April 27, 2022

Okapi Resources Limited (ASX: OKR) (Okapi or the Company) is pleased to announce that its wholly owned subsidiary Okapi Resources Canada Ltd. has received from the Ministry of Environment, Government of Saskatchewan (GoS), a Crown Resource Land Work Authorization, an Aquatic Habitat Protection Permit, a Temporary Work Camp Permit, and Forest Product Permit; together these permits will allow Okapi to drill up to 10,000m in 24 drill holes as well as conduct ground based geophysical surveys of up to 100 line kilometers. The permit is valid through to October 2023.

Key Points

- Okapi Resources receives permits to drill at its Middle Lake Uranium Project

- Extensive historically data at Middle Lake, including high grade surface samples, drilling data and geophysics indicate strong potential for economic mineralisation

- Diamond core drilling program is being planned in the North America winter (Q1 2023)

- Permits allows for up to 10,000m of drilling in 24 drill holes

Okapi’s Managing Director, Mr Andrew Ferrier said:

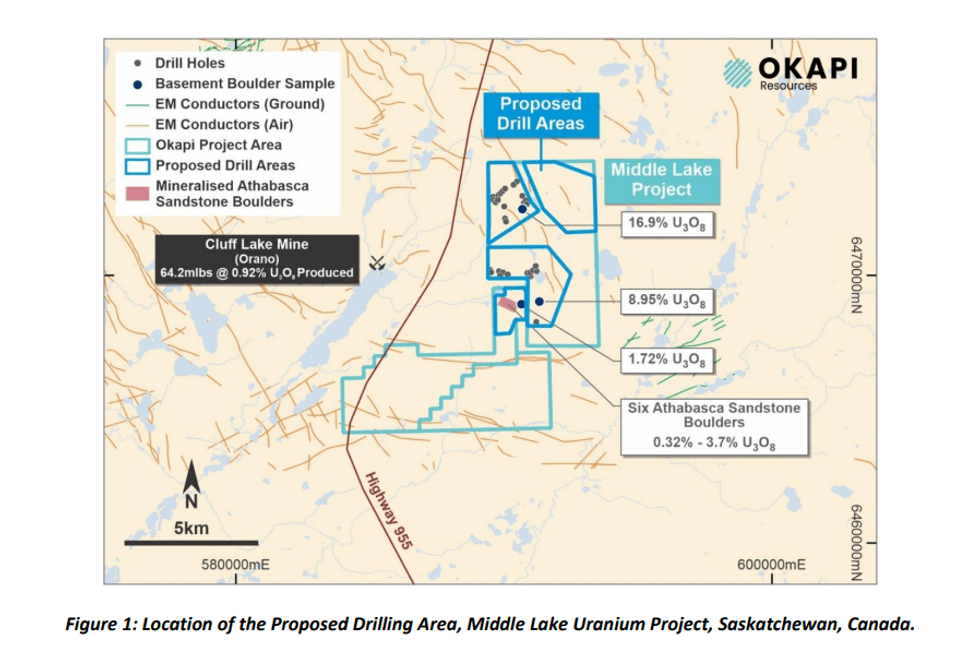

“This is an important milestone for Okapi, as the Company continues to progress and advance its uranium projects in North America. Obtaining a permit to drill at our 80% owned Middle Lake Project in the Athabasca Basin, the world’s premier uranium district, provides the opportunity for the company to start exploration work on our highly prospective exploration properties located only 4km from the past producing Cluff Lake Mine which produced approximately 64 million pounds of uranium.

The proposed exploration program will focus on prioritising drill targets by reinterpreting the historic geochemistry, geophysics and drill data, combined with satellite imaging (currently underway) which will provide a structural framework. The highest priority drill targets will then be followed by a potential diamond core drilling program, that is likely to be conducted in the North America winter of Q1 2023.

Proposed Exploration Program

The Middle Lake Uranium Project has had a long history of exploration work completed with the last drill program occurring in the winter of 2015 comprising 17 shallow drill holes for a total of 1,851 meters of drilling. The drilling revealed areas of anomalous radioactivity and uranium concentrations associated with graphitic schist and mylonite; the exploration is consistent of that for unconformity style uranium deposits in areas adjacent to the contact between the underlying Archean Basement and Athabasca Group rocks.

Okapi’s immediate aim is to take the historic data and reinterpret and remodel the historic surface and drill data, geochemistry and geophysics to provide targets for drill testing. This will be combined with new remote sensing image interpretation currently underway that, when integrated with the historic, existing geophysical survey results, will provide a structural framework that can be incorporated into the geologic modelling. The application of multi-spectral satellite imaging to exploration at Middle Lake, and the enhanced software capacity now available, can readily detect areas of alteration associated with Uranium mineralisation.

The targets generated from the geologic model will then be followed by a potential diamond core drilling program that is likely to be conducted in the North America winter of Q1 2023. The drill permits will allow Okapi to drill up to 10,000m in 24 drill holes.

Click here for the full ASX Release

This article includes content from Okapi Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OKR:AU

The Conversation (0)

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman Jon Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00