FALCON GOLD CORP. (TSX-V:FG)(GR:3FA)(OTC PINK:FGLDF); ("Falcon" or the "Company") is pleased to announce the Company has commenced its 2021 work programs on the Central Canada Gold Project in the Atikokan mining camp of northwestern Ontario. The first activities will be focusing on the outcrop exposures and trench areas where the geological team will be conducting detailed structural mapping along the 275 metre ("m") long strike of the Central Canada mine trend. In addition, the team intends to expand its attention onto the other high-priority gold targets along strike and paralleling the mine trend

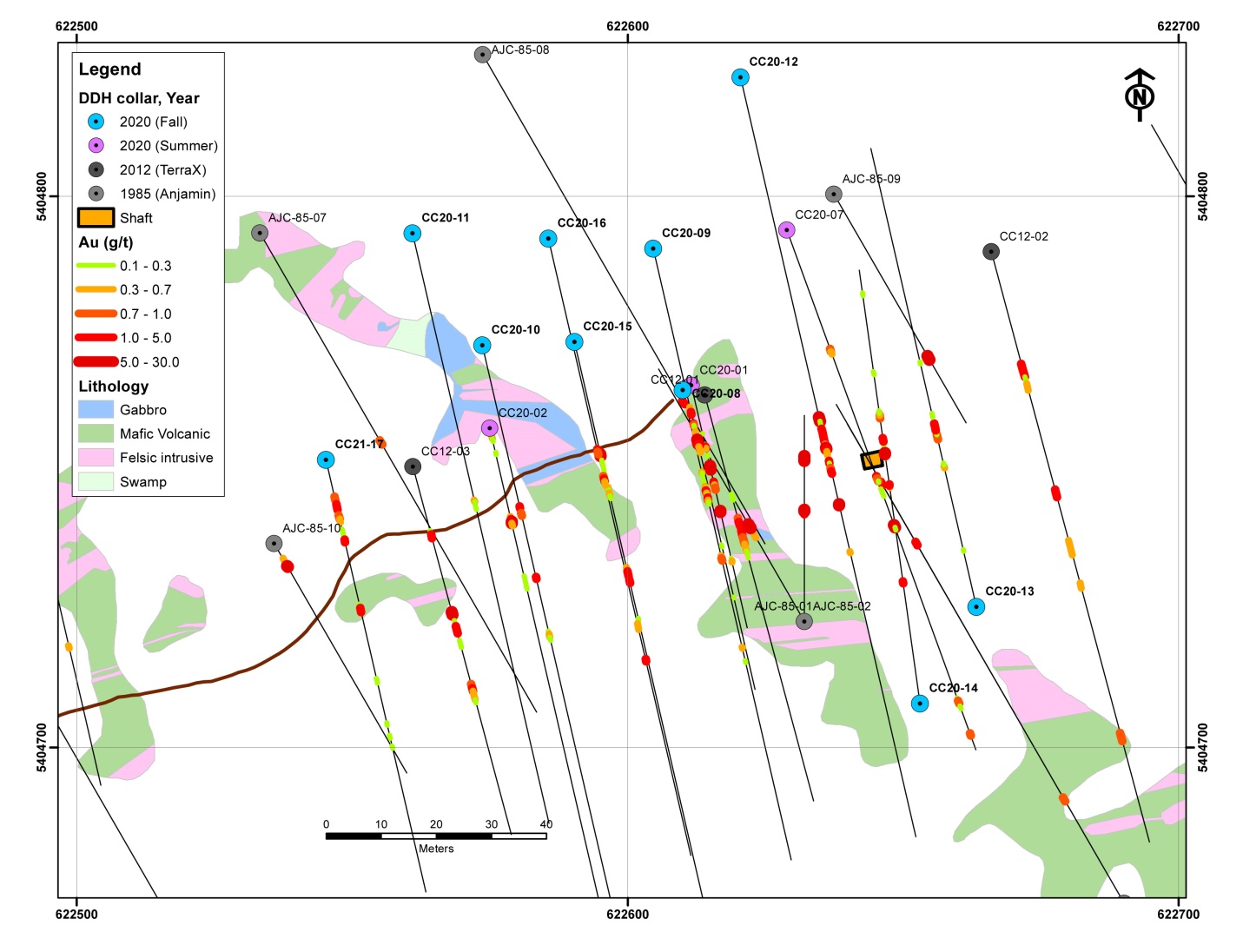

In its release of March 18, 2021, Falcon reported the last of the 17 drill holes of the initial drilling campaign by the Company in 2020. Figure One is a surface plan of the results of Falcon's program plus the drilling by predecessor companies.

Mr. Karim Rayani, Falcon's Chief Executive Officer, commented, "We are looking forward to commencing phase 3 drilling shortly, the intent is to target the historic shaft area initially and complete further infill along the 275 m strike of the Central Canada mine trend. With the recent airborne and survey interpretations completed we are now gathering the necessary modeling of the folding and faulting structures to better predict how the gold zones behave below surface. We are looking at a very busy season ahead of us."

Next Steps for 2021 Work Programs

In addition to the mapping of the outcrop exposures of the Central Canada mine trend, Falcon has begun the reinterpretation of the 2020 heliborne high-resolution magnetic and time-domain electromagnetic survey utilizing artificial intelligent ("AI") computer analyses. This type of AI system is an evolving and promising application that may be capable of identifying areas of complex folding and faulting and could accelerate the process of deciphering and modelling the complex structural setting of the Property.

For the 2021 drill program, the Company is planning to complete up to 20 diamond drill holes for approximately 2,000m of core. The intent will be to target the gold mineralization in the shaft area and to test other excellent gold zones such as mineralized quartz-feldspar porphyries and the Northern Vein also known as the No. 2 Vein. Based upon the surface mapping and the AI analyses, the drilling will be directed to intersect those targets recommended by the studies.

In Figure one, it is evident the gold enrichment appears greatest in the vicinity of the mine shaft. However, what is yet to be shown by the drilling is any preferential location of mineralization or control of its placement by folding or faulting.

Figure One. Surface level plan view of the 2020 drill program showing the Falcon, TerraX and Anjamin drill intersections. Gold intervals define a broad mineralized trend that includes the historical shaft vein. Note Falcon's drill hole CC 20 -17 results show an encouraging trend to the west.

E-Metals Exploration

The geology of the Central Canada project is divided into two distinct parts with Wabigoon Subprovince underlying the northern area and the Quetico Subprovince to the south. The boundary between the Subprovinces is a narrow zone, typically less than 100m wide and commonly occupied by lakes or swamps. This boundary is called the Quetico Fault Zone ("QFZ") and has been traced for more than 100km as an important structural feature particularly in its affiliation with a variety of mineral deposits. A report in the 1985 Ontario Geological Survey, Open File Report 5539 described the QFZ mineralization near the Central Canada claims as a massive sulphide zone located beneath Sapawe Lake of two parallel sulphide zones. The lenses or irregular masses of sulphide occur within a volcanogenic environment. There is an ultramafic to mafic intrusive associated with some of the massive sulphide zones. Sulphide mineralization consists mainly of pyrite, pyrrhotite, magnetite, chalcopyrite, sphalerite with associated pentlandite and carrollite.

The historical 1980 government-sponsored regional airborne geophysical surveys and Falcon's 2020 survey suggest that Falcon may have a significant zone or zones of conductive massive sulphide mineralization having an east northeast trending strike length of more than 3km beneath Sapawe Lake. An historical drill intersection known as the Staines Occurrence on Falcon's claims at the west end of Sapawe Lake had reported a wide sulphide-rich zone averaging 0.64% Cu, 0.15% Co, 1.1% Zn and 0.35 g/t Au over a true width of 40 m. The Company is planning to commence permitting a drill program to test the continuation of the sulphide horizon as indicated by the geophysical surveys. Drilling will likely be done during the winter when Sapawe Lake is frozen over.

Qualified Person

The technical content of this news release has been reviewed and approved by Mike Kilbourne, P.Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Falcon Gold Corp., the Central Canada Gold Mine Project, and Jack Lake Trend

Falcon is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon's flagship project, the Central Canada Gold Mine, is approximately 20 km south east of Agnico Eagle's Hammond Reef Gold Deposit which has currently estimated 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold) mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold). The Hammond Reef gold property lies on the Hammond shear zone, which is a northeast-trending splay off of the Quetico Fault Zone ("QFZ") and may be the control for the gold deposit. The Central Gold property lies on a similar major northeast-trending splay of the QFZ.

History of Central Canada gold mine includes;

1901 to 1907 - Shaft constructed to a depth of 12 m and 27 oz of gold from 18 tons using a stamp mill.

1930 to 1934 - Central Canada Mines Ltd. installed a 75 ton per day gold mill. Development work included 1,829 m of drilling and a vertical shaft to a depth of 45 m with about 42 m of crosscuts and drifts on the 100-foot level. In December, 1934 the mine had reportedly outlined approximately 230,000 ounces of gold with an average grade of 9.9 g/t Au.

1935 - With the on-going financial crisis of the Great Depression, the Central Canada Mines was unable to fund operations and the mine ceased operations.

1965 - Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft.

1985 - Interquest Resources Corp. drilled 13 diamond holes totaling 1,840 m in which a 3.8 ft intersection showed 30.0 g/t Au.

2010 to 2012 - TerraX Minerals Inc. conducted programs that included line cutting, geological surveys and 363 m of drilling.

2020 - Falcon Gold Corp. completed its inaugural 17-hole program totaling 2,942.5 m of core.

The Company holds 5 additional projects. The Camping Lake Gold property and the Springpole West Property in the world-renowned Red Lake mining camp; a 49% interest in the Burton Gold property near Sudbury Ontario; and in BC, the Spitfire-Sunny Boy Gold Claims and the Gaspard property.

CONTACT INFORMATION:

Falcon Gold Corp.

"Karim Rayani"

Karim Rayani

Chief Executive Officer, Director

Telephone: (604) 716-0551

Email: info@falcongold.ca

Cautionary Language and Forward-Looking Statements

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Falcon Gold Corp

View source version on accesswire.com:

https://www.accesswire.com/646356/Falcon-Starts-2021-Exploration-at-Central-Canada-Gold-Mine-NW-Ontario