October 10, 2024

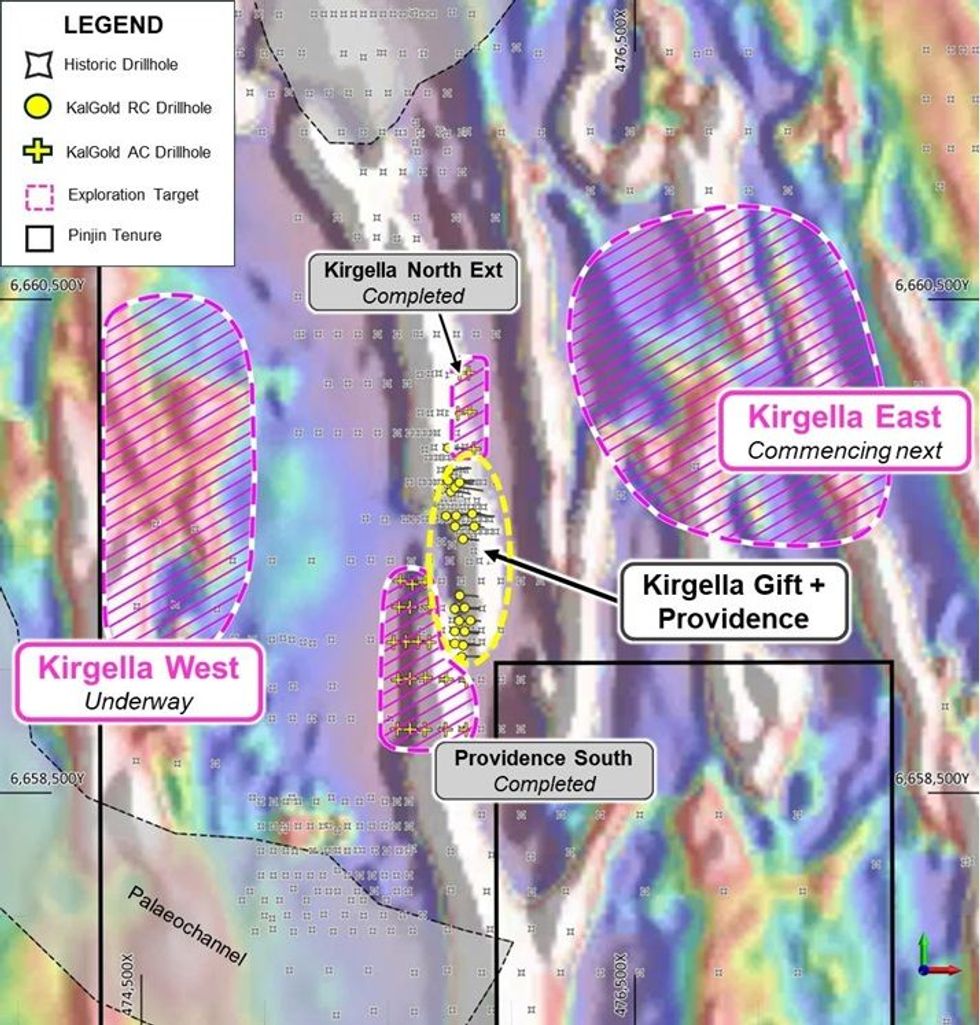

Kalgoorlie Gold Mining (ASX:KAL) (‘KalGold’ or ‘the Company’) has commenced aircore drilling at two new exploration target areas within the Pinjin Gold Project on 9 October 2024 (Figure 1).

Testing Two New Gold Target Areas

The aircore drill program currently underway focuses on two new exploration target areas at Kirgella West and Kirgella East (Figure 1). The target areas are both located near to the Kirgella Gift and Providence deposits where the Company recently defined a JORC (2012) Inferred Mineral Resource of 2.34 Mt at 1.0 g/t Au for 76,400 oz (ASX: KAL 25 July 2024). Both target areas show promising structural and geological complexity that has potential to host gold mineralisation. These targets have not been previously drill-tested and so are undergoing first-pass, widely spaced drilling in this program.

The initial program is scheduled to run for two weeks, drilling up to 4,500 m across key target areas in priority order.

KalGold Targets Untapped Potential in Southern LTZ

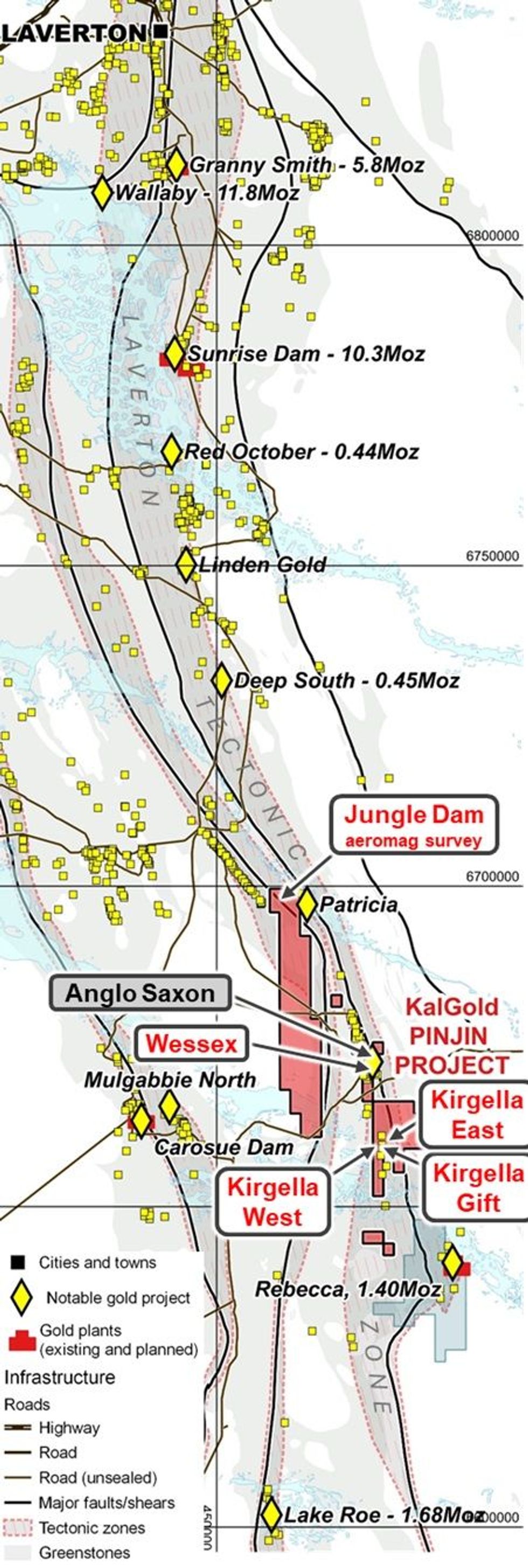

This marks KalGold’s first systematic assessment of the gold potential of the greater Pinjin Project area. For the first time, we are moving beyond historic efforts at Kirgella Gift and Providence, and the Wessex prospect adjacent to the Anglo Saxon gold mine.

KalGold believes the southern part of the Laverton Tectonic Zone (LTZ) holds significant potential, comparable to its northern end, which hosts major gold deposits like Sunrise Dam, Granny Smith, Wallaby and the Laverton Goldfield (Figure 2). The southern LTZ, remains underexplored due to poor surface exposure and limited historic exploration efforts. However, recent discoveries like Rebecca in the LTZ and Breaker/Lake Roe in the adjacent Celia Tectonic Zone show the area’s potential. KalGold aims to make similar discoveries on its LTZ tenure.

KalGold believes that drilling is the only effective way to test the LTZ on our Pinjin Gold Project, given transported cover over much of the area. Typically this approach results in several misses, but it also has the potential for significant discoveries. By applying a scientifically rigorous approach, KalGold is increasing its chances of success, focusing on key target areas that display geological, geophysical and geochemical hallmarks of gold mineralisation.

Progress will be driven by results, as well as logistics. Currently, KalGold is working to secure a new heritage survey over the area, with a focus on E28/3134. Heritage clearance of the unexplored eastern areas is important for on-ground investigation where the high-grade metamorphic rocks of the Rebecca sequence are interpreted to be juxtaposed by the LTZ against the host sequence of the Pinjin Goldfield. Additionally, known palaeochannel distributions are considered, allowing for initial exploration of shallow targets before potentially pursuing targets at depth as the palaeochannels can be over 100m deep.

Click here for the full ASX Release

This article includes content from Kalgoorlie Gold Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 May 2025

Kalgoorlie Gold Mining

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields Keep Reading...

12h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

13h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

16h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

19h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00