NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

ExGen Resources Inc. (TSX.V: EXG; OTC: BXXRF) (" ExGen ") is pleased to announce that, subject to TSX Venture Exchange (" TSX Venture ") acceptance, ExGen intends to complete a consolidation (the " Consolidation ") of its common shares (" Common Shares ") on the basis of 10 pre-Consolidation Common Shares for 1 post-Consolidation Common Share. The record date for the Consolidation will be set subsequent to the regulatory approvals for the Consolidation being obtained. ExGen will issue a further news release confirming the record date and the effective date for the Consolidation.

Once implemented, the Consolidation will not change ExGen's authorized share capital and each shareholder will hold the same percentage of Common Shares outstanding immediately after the Consolidation as such shareholder held immediately prior to the Consolidation. However, the exercise price and number of Common Shares of ExGen issuable upon the exercise of outstanding warrants, and options, if any, will be proportionally adjusted upon the implementation of the Consolidation in accordance with the terms of such securities.

About ExGen Resources Inc.

ExGen, is a project accelerator that seeks to fund exploration and development of our projects through joint ventures and partnership agreements. This approach significantly reduces the technical and financial risks for ExGen, while maintaining the upside exposure to new discoveries and potential cash flow. ExGen intends to build a diverse portfolio of projects across exploration stages and various commodity groups. ExGen currently has 6 projects in Canada and the US.

For more information on ExGen please contact ExGen Resources Inc.

| Jason Tong Chief Financial Officer Email: jason@catapultgroup.ca | |

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts respon sibility for the adequacy or accuracy of this news release .

This news release contains certain "forward-looking information" within the meaning of applicable Canadian securities laws. All statements included herein, other than statements of historical fact, are forward-looking information and such information involves various risks and uncertainties. In particular, this news release contains forward-looking information in respect of the completion of the Consolidation. There can be no assurance that such forward-looking information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such forward looking- information. This forward-looking information reflects ExGen's current beliefs and is based on information currently available to ExGen and on assumptions ExGen believes are reasonable. These assumptions include, but are not limited to: TSX Venture acceptance of the Consolidation; and the market acceptance of ExGen's business strategy. Forward-looking information is subject to known and unknown risks, uncertainties and other factors which may cause the actual results, level of activity, performance or achievements of ExGen to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the early stage development of ExGen and its projects; general business, economic, competitive, political and social uncertainties; capital market conditions and market prices for securities, junior market securities and mining exploration company securities; commodity prices, and in particular, copper, gold, silver and zinc prices; the actual results of current exploration and development or operational activities; competition; changes in project parameters as plans continue to be refined; accidents and other risks inherent in the mining industry; lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation or income tax legislation, affecting ExGen; timing and availability of external financing on acceptable terms; lack of qualified, skilled labour or loss of key individuals; and risks related to COVID-19 including various recommendations, orders and measures of governmental authorities to try to limit the pandemic, including travel restrictions, border closures, non-essential business closures, quarantines, self-isolations, shelters-in-place and social distancing, disruptions to markets, economic activity, financing, supply chains and sales channels, and a deterioration of general economic conditions including a possible national or global recession. A description of additional risk factors that may cause actual results to differ materially from forward-looking information can be found in ExGen's disclosure documents on the SEDAR website at www.sedar.com. Although ExGen has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned that the foregoing list of factors is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking information as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Forward-looking information contained in this news release is expressly qualified by this cautionary statement. The forward-looking information contained in this news release represents the expectations of ExGen as of the date of this news release and, accordingly, is subject to change after such date. However, ExGen expressly disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities law.

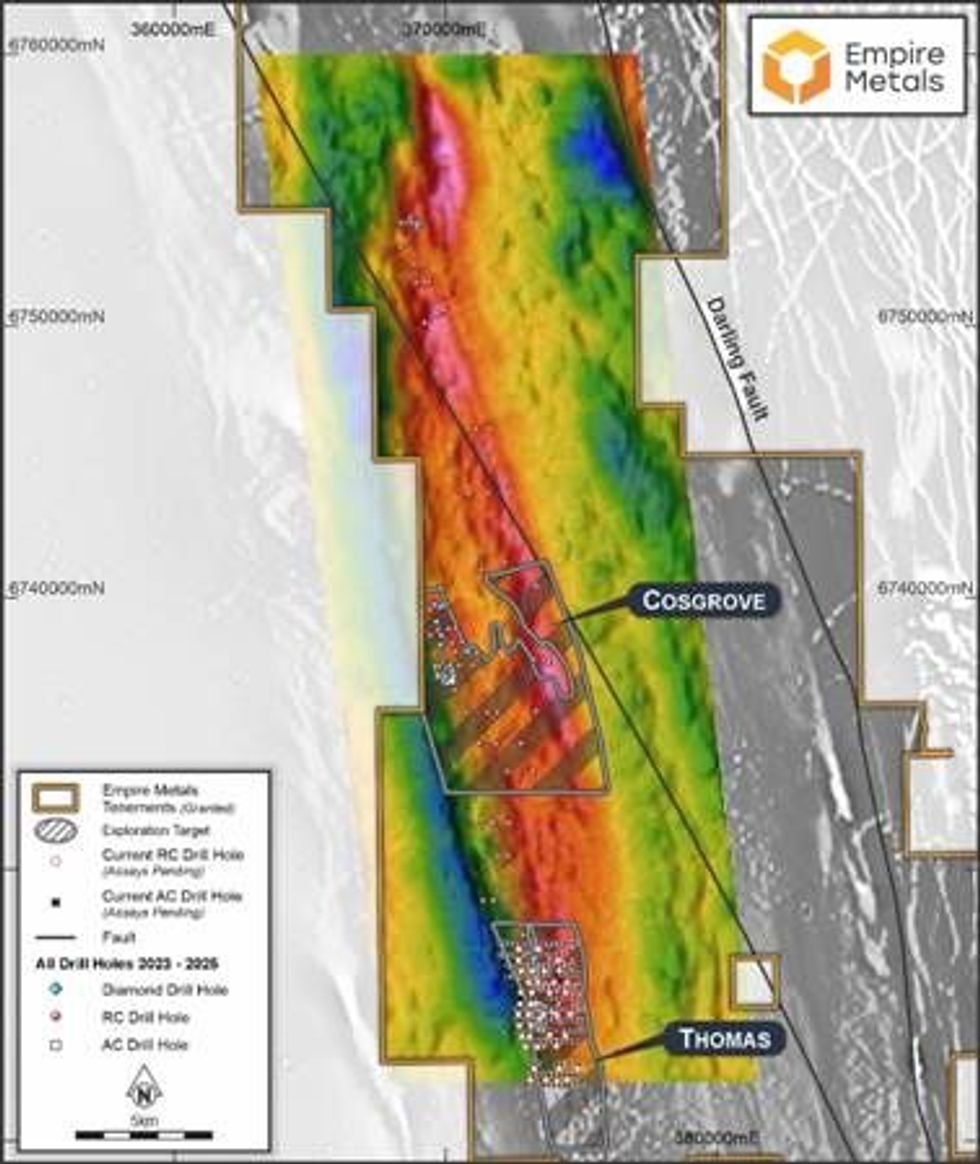

Figure 1. Grey-scale magnetics overlain by airborne gravity data showing RC, AC and diamond drillhole collar locations and JORC Exploration Target areas.

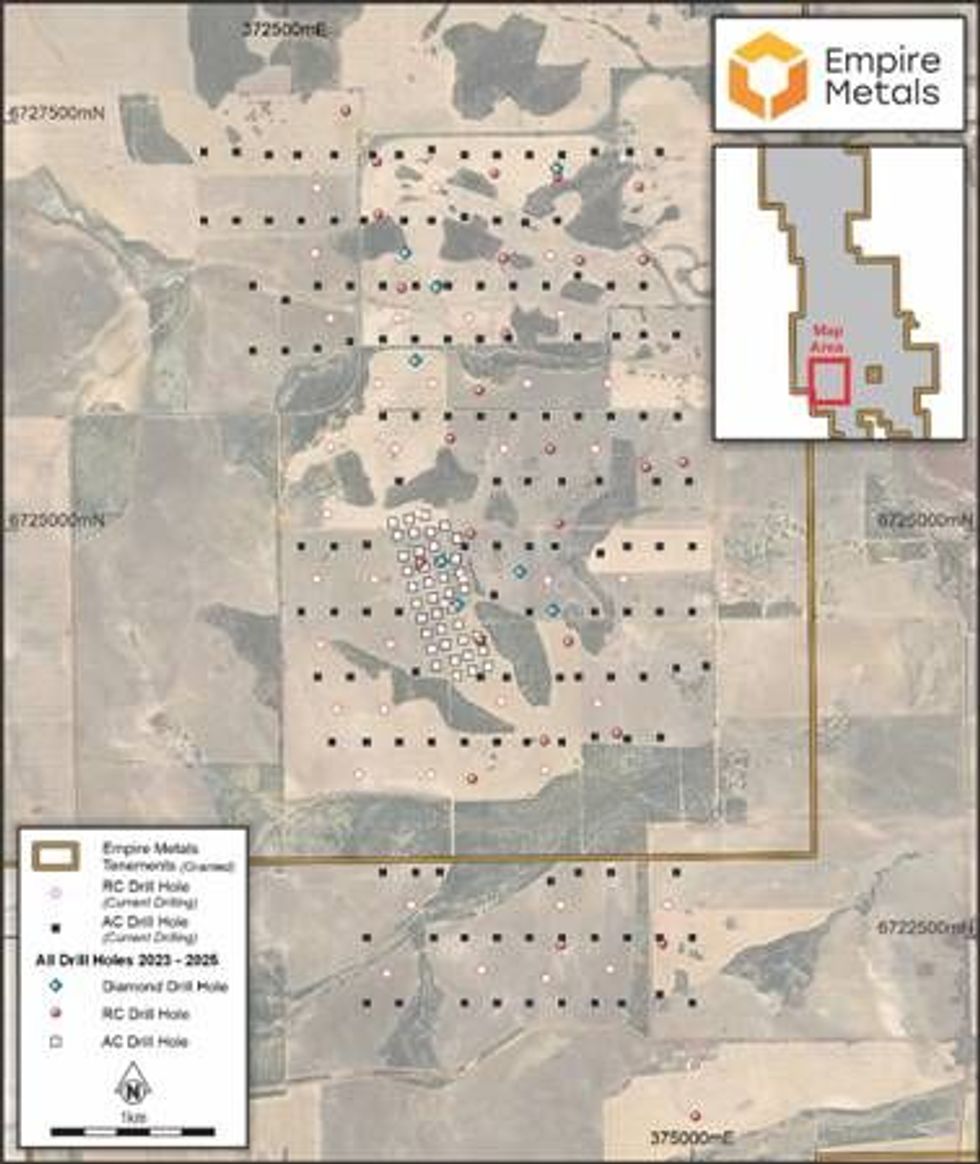

Figure 1. Grey-scale magnetics overlain by airborne gravity data showing RC, AC and diamond drillhole collar locations and JORC Exploration Target areas. Figure 2. RC and AC drill hole collar locations within the Thomas Prospect priority area.

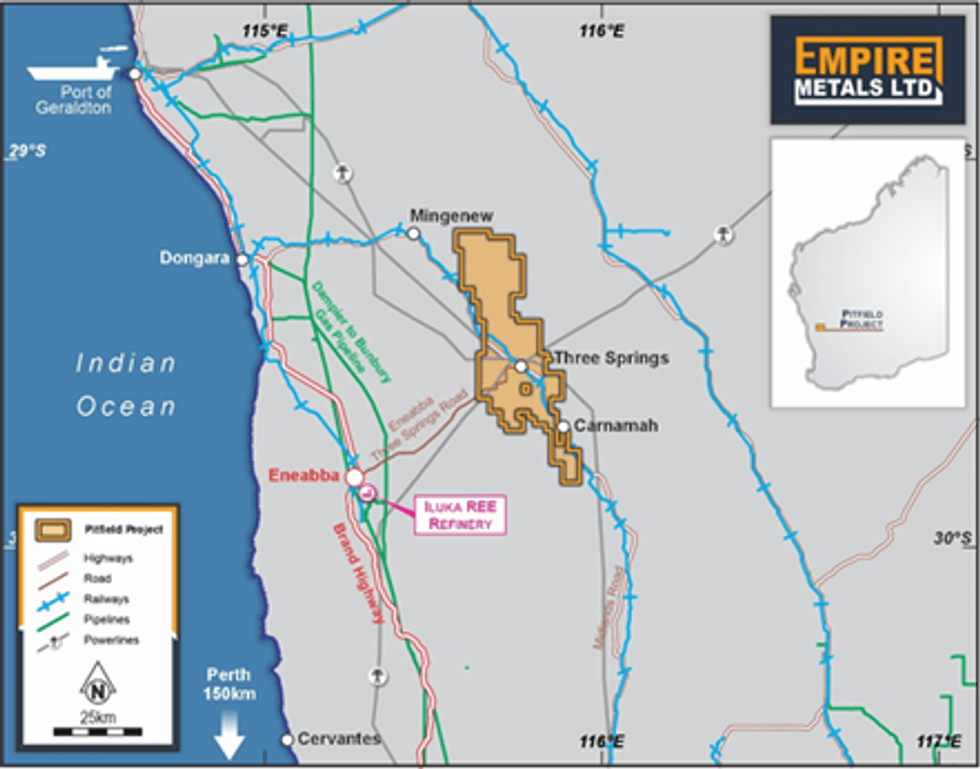

Figure 2. RC and AC drill hole collar locations within the Thomas Prospect priority area. Figure 2. Pitfield Project Location showing theMid-West Region Infrastructure and Services

Figure 2. Pitfield Project Location showing theMid-West Region Infrastructure and Services

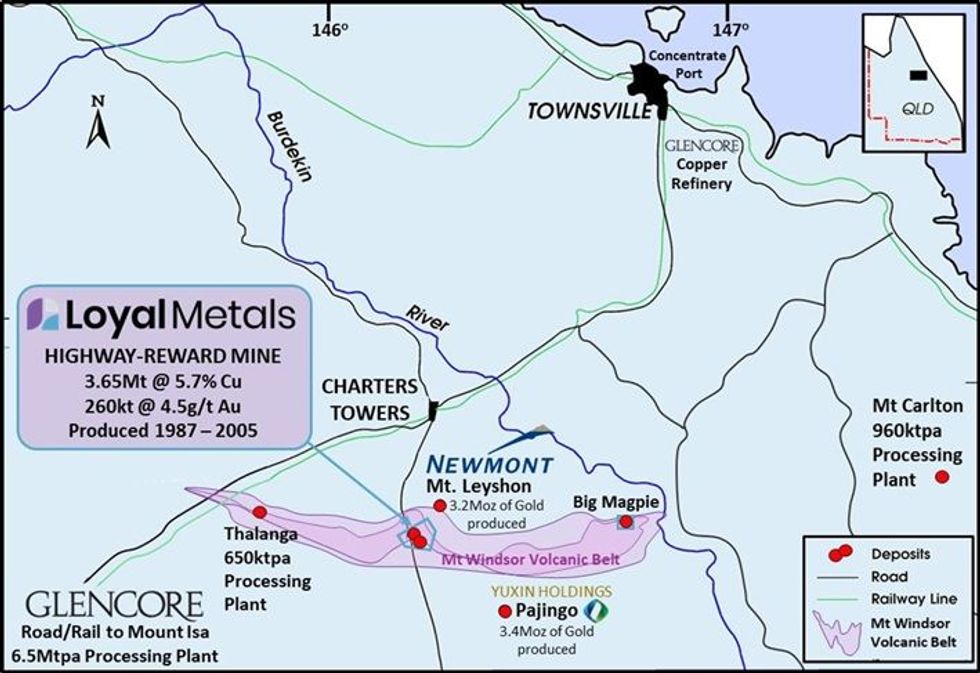

Figure 1 Highway Reward Copper Gold Mine: Located 37 km south of Charters Towers within the Mount Windsor Volcanic Belt. Accessible via an all-weather highway, 172 km from the Port of Townsville, Queensland, Australia.

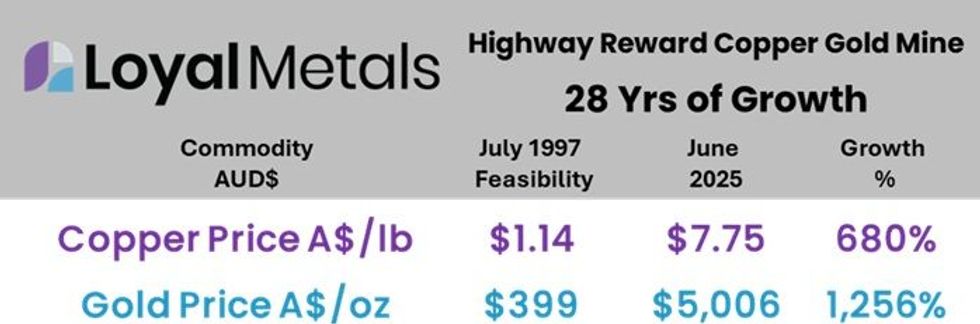

Figure 1 Highway Reward Copper Gold Mine: Located 37 km south of Charters Towers within the Mount Windsor Volcanic Belt. Accessible via an all-weather highway, 172 km from the Port of Townsville, Queensland, Australia. Graph 1: Highway Reward Copper Gold Mine - mining ceased in July 2005: 28 Years of Commodity Growth

Graph 1: Highway Reward Copper Gold Mine - mining ceased in July 2005: 28 Years of Commodity Growth