March 18, 2025

New acquisition complements Trigg’s flagship WCC deposit and the Company’s vision to become a primary antimony play and future global supplier of antimony

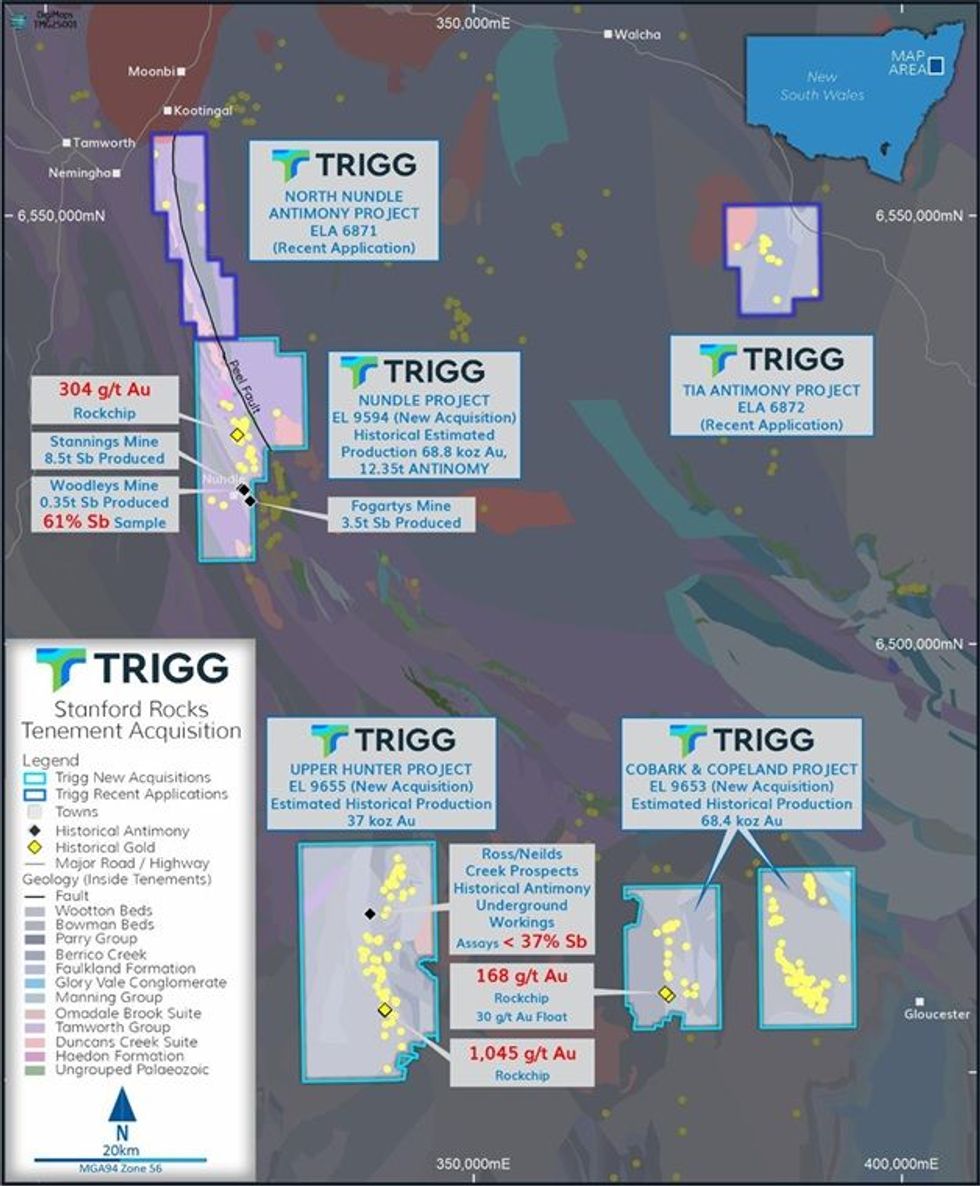

Trigg Minerals Limited (ASX: TMG| OTCQB: TMGLF) ("Trigg" or the "Company") is pleased to announce the acquisition of the Nundle, Upper Hunter and Cobark/Copeland Projects, a highly prospective tenement package covering a significant portion of the historic Nundle Goldfield and three additional historic goldfields within the New England Orogen (NEO) in northern New South Wales.

HIGHLIGHTS

- Trigg Minerals signs a binding purchase agreement to acquire 100% rights of the Nundle, Upper Hunter, Cobark/Copeland projects, conditional upon completion of due diligence. Covering a total area of 1,039.7 km².

- These projects will be developed as Trigg’s second flagship exploration asset behind its primary, advanced stage high-grade Wild Cattle Creek deposit. Trigg will have two exploration teams advancing both these new projects and Wild Cattle Creek simultaneously.

- The package includes five historical antimony deposits, with rock chips grading 61% Sb and 9.7% Sb, and 12 tonnes of recorded Sb production (EL 9594, Nundle), plus a 37% Sb sample collected from 12m down adit indicating potential mineralisation at depth (EL 9655, Upper Hunter).

- The tenements also feature 60+ historical gold mines/occurrences across each tenement with historical recorded high-grade production. As an example, Standard Reef was worked in 1904 with an estimated production of 15,000oz at 53.8 g/t Au.

- Total historical production across the tenement package is estimated at 174,000 oz Au without modern mining techniques and significantly lower gold prices. Initial review suggests that mineralisation is interpreted to be open along strike and down depth and with considerable high grade rock chip grades ranging from 30 g/t Au to 1,045 g/t Au.

- The addition of the Nundle Project to TMG’s North Nundle holdings extends the Company’s prospective strike along the underexplored and prolific Peel Fault to approximately 40 km, significantly enhancing exploration potential.

The acquisition includes four key projects:

Nundle (EL 9594)

The Nundle Goldfield has a rich history of gold production, with several historical antimony mines present within the region. It covers parts of the major Peel Fault and contains numerous old workings where typically small high-grade gold deposits occur in dolerites. The expanded Nundle Project, encompassing both Nundle and North Nundle, provides Trigg access to a 40 km length of the Peel Fault, a deep-seated conduit for mineralising fluids, controlling the localisation of auriferous (gold-bearing) quartz veins and antimony deposits. Several historical goldfields, including Nundle, Hanging Rock, and Bingara, are closely associated with this fault system.

Upper Hunter (EL 9655)

The Upper Hunter Goldfield in NSW is a historic gold-producing region known for its structurally controlled, quartz-vein-hosted gold deposits. Mineralisation occurs in fault breccia and shear zones within sedimentary rocks, with gold typically found alongside pyrite, arsenopyrite, minor chalcopyrite, and, locally, stibnite (antimony).

Cobark and Copeland (EL 9653)

The Cobark and Copeland Goldfields in NSW were prominent during the late 1800s gold rush. Mining focused on high-grade quartz veins hosted in faults and shear zones. The Copeland area became a key mining hub, with underground workings targeting gold-rich sulphides such as pyrite, stibnite (antimony), arsenopyrite, and minor chalcopyrite. The region remains highly prospective for modern exploration.

The association of antimony mineralisation with gold enhances the project's critical mineral potential, aligning with Trigg Minerals’ strategy to explore and develop high-value, multi- commodity assets in Tier-1 mining jurisdictions.

STRATEGIC RATIONALE

The Projects are in an underexplored yet highly prospective region, with historical workings and strong geological indicators suggesting significant upside potential. The presence of both gold and antimony presents an exciting opportunity for Trigg to unlock new resources and expand its footprint in the strategic metals sector.

Tim Morrison, Executive Chairman of Trigg Minerals, commented:

“The acquisition of the Nundle and other Projects marks an exciting expansion for Trigg Minerals into historically productive goldfields with strong critical mineral potential. The presence of both gold and antimony in this underexplored region aligns perfectly with our focus on high-value, strategically significant minerals. We look forward to applying modern exploration techniques to uncover new opportunities within this proven mineral province.”

Click here for the full ASX Release

This article includes content from Trigg Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Trigg Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 November 2025

Trigg Minerals

Developing America’s next sources of antimony and tungsten – critical minerals essential for defence, energy and advanced technologies.

Developing America’s next sources of antimony and tungsten – critical minerals essential for defence, energy and advanced technologies. Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Trigg Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00