- WORLD EDITIONAustraliaNorth AmericaWorld

15 Canadian Crypto ETFs in 2026

What Was the Highest Price for Silver?

What Was the Highest Price for Gold?

USD/JPY Rate Check Helps Boost Gold Above US$5,000

Is Now a Good Time to Buy Bitcoin?

Overview

Gold has historically been considered an inflation-resistant investment that is a reliable addition to any investor's portfolio. Even though the price of gold can experience drastic changes similar to a stock or bond, gold typically exhibits an overall consistent price increase when viewing it as a long-term investment.

While many investors may look for companies with new exploration projects, past-producing gold mines often offer some of the best exposure to gold. Companies that redevelop past-producing mines have a quicker path to production by leveraging existing infrastructure, workforce and historical data. Combined with the right management team, this provides ideal conditions for a successful mining venture.

Satori Resources (TSXV:BUD) is one such company. Its flagship project is the 100 percent owned Tartan Lake Gold project near Flin Flon, Manitoba. The past-producing Tartan Lake Gold Mine was operational from 1986 to 1989 but was shut down when the price of gold fell below $400 per ounce in 1989

The Flin Flon Snow Lake Greenstone Belt, home of the Tartan Lake Gold project, is considered one of the largest and most prolific greenstone belts in the world. Greenstone belts are unique geologic features that can contain numerous minerals, such as copper, silver and zinc. More importantly, there is a strong presence of gold deposits in greenstone belts. The Tartan Lake Gold project contains 20 mineral claims across 2,670 hectares, and produced 47,000 oz of gold from 1987 to 1989.

In an interview with INN, Satori Resources CEO Jennifer Boyle shared that the company has a dual-track strategy to advance the Tartan Lake Gold project. This strategy includes a primary focus of resource expansion (exploration) while simultaneously evaluating putting the mine back into production.

Satori Resources has a strong management team with the experience required to help nurture this promising project. Jennifer Boyle, the President and CEO, brings decades of experience as a mining executive who has a successful history of co-founding and re-organizing mineral companies. Peter Shippen, Chairman, has 20 years of experience as an investor in capital markets and brings his financial expertise to the company. Wes Hanson is the lead Technical Director who worked underground at the Tartan Lake Gold project as chief geologist during the time that the mine was in production (1986 to 1989). Wes brings a wealth of historic information and directs the technical activities at the Tartan Lake Gold project. Doug Flegg, Director, brings 30 years of mining and finance experience, along with a technical background in geology. Jeffrey Kilborn, director, is a seasoned finance executive.

Company Highlights

- Satori's July 2021 drilling campaign extended the Main Zone over 200 metres down plunge, evidencing that mineralization remains open at depth, along plunge.

- The grade and thickness of the mineralization in certain holes drilled in the summer of 2021 are not only consistent with the historical drill results but are also comparable with results currently being reported at some of Canada's most exciting gold discoveries in Red Lake and Newfoundland.

- Satori drilled longest and highest grade interval at the South Zone, averaging 9.59 g/t Au over 11.75 metres, and Main Zone returned 9.73 g/t Au over 4.15 metres.

- For the first time in decades this project is benefitting from a new team applying modern day techniques in a robust gold environment. The entire project area has been overlooked for decades and is sparsely-drilled.

- During fall 2021 ground reconnaissance program investigating remote showings, the low water levels exposed significant outcrop along the shoreline of Batters Lake, exposing extensive zones of shearing with favourable quartz-carbonate-tourmaline veining and sulphide mineralization similar to what is observed at the Main and South Zones.

- Satori Resources holds a 100 percent interest in the Tartan Lake Gold project (subject to a 2% NSR interest with a buy-back right) which includes a 450 mt/day processing plant.

- The Tartan Lake Gold project sits upon one of the largest greenstone belts on the planet, a geologic feature that is known for containing gold

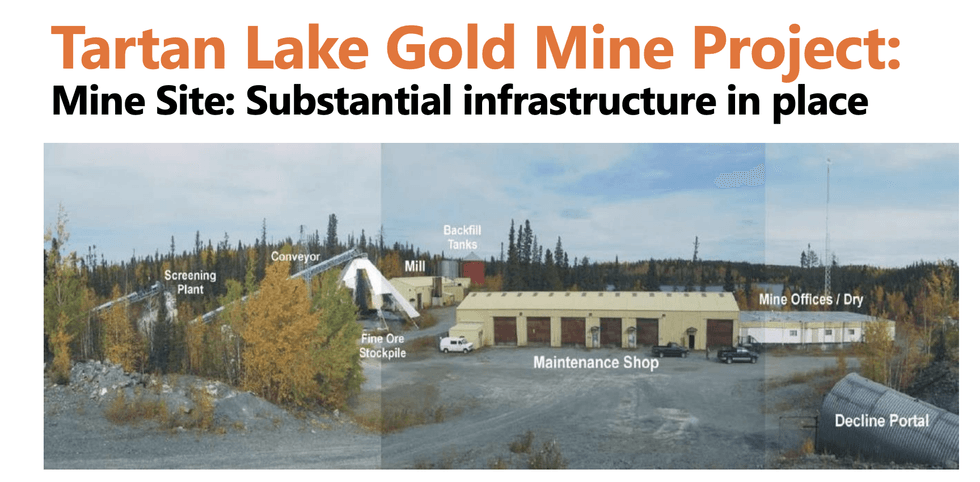

- The project has existing infrastructure that will reduce the time and resources required to become operational

- Previous operations in the Tartan Lake Gold Mine produced 47,000 ounces of gold between 1987 and 1989

- Satori Resources is operated by a strong management team

Get access to more exclusive Gold Investing Stock profiles here