July 28, 2024

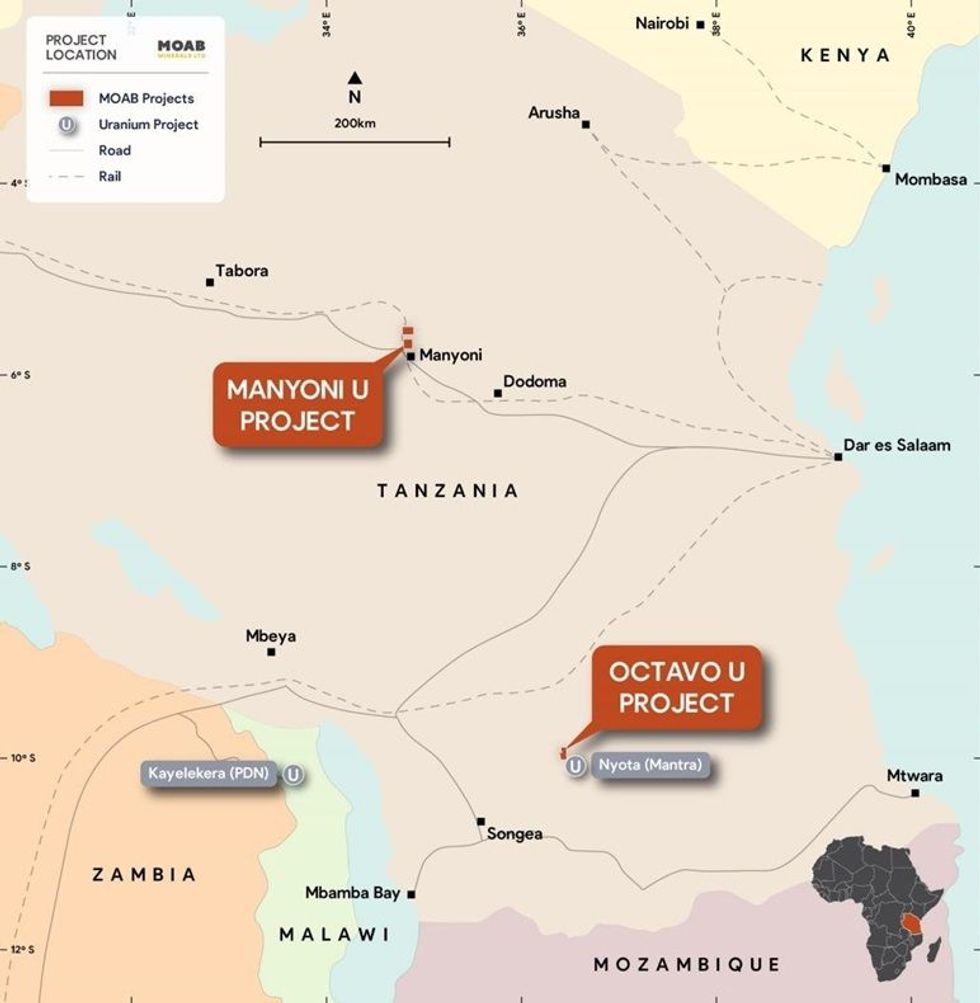

Moab Minerals Limited (ASX: MOM) (Moab or the Company) is pleased to announce that it has entered into a binding share sale agreement for the acquisition of 81.85% of the shares in Australian proprietary company Linx Resources Pty Ltd (Linx), 80% owner of certain mineral licenses comprising the Manyoni Uranium Project and the Octavo Uranium Project, both located in Tanzania.

HIGHLIGHTS:

- Moab is set to acquire 81.85% ownership of Linx Resources Pty Ltd, which boasts a diverse portfolio of advanced, large-scale uranium projects in Tanzania.

- The Asset portfolio includes the Manyoni and Octavo Uranium Projects, covering a total of 216 km2.

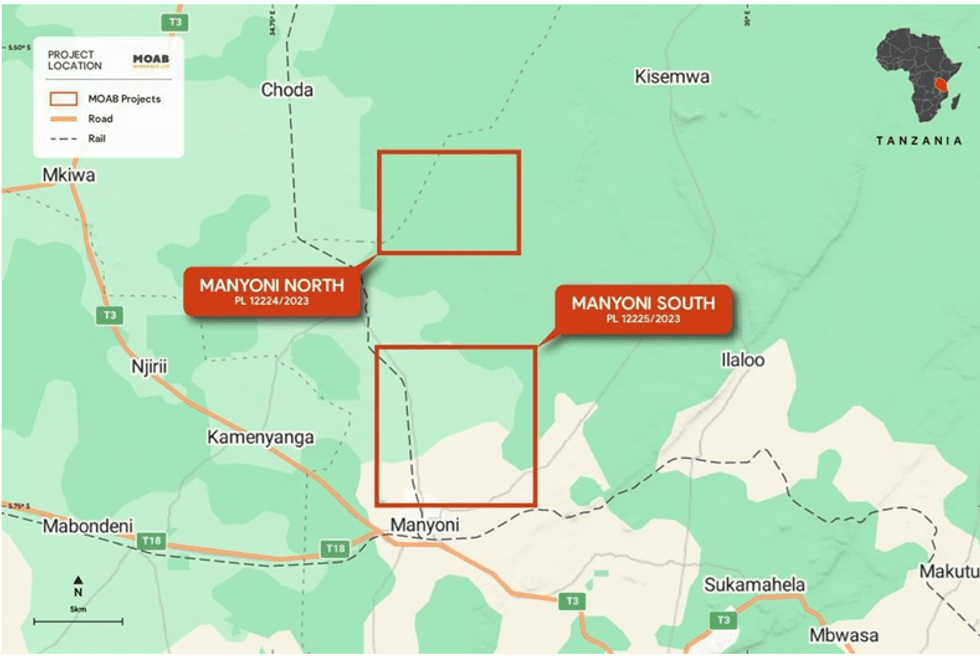

- Strategically located just 5km north of Manyoni town, the Manyoni Uranium Project enjoys convenient access to modern railway and sealed highway infrastructure as well as readily available power and water resources.

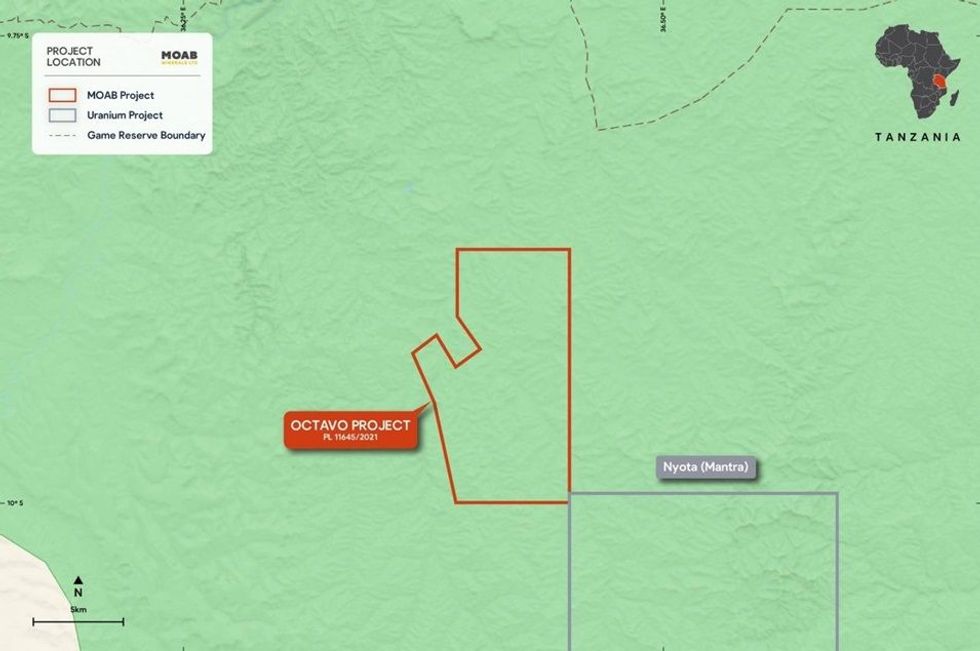

- The Octavo uranium project is adjacent to Rosatom’s world class Nyota Uranium Deposit (formerly ASX listed Mantra Resources Ltd; A$1.02bn takeover in 2011).

- Moab is committed to expediting exploration and development efforts across the Manyoni and Octavo projects.

- With approximately $3.2 million in cash and equivalents, Moab is well equipped to fund exploration and development initiatives.

Moab Managing Director, Malcolm Day commented “we are very pleased to announce the acquisition of such high potential uranium projects. The fact that Uranex Ltd previously explored the Manyoni Uranium Project and announced a JORC 2004 Mineral Resource Estimate of 20.5 m/lbs at 147pmm in 20101 is a great start for the Company. Post completion of the transaction our priority will be to convert the historic resource to a JORC 2012 compliant Mineral Resource Estimate. With the current spot price of uranium at a 17 year high of circa US$92/lb, it’s an exciting commodity to be exploring for”.

The Manyoni and Octavo Uranium Projects

The Manyoni Uranium Project tenements are located in the Republic of Tanzania (pop. 65 million), approximately 100km northwest of the capital city of Dodoma (pop. 765,000). The location of the uranium project at Manyoni is shown in Figure 2 and the location of the Octavo uranium project is shown in Figure 3.

Tenement Information

The Manyoni and Octavo tenements are Prospecting Licences that are granted for an initial period of 4 years, renewable for further periods of 3 years and then 2 years.

Click here for the full ASX Release

This article includes content from MOAB Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00