February 12, 2025

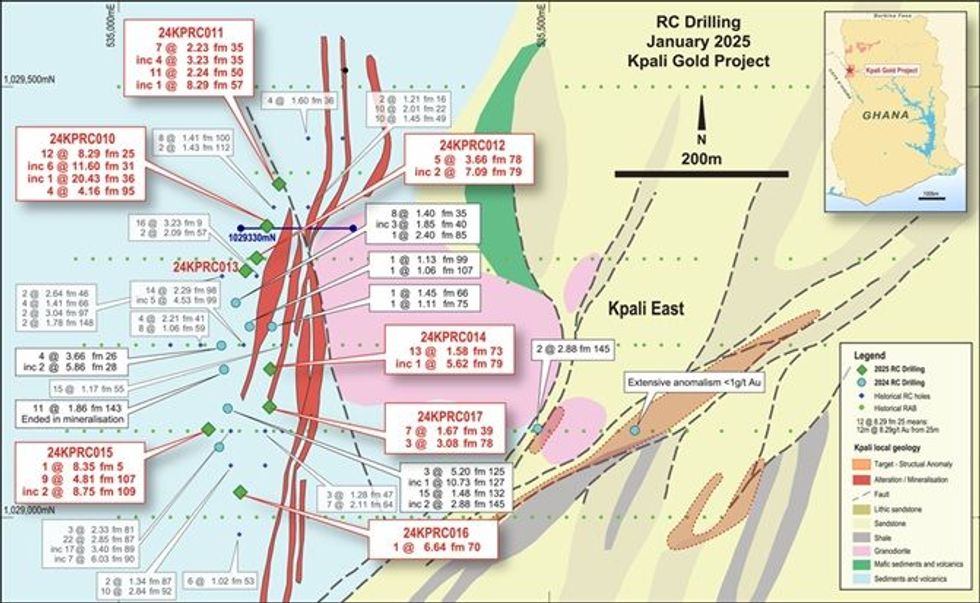

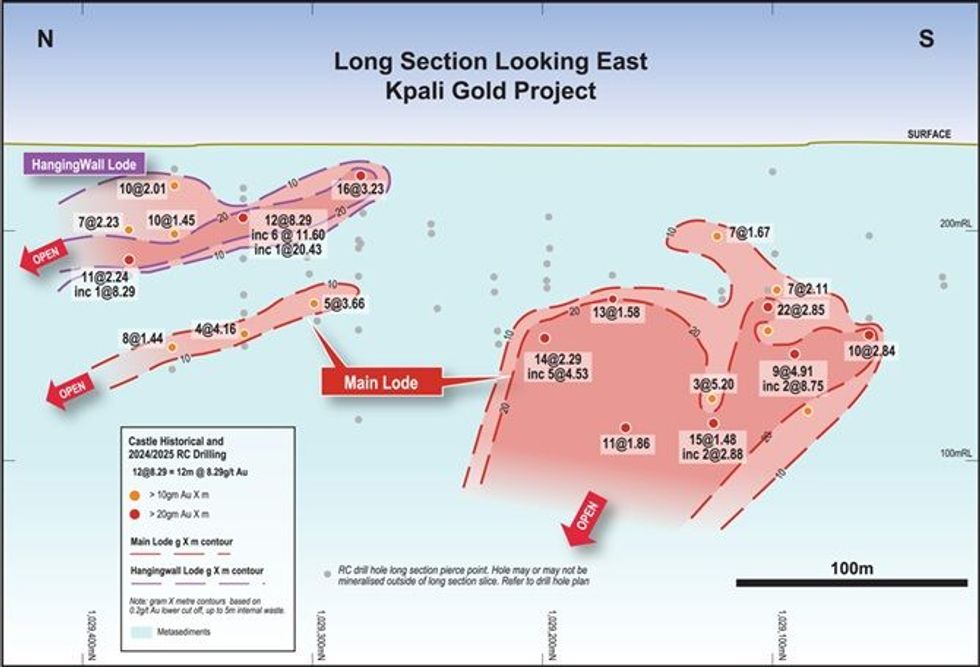

Castle Minerals Limited (“Castle” or the “Company”) advises that a recently completed eight-hole, 1,106m RC drill programme at its Kpali Gold Prospect in Ghana’s Upper West Region (“Project”, “Kpali”) has intersected mineralisation in all holes including 12m at 8.29g/t Au from 25m including 6m at 11.60g/t Au from 31m and a peak 1m intercept of 20.43g/t Au at 36m in an interpreted ‘hangingwall’ lode and then 4m at 4.16g/t Au from 95m in a lower “footwall” lode (24KPRC010).

- Extremely strong gold intercepts from eight-hole RC drilling programme at Kpali Gold Prospect in Ghana’s Upper West Region.

- All eight holes intersected shallow mineralisation with better intercepts including:

- 12m at 8.29g/t Au from 25m (24KPRC010) incl.

- 6m at 11.60g/t Au from 31m and

- a peak 1m intercept of 20.43g/t Au at 36m and

- 4m at 4.16g/t Au from 95m.

- 7m at 2.23g/t Au from 35m (24KPRC011) incl.

- 4m at 3.23g/t Au from 35m and

- 11m at 2.24g/t Au from 50m incl.

- 1m at 8.29g/t Au from 57m.

- 5m at 3.66 g/t Au from 78m (24KPRC012) incl.

- 2m at 7.09g/t Au 79m.

- 13m at 1.58g/t Au from 73m (24KPRC014) incl.

- 1m at 5.62g/t Au from 79m.

- 1m at 8.35g/t Au from 5m (24KPRC015) and

- 9m at 4.81g/t Au from 107m incl.

- 2m at 8.75g/t Au from 109m.

- 1m at 6.64g/t Au from 70m (24KPRC016).

- 7m at 1.67g/t Au from 39m (24KPRC017) and

- 3m at 3.08g/t Au from 78m.

- 12m at 8.29g/t Au from 25m (24KPRC010) incl.

- Status of Kpali Gold Prospect considerably upgraded.

- Broader district containing several other high conviction prospects confirmed as an emerging new exploration frontier.

- Next drilling programme to comprise step-out drilling at Kpali Gold Prospect and testing of other prospects including equally prospective Bundi discovery.

- Results hot on heels of recent Kandia “4000 Zone” RC programme that confirmed good gold continuity and returned strong intercepts including:

- 7m at 3.36g/t Au from 149m within 24m at 1.78g/t Au from 139m (24KARC002) and

- 5m at 3.49g/t Au from 82m within 11m at 2.26g/t Au from 79m (24KARC004).

- Immediate high-level objective is to confirm robust new West African mining camps at Kpali and Kandia and an initial 1.0Moz Au multi-prospect based mineral resource.

Castle Executive Chairman, Stephen Stone, commented “The Kpali Gold Prospect is developing into a robust discovery and is a strong indicator that we may be dealing with a new West African gold mining camp in Ghana’s emerging northern region.

The latest intercepts include some very decent widths and grades at shallow depths with good continuity which can have considerable positive impacts should mining be considered.

We have intersected a very impressive 12m at 8.29g/t Au from 25m, including 6m at 11.60g/t Au from 31m and a peak 1m intercept of 20.43g/t Au at 36m in a ‘hangingwall’ lode, and also 4m at 4.16g/t Au from 95m in a lower ‘footwall’ lode.

Apart from these standout results, very strong mineralisation has been encountered within most holes drilled, implying that with additional drilling we may be able to delineate a decent high value deposit.

We are very keen to get back drilling and to extend the Kpali Gold Prospect discovery as well as to follow-up historical drilling at the nearby Bundi discovery, 4km north.

There are also several other enticing prospects in the broader Kpali Gold Project area.

These drilling results follow excellent recent results from four holes at the Kandia Prospect, a second and separate gold discovery associated with a relatively under- explored 16km prospective contact between Birimian metasediments and a granite intrusion. Recent intercepts at Kandia included 7m at 3.36g/t Au from 149m within 24m at 1.78g/t Au from 139m and 5m at 3.49g/t Au from 82m within 11m at 2.26g/t Au from 79m.

These deposits lie in a classic setting for major gold deposits in West Africa and in particular northern Ghana which hosts the Cardinal Resources 5.1Moz gold Namdini deposit and the Azumah Resources 2.8Moz gold Black Volta Gold Project. The latter’s high-grade Julie deposit is immediately along strike from Kandia.

West Africa is where big gold discoveries can be and are still being made. With the gold price now at a level I could only dream of when starting my career, it’s the perfect time to be exploring Castle’s two new discoveries in the very stable, safe and mining friendly jurisdiction of Ghana.”

Additional intercepts included 7m at 2.23g/t Au from 35m(24KPRC011) including 11m at 2.24g/t Au from 50m, 5m at 3.6g/t Au from 78m (24KPRC012), 9m at 4.81g/t Au from 107m (24KPRC015) and 3m at 3.08g/t Au from 78m (KPRC017).

These results confirm the Kpali Gold Prospect, just one of several prospects within the broader Kpali Gold Project, as a robust discovery in a completely new district within Ghana’s emerging Northern Region exploration frontier.

With several other high conviction prospects yet to be evaluated in the area, including the nearby Bundi, Kpali East, Wa South East and Wa South West prospects, there appears to be present all the hallmarks of a new West African mining camp and the possibility of a considerable gold endowment.

The Kpali Gold Prospect lies within a mineralised corridor associated with a 30m to 50m wide zone of structural deformation immediately west of a granite intrusion. Three drilling programmes have identified near-surface, shallow plunging high-grade lode-style mineralisation to a depth of at least 100m. Multiple, closely-spaced mineralised lodes have been identified over at least 650m strike.

Overall, the geological setting at the broader Kpali Gold Project is of typically structurally-controlled, orogenic style mineralisation within Birimian terrane. This is a similar setting as that hosting several world- class gold mining operations in Ghana and West Africa generally. Orebodies with these characteristics can often extend to considerable depth.

Click here for the full ASX Release

This article includes content from Castle Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

19h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00