- WORLD EDITIONAustraliaNorth AmericaWorld

June 05, 2023

Tartisan Nickel Corp. (CSE: TN) (OTCQX: TTSRF) (FSE: 8TA) ("Tartisan", or the "Company") is pleased to report the airborne high resolution MAG Survey for the Company's 100% owned Sill Lake Lead-Silver Property has been completed. The high-res MAG survey covered approximately 297-line kms and used a 50-meter line spacing. The Sill Lake Project is in Van Koughnet Township, about 30 km north of Sault Ste. Marie, Ontario and consists of 57 single cell mining claims covering some 1260.77 hectares.

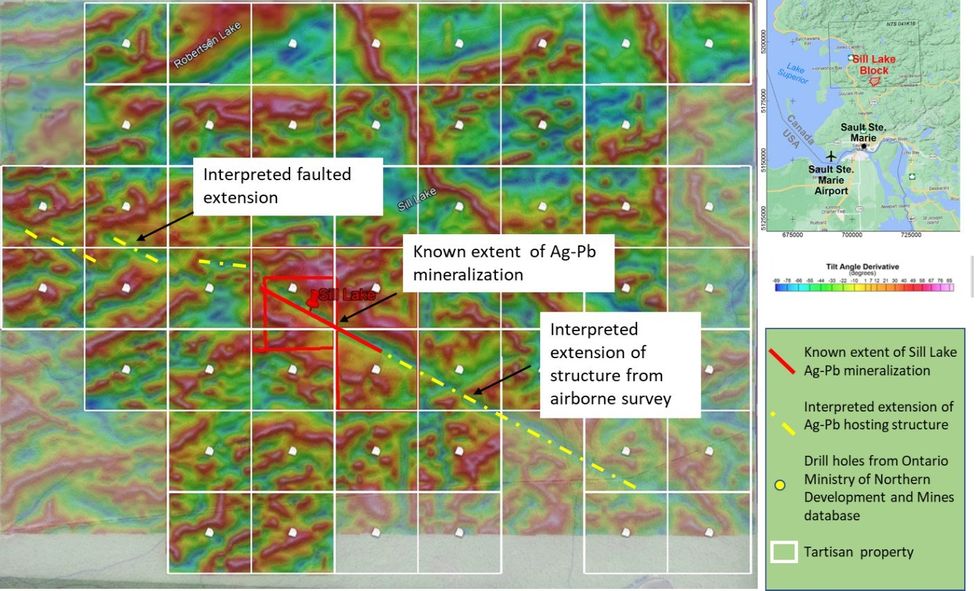

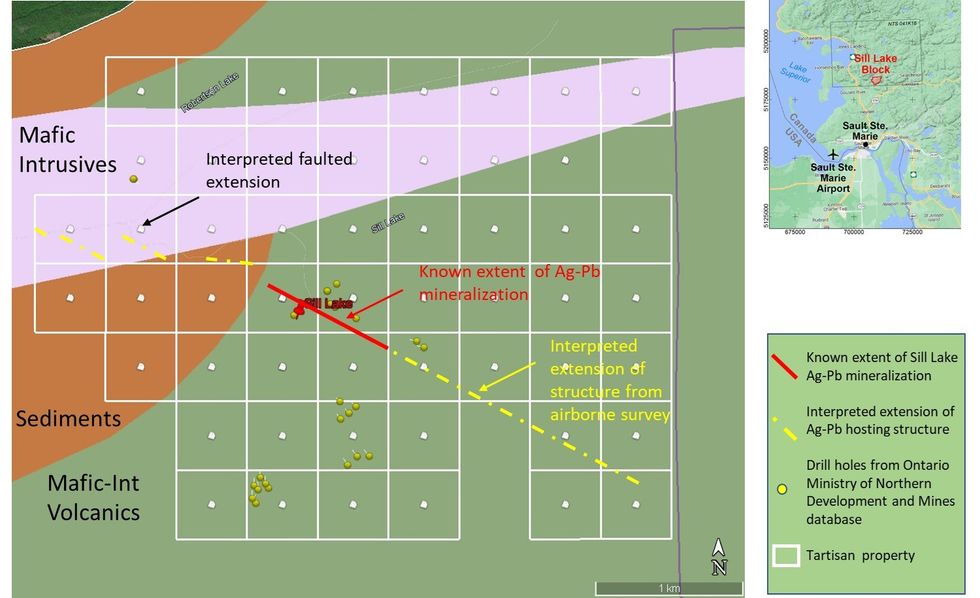

Tartisan CEO Mark Appleby, states, "We are pleased with the results of the high resolution airborne magnetic survey. The Sill Lake Deposit is associated with a northwest-southeast trending magnetic low feature in the survey data. Interpretation of the data suggests the structure which hosts the known Sill Lake Ag-Pb resource extends approximately 2 kilometers to the southeast and appears to be extending to the northeast offset by a series of interpreted faults. A two-kilometer extension is exciting and worthy of follow up and potentially a new exploration and drill program." (See Figures 1 and 2).

Lead-silver mineralization was originally discovered at Sill Lake in 1892, when a 30m adit was driven to a 17m internal shaft, with approximately 40m of lateral development to exploit a lead-silver vein. The Sill Lake Lead-Silver Property was later defined by explorers who conducted a 3750-meter diamond drill program along a defined steeply dipping mineralized trend some 850m in length, with mineralized widths varying between 1.5m and 4.5m. The Sill Lake Lead-Silver Property has seen two distinct periods of underground development and production and it is estimated that 7,000 tonnes of ore containing lead and silver were mined. In 2010, a historical NI 43-101 Technical Report gave a measured and indicated mineral resource of 112,751 tonnes at 134 g/t silver; 0.62% lead, and 0.21% zinc. The historical resource estimate used a silver cutoff grade of 60 g/t; but no cutoff grade for the base metal content was used.

An updated Technical NI 43-101 Report dated May 9, 2021, was prepared for Tartisan Nickel Corp. by SMX International Corporation (SMX) as an update to work previously done by Chemrox Technologies LLC from 2008-2010, an SMX predecessor company. The Sill Lake Lead-Silver Property NI 43-101 Technical Report is on SEDAR.

Fig 1: Tartisan property position over the Sill Lake area outlining extent of high resolution airborne magnetic survey. First Vertical Derivative and Tilt processing of the data highlights an extension of the structure hosting Sill Lake Ag-Pb for approximately 2 km to the southeast. Possible faulted extension is also interpreted to the northwest.

Fig 2: Tartisan property position illustrating general geology and location of historical diamond drill holes (source MNDM drill hole database).

Dean MacEachern P.Geo. is the Qualified Person under NI 43-101 and has read and approved the technical content of this News Release.

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based battery metals and mine development company whose flagship asset is the Kenbridge Nickel Deposit located in northwestern Ontario. Tartisan also owns; the Sill Lake Lead- Silver Property in Sault St. Marie, Ontario, and the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru. Tartisan Nickel Corp. owns equity stakes in: Class 1 Nickel & Technologies Corp. and Peruvian Metals Corp.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE: TN) (OTCQX: TTSRF) (FSE: 8TA). There are currently 113,105,328 shares outstanding (126,147,159 fully diluted).

For further information, please contact Mark Appleby, President & CEO, and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan can be found at the Company's website at www.tartisannickel.com or on SEDAR at www.sedar.com.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

TN:CNX

Sign up to get your FREE

Tartisan Nickel Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

6h

Tartisan Nickel Corp.

Advancing a high-grade Nickel-Copper-Cobalt Project in Northwestern, Ontario

Advancing a high-grade Nickel-Copper-Cobalt Project in Northwestern, Ontario Keep Reading...

11 February

10 Bodies Found as Mexico Probes January Kidnapping at Vizsla Silver Site

Mexican authorities have recovered 10 bodies as part of an investigation into the January abduction of workers from a mining site operated by Vancouver-based Vizsla Silver (TSXV:VZLA) in the northern state of Sinaloa.Mexico’s Attorney General’s Office said the bodies were located in the... Keep Reading...

10 February

Gary Savage: Silver Run Not Over, US$250 is Easy in Next Leg

Gary Savage, president of the Smart Money Tracker newsletter, breaks down gold and silver's recent price activity, saying that while the precious metals have reached the parabolic phase of the bull market, it's typical to see a correction midway through. "The second phase I think will be several... Keep Reading...

09 February

Panelists: Silver in Bull Market, but Expect Price Volatility

Gold often dominates conversations at the annual Vancouver Resource Investment Conference (VRIC), but silver's price surge, which began in 2025 and continued into January, placed the metal firmly in the spotlight. At this year’s silver forecast panel, Commodity Culture host and producer Jesse... Keep Reading...

09 February

Southern Silver Intersects 5.8 metres averaging 781g/t AgEq at Cerro Las Minitas Project in Durango, México

Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports additional assays from drilling which continues to outline extensions of mineralization on the recently acquired Puro Corazon claim and identified further thick intervals of high-grade and... Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

Latest News

Sign up to get your FREE

Tartisan Nickel Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00