July 27, 2023

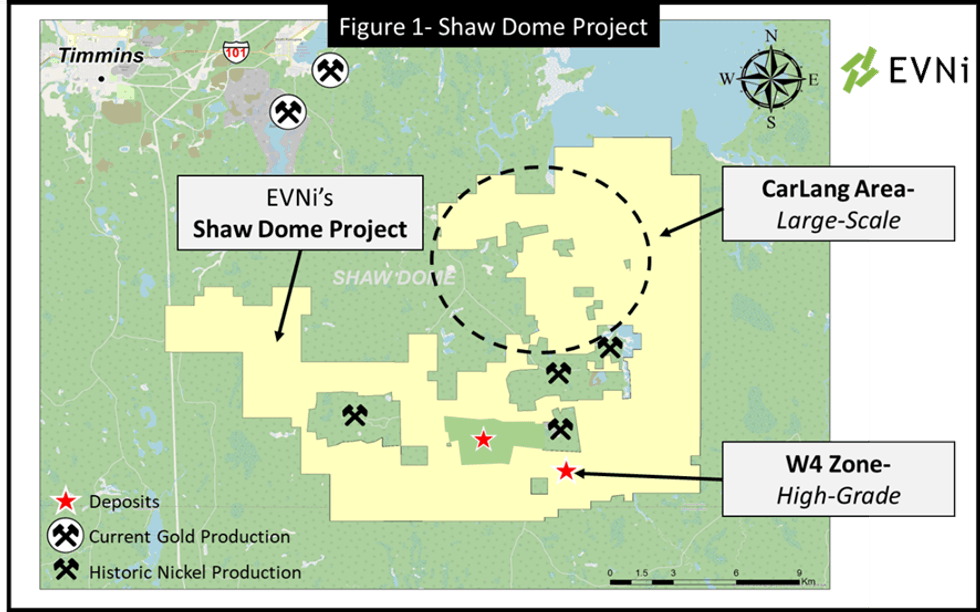

EV NICKEL INC. (TSXV:EVNI) ("EVNi" or the "Company") today announced the completion of a National Instrument 43-101 technical report ("Technical Report") supporting the updated mineral resource estimate ("MRE") for the W4 Nickel Deposit ("W4 Deposit"), a High-Grade nickel deposit in the southeast of its Shaw Dome Project (Figure 1).

- Measured + Indicated Resources of 31.3M pounds at 0.98% Ni (2.1x the 2010 historical estimate).

- Inferred Resources of 12.1M pounds at 0.98% Ni (3.6x the 2010 historical estimate).

- 72% of the W4 Deposit Mineral Resource Estimate Ni lbs are in the Measured and Indicated categories.

- Significant resource expansion potential exists at the W4 Deposit as it is open at depth and along plunge.

The Technical Report was prepared in accordance with Canadian Securities Administrators' NI 43-101 Standards of Disclosure for Mineral Projects and Form 43-101F1 (together "NI 43-101") and is now available on the Company's website (evnickel.com) for review and will soon be posted to SEDAR (sedar.com), once today's SEDAR+ rollout is completed.

"The completion of this Updated Mineral Resource for our High-Grade W4 Deposit is another major milestone for EV Nickel," said Sean Samson, President & CEO. "More than doubling W4's total Measured, Indicated, and Inferred resources to over 43M pounds of nickel sets up our two-track strategy of defining near surface, High-Grade nickel resources and combining them with the Large-Scale projects in the Shaw Dome."

"The W4 Nickel Deposit is an excellent example of the High-Grade nickel potential of the Shaw Dome Project," said Paul Davis, Vice President Exploration. "The Shaw Dome has many analogies with the Kambalda District of Western Australia including the host rocks, sulphur sources and the clustering of High-Grade nickel deposits along defined stratigraphic horizons. The Shaw Dome has to be considered one of the top prospects in the world to host additional High-Grade nickel as demonstrated by the current and historical exploration success. I am confident with additional exploration, that more High-Grade nickel deposits will be defined within the EVNI property."

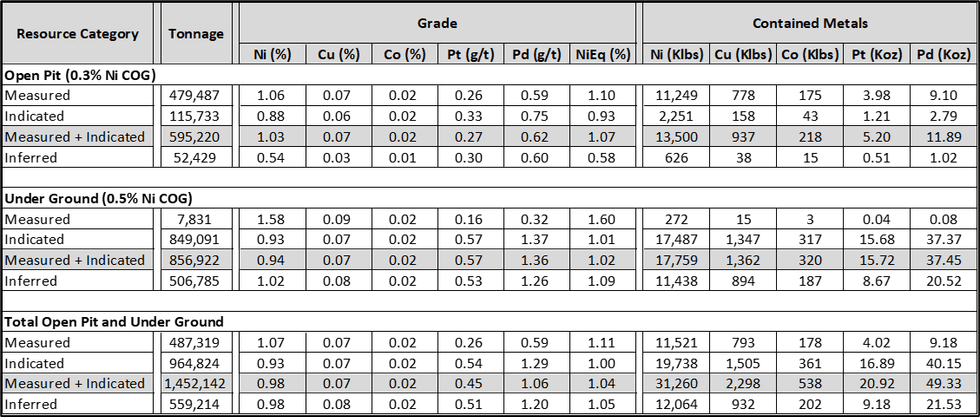

EVNi completed diamond drilling on the W4 Nickel Deposit between 2021 and 2023, combing this new data with historical drilling completed on the Langmuir W4 Zone by Golden Chalice Resources (see Technical Report filed on SEDAR dated April 12, 2021) to complete an updated MRE in accordance with NI 43-101. The updated MRE reports Measured Resources of 0.49Mt or 11.5M pounds of contained nickel, Indicated Resources of 0.96Mt or 19.7M pounds of contained nickel, and Inferred Resources of 0.56Mt or 12.1M pounds of contained nickel (Table 1). This Updated MRE was modeled to ~500 m from surface while the 2010 historical resource estimate was to ~400 m from surface. The W4 Nickel Deposit remains open at depth and along plunge.

Table 1 - Current Mineral Resource Estimate for the W4 Nickel Deposit, Shaw Dome Project, Ontario.

Notes to Table 1:

- The independent Qualified Person for the MRE, as defined by NI 43-101, is Mr. Simon Mortimer, (FAIG #7795) of Atticus Geoscience Consulting S.A.C., working with Caracle Creek International Consulting Inc. The effective date of the MRE is June 9, 2023.

- These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The MRE was prepared following the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (November 29, 2019).

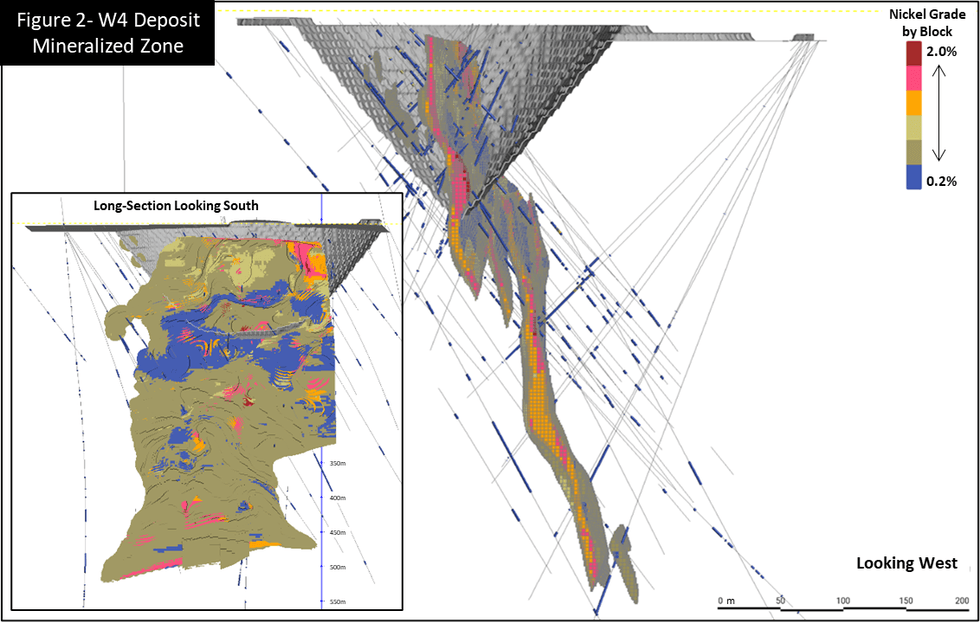

- 3D geological modelling revealed that the mineralization exists as a single steeply dipping continuous unit that have been faulted, thickened, and displaced along five fault surfaces. The estimation has been carried out using "un-faulting" techniques, restoring the mineralization within each fault block to its pre-faulted position, estimating and then returning each block to its present location.

- Mineralized domains were based on a combination of lithological and structural contacts with internal boundaries based on the distribution of nickel mineralization, utilizing thresholds of 0.2% Ni to define the Low-grade Nickel Domain and 0.5% Ni to define the High-grade Nickel Domain.

- Geological and block models for the MRE used core assays (1,977 samples), data and information from 70 surface diamond drill holes (23 from EVNi and 47 historical). The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by EV Nickel Inc.

- Estimates have been rounded to three significant figures for Measured and Indicated categories, and two significant figures for the Inferred classification.

- The resource estimates have been constrained by a conceptual open pit using the following optimization parameters, as reviewed and agreed to by the QP. Metal prices used were (US$) $8.00/lb nickel, $3.25/lb copper, $13.00/lb cobalt, $900/oz for platinum and $1,200/oz for palladium. An overall pit slope of 50 degrees was used. Mining and processing costs (US$) were based on benchmarking from similar deposit types in the area, utilizing a mining cost of $3.80/t, a processing cost of $45.00/t, a G&A cost of $5.00/t, and a selling cost of $8/lb. All resources below the conceptual pit are considered extractable via underground mining scenarios. A cut-off grade of 0.30% Ni was applied to the resource block model for the portion that could be extracted via open pit mining method and a cut off grade of 0.5% Ni applied to the portion of the block model below the optimized conceptual pit.

- The MRE comprises nickel, cobalt, copper, platinum and palladium and considers a calculation of nickel equivalent ("NiEq"), calculated using the metal prices (US$) $8.00/lb nickel, $3.25/lb copper, $13.00/lb cobalt, $900/oz for platinum and $1,200/oz for palladium, and considering recoveries of 85% for nickel, 80% for cobalt, 70% for copper, 50% for platinum, and 50% for palladium.

- The block model was prepared using Micromine 2020. A 3 m x 3 m x 3 m block model was created, with sub-blocks to 1 m x 1 m x 1 m. Drill composites of 1.5 m intervals were generated within the estimation domains, and subsequent grade estimation was carried out for Ni, Cu, Co, Pt and Pd using Ordinary Kriging interpolation method.

- Grade estimation was validated by comparison of input and output statistics (Nearest Neighbour and Inverse Interpolation methods), swath plot analysis, and by visual inspection of the assay data, block model, and grade shells in cross-sections.

- Density estimation was carried out for the mineralized domains using the Ordinary Kriging interpolation method, on the basis of 228 specific gravity measurements collected by EVNi during the core logging process and 90 from historical reporting, using the same block model parameters of the grade estimation. As a reference, the average estimated density value within the mineralised domain is 2.82 g/cm3 (t/m3).

For context - equivalent number of EVs in the Resource's contained nickel

It is estimated that the average electric vehicle battery requires ~145 pounds of nickel (Bloomberg New Energy Finance ("BNEF") estimate, for 100kWh battery1) and based on this, the Contained Nickel in this Updated Mineral Resource Estimate represents the equivalent nickel which would be used in roughly 300K electric vehicles.

On a Nickel Equivalent basis, the Measured & Indicated Resources of 31.3M pounds at 0.98% Ni, works out to 33.0M NiEq pounds (2.16x the 2010 historical estimate) and the Inferred Resources of 12.1M pounds at 0.98% Ni works out to 12.7M pounds (3.71x the 2010 historical estimate).

Core Handling and Assay-QA/QC Procedures

Drill core samples from EVNi drilling at the W4 Nickel Deposit were cut or whole core sampled and bagged at the core logging facility located near the Shaw Dome Project and transported to ALS Canada Ltd. ("ALS") for analysis. Samples, along with certified standards and blanks, included by the Company for quality assurance and quality control, were prepared and analyzed at ALS. Samples were crushed at ALS to 70% less than 2 millimetres. A riffle split was pulverized to 85% passing 75 microns. Nickel, copper, cobalt and sulphur are analyzed by sodium peroxide fusion with an ICP finish and platinum, palladium and gold by fire assay and an ICP-AES finish. These and future assay results may vary from time to time due to re‒analysis for quality assurance and quality control purposes.

Calculation of the New Resource Payment

As part of the original consideration paid to Rogue Resources (TSX-V: RRS, "Rogue") for vending the Langmuir Project to EVNi in 2021, Rogue is owed a future payment based on the size of an updated new mineral resource estimate (the "New Resource Payment"). This Updated MRE now triggers this payment by EVNi and it is due within 60 days of this Technical Report being filed. The payment has a calculation formula, and is capped at $5,000,000, to be paid in cash, EVNi shares, or a combination thereof to be determined by EVNi. Originally due in 2021, Rogue amended the Langmuir Asset Purchase Agreement, granting until the end of 2023 for EVNi to complete the Updated MRE. In exchange for this amendment, EVNi agreed to provide Rogue with access to an advance on the New Resource Payment, and as of July 31, 2023, that will total $375,284, including the interest due. This advance will be subtracted from the New Resource Payment amount due.

EVNi has indicated to Rogue that it plans to settle the remaining value of the New Resource Payment completely in shares and independent directors of both companies will be in communication about the specifics.

About EV Nickel Inc.

EV Nickel's mission is to accelerate the transition to clean energy. It is a Canadian nickel exploration company, focussed on the Shaw Dome Project, south of Timmins, Ontario. EV Nickel has over 30,000 hectares to explore across the Shaw Dome and has identified >100 km of additional favourable strike length. The Shaw Dome includes the High-Grade W4 Deposit- with a Resource which defined 2.0M tonnes @ 0.98% Ni for 43.3M lbs of Class 1 Nickel across Measured, Indicated and Inferred and the Large-Scale CarLang Area with more than 10km of mineralization and where the first 20% contains the A Zone- with a Resource which defined 1.0B tonnes @ 0.24% Ni for 5.3B lbs of Class 1 Nickel across Indicated and Inferred. EV Nickel owns the trademark for Clean Nickel and plans to grow and advance a Clean Nickel™ business, targeting the growing demand from the electric vehicle battery sector. The Company is focused on a 2-track strategy: Track 1- to produce High-Grade Clean Nickel™ (starting with W4) and Track 2- an integrated Carbon Capture & Storage project with Large-Scale Clean Nickel™ production (starting with CarLang).

The Company acknowledges the financial contributions being provided by the Province of Ontario's Critical Minerals Innovation Fund ("CMIF) and the Government of Canada through the Industrial Research Assistance Program ("IRAP") in assisting with the implementation of EVNi's Clean Nickel™ Research and Development Program.

Qualified Person

The Qualified Person for the MRE reported herein and as defined by NI 43-101, is Mr. Simon Mortimer, FAIG #7795, Principal Geoscientist at Atticus Geoscience Consulting S.A.C., working with Caracle Creek International Consulting Inc.

The Company's Projects are under the direct technical supervision of Paul Davis, P.Geo., and Vice-President of the Company. Mr. Davis is a Qualified Person as defined by NI 43-101. He has reviewed and approved the technical information in this press release. There are no known factors that could materially affect the reliability of the information verified by Mr. Davis.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking information. Such forward-looking statements or information are provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Any such forward-looking information may be identified by words such as "anticipate", "proposed", "estimates", "would", "expects", "intends", "plans", "may", "will", and similar expressions. Forward-looking statements or information are based on a number of factors and assumptions which have been used to develop such statements and information, but which may prove to be incorrect. Although EV Nickel believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct. Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, changes in business plans and strategies, market conditions, share price, best use of available cash, the ability of the Company to raise sufficient capital to fund its obligations under various contractual arrangements, to maintain its mineral tenures and concessions in good standing, and to explore and develop its projects and for general working capital purposes, changes in economic conditions or financial markets, the inherent hazards associated with mineral exploration, future prices of metals and other commodities, environmental challenges and risks, the Company's ability to obtain the necessary permits and consents required to explore, drill and develop its projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives, changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with such laws and regulations, the Company's ability to obtain required shareholder or regulatory approvals, dependence on key management personnel, natural disasters and global pandemics, including COVID-19 and general competition in the mining industry. These risks, as well as others, could cause actual results and events to vary significantly. The forward-looking information in this press release reflects the current expectations, assumptions and/or beliefs of EV Nickel based on information currently available to the Company. Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or expressly qualified by this cautionary statement.

Contact Information

For further information, visit www.evnickel.com

Or contact: Sean Samson, President & CEO at info@evnickel.com.

EV Nickel Inc.

200 - 150 King St. W,

Toronto, ON M5H 1J9

www.evnickel.com

EVNI:CA

The Conversation (0)

05 January 2022

EV Nickel

Accelerating the Transition to Clean Energy

Accelerating the Transition to Clean Energy Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00