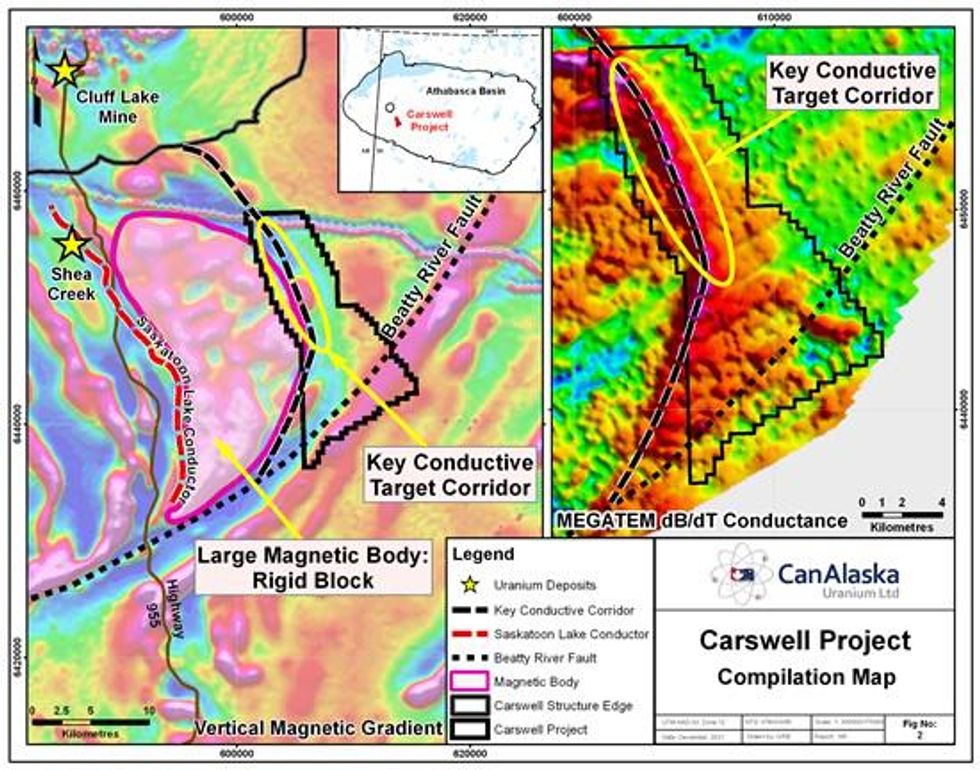

15 Kilometre Strongly Conductive Target Corridor Identified

Corridor Mirrors Saskatoon Lake Conductor - Host to the Large Shea Creek Uranium Deposits

CanAlaska Uranium Ltd. (TSXV: CVV) (OTCQB: CVVUF) (FSE: DH7N) ("CanAlaska" or the "Company") is pleased to announce that compilation work on the Company's newly acquired Carswell project, totalling 13,352 hectares, in the western Athabasca Basin has identified a conductive structural corridor which joins the Beatty River Fault zone to the Carswell structure (Figures 1 & 2). The conductive corridor wraps around a large magnetic-high body, which on the opposite side of the magnetic feature, is mirrored by the Saskatoon Lake conductor. The Saskatoon Lake conductor is host to the high-grade Shea Creek uranium deposits. The Company is completing further compilation of the newly acquired Carswell project and is actively seeking Joint Venture partners.

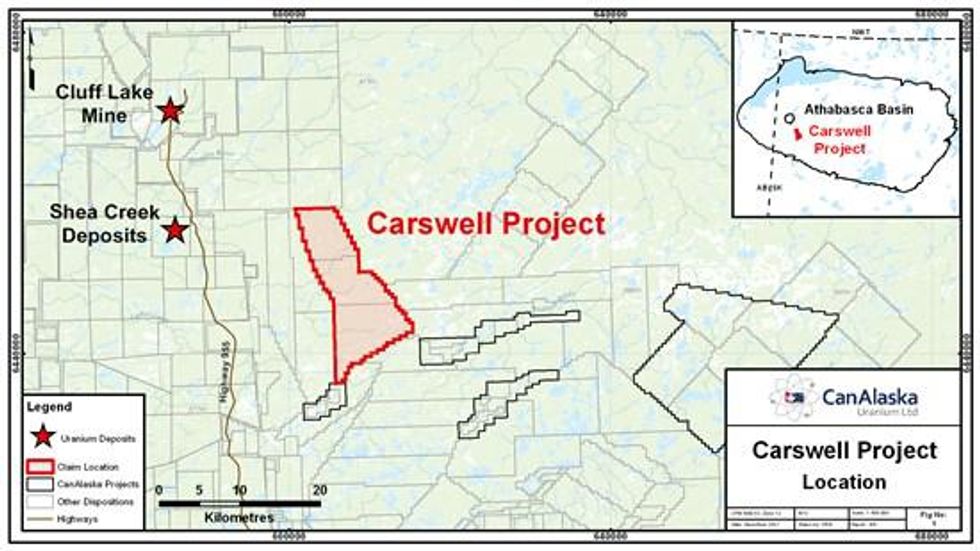

Carswell Project Location

To view an enhanced version of this map, please visit:

https://orders.newsfilecorp.com/files/2864/107175_53bbd3cfd4e259b8_001full.jpg

CanAlaska's Carswell project is located 15 km east of the Shea Creek deposits, owned by Orano Canada and UEX Corporation. The Shea Creek deposits are located along the Saskatoon Lake Conductor, which runs perpendicular to the Beatty River Fault zone, connecting it to the Carswell Structure. The apparent connection between the Beatty River Fault zone and the Carswell structure along these perpendicular conductive corridors in the Saskatoon Lake conductor and on the Carswell project presents a compelling exploration target. The Shea Creek deposits consist of four deposits of unconformity- and basement-hosted uranium mineralization, which combined host 95 million lbs of U3O8 at an average grade of 1.47%. The Shea Creek deposits form one of the largest undeveloped uranium resources in the Athabasca Basin.

Carswell Project Compilation Map

To view an enhanced version of this map, please visit:

https://orders.newsfilecorp.com/files/2864/107175_53bbd3cfd4e259b8_002full.jpg

CanAlaska's Carswell project covers 15 km of a 24 km long magnetic low, coincident with a conductive corridor, that runs along the eastern edge of a large magnetic-high body. Along the western edge of the same large magnetic-high body, the Saskatoon Lake conductor runs through a similar broad magnetic low. The presence of conductive corridors along the edges of magnetic high features creates a strong competency contrast that is important in the formation of large structural traps host to unconformity-hosted uranium deposits. The mirror analog between Shea Creek on the western edge of the magnetic feature and the Carswell project along the eastern edge of the same magnetic feature provides potential for similar brittle fault re-activation and the development of structural traps on the Carswell project.

CanAlaska CEO, Cory Belyk, comments, "Further compilation work by the CanAlaska team has identified a geological scenario that is very important in the formation of tier 1 uranium deposits in the Athabasca Basin providing an immediate target corridor for future exploration. We look forward to finding a joint venture partner to help advance this project toward discovery."

Other News

CanAlaska is currently processing summer and fall drill results from its recently completed West McArthur drill program near the McArthur River uranium mine. The Company is also planning its exploration programs for 2022.

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSXV: CVV) (OTCQB: CVVUF) (FSE: DH7N) holds interests in approximately 300,000 hectares (750,000 acres), in Canada's Athabasca Basin - the "Saudi Arabia of Uranium." CanAlaska's strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company's properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world's richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds. For further information visit www.canalaska.com.

The qualified technical person for this news release is Nathan Bridge, MSc., P.Geo., CanAlaska's Vice President, Exploration.

On behalf of the Board of Directors

"Peter Dasler"

Peter Dasler, M.Sc., P.Geo.

President

CanAlaska Uranium Ltd.

Contacts:

Cory Belyk, Executive VP and CEO

Tel: +1.604.688.3211 x 306

Email: cbelyk@canalaska.com

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: info@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company's control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107175