FPX Nickel Corp. (TSXV: FPX) (OTCQB: FPOCF) (" FPX " or the " Company ") is pleased to announce the final drill results confirming the continued near-surface lateral extension of the significant new nickel discovery at the Van Target (" Van ") in the Company's Decar Nickel District (" Decar " or the " District ") in central British Columbia. The results from holes 21VAN-005, 21VAN-006 and 21VAN-007 complement the first four discovery holes previously reported by the Company, with the first seven Van holes now defining a zone of strong awaruite nickel mineralization approximately 400 to 750 metres wide and up to 750 metres long, to downhole depths of up to 350 metres.

Highlights

- The mineralized footprint defined by the Company's 2021 Van program remains wide open for expansion to the south and west, and potentially at depth within and beyond the initial 2.5 km 2 target area, confirming the potential for this target to host a large-scale, standalone nickel deposit which could rival the deposit already delineated at the Baptiste Deposit

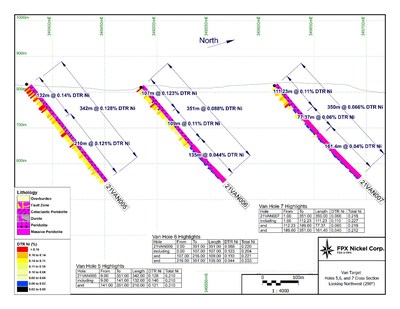

- Final set of Van holes (including 21VAN-005, 21VAN-006 and 21VAN-007) extend mineralization by approximately 350 m west from the first two holes (21VAN-001 and 21VAN-002), with the first seven holes returning strong nickel mineralization over broad intervals

- Hole 21VAN-005 intersected 132 m grading 0.140% DTR nickel (0.210% total nickel), starting from bedrock at 9 m downhole, which is one of the 10 highest-grading, near-surface intervals encountered at Decar (see Table 1 regarding vertical depth)

- The highest values in all holes start from the bedrock surface, with the three southernmost holes, returning long intervals of strong nickel mineralization as follows:

- 21VAN-002: 260 m 0.134% DTR Ni from below a fault zone to the end of hole;

- 21VAN-003: 143 m of 0.143% DTR Ni from bedrock surface; and

- 21VAN-005: 342 m of 0.128% DTR Ni from bedrock surface to the end of hole

- Nickel mineralization at Van occurs as disseminated awaruite (nickel-iron alloy) and in the same ophiolite host rocks as at Baptiste

- The results of the first-ever Van drilling program compare favourably with early drilling results at Baptiste, which contains 1.996 billion tonnes of indicated resources at an average grade of 0.122% DTR nickel , and 593 million tonnes of inferred resources with an average grade of 0.114% DTR nickel , both reported at a cut-off grade of 0.06% DTR nickel. Mineral resources are not mineral reserves and do not have demonstrated economic viability. See the resource estimate set out in FPX's NI 43-101 Technical Report – "Preliminary Economic Assessment – Baptiste Nickel Project, British Columbia, Canada ," with an effective date of September 9, 2020 , filed under the Company's SEDAR profile on March 17, 2021

"We are very pleased with this final batch of drill results from the maiden drilling program at Van, with the first seven holes all returning broad intervals of strong awaruite nickel mineralization," commented Martin Turenne , the Company's President and CEO. "The three southernmost of the Van holes (21VAN-002, 21VAN-003 and 21VAN-005) returned among the 10 highest-grading, near-surface intervals in the history of Decar, suggesting that Van has strong potential to host a higher-grade, near-surface resource than that found at Baptiste, where the majority of higher-grade mineralization occurs at depth."

FPX's Chairman Peter Bradshaw added: "The results of the first seven holes at Van, drilled in the central and eastern portion of the large 2.5 km 2 target area, have exceeded our expectations and confirmed Van as a major new discovery for the nickel industry. Having confirmed that the strong mineralization in previously reported outcrop samples continues to depth, we now look forward to additional drilling in 2022 to expand the mineralization to the south and the west of the 2021 holes, with a view of generating an initial mineral resource estimate for the deposit."

Link to view drill results within interactive 3D VRIFY model (for best results, view in full screen): https://vrify.com/decks/FPX-Nickel-Van

Van Target Drilling Overview

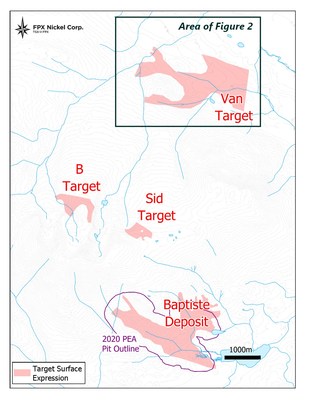

Starting in June, the Company executed a maiden nine-hole, 2,688 m drill program at the Van Target, which is located 6 km north of Baptiste at a similar elevation, and accessible via active logging roads (see Figure 1). Maiden drilling at Van tested the sub-surface potential for mineralization below and adjacent to prospective mineralized outcrop, which had defined a target area of approximately 2.5 km 2 . The size of the Van Target as defined by this outcrop sampling is comparable to the Baptiste deposit, which measures 3 km along strike with widths of up to 1 km. All nine holes at Van were drilled to the north-northeast at an inclination of minus 50 degrees to a target depth of 350 m .

The results from holes 21VAN-005, 21VAN-006 and 21VAN-007 complement the first four discovery holes previously reported by the Company, with the first seven Van holes now defining a zone of strong awaruite nickel mineralization measuring approximately 400 to 750 metres wide by up to 750 metres long, to downhole depths of 350 metres in the southernmost holes. The approximately mineralized footprint defined by this program remains wide open for expansion to the south, to the west, and at depth to the south, confirming the potential for this target to host a large-scale, standalone nickel deposit to rival the deposit already delineated at Baptiste, but with the possibility of higher grades in early years of a mine plan.

Table 1 – Van Target Drill Hole Results

| Hole | Intersections 1 | DTR Nickel (%) 2 | Total Nickel (%) 2 | ||

| From | To | Intersected | |||

| 21VAN-005 | 9 | 351 | 342 | 0.128 | 0.210 |

| including | 9 | 141 | 132 | 0.140 | 0.210 |

| and | 141 | 351 | 210 | 0.121 | 0.210 |

| | |||||

| 21VAN-006 | 0 | 351 | 351 | 0.088 | 0.220 |

| including | 0 | 107 | 107 | 0.123 | 0.204 |

| and | 107 | 216 | 109 | 0.110 | 0.221 |

| and | 216 | 351 | 135 | 0.044 | 0.233 |

| | |||||

| 21VAN-007 | 1 | 351 | 350 | 0.066 | 0.218 |

| including | 1 | 112.23 | 111.23 | 0.110 | 0.227 |

| and | 112.23 | 189.6 | 77.37 | 0.060 | 0.218 |

| and | 189.6 | 351 | 161.4 | 0.040 | 0.212 |

1 The vertical depth (true width) of all quoted intersections in this news release is interpreted to be approximately 75% of downhole depth.

2 Core samples are assayed for "total nickel" and "Davis Tube Recoverable (" DTR ") nickel." "DTR nickel" analyses measure only the magnetically recoverable nickel hosted in awaruite (nickel-iron alloy), whereas the "total nickel" analyses measure both recoverable and refractory nickel, the latter hosted in silicate phases like olivine and, to a lesser extent, serpentine. The Davis Tube method is in effect a mini-scale metallurgical test procedure used to provide a more accurate measure of recoverable nickel and is the global industry-standard geometallurgical test for magnetic recovery operations and exploration projects. See "Sampling and Analytical Method", below.

Nickel mineralization intersected within 21VAN-005, 21VAN-006 and 21VAN-007 is characterized by disseminated, coarse-grained awaruite (nickel-iron alloy) mineralization hosted in serpentinized peridotite and is very analogous to the mineralization and geological setting at the Baptiste Deposit.

21VAN-005 was collared 400 m west of 21VAN-002 and was drilled to the north-northeast at an angle of minus 50 degrees. The hole encountered bedrock at 9 m downhole (approximately 7 m vertical depth) and thereafter intersected 342 m of strong awaruite mineralization to the end of the hole. The strongest mineralization was encountered near the top of hole, including a 141 m interval of 0.140% DTR nickel starting from bedrock at a downhole depth of 9 m . Nickel mineralization in this hole remains open at depth and to the south.

21VAN-006 was collared 300 m north-northeast along section from 21VAN-005 and was also drilled to the north-northeast at minus 50 degrees. The hole was collared into bedrock and intersected 351 m of awaruite mineralization, grading 0.088% DTR nickel to the end of the hole. The strongest mineralization at 21VAN-006 was encountered near the top of hole, including a 107 m interval of 0.123% DTR nickel starting from surface. This hole ended in weakly-mineralized semi-massive peridotite.

21VAN-007 was collared 280 m northwest from 21VAN-001 and was drilled to the north-northeast at an angle of minus 50 degrees. The hole encountered bedrock at 1 m downhole and then intersected 350 m of awaruite mineralization, to a downhole depth of 351 m . The strongest mineralization at 21VAN-005 was encountered near the top of hole, including a 111.23 m interval of 0.110% DTR nickel starting from bedrock surface at downhole depth of 1 m . This hole ended in weakly-mineralized semi-massive peridotite.

21VAN-008 and 21VAN-009 were collared on a section 350 m east-southeast of 21VAN-003 to test the potential for nickel mineralization several hundred meters to the south and to the east of previously reported outcrop samples. 21VAN-008 encountered bedrock at 8.84 m downhole and thereafter encountered dyking and intercelated iron carbonate altered peridotite to a downhole depth of 28.25 m where the hole was abandoned due to drilling complications.

21VAN-009 was collared 350 m south-southwest along section from 21VAN-008 and was drilled to the north-northeast at an angle of minus 50 degrees. The hole encountered bedrock at 6 m downhole consisting of dyking, intercalated iron carbonate altered peridotite and metasediments to a downhole depth of 189 m , at which point drilling was terminated due to unfavourable geology.

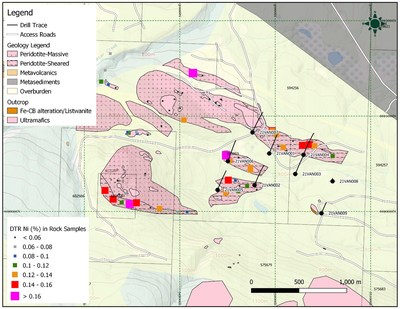

Collar locations for the nine holes drilled at the Van Target are provided in Figure 2. Holes were spaced on section lines approximately 350 m apart and tested the Van Target over an area of approximately 0.6 km 2 to a maximum downhole depth of 350 m . Assay results from holes 21VAN-001 and 21VAN-002 were reported in the Company's October 19, 2021 news release, and from holes 21VAN-003 and 21VAN-004 in the Company's November 15, 2021 news release.

Regional Exploration Program

As disclosed in its May 26, 2021 news release, the Company conducted a regional exploration program over the summer months on five prospective under- and un-explored areas within the 245 square kilometre Decar ophiolite complex. These new areas were identified on the basis of magnetic response from a previous airborne survey, very limited previous sampling, and/or improved access resulting from more recent clear-cut logging activity, providing possibility of exposure of new outcrops which are by far the best method of indicating new targets

The regional exploration program was constrained however by the general lack of outcrop, even in logged areas, due to a blanket of glacial till covered by thick vegetation and deadfall. In two of those areas (located to the northwest and to the east of the Van Target), no outcrop was identified, and in a third area (located to the southeast of Van), outcrop samples of listwanite and iron-carbonate altered peridotite suggest very limited potential for significant nickel mineralization.

The remaining two prospective areas (located to the north and to the northeast of Baptiste) contained some limited samples of prospective outcrop comprising massive to semi-massive peridotite and cataclastic peridotite which returned nickel grades ranging from 0.060 to 0.075% DTR nickel. While further exploration work is warranted in these two areas, the Company expects to focus its 2022 exploration efforts on further drilling and surface sampling work at the Van Target. Efficient and low-impact methods of collecting the first 20 to 40 cm of bedrock under overburden are being investigated, particularly for extensions of the Van target where it goes undercover.

Sampling and Analytical Method

For a description of the Company's sampling and analytical method, including a description of QA/QC procedures, see the news release dated October 19, 2021 .

Dr. Peter Bradshaw , P. Eng., FPX Nickel's Qualified Person under NI 43-101, has reviewed and approved the technical content of this news release.

About the Decar Nickel District

The Company's Decar Nickel District claims cover 245 km 2 of the Mount Sidney Williams ultramafic/ophiolite complex, 90 km northwest of Fort St. James in central British Columbia . The District is a two-hour drive from Fort St. James on a high-speed logging road.

Decar hosts a greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite (Ni 3 Fe), which is amenable to bulk-tonnage, open-pit mining. Awaruite mineralization has been identified in four target areas within this ophiolite complex, being the Baptiste Deposit, and the B, Sid and Van targets, as confirmed by drilling in the first three plus petrographic examination, electron probe analyses and outcrop sampling on all four. Since 2010, approximately US $28 million has been spent on the exploration and development of Decar.

Of the four targets in the Decar Nickel District, the Baptiste Deposit, which was initially the most accessible and had the biggest known surface footprint, has been the focus of diamond drilling since 2010, with a total of 82 holes and over 31,000 m of drilling completed. The Sid target was tested with two holes in 2010 and the B target had a single hole drilled in 2011; all three holes intersected nickel-iron alloy mineralization over wide intervals with DTR nickel grades comparable to the Baptiste Deposit. The Van target was not drill-tested at that time as bedrock exposures in the area were very poor prior to more recent logging activity. In 2021, the Company executed a maiden drilling program at Van, initial results of which are reported here and in the Company's October 19, 2021 news release, which has returned promising results comparable with the strongest results at Baptiste.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite.

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/06/c4165.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/06/c4165.html