June 30, 2024

Maiden soil sampling assays uncover Uranium grades beyond laboratory detection limit

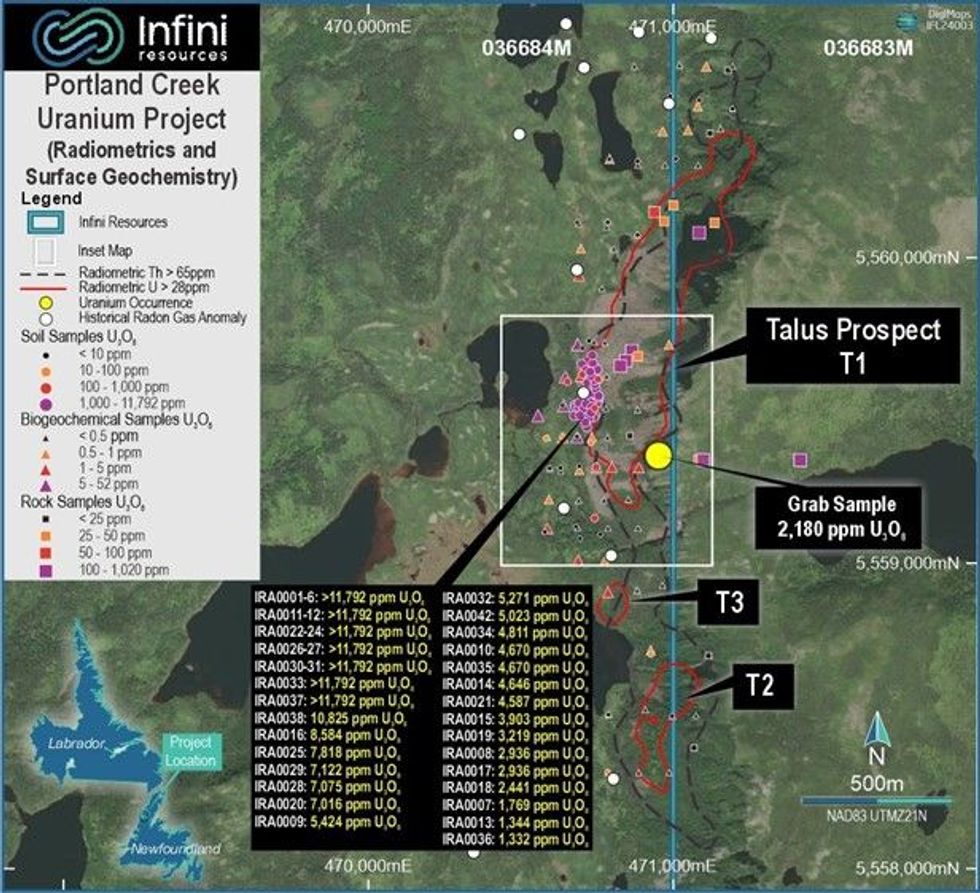

Infini Resources Ltd (ASX: I88, “Infini” or the “Company”) is delighted to announce its maiden field sampling assay results at its highly prospective and 100% owned Portland Creek Uranium Project in Newfoundland, Canada. The return of these material assay results follows the completion of the Company’s maiden exploration program (Figure 1 and refer to ASX announcement 28 May 2024).

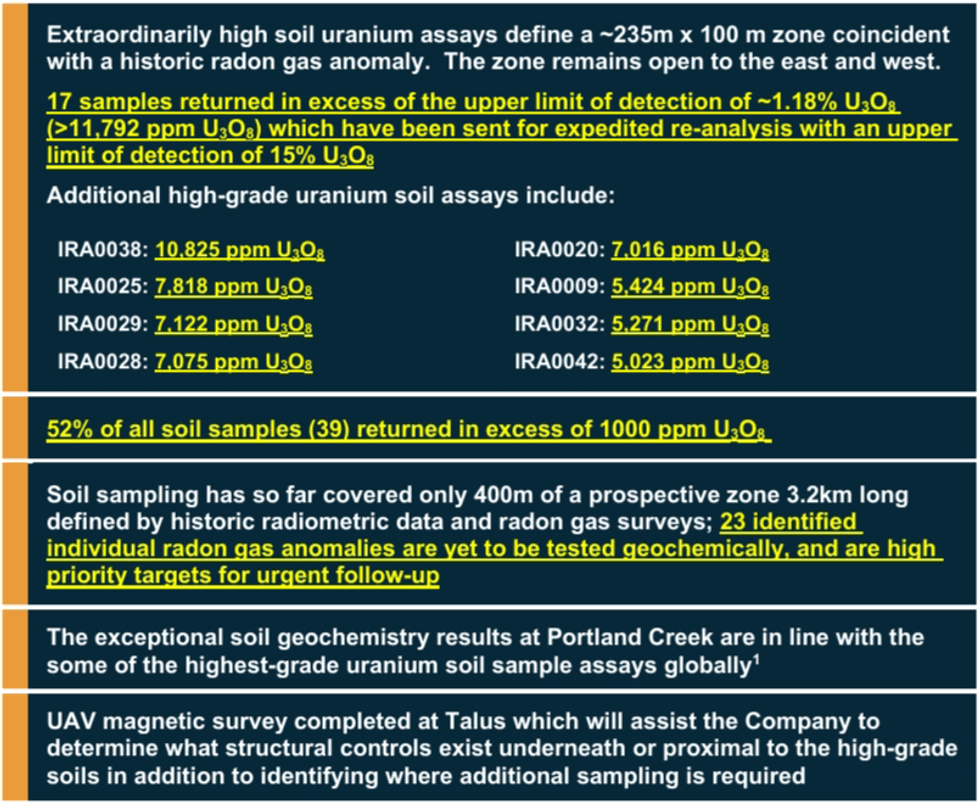

Highlights

Infini’s CEO, Charles Armstrong said: “These first pass soils are nothing short of outstanding and represent some of the highest uranium soil grades returned globally. To see such consistent and high- grade mineralisation within soil sampling across ~235m x 100m, which sits within a ~3.2km radiometric corridor is remarkable and suggests we may be very close to a potential discovery here at Portland Creek. The high-grade soils are proximal to highly anomalous biogeochemical and boulder rock samples, further increasing our confidence in this remarkable uranium asset. We might be onto something of significant scale here. Right now, we await the follow-up assay results from these ‘ore grade’ soil samples to determine how high they really are, in addition to planning fieldwork to sample the unexplored radon gas anomalies at the property.”

Soil Sampling Results

A total of 75 soils were taken in east-west traverse lines through known radiometric anomalism except for one area surrounding a historical radon gas anomaly. This area was identified as anomalous during spectrometer line traverses and infill samples on tight ~25m spacings where terrain allowed. Two uranium soil anomalies have been identified running in north-south orientations at the Talus prospect. High grade anomaly one (Figure 2 and Appendix 1 Table 1) is ~235m x 100m with a peak value of >11,792 ppm U3O8 (above LOD) and anomaly two is ~165m long with a peak value of 284 ppm U3O8. These findings are even more significant given the average background reading in soils is only ~8 ppm U3O8 (peak anomaly - 1474 times background).

Click here for the full ASX Release

This article includes content from Infini Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00