May 16, 2024

Impact Minerals Limited (ASX:IPT) (Company) is pleased to advise that it has received firm commitments from sophisticated investors for a strategic placement (Placement) to raise A$3,000,000 (before costs) via the issue of 150,000,000 fully paid ordinary shares (Placement Shares) in the capital of the Company (Shares) at an issue price of A$0.02 per Placement Share. For every three Placement Shares subscribed for, one free-attaching option will be issued with an exercise price of $0.027 per option and an expiry date that is 15 months after the date of issue (Placement Options).

- Strategic A$3 million placement mostly supported by major shareholders to be issued under the Company's existing available placement capacity under ASX Listing Rule 7.1.

- In addition, funds being received from exercise of listed options (IPTOB) into shares.

- Anticipated Research and Development Rebate of $395,000 due shortly.

Major shareholders strongly supported the placement, an endorsement of the Company's future strategic plans.

Impact Minerals’ Managing Director Dr Mike Jones, said, “We are now very well-funded to complete the Pre-Feasibility Study on our unique Lake Hope High Purity Alumina Project located here in Western Australia by the end of this year. We have deliberately placed most of the shares to our major shareholders which is a strong endorsement of our plan to move forward as quickly as possible with Lake Hope and we thank them for their support.

We would also like to thank those new shareholders who have recently exercised our listed IPTOB 2 cent per share options I would like to encourage other holders of IPTOB to consider doing the same before the expiry date of June 2nd. As well as the Lake Hope project we will also be able to progress our Arkun battery and strategic metals project for which we recently received up to $180,000 in co-funding from the WA Governments Exploration Incentive Scheme for drilling of our exciting Caligula copper target”.

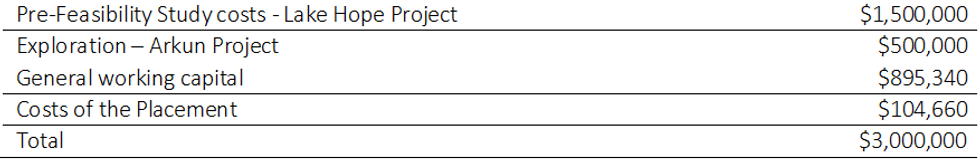

The proposed use of funds of the placement funds is as follows:

Evolution Capital and Barclay Pearce Capital acted as the Joint Lead Managers to the Placement (Broker) and will be issued a cumulative total of 15,000,000 options exercisable at A$0.027 each with an expiry date 15 months after the date of issue (Broker Options). The Broker Options will be split equally between the Joint Lead Managers.

In addition to the Broker Options, the Brokers will receive a Management fee of 2% of Proceeds from the Offer and a Selling Fee of 4% of Proceeds from the Offer excluding the Chairman’s List.

The Placement Shares, Placement Options and Broker Options will be issued under the Company’s existing available placement capacity under ASX Listing Rule 7.1. The issue price of the Placement Shares represents a 5.6% discount to the volume weighted average price for the 15 days immediately before 15 May 2024 being $0.0211.

All Placement Shares and Shares issued upon exercise of the Placement Options and Broker Options will rank equally with the Company’s existing Shares on issue.

Provided all the requirements under the ASX Listing Rules have been met, the Company intends to seek quotation of the Placement Options and Broker Options, and to issue the Placement Options and Broker Options under a prospectus.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00