February 16, 2025

Kalgoorlie Gold Mining (ASX:KAL) (‘KalGold’ or ‘the Company’) is expanding its search radius around its new Lighthorse discovery after defining key target areas along strike that have never been drilled.

Highlights:

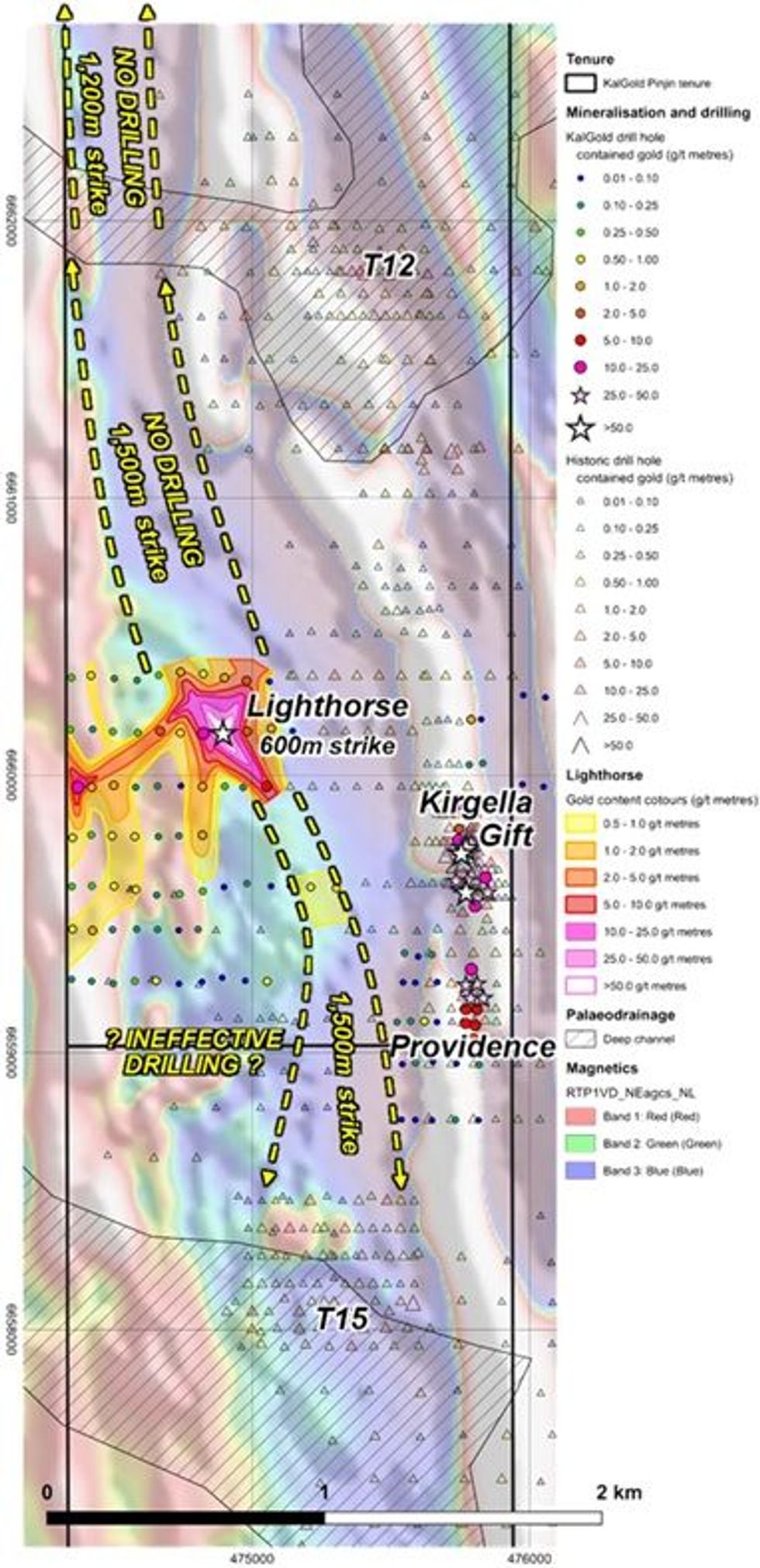

- Analysis of the Lighthorse host sequence defines a north-south geological ‘corridor’ beneath cover that extends approximately 13 km within KalGold tenure. Around 6 km of this strike length is being actively assessed for priority additional drilling.

- Immediately north and northwest of Lighthorse, no historic drilling exists along strike for 2.7 km. Gold mineralisation and anomalism at Lighthorse is open and untested to the north.

- The effectiveness of shallow, historic RAB and aircore drilling south along strike from Lighthorse, is being assessed. This includes deeper drilling at the large, historic T15 gold prospect.

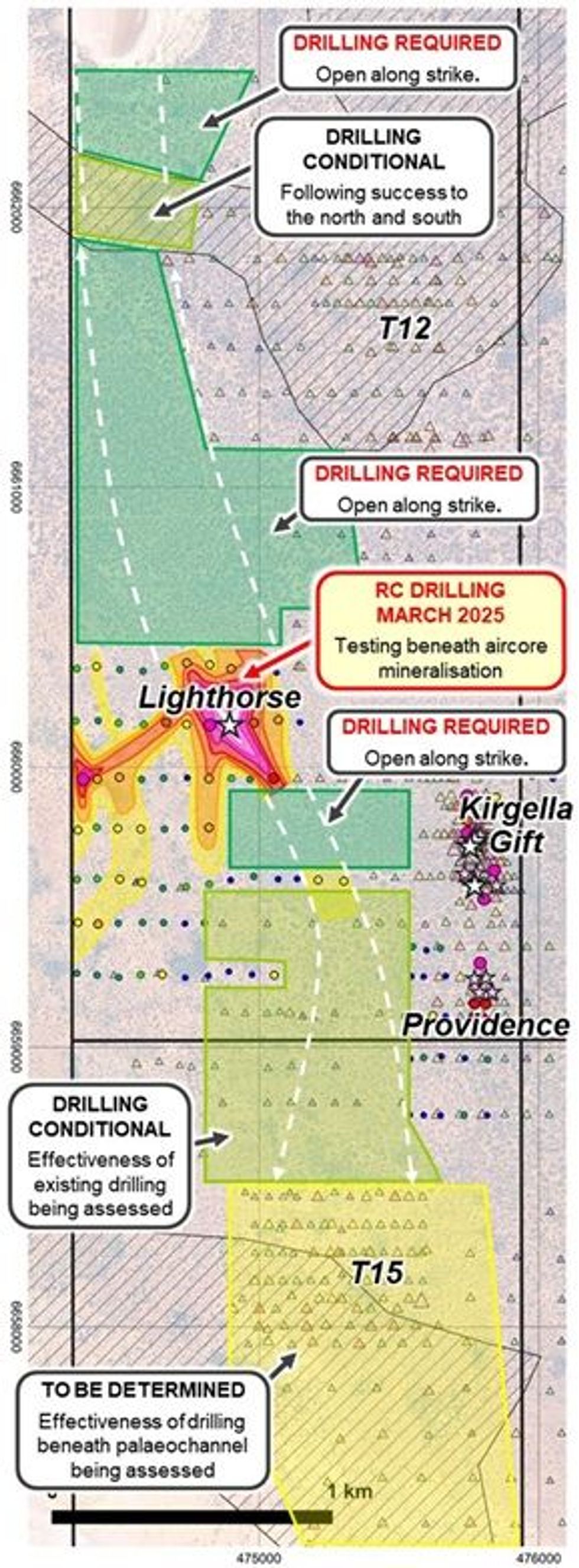

- KalGold’s upcoming RC drill program will test under and around the high-grade Lighthorse discovery. It is the first in a series of programs, which will include additional aircore drilling to the north and south, designed to define the full extent of the gold mineralisation system.

KalGold’s inaugural drilling at Lighthorse (ASX: KAL 7 February 2025) returned thick, high-grade intervals, such as 17 m at 4.81 g/t Au from 48 m, including 8 m at 9.21 g/t Au from 52 m, with the hole ending in mineralisation. Investigations show that areas adjacent and up to several kilometres north and south along strike are either untested or poorly tested. KalGold has expanded its search area to assess the full potential of its Lighthorse discovery.

Commenting on the expanded search for gold mineralisation at and around Lighthorse, KalGold Managing Director Matt Painter said:

“We are extremely excited by the potential magnitude of the Lighthorse gold mineralised system. Our analysis indicates that Lighthorse is hosted within a 13 km long, north-south trending geological sequence within KalGold’s tenure. The Company is assessing 6 km of strike for follow up aircore drilling and, based on results, will continue to expand the search space.

Gold mineralisation and anomalism at Lighthorse is open to the north, with no outcrop or prior drilling along strike for 2.7 km. Within 1.5 km to the north, magnetic data shows a bottleneck and deviation of the host sequence, which may be favourable for further gold mineralisation.

Southwards from Lighthorse, undrilled gaps are interspersed with shallow, irregular RAB and aircore drilling over around 1.5 km. Further south, many drill holes at the deeply buried T15 prospect appear to have not penetrated fresh rock sufficiently. The effectiveness of historic drilling is being determined to assess this southern area for its gold potential.

In addition to the upcoming March 2025 RC drill program, the Company has begun planning follow up drilling, including widely spaced aircore drilling (similar to the discovery program). Our assessment of geophysical and geochemical data suggests that we may be onto a gold mineralised system of significant scale. If results comparable to those at Lighthorse are encountered along this multi-kilometre trend, it could be a transformational development for KalGold.”

New priority target areas at Lighthorse

KalGold has defined key target areas along strike from the Lighthorse discovery that have not previously been drilled. North-south striking, deformed magnetic ridges bracket the discovery (Figures 1 and 3), outlining the Lighthorse Corridor. This corridor appears to extend for around 13 km along strike on KalGold tenure, with KalGold actively assessing an approximate 6 km subsection.

In addition to the 600 m strike length already defined at Lighthorse, the following new targets have been identified.

To the north:

- An undrilled area of 1,500 m strike length immediately north of Lighthorse (Figure 1). This target corresponds with a structural anomaly where the Corridor narrows from 1,000 m wide in the south to approximately 400 m in the north, corresponding with a deviation in strike. The northern extent of this target area is marked by an east- west palaeochannel, where deeper transported cover is expected. Near the palaeochannel, minor gold anomalism has been recorded on the eastern magnetic ridge at the limit of historic drilling (Figure 1).

- Further north along strike, an additional 1,200 m, north-south strike target is also undrilled. The prospective corridor here ranges from 400 to 650 m wide, including the portion extending beneath the palaeochannel.

To the south of Lighthorse:

- KalGold drilling defined gold anomalism within a lightly drilled, approximately 1,500 m long area, where historic RAB and aircore drilling by previous operators was irregularly spaced, shallow, and likely ineffective. Assessment is underway.

- Further south, the T15 prospect coincides with the regional paleochannel, with transported cover up to 100 m thick. Initially assessed by Newmont in the mid-2000s, the prospect later was the subject of additional aircore and limited RC and diamond drilling by Renaissance Minerals through 2010-2011. Gold mineralisation and anomalism was intersected in numerous drill holes, over an approximate 650 m width, and 1,400 m north- south strike length. Gold mineralisation was intersected predominantly within basal paleochannel sediments but also within underlying weathered bedrock. Further assessment of historic work is required.

Drilling opportunities around Lighthorse

KalGold will drill test undrilled target areas to the immediate north and south of the Lighthorse discovery where gold mineralisation and anomalism remains open (green areas, Figure 2), Initial aircore programs will be drilled on 400 x 80 m centres to provide adequate first pass coverage.

Some target areas require further assessment before drilling is required (yellow-green areas, Figure 2). To the south of Lighthorse, the effectiveness of prior irregular, shallow, historic drilling needs further assessment. If deemed ineffective, historic RAB and aircore drilling will be superseded and systematically redrilled by KalGold to provide uniform coverage. In the north, an area interpreted to lie under the palaeochannel will only be drilled if supported by KalGold drilling results to the north and south. Unconsolidated transported cover in the palaeochannels can be over 100 m thick, making drilling expensive and prone to failure.

Click here for the full ASX Release

This article includes content from Kalgoorlie Gold Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 May 2025

Kalgoorlie Gold Mining

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields Keep Reading...

4h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

11h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00