September 11, 2024

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to present the updated production target improves economics at Tiris Uranium Project.

KEY POINTS:

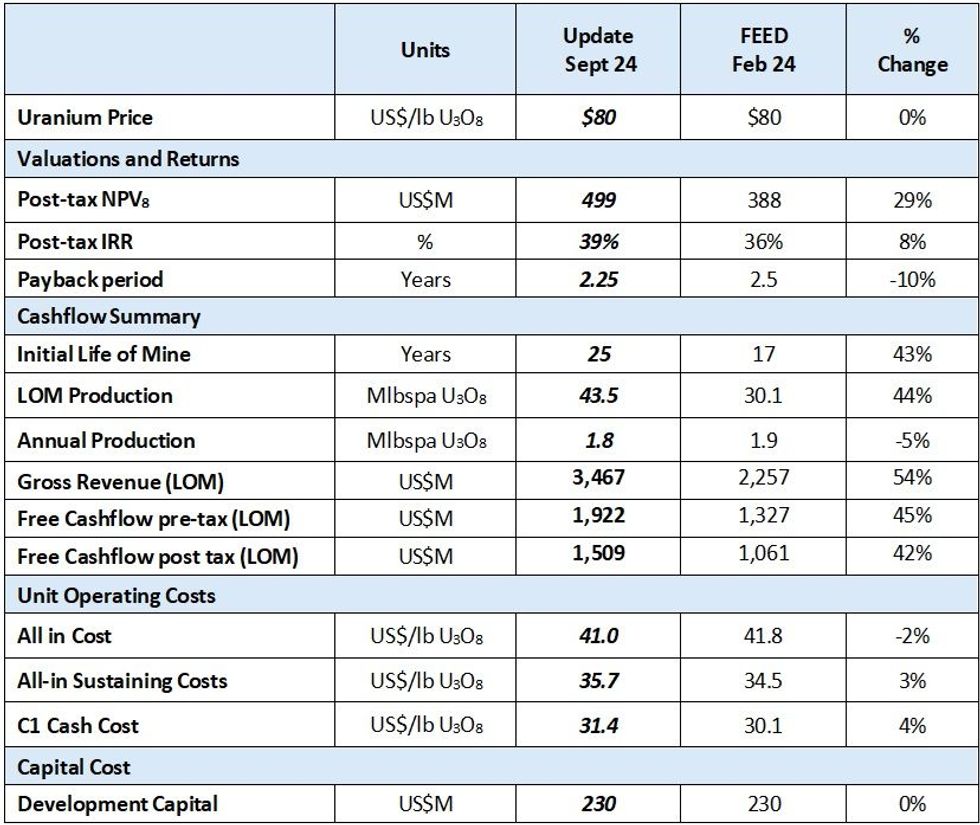

- The February 2024 Front End Engineering Design (“FEED”)1 study production target and economics has been updated using the recently expanded 91.3Mlbs U3O8 Mineral Resource2 at the Tiris Uranium Project in Mauritania

- Production Target Update increased the total Project U3O8 life of mine production by 44% to 43.5Mlbs U3O8 and extended the mine life from 17 years to 25 years

- Project economics have also significantly improved:

- NPV8% of US$499 million (A$734 million) an increase of 29%

- IRR of 39% post tax and payback only 2.25 years

- Life of Mine post tax cash flows of US$1,509 million an increase of 42%

Aura’s Managing Director and CEO, Andrew Grove commented:

"The updated economics from the Production Target Update clearly show the very significant value inherent at Tiris as Aura Energy rapidly progress towards the funding and development of the Project. The US$4.5 million drilling program undertaken earlier this year not only delivered a 55% increase In Mineral Resources3 but has also demonstrated over US$100 million of additional Project NPV, now standing at US$499 million. It is our strong belief that there is still very significant potential to continue to add to the Mineral Resource and Reserve inventory around Tiris East and across the whole northern Mauritanian region, within the 13,000km2 of tenements that Aura has under application4.

With the current large scale of the Mineral Resource Estimate inventory and future resource growth potential, the prospect for significant increase in the uranium production rate from Tiris once in production is very real and we are working on assessing, analysing and shortly presenting the results from the work currently being undertaken.

The updated Production Target study has not only increased the mine life and significantly improved the project economics but has simplified and de-risked the early mining sequence and brought forward some uranium production by 21% in the first year, and by 9% over the first five years compared to the FEED study5. These improved metrics will further support the funding process which is currently underway with indicative offers due this quarter.

The Company is rapidly working towards achieving the Final Investment Decision by the end of the current quarter with many activities underway including water drilling, engagement with EPCM contractors and operational readiness preparations. And we look forward to providing further updates on progress.”

Key highlights and outcomes of the updated Production Target:

The update to the production target for the FEED study5 has allowed revenue to be moved forward in the mining schedule and also increased the overall life of mine.

- Robust base case project financial economics demonstrated by post-tax NPV8 of US$499M (A$734M) with IRR of 39%, and a 2.25-year payback at realised uranium price of US$80/lb U3O8

- At uranium prices of US$100/lb U3O8 the economics increase to post-tax NPV8 of US$779M (A$1,145M) with IRR of 55%

- Initial mine life increased from 17 years to 25 years, producing an average 1.8Mlbspa U3O8 from the 2.0Mlbspa U3O8 capacity process plant

- Life of Mine (“LOM”) uranium production increased from 30.1Mlbs U3O8 to 43.5Mlbs U3O8

- 93% Measured and Indicated Mineral Resources in mining schedule during the first four years, LOM Inferred material totals 33% mostly beyond ten years in the mining schedule

- The open pit mining is a simple, low-risk, shallow, free digging operation without the need for crushing and grinding

- Beneficiation delivers a high-grade leach feed averaging 2,217ppm U3O8 increasing from 1,997ppm U3O8 (over first 5 years) and overall remains approximately the same at 1,752ppm U3O8 from 1,743ppm U3O8 (LOM) at a very low average cost of US$9.16/lb U3O8

- AISC has increased to US$35.7/lb U3O8, an escalation of 3% on the 2024 FEED estimate5, largely due to a minor increase in waste to ore strip ratio from 0.7 to 0.8 waste to ore tonnes

- CAPEX of US$230M, was not re-evaluated in this update and remained unchanged from the FEED study7

- Uranium production planned within 18 months of Final Investment Decision

- Modular design provides opportunities for further capital efficient expansion and scalability

- The construction and operation of the Tiris Uranium Project will deliver significant and ongoing benefits to the people of Mauritania

Modular design provides opportunities for further capital efficient expansion and scalability

The update to the Production Target based on the successful exploration drilling program to update the Mineral Resource Estimate6 confirms the value in continued growth of the Tiris Project. The modular circuit design shown in Figure 1 allows flexibility in production scheduling and potential for rapid and simple expansion of production capacity.

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00