May 05, 2022

Arcadia Minerals Limited (ASX:AM7, FRA:8OH), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that Snowden Optiro has provided the Company with an Independent Geological Report titled “Report for Orange River Pegmatite Geology and Resource Estimation of the D, E and F Pegmatites, Project Number JB018308, May 2022” 1 which consist of a revision of a Mineral Resource Estimate, announced by the Company on 23 September 20212 , for the Company’s 80% owned Swanson Tantalum exploration project situated in Tantalite Valley, Namibia.

HIGHLIGHTS

- Revision of September 2021 Mineral Resource delivers a new estimate including a total indicated and inferred resource of 2.59Mt (an increase of 115%) at an average grade of 486 ppm Ta2O5 (an increase of 17.9%), 73 ppm Nb2O5 and 0.15 % Li2O.

- Total in situ metal content of 1,257 tonnes (represents an increase of 154%)

- Mineral Resource Categorisation:

- Indicated Resource: 1,439Mt at an average grade of 498 ppm Ta2O5, 72 ppm Nb2O5 and 0.14 % Li2O,

- Inferred Resource: 1,145Mt at an average grade of 472 ppm Ta2O5, 75 ppm Nb2O5 and 0.17 % Li2O

- To date only 15 of the more than 200 known pegmatites present over Arcadia’s three licenses have been explored.

- Mineral Resource Estimate conducted over 10 (of 15) outcropping opencastable shallow pegmatites located at Swanson, namely the D0, D1, D2, E2, E3, E4, E6, E7, E8 and F1.

- Public domain information from 11 Tantalum operations from around the world were used to benchmark the Swanson project against other Tantalum projects. The weighted average grade of these 11 deposits is 233 ppm Ta2O5, indicating that the Swanson Project grades are significantly above its global peer group and of the highest grades in the world.

- The Mineral Resource Estimate is to form the basis of a feasibility study currently underway (expected to be completed in September 2022).

- Mineral Resource is based on an exploration program that includes:

- 283 channel / chip samples and

- 52 diamond boreholes on a 50m grid spacing

Philip le Roux, the CEO of Arcadia stated:

“When the company commenced the phase 2 drilling program at Swanson the primary objective was to increase the previous JORC resource of 1,214Mt @ 412 ppm Ta2O5 we set out to increase the resource to more than 2.5 million tonnes. It is very pleasing to announce that we’ve achieved this goal and more, by attaining an 18% higher grade than what was reported under the maiden Mineral Resource published in September 2021. The results bode well for the Company’s upcoming feasibility study, which is already underway with an outcome expected by September 2022.”

Jurie Wessels, the Executive Chairman of Arcadia stated:

“With this impressive result our priority for the Swanson project has progressed towards the feasibility study, with the aim to demonstrate that the production of a 25% Ta2O5 concentrate is feasible and to prove that Swanson will become the cash generator we envisioned it to be for Arcadia. Additionally, we’ll aim to explore the abundant pegmatite swarms scattered throughout our licenses in Tantalite Valley to possibly replicate the resources we discovered at Swanson and thereby increase more value for our shareholders.”

Revised Mineral Resource Estimate

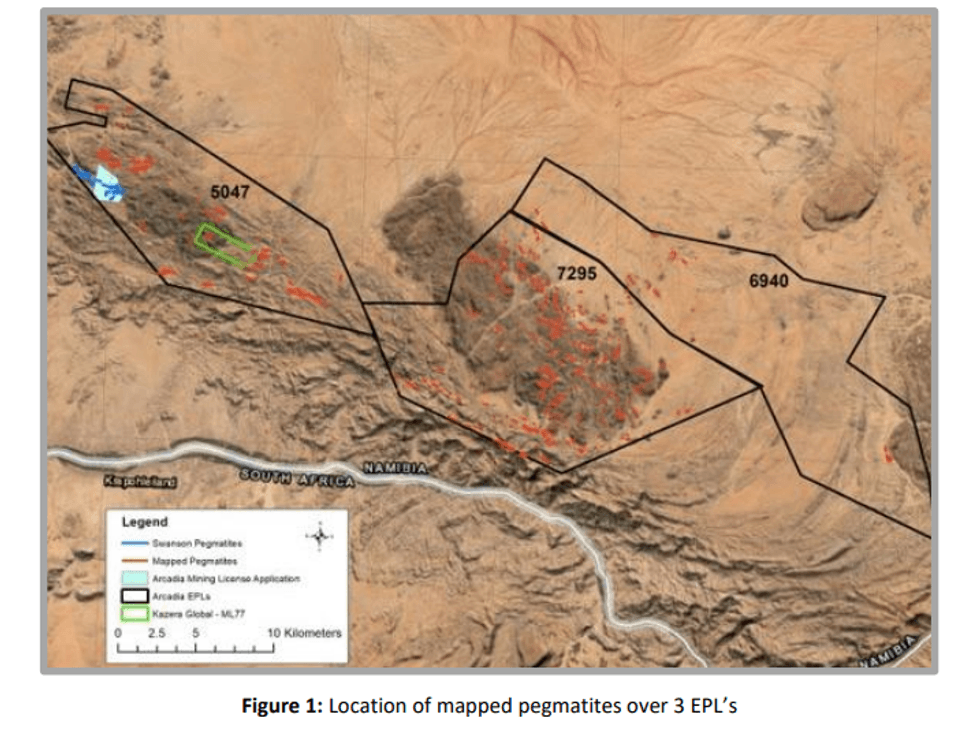

Through its 80% owned subsidiary Orange River Pegmatite (Pty) Ltd (“ORP”) Arcadia ownsthe exploration rights to three EPL’s (5047, 6940 and 7295). The total amount of pegmatites mapped by the South African Council of Geoscience over the three ORP EPL’s amount to more than 200 pegmatites (see Figure 1). All indications are that the same mineralisation model present in the 15 pegmatites explored to date at Swanson could be applicable to these pegmatites.

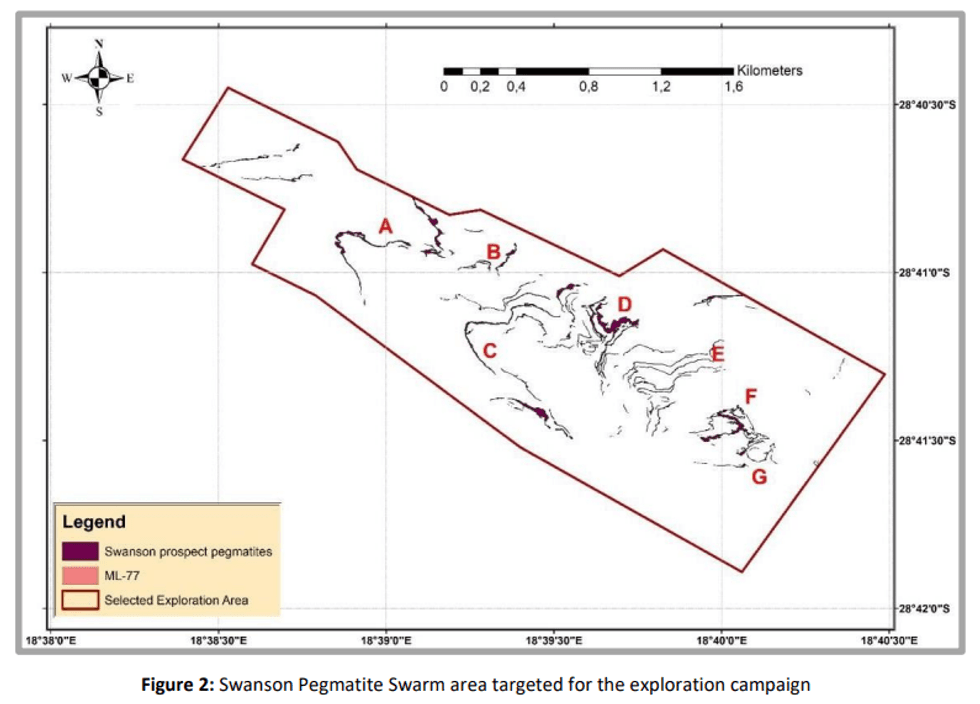

Fifteen individual pegmatite bodies > 1 m thickness within the Swanson Pegmatite Swarm

were identified as high priority and were then targeted for mapping, sampling and drilling.

This area was delineated, and a high-resolution drone survey was undertaken to assist with

the planning of the exploration program. The pegmatite units were clustered and named “A”

to “F” in a west to east direction as shown in Figure 2.

Click here for the full ASX Release

This article includes content from Arcadia Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AM7:AU

The Conversation (0)

11 September 2021

Arcadia Minerals

A Battery Metal Explorer Operating Within Resource-Rich Namibia

A Battery Metal Explorer Operating Within Resource-Rich Namibia Keep Reading...

23 September 2022

Drilling Completed At Karibib Copper-Gold Project

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that its drilling contractor Hammerstein Mining and Drilling completed a 551m... Keep Reading...

29 August 2022

Drilling Commenced At Karibib Copper-Gold Project

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that it instructed Hammerstein Mining and Drilling to execute a 526m RC... Keep Reading...

29 July 2022

Quarterly Activities Report – June Quarter 2022

Arcadia Minerals Limited (ASX:AM7, FRA:8OH) (Arcadia, AM7 or the Company), the diversified exploration company targeting a suite of battery metal projects aimed at Lithium, Tantalum, Nickel, Copper and Gold in Namibia, is pleased to provide its quarterly activities report for the period ending... Keep Reading...

09 May 2022

Kum-Kum Nickel Project Mineral Systems Approach Results

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that the Department of Earth Sciences at the University of Stellenbosch... Keep Reading...

15h

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00