January 03, 2024

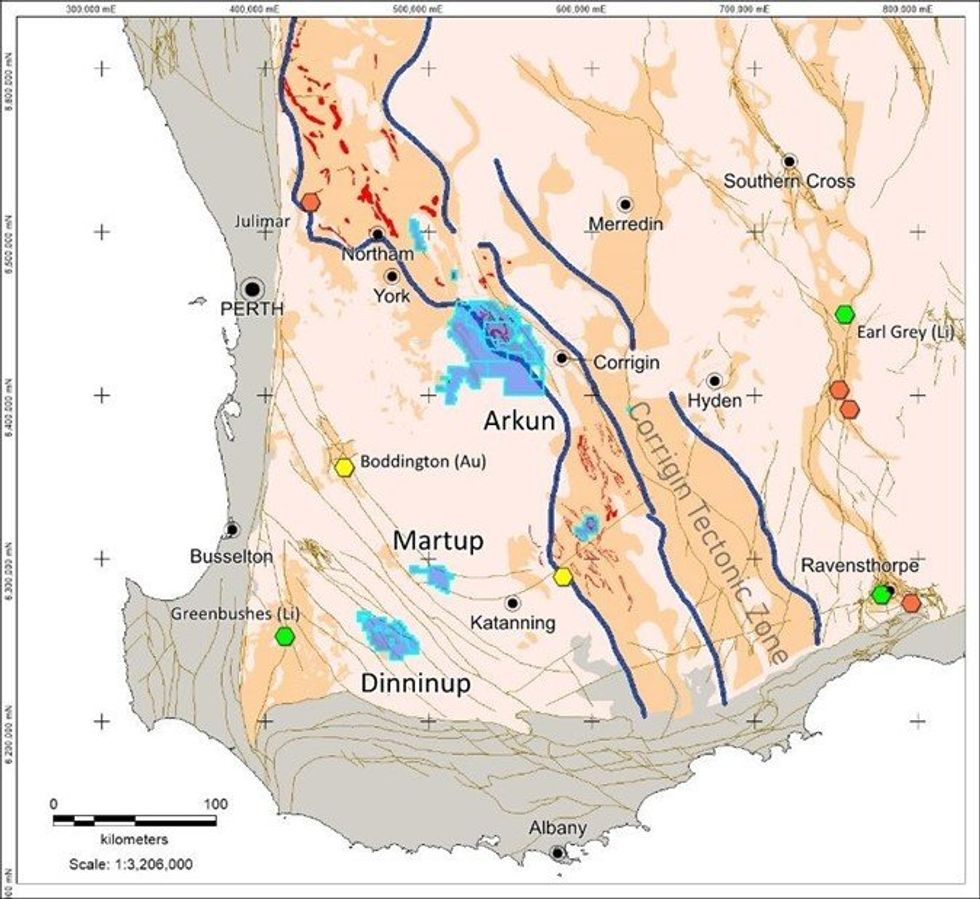

Significant high-tenor Rare Earth Element (REE) results have been returned from recent soil geochemistry surveys at Impact Minerals Limited’s (ASX:IPT) 100% owned Arkun Project located 150 km east of Perth in the emerging mineral province of southwest Western Australia (Figure 1).

- Rare Earth Element anomalism of up to 5,880 ppm (0.59%) Total Rare Earth Oxide (TREO+Y) and Nd+Pr of up to 21% has been returned from soil sampling at the Arkun Project.

- The anomaly covers at least a 3 km2 area at greater than 1,000ppm TREO and is open along strike to the northwest and southeast.

- The soil anomaly is developed in weathered granite and is a prime target for a large clay-hosted REE deposit. The granite covers a further area of about 170 km2 which has yet to be explored.

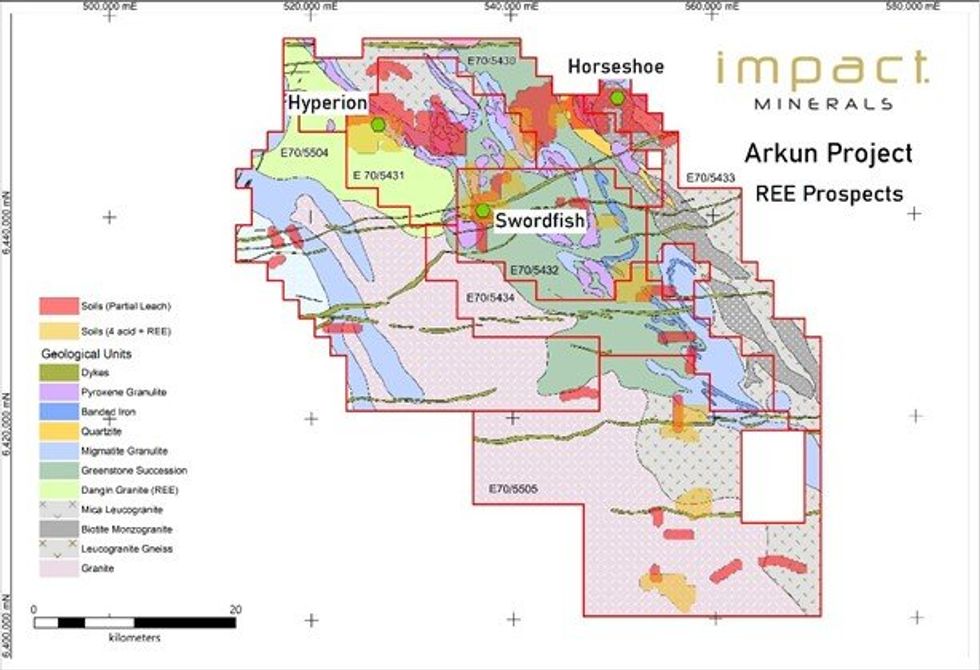

- Another new prospect, Swordfish, and the previously identified Horseshoe prospect attest to the significant prospectivity for REE mineralisation across the Arkun project.

- Early drilling and bulk sampling for metallurgical test work is planned for the next two Quarters.

Very significant assays of up to 5,880 parts per million (ppm) Total Rare Earth Element Oxides and Yttrium (TREO +Y) have been returned from the newly identified Hyperion prospect in the northwestern part of the project area (Figure 2). These are some of the highest TREO-in-soil results reported recently in Western Australia. A further anomaly with up to 1,783 ppm TREO+Y has also been identified at Swordfish. 10 km southeast of Hyperion (Figure 2).

These new anomalies add to the previously reported significant and large, 10 km long REE anomaly at the Horseshoe Prospect located 25 km east of Hyperion (Figure 2) and emphasise the significant exploration potential for REE at the Arkun project (ASX Release 1st June 2023).

Impact Minerals’ Managing Director, Dr Mike Jones, said, “The discovery of the Hyperion Prospect is a significant breakthrough in exploring the Arkun Project, which has so far focused on nickel, platinum, and copper. Impact's exploration strategy recognises that the Corrigin Tectonic Zone has potential for various commodities, including Rare Earth Elements (REEs), and the Hyperion Prospect could host a large REE deposit in the clays developed in weathered granite. However, the key to an economic discovery is to evaluate how easily the REEs can be extracted through simple acid leaching. For this purpose, initial drill testing and bulk sampling for metallurgical test work will be conducted in the upcoming field season. The extraction characteristics will help guide resource definition drilling later in the year”.

Hyperion Prospect

The soil geochemistry results have defined an area of more than 3 km2 at greater than 1,000 ppm TREO+Y at Hyperion (Figure 3). Five samples returned greater than 2,500 ppm TREO+Y with a peak value of 5,880 ppm (0.58%) TREO+Y, amongst some of the highest tenor REE soil values reported in Western Australia. A selection of assays containing more than 1,000 ppm TREO is given in Appendix 1.

Within the anomaly, two broad northwest-southeast trending zones of more than 1,500 ppm TREO+Y-in- soils extend for 2.5 km along-trend and are open in both directions (Figure 3).

The anomaly has an average neodymium plus Praesedynium percentage of about 20%, typical of most regolith-hosted mineralisation in the region with Heavy REE contents of between 54 ppm and 200 ppm within the >1,000 ppm parts of the anomaly (Appendix 1). This is encouraging for discovering the more economically compelling Heavy Rare Earths close to the surface.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00