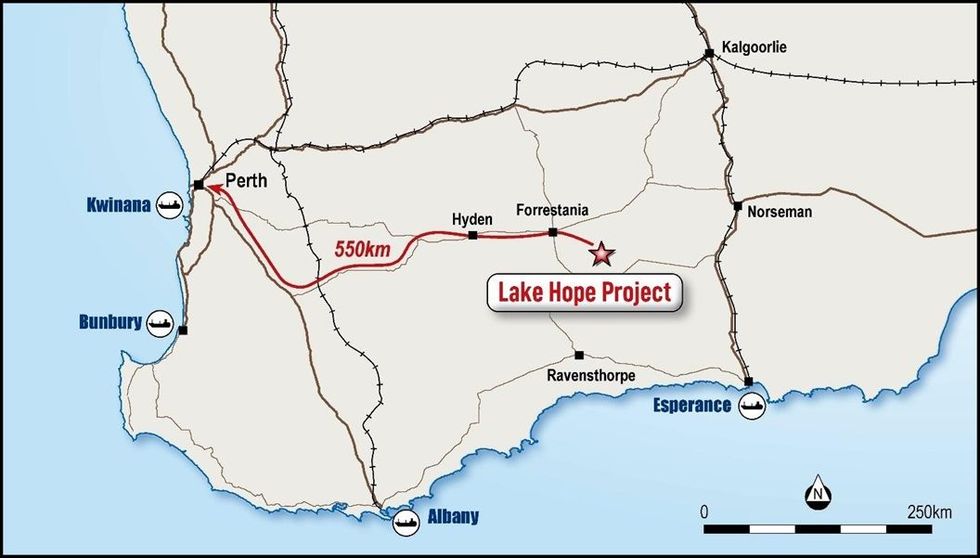

During the Quarter Impact Minerals announced that it had lodged a Mining Lease Application (MLA63/684) and associated Miscellaneous Licence (L63/99) for the Lake Hope High Purity Alumina (HPA) Project located 500 km east of Perth in Western Australia, (Figures 1 and 2). This is a crucial step in advancing the project towards production as it defines the work required to obtain the statutory approvals needed for the grant of the Mining Lease.

The approvals process, together with the logistics and estimated costs of mining and transporting the Lake Hope mud to the process plant, form one of the four key parts of a Pre-Feasibility Study (PFS) on Lake Hope, which is in progress (Figure 3 and ASX Release July 10th, 2024). Impact can take an 80% interest in Playa One Pty Limited, which owns the Lake Hope Project and associated intellectual property, by completing the PFS (ASX Releases March 21st 2023 and July 10th 2024).

The PFS followed on from a positive Scoping Study, which showed that for a benchmark production of 10,000 tonnes per annum of HPA, the Project has an estimated post-tax Net Present Value (NPV8) of about A$1.3 billion and would potentially be one of the lowest-cost producers of HPA globally (ASX Release November 9th 2023).

Click here for the Quarterly Cashflow Report

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

22 January

Red Metal Resources Closes First Tranche of Financing

RED METAL RESOURCES LTD. (CSE: RMES) (OTC Pink: RMESF) (FSE: I660) ("Red Metal" or the "Company") announces that it has closed the first tranche of its previously announced non-brokered private placement financing (the "Offering") (see news releases dated January 7, 2026, and January 19, 2026)... Keep Reading...

22 January

Questcorp Mining and Riverside Resources Chip Channel Sample 30 Meters @ 20 g/t Gold and 226 g/t Silver at the Mexican Union Project

Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the "Company" or "Questcorp") along with its partner Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) ("Riverside"), is pleased to report a high grade interval of 20.2 g/t gold and 226 g/t silver with 2.7% zinc over a 30... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00