16.27 GPT Gold over 10.5 Metres Within 8.47 GPT Gold over 24.9 Metres

Endurance Gold Corporation (TSXV: EDG) (the "Company") is pleased to report further assay results from the 2021 diamond drilling program at the Reliance Gold Property (the "Property") in southern British Columbia. The Property is located 4 kilometres ("km") east of the village of Gold Bridge with year-round road access, and 10 km north of the historic Bralorne-Pioneer Gold Mining Camp which has produced over 4 million ounces of gold.

As announced on November 3, 2021, the Company completed 4,329 metres ("m") of diamond drilling in twenty-two (22) drill holes at the Eagle and Imperial Zones. Assay results for the first three (3) of six (6) holes drilled at the Imperial Zone have now been received. The assay results for the first four (4) of sixteen (16) holes completed at the Eagle Zone were reported on November 29, 2021 which included 10.94 grams per tonne ("gpt") gold over 5.4 m and 7.49 gpt gold over 9.0 m from drill holes DDH21-003 and DDH21-004, respectively. Assay results are pending for the remaining fifteen (15) holes.

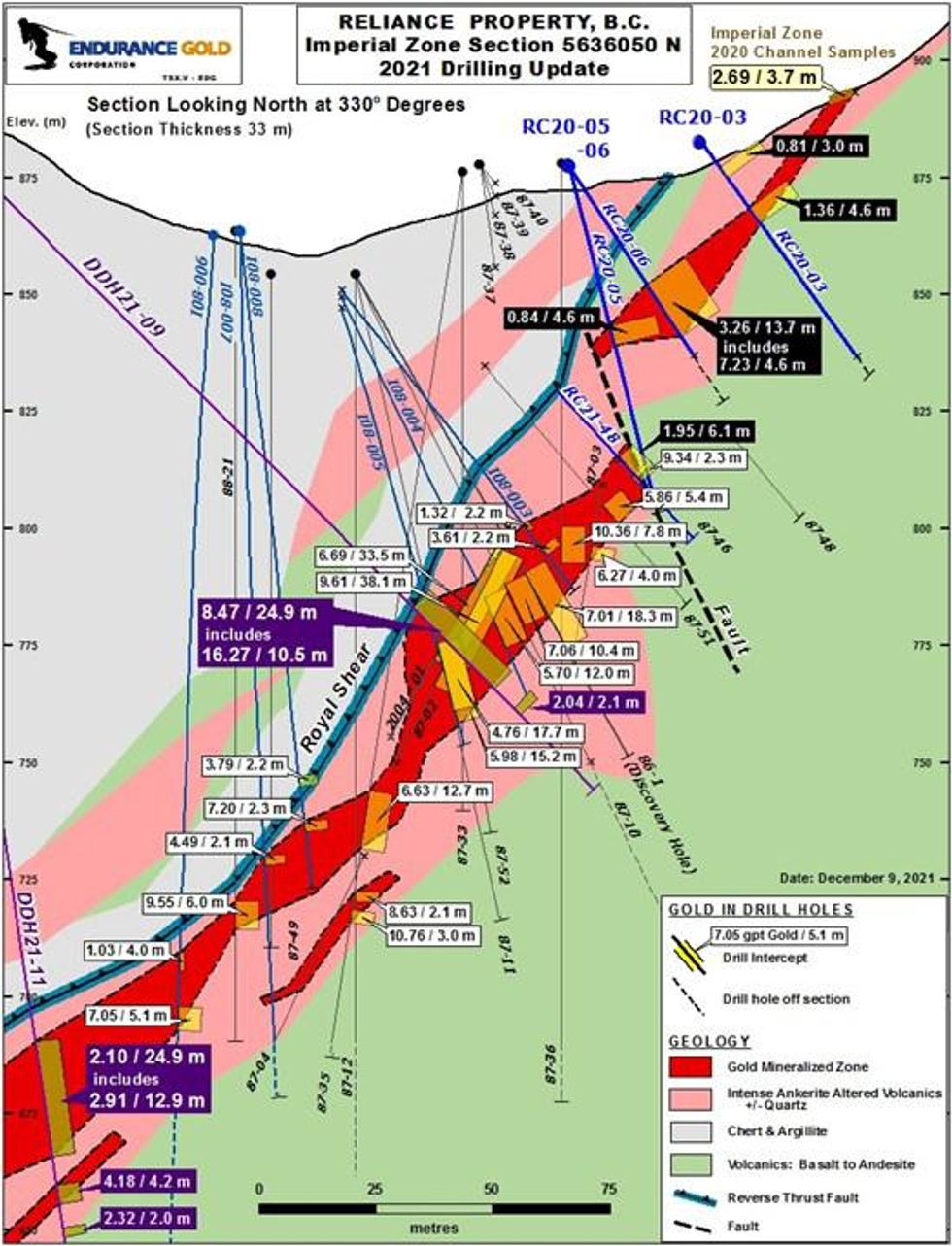

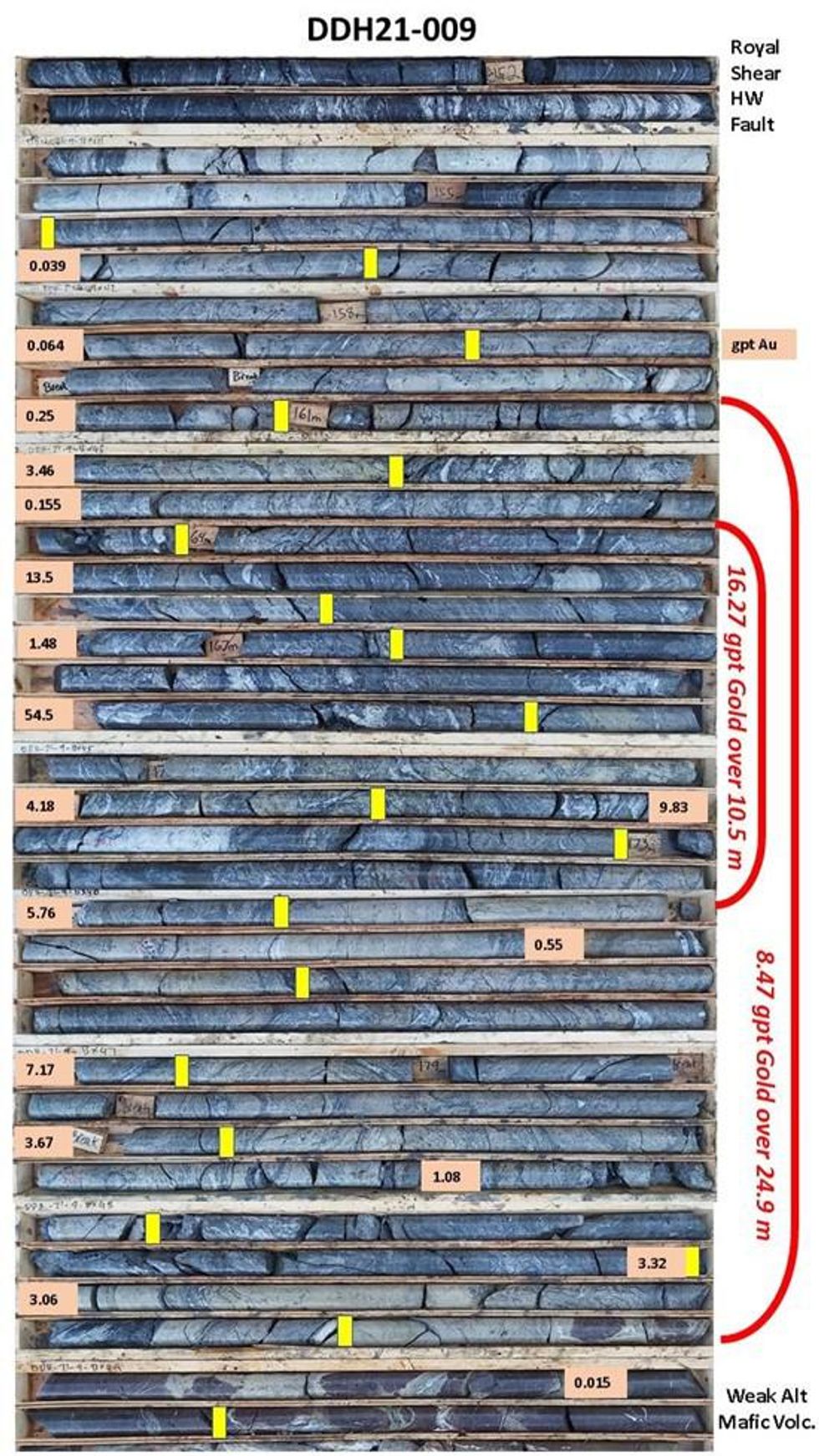

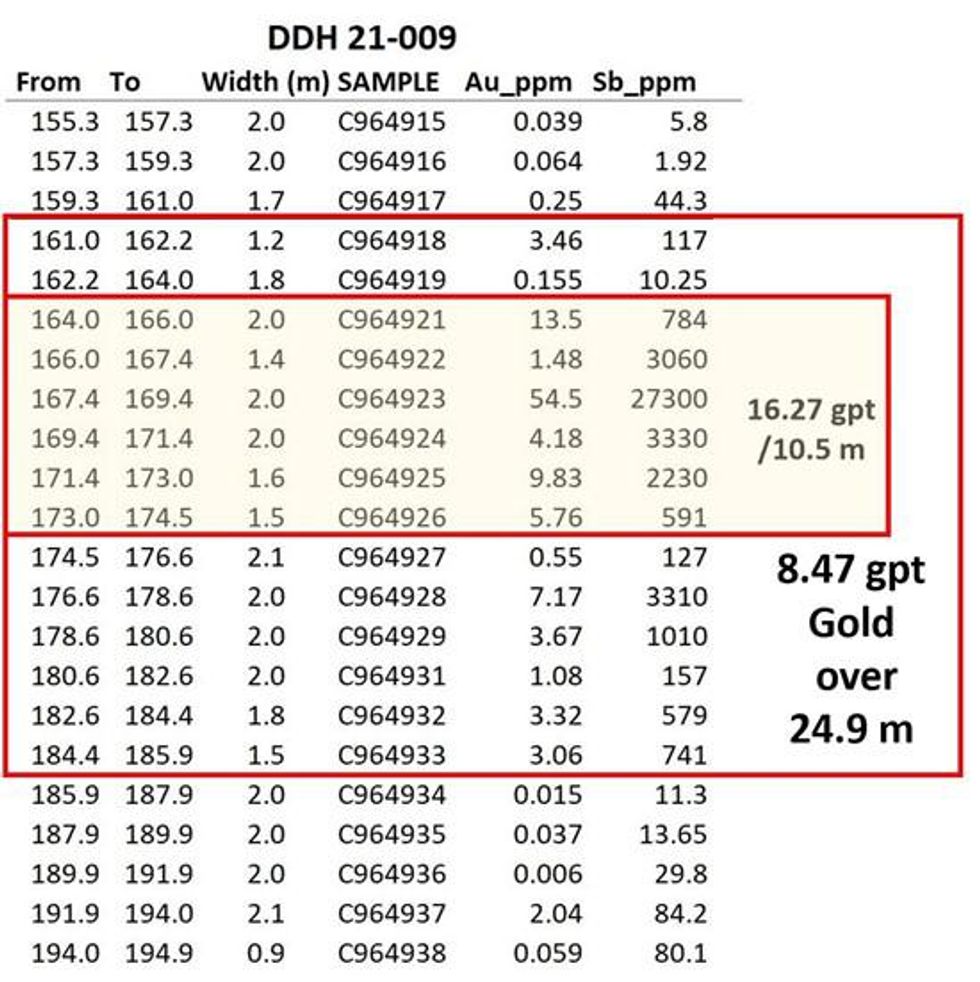

- DDH21-009 intersected gold mineralization commencing at 161 m which returned 8.47 gpt gold over an interval of 24.9 m (est true width of 24 m) with a high-grade interval of 16.27 gpt gold over 10.5 m. The hole was targeted to intersect the Imperial Zone about 100 m below surface. The hole was drilled at an azimuth of 045 degrees and angle -45 degrees. The location is plotted on the drill section included as Figure 1. A photo of the drill core intersection is shown on Figure 2 below. The individual gold and antimony sample results for DDH21-009 are summarized in Table 1 below.

- DDH21-011 was drilled from the same setup as DDH21-009 at an azimuth of 055 degrees and steeper dip of -82 degrees. The hole intersected gold mineralization commencing at 208.1 m which returned 2.10 gpt gold over 24.9 m (est true width of 19 m) with a better grade interval of 2.91 gpt gold over 12.9 m. There was also a deeper intersection commencing at 239 m which returned 4.18 gpt gold over 4.2 m. The hole was targeted to intersect the Imperial Zone about 130 m down dip from the intersection in DDH21-009. The location is plotted on Figure 1.

"We are pleased to see the Reliance Property continue to deliver high-grade intervals over substantial widths," commented Robert T. Boyd, CEO of Endurance Gold. "This wide high grade Imperial Zone diamond drill intersection is located 420 metres away from the wide high-grade intersections at the Eagle Zone Discovery announced last week, indicating excellent exploration potential of the Reliance Property. We look forward to expanding the system further with the pending assay results."

Drill holes DDH21-009 and DDH21-011 were collared in a hanging wall sequence of interbedded carbonaceous argillite and chert with minor mafic volcanic. Within the hanging wall sediments, the Royal Shear complex is observed as multiple anastomosing brittle-ductile bedding parallel shears that deform the sedimentary package. The gold mineralized zone is hosted within the mafic volcanic sequence just below the Royal Shear Fault which is a bounding fault separating the hanging wall sediments from the foot wall mafic volcanics. The gold mineralized zones are associated with pervasively iron carbonate and sericite altered mafic volcanic host rocks which have been subject to brittle deformation and consist of multigenerational breccia with introduced pyrrhotite-pyrite-stibnite-arsenopyrite, silicification and quartz-vein stockwork.

DDH21-012 is a vertical hole drilled 160 m east of DDH21-009 with the objective of intersecting the Imperial Zone near surface and to explore a covered area between the Imperial Zone and Eagle Zone. There were no significant gold intersections in this hole. In the target horizon feldspar porphyry was intersected and obscures the mineralized zone in this area. Assay results are pending for DDH21-008 and DDH21-010 which were drilled in a horizontal fan pattern from the same setup as DDH21-009 with the goal of testing the strike extensions of mineralization for approximately 100 m along strike from the encouraging intersection in DDH21-009.

As reported on September 27, 2021, the majority of the drill core from the 1980s Imperial Zone drilling is in very poor condition or entirely lost, and not recoverable to professional standards. Thus, the four holes of the 2021 drill program that tested the Imperial Zone were dedicated to collect representative gold mineralized intervals to assist in developing a new lithological, structural and alteration model for the zone.

To date, assay results have been received for 322 of the 1,310 drill core samples that have been submitted for assay analysis. The remaining gold assay results are expected to be received through December and the first quarter of 2022 and will be reported when received.

Endurance Gold Corporation is a company focused on the acquisition, exploration and development of highly prospective North American mineral properties with the potential to develop world-class deposits.

Robert T. Boyd

FOR FURTHER INFORMATION, PLEASE CONTACT

Endurance Gold Corporation

(604) 682-2707, info@endurancegold.com

www.endurancegold.com

Diamond drill core was logged and evaluated on the Property and samples designated for collection under the supervision of a geologist at the property. Drilling was completed using a skid mounted Hydracore 2000 equipped with NQ size tools capable of collecting 4.76 cm diameter core. Diamond drill core was cut using a diamond drill saw with one half of the core sent for analysis and the remaining kept for future studies. Sample intervals were typically 2 metre core length and intervals were shortened for lithology or alteration changes. For drilled and sampled intervals of poor average core recovery, the complete core was sampled and sent to the laboratory for assay analysis. All diamond drill core samples have been submitted to ALS Global in North Vancouver, BC, an ISO/IEC 17025:2017 accredited laboratory, where they are crushed to 70% Endurance Gold monitors QA/QC by inserting blanks, certified standards and pulp duplicates into the sample stream.

The 2020 and 2021 work program is supervised by Darren O'Brien, P.Geo., an independent consultant and qualified person as defined in National Instrument 43-101. Mr. O'Brien has reviewed and approved this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of factors beyond its control, and actual results may differ materially from the expected results.

Figure 1: Reliance Property, Imperial Zone - Drill Section

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/4976/107178_bdc49d15c4f91a78_002full.jpg

Figure 2: Reliance Property, Imperial Zone - DDH21-009 Drill Intersection Photo

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4976/107178_figure%202_%20reliance%20ddh21-009%20imperial%20zone%20core%20photo%20with%20assays.jpg

Table 1: Reliance Property, Imperial Zone - DDH21-009 Assay Results Summary

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/4976/107178_table%201_%20ddh21-009%20results%20table.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107178