February 13, 2023

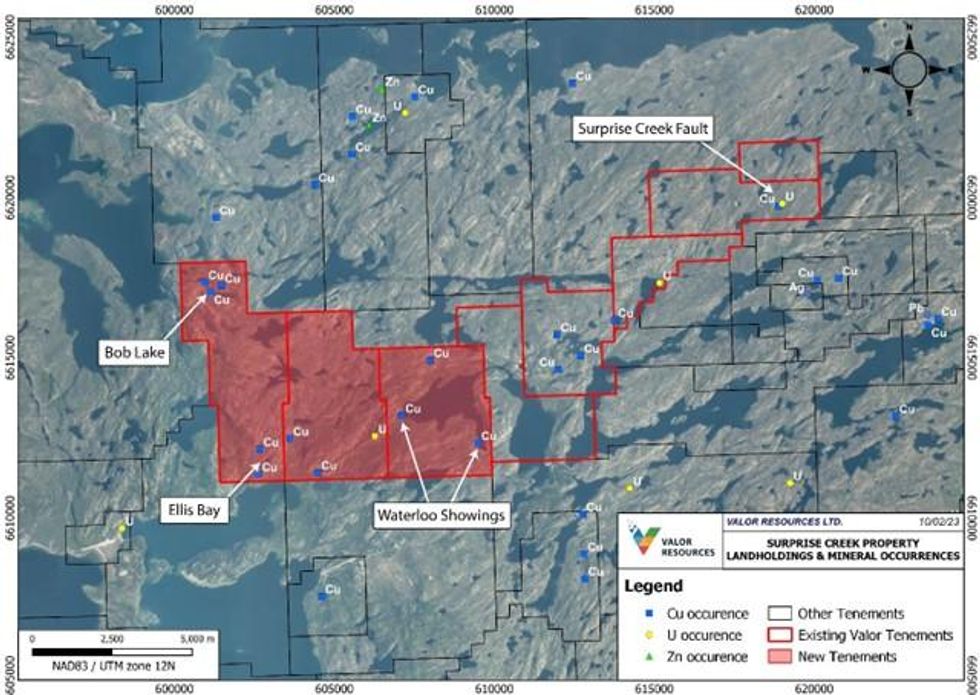

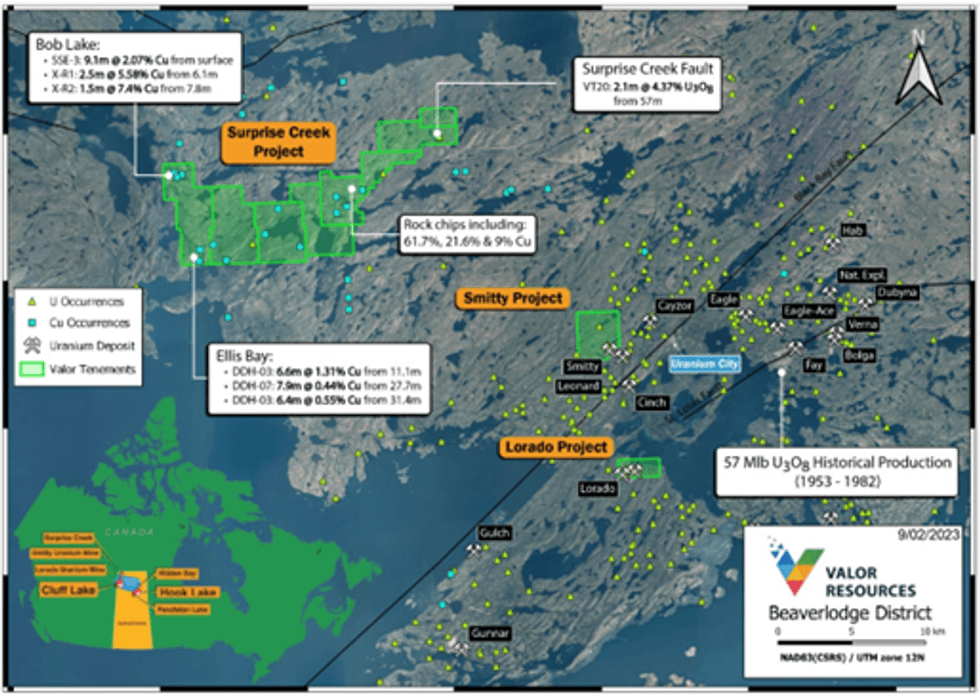

Valor Resources Limited (Valor or the Company) (ASX: VAL) is pleased to advise that a detailed historical exploration data review of three recently staked mineral claims at the Surprise Creek Uranium Project, located near the Beaverlodge Uranium District in northern Saskatchewan, Canada, (see Figure 2) has identified strong prospectivity for copper mineralisation.

HIGHLIGHTS

- Historical exploration data review completed for three recently staked mineral claims immediately west of the Surprise Creek Uranium Project

- The new mineral claims cover an area of 44km2 and include three significant historical copper showings – Ellis Bay, Bob Lake and Waterloo

- Bob Lake – historical drilling results reported of up to 9m @ 2.07% Cu and 27.3g/t Ag from surface and 2.5m @ 5.58% Cu and 17.43g/t Ag from 6.1m

- Ellis Bay (Zone 25) – historical drilling results reported of up to 6.6m @ 1.31% Cu from 11m and 4m @ 0.60% Cu from 8m.

- Waterloo – historical channel sampling of trenches with results reported up to 1.39% Cu over 4.5m and 2.41% Cu over 3m

- Postulated that the copper occurrences are unconformity-related and/or sediment-hosted stratiform copper

- Field work to commence in mid-2023 with geological mapping and rock chip sampling to validate the historical copper occurrences and improve geological understanding.

The new mineral claims were acquired in November 2022 (see ASX Announcement 22 November 2022 titled “Valor increases landholding at Surprise Creek”) and cover an area of nearly 44km2 to the west of the Surprise Creek Project.

The data review has highlighted three significant copper occurrences, in particular the Ellis Bay and Bob Lake Prospects. Trenching, channel sampling and drilling was undertaken on these two prospects in the 1950s-70s, with minimal modern exploration completed since that time.

Drilling results of up to 9m @ 2.07% Cu and 27.3g/t Ag from surface and 2.5m @ 5.58% Cu and 17.43g/t Ag from 6.1m were reported at Bob Lake and 6.6m @ 1.31% Cu from 11m at Ellis Bay. Due to the historical nature of some of this data, some aspects of the sampling, assaying and drilling cannot be verified at this time and therefore caution must be applied, and some data has been excluded where the results are not considered accurate. The Company intends to verify the copper occurrences during the 2023 field season by completing geological mapping and geochemical sampling over these targets.

Valor Executive Chairman, George Bauk, commented: “The recently staked claims at the Surprise Creek Project cover an area that has lacked any significant exploration activity over the past 40 years. The copper results generated in the 1950s-1970s have never been followed-up using modern exploration techniques, providing an exceptional opportunity for new discoveries”.

Limited historical drilling from the Bob Lake and Ellis Bay prospects returned significant copper results. These results, together with the copper mineralisation that we have previously reported from the Surprise Creek Project during the 2022 field program and other regional copper occurrences, suggests potential for a significant mineralising system over a widespread area. This presents as a high-quality regional copper exploration opportunity, which has largely been overlooked for the last 40 years”.

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00