October 30, 2024

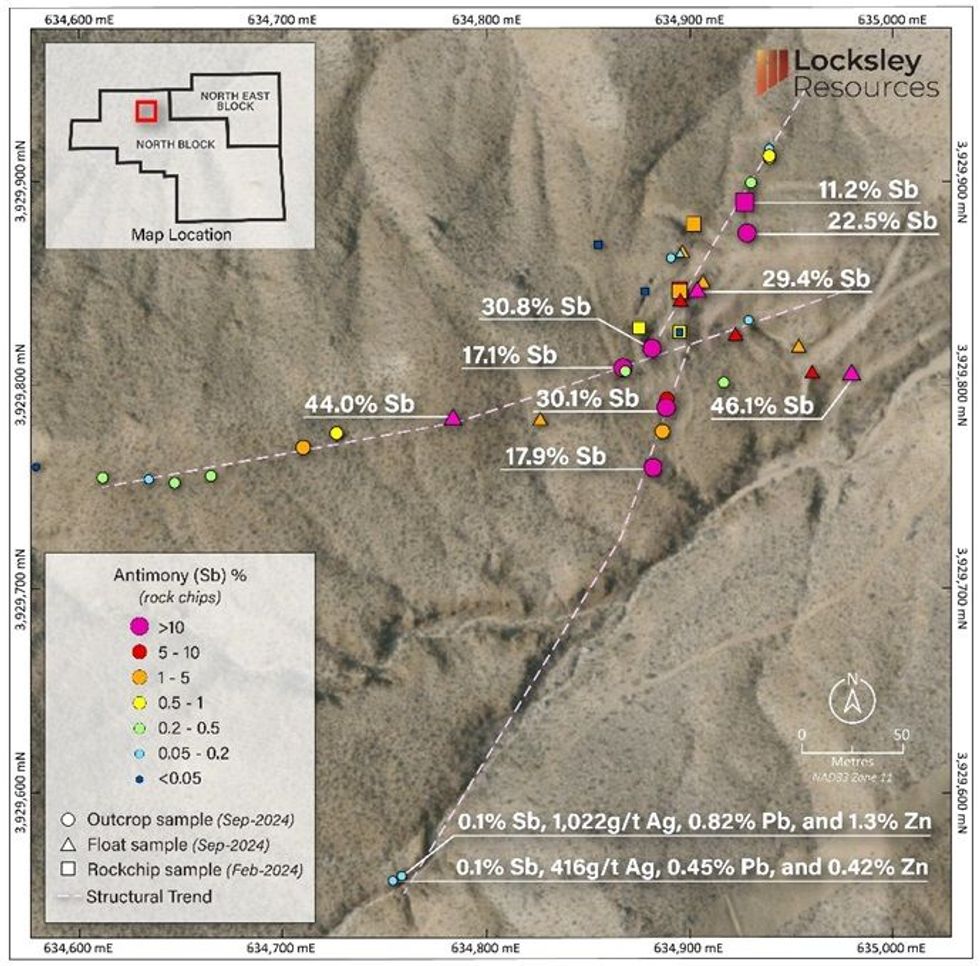

Locksley Resources Limited (ASX:LKY) (“Locksley” or “the Company”) is pleased to announce high-grade antimony grades up to 46% Sb from the recent rock chip sampling program. Eighteen (18) rock chips returned grades in excess of 1.4% Sb with eight (8) returning grades over 17% Sb. Since mid-2023, Locksley Resources has completed four surface sampling programs, mainly focused on detecting rare earth minerals at the Mojave Project, CA, located 45 minutes from Las Vegas. The most recent surface sampling program focused on the Desert Antimony Mine and potential for high-grade antimony mineralisation to be present along strike of the historically mined mineralised structures in an east-west and north-south direction. The sampling program revealed polymetallic mineralisation along strike of the mineralised structures suggesting a zoned reduced intrusive related system (RIRS).

Highlights:

- Extremely high-grade rock chip assays up to 46% antimony received

- 8 rock chip assays returned values over 17% antimony with over 18 of the returned assays over 1.4% antimony

- High-grade antimony is represented by historic workings developed on the quartz-calcite-stibnite veins

- Drill targeting and drilling approval application being prepared for submission to the Bureau of Land Management, alongside the Plan of Operations & Environmental Assessment Plan

- Antimony is listed as a critical mineral by the U.S. Department of Interior as it is used in a wide variety of military, energy, industrial and consumer applications

- U.S. has very limited domestic mined sources of Antimony and China has restricted export of antimony

- Funding opportunities for exploration through the Department of Défense (DoD) is being investigated with the next solicitation for funding through the Défense Industrial Base Consortium (DIBC) being considered

The Company is preparing drilling targets post receiving the recent high-grade antimony results and has commenced work to submit a drilling approval application to the U.S. Bureau of Land Management, which includes a comprehensive Plan of Operations and Environmental Assessment Plan. As antimony is designated a critical mineral by the U.S. Department of Interior, due to its widespread use in military, energy, industrial, and consumer sectors, domestic supply is crucial for national security and economic stability. With China recently restricting global exports, the U.S. faces a significant supply gap, highlighting the importance Locksley’s antimony asset could play if it can be commercialised. The Company is exploring funding opportunities through the Department of Defense, with particular interest in the next Defense Industrial Base Consortium (DIBC) solicitation to support the advancement of the Mojave Desert Antimony project.

Locksley Resources Limited Managing Director, Steve Woodham commented:

“The high-grade results from the follow-up sampling around the Desert Antimony Mine have exceeded expectations and highlights how well mineralised the property is, and not just for REEs. The surface strike length based on the recent high-grade results looks to be over 400m which has us very encouraged and looking forward to commencing a drill program post receiving the necessary approvals”.

We certainly look forward to sharing the outcomes of this review and unlocking value for our shareholders.”

Click here for the full ASX Release

This article includes content from Locksley Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Locksley Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

29 September 2025

Locksley Resources

High-grade antimony and rare earths prospects for a strategic, US critical minerals play

High-grade antimony and rare earths prospects for a strategic, US critical minerals play Keep Reading...

10h

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

11h

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

19 February

Mercado Minerals Provides Exploration Update on Copalito; Reveals New Vein Discoveries

Mercado Minerals Ltd. (CSE: MERC) ("Mercado" or the "Company") is pleased to report continued progress from ongoing exploration activities at its flagship Copalito Project ("Copalito" or the "Project"). The Company's technical team in Mexico has been actively mapping, sampling, and advancing... Keep Reading...

Latest News

Sign up to get your FREE

Locksley Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00