November 28, 2023

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to announce that the Company has applied for multiple highly prospective exploration tenements adjacent to and surrounding its existing Tiris Uranium Project ("Tiris” or “Tiris Project”) in Mauritania.

KEY POINTS:

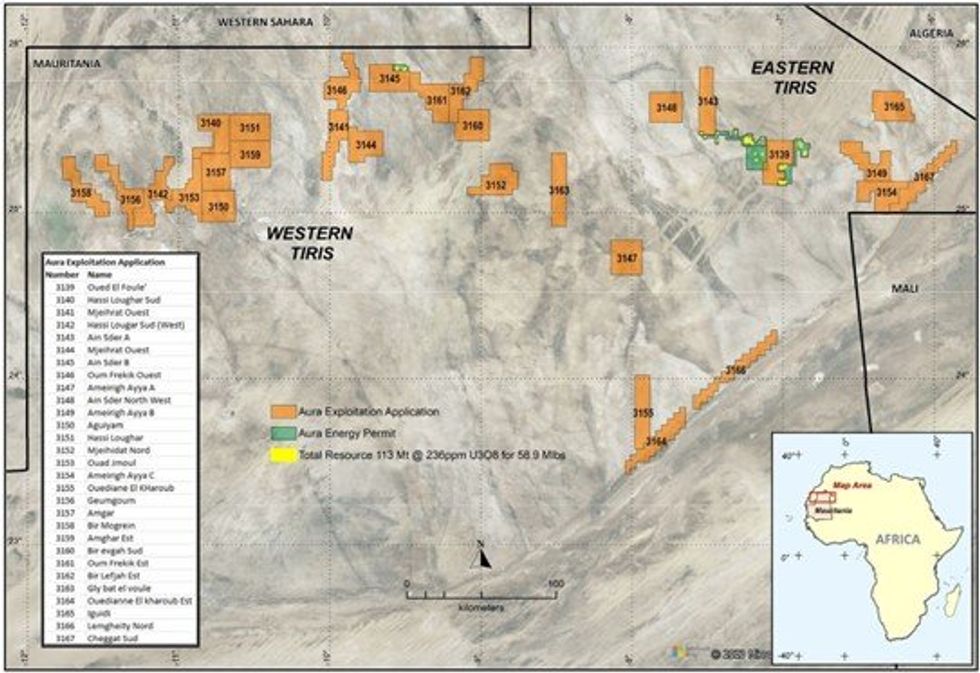

- Aura Energy Ltd has applied for an additional ~13,000 km2 of exploration tenements in the Tiris Uranium Province in Mauritania.

- The new exploration license applications target areas with strong synergies with the Tiris West resource of 11.2Mlbs (16.4Mt @ 305ppm U3O8)1.

- The goal is to confirm Aura’s radiometric analysis that the Tiris region is a world-class uranium province.

- Aura believes the Tiris Uranium Project now has the potential to confirm a world-class scale.

- The Tiris Project's Front-End Engineering Design (FEED) study is approaching completion, with Tiris East exploration and preconstruction activities to commence shortly.

Aura is delighted that His Excellency Mr. Nany Chrougha, Mauritania’s Minister of Mines, is supporting His Excellency President Mohamed Ould Cheikh El Ghazouani’s goal of ensuring the development of a strong resources industry in Mauritania. This goal has seen the reopening of the Mining Cadastre and the Ministry has begun accepting applications for exploration tenure, including Aura’s application.

Aura has completed the application processes and filed exploration tenure applications covering an extensive 13,000 km2. The new tenure application areas were selected following a detailed 12-month evaluation program based on historical drilling and radiometric data and analogues from the Company’s successful uranium discoveries, which underpin the Tiris Uranium Project. This analysis led to the recent Exploration Target announced for the existing Tiris East Resource areas2, for which drilling is planned to commence before the end of 2023. The Company is confident that the proven model for successful exploration can be extended across the wider Tiris Zemmour region by extending the exploration footprint.

Subject to the successful granting of these applications, Aura will work to progressively confirm and test exploration targets within these tenements through 2024 and 2025.

Chairman Phil Mitchell commented:

“Our geologists are confident that the Tiris Zemmour region of Mauritania is a world-class uranium region, similar in importance to the uranium market as the Pilbara region in Western Australia is for iron ore. We believe Aura’s uranium-enriched carnotite zone extends across the north-eastern Mauritania area of Tiris Zemmour, and our exploration success to date provides validation for pursuing further strong growth platform for Aura’s shareholders and our Mauritanian partners.

“With the potential for our current Tiris West resource to be materially expanded, the Company strategy is to:

- progressing development of the already defined resource in Tiris East as a new uranium producer; and

- undertaking a significant resource expansion exploration study on the new tenure.”

Aura’s Managing Director and CEO David Woodall said,

"Aura Energy has already established a commanding position with its Mineral and Reserves and Resources at Tiris West, which has put us in a position to consider a final investment development decision in the coming months.

“Combined with our recently announced Exploration Target, these tenement applications – if successful – will give us an opportunity to be a driving force to realise the full potential of this region, which we believe could be truly world-class in scale.

“Our development strategy for Tiris is complemented by our exploration strategy, which aims to grow our resources and allow scaled-up production over time in a capital-efficient manner.

“We look forward to working with our stakeholders to progress our applications, ultimately growing the Tiris Project into a global-scale project that contributes to Mauritania's economic and social development.”

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00