September 04, 2023

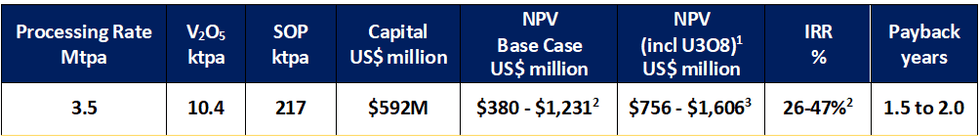

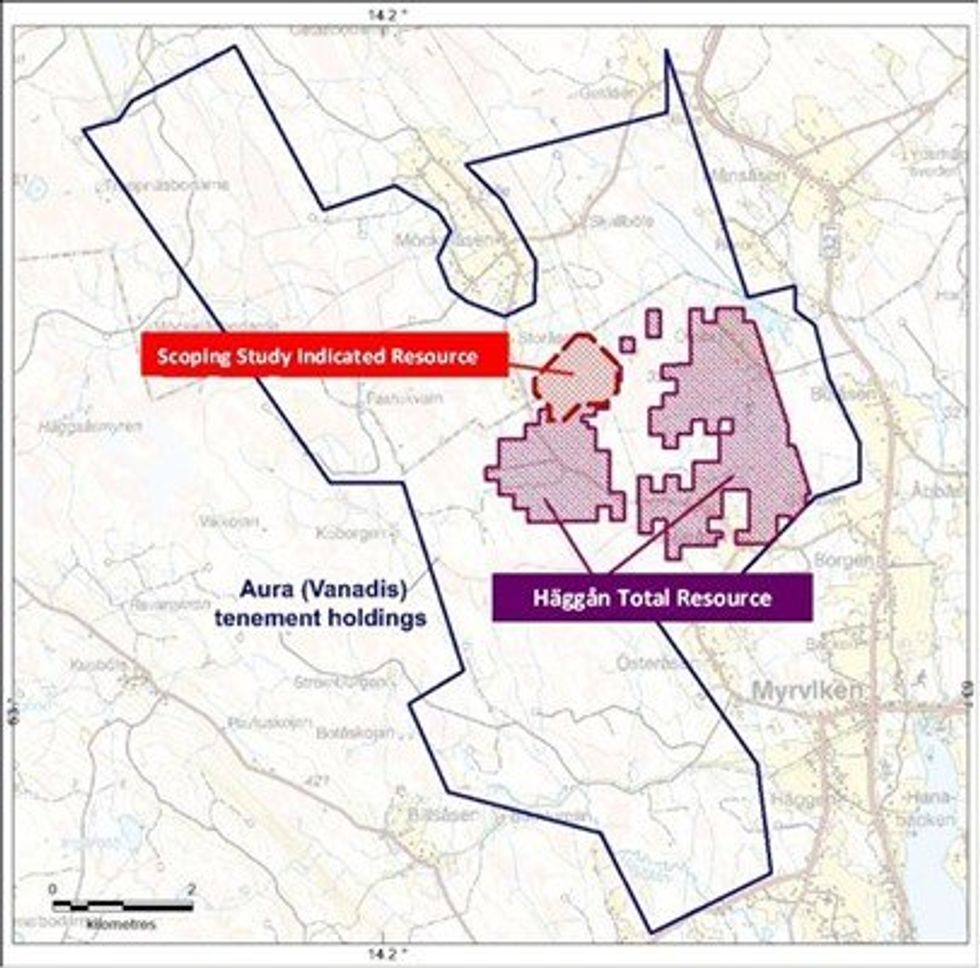

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to release its Scoping Study for the Häggån Project (“Häggån” or “the Project”) in Sweden.

- Scoping Study reveals extraordinary Häggån scale and optionality

- Vanadium, potash, nickel, molybdenum, zinc and uranium1 among a diversified suite of future- facing commodities

- Swedish location positive in light of leadership in the European resource industry

- 65MT Scoping Study covers less than 3% of Haggan’s known 2.0Bn tonne Mineral Resource Estimate.

- Scoping Study delivers strong project sample for re-engagement with potential strategic partners

- Scoping Study underpins application for a 25-year Exploitation Permit

- Sweden is Europe’s leading mining and mineral nation, and its minerals strategy and anticipated legislative changes will strengthen that position

Aura Chairman Philip Mitchell said, “The Scoping Study underpins our 25-year Exploitation Permit Application and addressed <3% of the Haggan resource whilst confirming Haggan’s scale and optionality. Haggan’s products are crucial to Battery Technology, Agriculture and potentially with legislative change low carbon, secure and affordable electricity.

The Swedish Government acknowledges that for Sweden’s clean power system to function, a large part must be readily dispatchable, and nuclear power is the only non-fossil option. I noted Sweden’s Minister of the Environment's comments to the Times of London on 18 August 2023 “There was a parliamentary majority behind lifting Sweden’s ban on uranium extraction and opening up by far the largest deposits in the European Union.

She noted that “Nearly 40 years after the completion of the country’s last new nuclear power plant, Minister Pourmokhtari has announced plans to build at least ten large reactors to meet an anticipated surge in demand for zero-carbon power”.

She said that while wind and solar power would be important, the country also needed massive volumes of nuclear-generated electricity because output can be reliably dialled up or down to keep the power supply steady through the peaks and troughs of renewable generation.”

“The government is aiming at doubling electricity production in 20 years,” Minister Pourmokhtari said. “For our clean power system to function, a large part of this has to be dispatchable where nuclear power is the only non-fossil option. Nuclear power also has a reduced environmental footprint and requires limited resources in comparison with most energy sources.”4

The 65MT Haggan Scoping Study covers <3% of Haggan’s known 2.0Bn tonne Mineral Resource Estimate. The Study portends a Tier 1 polymetallic mineral resource providing key minerals for a transitioning world. The remaining 97% of the resource will be further studied and offers exciting future prospects including further study of the potential of rare earth minerals known to occur in the Alum shales. The Scoping Study will support the engagement with potential strategic partners in the project.”

Aura Managing Director Dave Woodall said “The Häggån ore body is massive with a richly endowed polymetallic orebody that contains significant quantities of critical metals that are essential to the rapidly growing energy transition and agricultural supply chains including significant quantities of vanadium, potash, uranium, and base metals. Our project can be integral to the Swedish and European supply of these critical metals that can significantly de-risk the energy transition while providing benefits to all stakeholders.

Our next steps in the Prefeasibility Study will be to further infill drilling that aims to increase mine life and further enhance the project economics."

The Häggån Project is based on a substantial discovery in the Jämtland province in central Sweden, with a polymetallic global Mineral Resource Estimate of ~2 billion tonnes at a 0.2% V2O5 cutoff5. While vanadium is a significant driver of Häggån’s value, it contains economically significant volumes of other strategic metals and minerals including potassium, nickel, zinc, molybdenum, and uranium. A significant benefit of the polymetallic deposit is the potential for economically extractable sulphate of potash (SOP) as a byproduct in the processing.

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00